Expecting a Recession? Considering Buying Bonds

The bond market has been put to rout in the last 18 months, but this sector could rebound in 2024 if the Federal Reserve is forced to cut interest rates

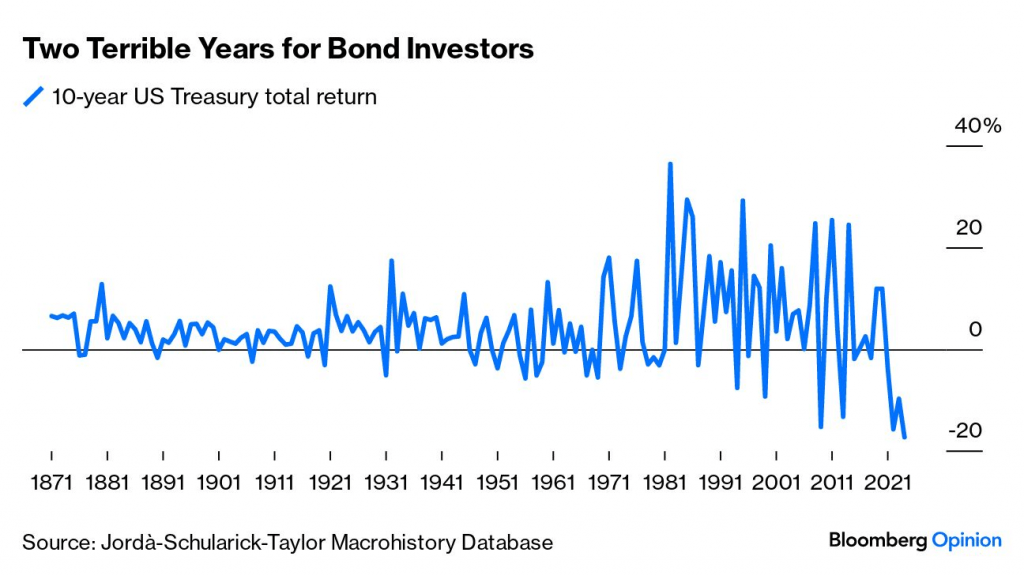

- The years 2022 and 2023 have been two of the worst on record for U.S. bond markets since 1871.

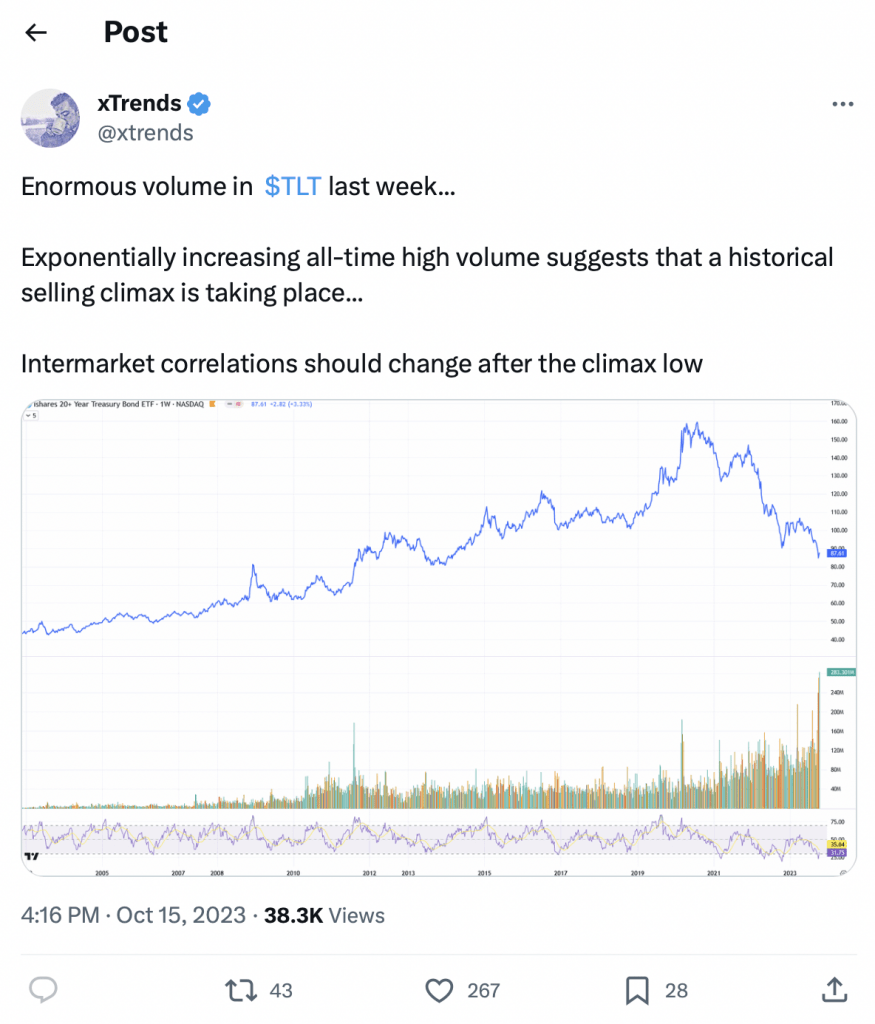

- The iShares 20 Plus Year Treasury Bond ETF (TLT) recently hit its lowest point since 2007.

- However, bond prices could rebound in 2024 if the Federal Reserve is forced to cut interest rates due to a recession.

The bond market has been under serious pressure since the Fed started aggressively raising benchmark interest rates at the start of last year. By some accounts, recent performance in the bond market is on par with the worst since 1871.

Speaking to the 2022-2023 bond rout, Bloomberg columnist Niall Ferguson recently wrote, “Last year was in fact U.S. bond investors’ worst year since 1871, with a total return of minus 15.7%, even worse than the annus horribilis of 2009. For 2023, the year-to-date return has been almost minus 10%; annualized, that’s minus 17.3%—even worse than 2022.”

According to Ferguson, 2022 and 2023 are therefore the two worst years for the bond market in the last century and a half. Considering those historic levels of futility, one can understand why investors and traders might be hesitant to open new positions in the bond market.

However, severe downdrafts often lead to some of the best opportunities. And at some point in the foreseeable future, this might be true of the bond market.

Case in point, the iShares 20 Plus Year Treasury Bond ETF (TLT) recently hit its lowest point since 2007, representing a drop of 51% since peaking in July 2020. The TLT climbed as high as $171/share in 2020, and is currently trading around $85/share.

For long-term holders of TLT, that’s undoubtedly been a painful experience. That said, there’s every reason to believe the worst is over—especially for those market participants that are expecting a recession to take hold in the U.S. economy at some point in H1 2024.

In order to stage a strong, prolonged rebound, the U.S. bond market needs benchmarket interest rates to drop back from 22-year highs. And the most plausible mechanism for a rate drop would be weakness in the underlying economy, which would almost certainly force the U.S. Federal Reserve to cut rates.

That’s especially true because the Fed is currently fighting a bout of record inflation, and recently implied they will keep rates “higher for longer.” While that might be the plan, the Fed won’t be able to keep rates at these levels if the economy suffers a meaningful contraction.

Interestingly, the TLT did rebound recently—it rallied by about 4% from Oct. 3 to Oct. 11. During that period, it climbed from its 52-week low of roughly $84/share all the way back above $87/share.

Considering that war recently broke out in the Middle East, this moderate rally may be attributable to a “flight to safety” in government bonds. But with two major military conflicts now unfolding, it’s hard to imagine bond prices dropping off a cliff anytime soon.

As a reminder, bond prices share a strong negative correlation with interest rates. When interest rates rise—as observed since early 2022—bond prices typically decline. On the other hand, bond prices usually increase when interest rates are declining. That’s why a Fed rate cut would represent an important paradigm shift in this niche of the financial markets.

As a reminder, bond prices share a strong negative correlation with interest rates. When interest rates rise—as observed since early 2022—bond prices typically decline. On the other hand, bond prices usually increase when interest rates are declining. That’s why a Fed rate cut would represent an important paradigm shift in this niche of the financial markets.

Investment point of view

From an investment standpoint, rising bond prices would represent a significant shift from the last two years, when bond prices plummeted as a result of rising interest rates. In the bond world, “total return” is paramount—a method of calculating returns that incorporates both interest income as well as any appreciation/depreciation in the price of the underlying bond.

Bond returns were historically bad in 2022 and 2023 mostly due to depreciating prices (linked to rising interest rates). However, in the majority of cases, the interest income generated from bonds has been safe, especially bonds issued by the U.S. government.

Municipal bonds performed poorly during the first three quarters of 2022, but have done far better since that time. According to Amundi Asset Management, municipal bonds returned on average about 6.4% from Sept. 30, 2022 through Aug. 10 of this year.

In the corporate bond sector, defaults have risen marginally, but that’s on the lower end of the quality spectrum (e.g. below investment grade). That means riskier bonds have experienced some hiccups. That’s how risk and reward works in the financial markets.

Going forward, however, the bond market could strengthen significantly if interest rates pull back—especially government bonds and high-quality corporate bonds.

Under this scenario, total returns could get a boost from rising prices, thus providing a lift to the sector. At minimum, a drop in rates would help slow down the price declines observed over the last 18 months.

Why a recession could benefit the bond market

There’s no guarantee that a recession will materialize in the immediate future, but many projections indicate a recession could emerge at some point in H1 2024.

A recession could be bullish for higher quality bonds because it would force the Fed to cut rates, potentially providing a lift to bond prices.

Historically, recessions have not been good for the stock market. For the bond market, however, historical data shows that total returns have held up far better.

A recession is typically defined as two consecutive quarters of negative growth in U.S. gross domestic product (GDP). The table below highlights total returns in the stock and bond markets during the last six recessions, according to data compiled by Morningstar.

| 1981-1982 | 1990-1991 | 2001 | 2008-2009 | 2020 | |

| Bond Performance | +24.76% | +9.10 | +6.34% | +5.46% | +5.26% |

| Stock Performance | +10.00% | +7.64% | -7.18% | -24.17% | -9.26% |

While past returns are certainly no guarantee of future results, the above data provides evidence that the bond market has historically performed reasonably well during economic recessions.

Moreover, one can from the above data that recessions during the 20th century haven’t been kind to the stock market—especially the 2008-2009 Great Recession.

The above numbers are even more interesting when one considers that TLT recently hit a 16-year low. The major stock indices, on the other hand, are trading closer to their all-time highs, although they have pulled back somewhat since mid-September.

At present, TLT is down 14% on the year, while the S&P 500 is up more than 10%, and the Nasdaq 100 is up more than 35%. If a recession does materialize in the next six months, the data highlighted above suggests that TLT could outperform the major stock market indices during that period.

TLT is essentially a proxy for long-term US government bond prices (20+ years) in ETF form. This is outlined clearly in the fund summary, which indicates that TLT invests “at least 95% of its assets in US government bonds.”

In addition to TLT, investors and traders can also consider the following government bond-focused ETFs (filtered by total assets, largest to smallest, with associated year-to-date return):

- iShares 20+ Year Treasury Bond ETF (TLT), -16%

- SPDR Bloomberg 1-3 Month T-Bill ETF (BIL), 0%

- iShares 7-10 Year Treasury Bond ETF (IEF), -7%

- iShares 1-3 Year Treasury Bond ETF (SHY), 0%

- Shares U.S. Treasury Bond ETF (GOVT), -6%

- Vanguard Intermediate-Term Treasury ETF (VGIT), -4%

- WisdomTree Floating Rate Treasury Fund (USFR), -1%

- iShares 3-7 Year Treasury Bond ETF (IEI), -3%

- Schwab Intermediate-Term U.S. Treasury ETF (SCHR), -4%

- Vanguard Long-Term Treasury ETF (VGLT), -15%

Looking ahead, one’s portfolio positioning will hinge heavily on the outlook, trading approach and risk profile of the investor/trader in question. However, the aforementioned data points should prove useful when assessing ongoing opportunities in the bond market.

To follow everything moving the markets, including the bond markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Hungry for more? The next issue of Luckbox is food-focused looking at new growth opportunities and trading ideas in food, beverage, agricultural, hospitality and grocery stocks. Not a subscriber? Subscribe for free at getluckbox.com.