Nano-X Imaging (NNOX): Don’t Buy Into the Nvidia Hype

Shares of Nano-X Imaging (NNOX) received a boost when Nvidia revealed a small passive stake in the company, but further investigation reveals that the shares don’t offer a compelling value proposition at this time

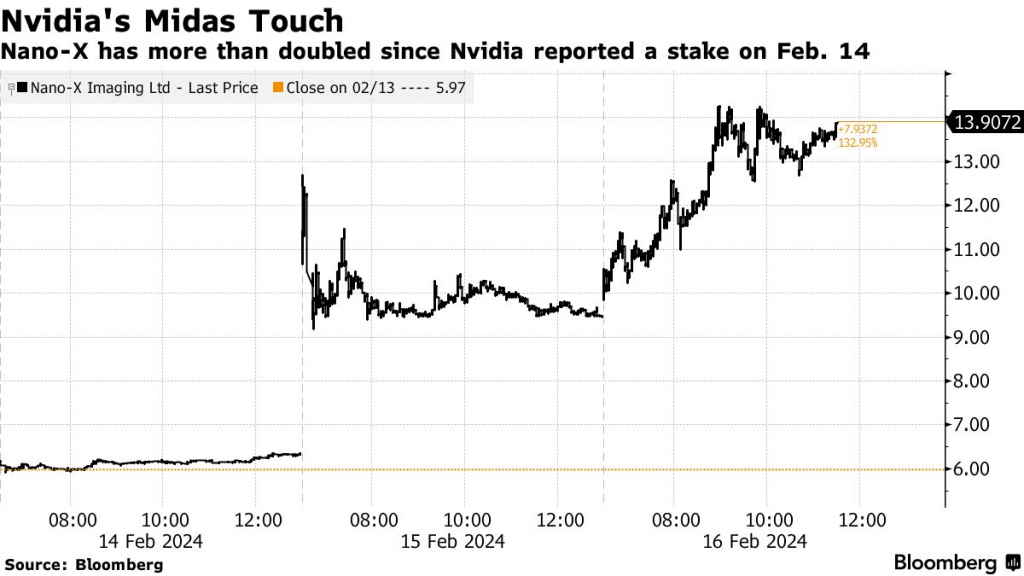

- Shares of Nano-X Imaging (NNOX) had been trending lower since June of 2023, dropping from around $23/share all the way down to $5.50/share in early February 2024.

- In mid-February, Nvidia (NVDA) disclosed a small, passive investment in Nano-X Imaging, which triggered a strong rally in the underlying shares of NNOX.

- Further investigation reveals that Nvidia basically inherited this stake through a previous investment.

- Nvidia hasn’t expanded its stake in the company, and at this time we rate the shares a “hold,” because Nano-X has yet to demonstrate that it can successfully commercialize its innovative technologies.

In the 1980s, E.F. Hutton, a well-known brokerage firm on Wall Street, featured a clever tagline in their advertising campaign.

The slogan was “When E.F. Hutton talks, people listen.” The commercials featured busy scenes in which everyone would freeze in place and listen to the sage advice of an E.F. Hutton representative, implying that the company’s market insight was beyond comparison.

Today, one might say the same about Nvidia: “When Nvidia talks, people listen.”

That was certainly the case on Feb. 14 when Nvidia disclosed passive investments in several publicly-traded companies. In mid-February, Nvidia disclosed that it maintains investments in five publicly-traded companies: Arm Holdings (ARM), Nano-X Imaging (NNOX), Recursion Pharmaceuticals (RXRX), SoundHound AI (SOUN) and TuSimple Holdings (TSPH).

Not surprisingly, each of the stocks moved higher in the wake of that news. Considering Nvidia’s unique perspective on the emerging AI niche, there’s likely a good reason for that. In the case of Nano-X Imaging (NNOX), one could argue that particular investment isn’t like the others.

Further investigation has revealed that Nvidia didn’t actually buy a stake in Nano-X. Instead, Nvidia basically inherited the Nano-X position after Nano-X acquired Zebra Medical back in 2021. Nvidia owned a stake in Zebra Medical, and that holding is now represented through its current Nano-X holding.

Beyond being a somewhat accidental investment, Nvidia’s position in Nano-X is miniscule. Nvidia owns about 60,000 shares of Nano-X, which was worth about $400,000 at the time of the disclosure. For a company like Nvidia, that’s an insignificant amount.

After the rally in Nano-X shares, that position was worth a bit more. Shares spiked to around $14/share in the wake of the Nvidia disclosure, pushing Nvidia’s position in Nano-X up to about $850,000. That’s still pocket change for a tech titan like Nvidia. In the interim, shares of Nano-X have tailed back down to about $8.50/share, losing a large portion of their previous gains.

Prior to the Nvidia disclosure, Nano-X shares were trading around $6/share, and the primary trend over the last year was downward. Nano-X stock hit its 52-week high of around $23/share last June, and then proceeded to trend lower for most of the time in between. Prior to the Nvidia announcement, Nano-X shares were down about 75% from their 52-week high.

Looking more closely at Nano-X’s recent fundamentals, there appears to be a good reason for recent pessimism in Nano-X shares.

Nano-X Imaging business model

In terms of its fundamental business, Nano-X Imaging is somewhat of a hybrid medical devices and software company that focuses on x-ray imaging. X-ray imaging, commonly used in radiology, works by passing X-ray beams through the body to create images of internal structures such as bones, organs and tissues.

X-ray imaging is commonly used for diagnosing conditions such as fractures, infections, tumors and lung diseases. It is a valuable tool in the broad field of medical imaging due to its ability to produce detailed images quickly and non-invasively, aiding in the diagnosis and management of various medical conditions.

In the case of Nano-X, the company is not only pursuing a new method of x-ray imaging, but it is also hoping to pair the analysis of those images with an AI-assisted digital diagnosis platform. A critical piece of this process involves the Nano-X “Robodiologist,” which scans the x-ray image, and highlights any abnormalities. If abnormalities are discovered, the image is then sent to a specialist, so they can be reviewed in greater detail.

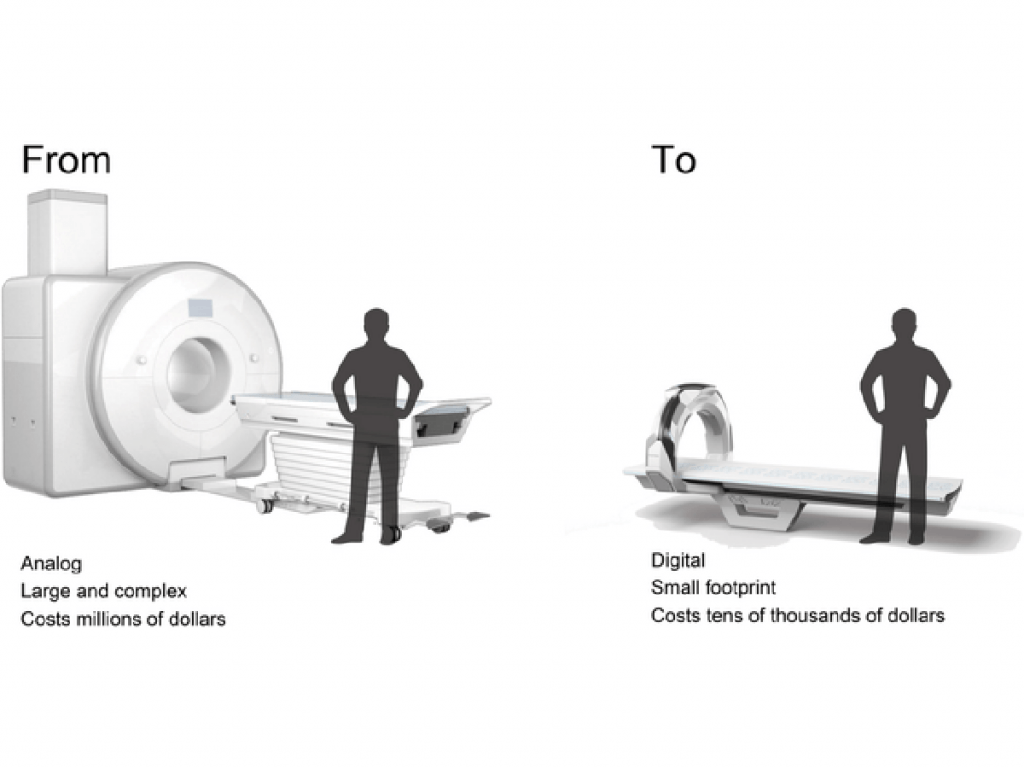

In terms of its new approach to imaging, Nano-X has developed some innovative technologies it refers to as Nanox.ARC and Nanox.Source.

The Nanox.ARC technology uses a digital x-ray that is based on a proprietary semiconductor chip. The Nano-X proprietary chip is designed to produce digital x-rays through a process called cold cathode emission, which eliminates the need for the traditional high-voltage vacuum tubes that are found in conventional x-ray machines. Nano-X’s goal is to produce smaller, lighter, and potentially more cost-effective devices as compared to traditional x-ray systems.

On the plus side, Nano-X imaging has already reaped some rewards from its development efforts. Nano-X has secured a large number of associated patents, and some key clearances by the Food and Drug Administration (FDA).

That includes a key 510(k) clearance from the FDA that allows Nano-X to officially market its Nanox ARC X-ray system. As part of that 510(k), the FDA cleared the system for use in healthcare facilities and radiological departments of hospitals, imaging centers and clinics.

An FDA clearance is a key reason shares of Nano-X rallied sharply last summer. However, the shares weren’t able to sustain the momentum. Since June of last year, shares of Nano-X were trending steadily lower, dropping from $23/share all the way back down to about $5.50/share. At least that was the case until Feb. 14, when Nvidia unexpectedly revealed its small, passive investment in the company.

Fundamentals don’t justify current stock price

While the Nvidia disclosure certainly represents a positive development, investors and traders considering a new position in the stock have to look at the overall value proposition offered by Nano-X shares, not just the fact that Nvidia is a minor investor in the company. And from this perspective, the argument for owning Nano-X stock gets a little weaker.

One of the main reasons for this outlook is that the company hasn’t yet proven it can successfully commercialize its innovative technologies. With a small cap company, one of the most compelling reasons to own the shares is the potential for strong growth.

Unfortunately, Nano-X has yet to demonstrate it’s capable of achieving such growth. Or that it has the capital, agency and resources to do so.

In Q3 of last year, the company generated only $2.5 million in revenue, which was almost identical to the amount it produced in the same quarter a year prior. For the full year 2023, Nano-X is estimated to have generated about $9.5 million in revenue, which is only marginally higher than the $8.5 million it produced in 2022.

Nano-X is scheduled to release its Q4 2023 earnings report in early March 2024, and at this point there’s no reason to believe that the company’s revenues will be significantly different from Q3.

Overall, the company reported a net loss of around $21.5 million last quarter, indicating it is still far removed from its ultimate goal of turning an annual profit.

As of Sept. 30, the company still had total cash, cash equivalents, restricted cash and marketable securities of around $95 million.

However, that figure is likely to have shrunk over the last several months. If the company continues posting quarterly losses—as it has for many years—concerns over Nano-X’s continuing cash burn and solvency could intensify.

It should be noted that back in 2020, both Citron Research and Muddy Waters Research—two well-known investment firms that focus on short side opportunities—published negative reports on Nano-X. At the time, those reports suggested that Nano-X hadn’t achieved any material level of success, and that the company’s market capitalization was bloated as compared to its valuation.

The recent approval by the FDA may have helped to allay some of those concerns, as evidenced by the strong rebound in the company’s shares last summer. But the fact that the company hasn’t been able to significantly grow its revenues in the wake of that approval, provides a valid reason for continuing skepticism.

Nano-X may ultimately have to raise additional capital to fund its future growth. A secondary offering like that could dilute the existing shares, and potentially push them lower in value.

Investors and traders should tread cautiously when it comes to new or existing positions in Nano-X Imaging. The Nvidia disclosure was certainly positive news for existing shareholders.

But considering that Nvidia inherited the position, and hasn’t built on it, the benefit from that disclosure appears limited. Instead, investors and traders should focus on why the stock was moving lower ahead of that Nvidia disclosure.

Nano-X is a company that’s posted considerable and consistent quarterly losses. Until that changes—or there’s some reason to believe that it will change in the near future—there doesn’t appear to be a compelling reason to own this stock.

Especially with a potential secondary offering on the horizon. On the other hand, if Nvidia were to add to its existing holdings in Nano-X, that would change the narrative dramatically, and likely signal a bullish shift in the company’s future prospects.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.