AMD Leapfrogged Intel: Look out Nvidia!

AMD released a new AI-focused graphics processing unit at the end of 2023, and as a result, looks well-positioned to compete in the fast-growing market for AI chips

- Advanced Micro Devices (AMD) recently released a new AI-focused graphics processing unit (GPU) that’s poised to compete with Nvidia’s AI chip offerings.

- AMD has fought similar battles in the past, having previously leapfrogged Intel (INTC) in the CPU universe.

- AMD looks well-positioned to compete in the fast-growing market for AI chips, and we rate the shares a long-term “hold,” with near-term corrections representing an opportunity to add to existing positions, or to initiate new ones.

Wall Street is famous for overnight sensations, but the current generative AI craze feels like it has staying power, much like the cloud did 15 years ago.

At its core, generative AI will equip modern computers with the ability to automate increasingly advanced tasks. To that point, the Director of Machine Learning at Apple (AAPL) Ian Goodfellow said of recent AI advancements, “Generative models are a key enabler of machine creativity, allowing machines to go beyond what they’ve seen before and create something new.”

Generative AI has unlocked another level of productivity, allowing for even greater technological efficiencies, automation and innovation.

And the future promise of generative AI is so significant that CEO of Nvidia (NVDA Jensen Huang refers to the current era as “a new industrial revolution.”

Nvidia has of course been one of the big winners of the new era. Nvidia makes some of the most advanced chips in the world—chips that are uniquely suited for AI-focused computing tasks.

However, another chip company, Advanced Micro Devices (AMD), appears poised to challenge Nvidia’s current monopoly.

A few months ago, AMD introduced its own AI-suitable graphics processing unit (GPU), and the early returns have been favorable. Interestingly, AMD also introduced a line of cutting-edge central processing units (CPUs) in 2017, which ultimately allowed AMD to leapfrog the long-time leader in desktop CPUs—Intel (INTC).

Based on AMD’s previous success in the CPU universe, the company is uniquely positioned to challenge Nvidia in the AI-focused GPUs, and therefore represents a long-term hold, with substantial potential upside.

As with any investment, an investment in AMD comes with risk. Shares have already rallied significantly, and could be susceptible to a sharp pullback in the face of a market correction, or a potential U.S. recession.

But from a long-term perspective, AMD is well-positioned to compete as one of the world’s foremost chip designers, suggesting that any near-term correction may represent an opportunity to add to an existing position or initiate a new one.

Emergence of generative AI

The primary catalyst for the new era of generative AI was the release of OpenAI’s ChatGPT in late 2022. ChatGPT is a chatbot that uses artificial intelligence (AI) to create human-like responses to questions.

The adoption of generative AI technologies is driving an exponential increase in AI workloads, which require significant computational resources for training large neural networks, processing massive datasets and running complex algorithms.

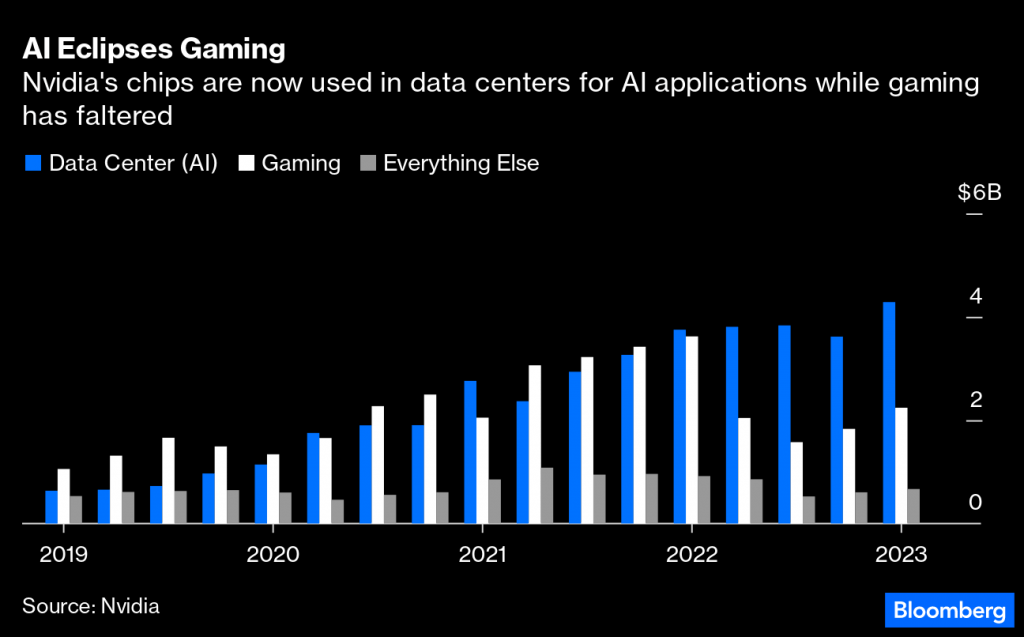

This surge in demand for graphics processing units (GPUs), particularly those crafted by Nvidia, stems from their unparalleled suitability for AI training.

While originally designed for rendering high-quality graphics in video games, GPUs have emerged as a powerhouse in AI computation due to their unique architecture.

Consequently, data centers worldwide are swiftly upgrading their hardware and software with AI-capable products, driving an unprecedented surge in demand for Nvidia’s A100, H100 and H200 GPUs.

This exceptional performance has fueled a remarkable rally in the company’s underlying shares, catapulting Nvidia to the forefront of the global market.

With a market capitalization reaching roughly $2.2 trillion, Nvidia now stands as one of the world’s most valuable companies.

Benefiting from these competitive advantages, Nvidia has solidified its position with a virtual monopoly in AI-focused chips, locking down an estimated 85%-90% market share of global AI chip sales.

Furthermore, the company commands gross profit margins of approximately 76%, a testament to its status as an unrivaled market leader.

Advanced Micro Devices (AMD) represents a legitimate threat to Nvidia

When it comes to AI-suitable GPUs, there’s only one company with the potential to threaten Nvidia’s data center monopoly during the foreseeable future. That company is Advanced Micro Devices (AMD).

In December 2023, Advanced Micro released its own data center-focused GPU, known as the MI300X. As a result of widespread anticipation over the potential of Advanced Micro’s new AI chip, shares of the company have skyrocketed alongside those of Nvidia’s—albeit to a slightly lesser degree.

In the last 52 weeks, shares of Advanced Micro are up 140%, while shares of Nvidia are up 270%.

Unlike Nvidia, which has reported better than expected earnings reports in recent quarters, Advanced Micro reported Q4 earnings that were on par with expectations.

During the last three months of 2023, Advanced Micro generated revenues of roughly $6.1 billion, alongside gross profit margins of 52%—both of which were in line with analyst forecasts.

Despite those modest top-line numbers, the company provided investors and traders with a reason for optimism—strong growth in its data center division.

Last quarter, sales in this division rose by 38%, ostensibly due to the introduction of the aforementioned MI300X AI chip.

For the full year, Advanced Micro is now expecting total sales of roughly $3.5 billion for its data center division, which is considerably more than its previous guidance of $2 billion.

Management at the company has set a low bar for sales and profitability in 2024, but they may have done so intentionally, hoping for upside surprises throughout the year.

The company’s foray into advanced GPUs appears to be paying off, but it may take some time before the company can generate the type of growth that Nvidia has experienced during the last several quarters.

AMD Leapfrogged Intel on CPUs, and can do the same to Nvidia on GPUs

One key reason Advanced Micro is so well positioned to pressure Nvidia is because it successfully overcame a similar challenge in the past.

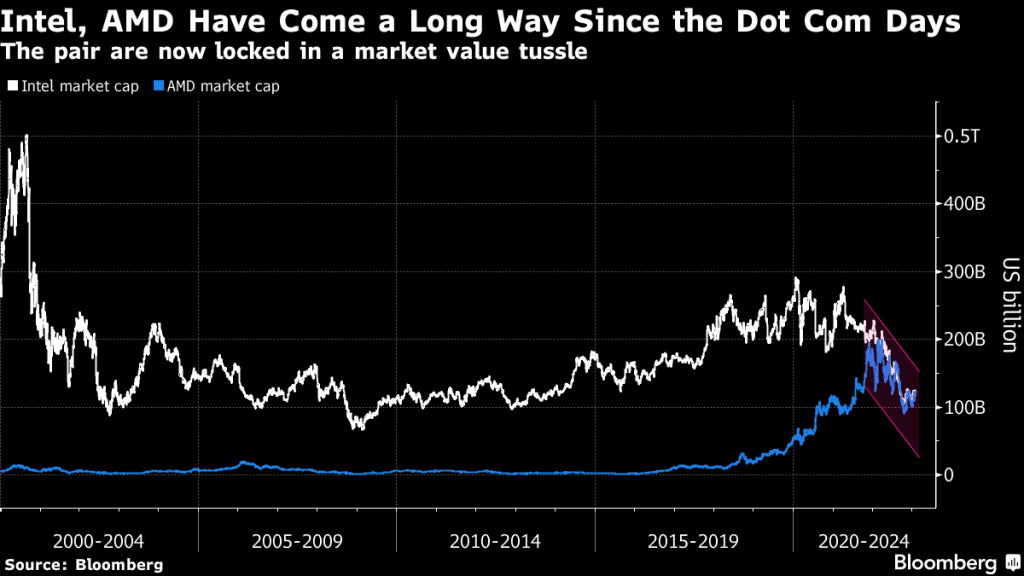

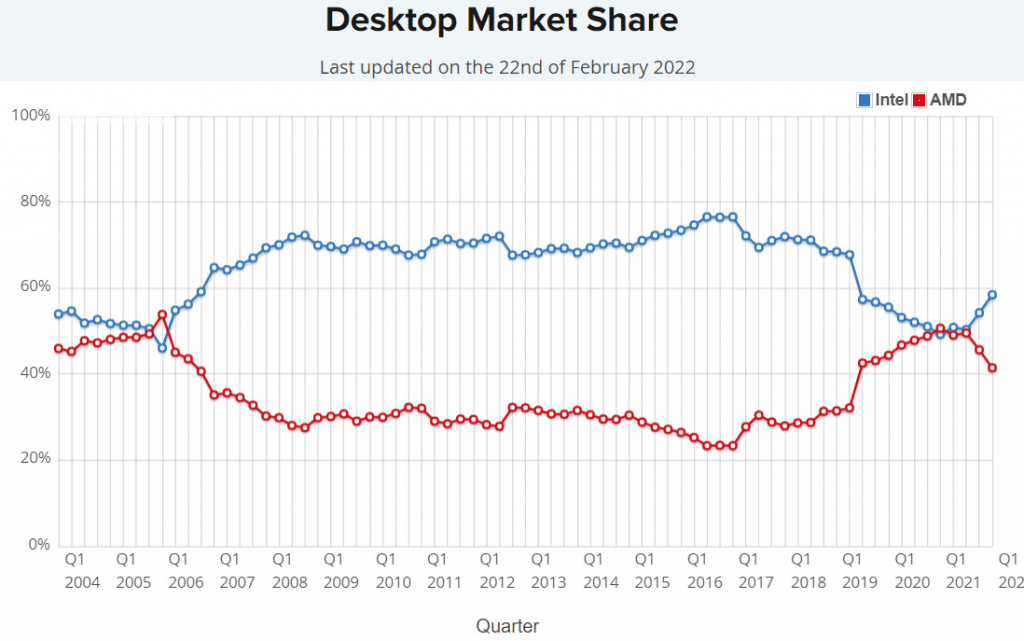

Prior to 2017, Advanced Micro was fighting an uphill battle to win market share from Intel in the desktop CPU market. Back in 2016 (a year prior to the Ryzen release), Intel controlled nearly 80% of the CPU market for desktop personal computers.

But after the introduction of the Ryzen series, Advanced Micro started steadily eating into Intel’s market share, and eventually claimed about 50% of the market.

As shown above, Intel did claw back some of its lost market share, because the company finally woke up to the threat posed by Advanced Micro, and released some cutting-edge CPUs.

However, this example helps illustrate how Advanced Micro could eventually steal market share from Nvidia in the GPU universe, as it did with Intel in the CPU universe.

The introduction of the MI300X is clearly the first step in that direction. The company also offers the MI300A, which is similar to Nvidia’s Grace Hopper—a multi-chip module containing both a CPU and a GPU. Importantly, several key companies, such as Meta (META), Microsoft (MSFT) and OpenAI, have already started buying MI300Xs and MI300As from AMD.

AMD’s MI300X is priced at around $15,000 per unit, which is far more reasonable than Nvidia’s H100, which costs closer to $40,000 per unit.

Nvidia recently indicated that CUDA had been installed on hundreds of millions of the company’s GPUs, and that some 4.7 million developers had licensed the software.

That means Advanced Micro’s software ecosystem remains very much a work in progress. But if the developer community ultimately favors the open-source platform, this disadvantage could quickly transform into a key differentiator for Advanced Micro.

Valuation and investment takeaways

Due to the uncertainty linked to Advanced Micro Devices’ future sales growth, it’s hard to conduct a traditional valuation analysis of the company’s stock.

For example, how do you estimate a reliable forward Price/Earnings ratio (P/E ratio) for Advanced Micro Devices when it’s extremely difficult to predict future demand for the company’s new AI chips.

In place of a traditional DCF analysis, investors and traders can therefore use a comparative company analysis (CCA) to try and ascertain a fair valuation for the company. This valuation approach compares the company in question to similar publicly traded companies in the same sector/industry (e.g. AMD versus NVDA).

At present, Advanced Micro Devices trades with a market capitalization of roughly $340 billion, while Nvidia trades with a market capitalization of around $2.2 trillion. That means Advanced Micro Devices is currently about 15% the size of Nvidia, in terms of valuation.

Looking at revenues, however, Nvidia produced roughly $18 billion in sales during the last three months of 2024, while Advanced Micro produced $6 billion.

From this perspective, Advanced Micro is capable of generating revenues that are roughly 33% the size of Nvidia’s. Based on these figures, there’s an argument to be made that Advanced Micro’s valuation should be higher than it is today.

Right now, Advanced Micro likely trades at a steeper discount to Nvidia because the latter enjoys a much larger gross profit margin—76% vs. 52%. That’s because Nvidia has a virtual monopoly in the market right now, which provides the company with substantial pricing power.

However, if Advanced Micro starts eating into Nvidia’s market share, the latter may have to lower its prices—especially if Nvidia’s current backlog dissipates.

Advanced Micro’s valuation is arguably more subjective than Nvidia’s, because it’s unclear whether Advanced Micro’s new GPUs will receive the same reception in the marketplace as Nvidia’s. In Q4, Nvidia’s total revenues grew by 400% as compared to the same period a year prior.

If Advanced Micro’s GPU offerings are well received, the company will probably experience a similar spike in sales. Under this bullish scenario, Advanced Micro’s valuation could easily be re-rated to a level that better reflects the proportion of the company’s total revenues relative to Nvidia’s.

If that were to happen tomorrow, Advanced Micro would likely be worth twice the amount it is today. Currently Advanced Micro’s market cap is 15% of Nvidia’s, clocking in at roughly $340 billion. But if it was reassessed in proportion to its total revenues as a percent of Nvidia’s (33%), then Advanced Micro could be worth closer to $700 billion.

There’s also the reverse scenario, in which Advanced Micro struggles against Nvidia’s considerable first-mover advantage. Under that more bearish scenario, the current market capitalization as a percentage of Nvidia’s (15%), might be more appropriate. Moreover, if Advanced Micro were to lose ground against Intel in the CPU universe, that could also weigh on the company’s valuation.

Ultimately, we view the future potential of Advanced Micro as extremely promising, and believe that shares of the company deserve to be rated a long-term hold at this time. Advanced Micro is one of the world’s leading chip designers, and has previously exhibited the moxy necessary to close the gap on an entrenched market leader.

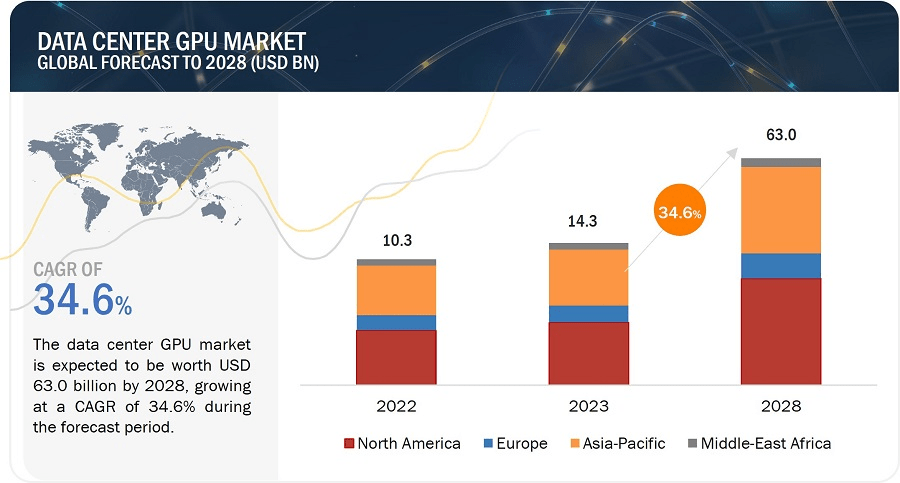

Moreover, the size of the GPU market in the data center universe is expected to grow substantially in the coming years.

At the end of the day, nothing is guaranteed. Advanced Micro is going to have to do it the hard way and earn its place in the global AI hierarchy. But Advanced Micro’s ascension to the AI mountaintop is starting to feel inevitable, as opposed to improbable, suggesting that any near-term correction may represent an opportunity to add to an existing position, or initiate a new one.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.