3 Reasons Why Natural Gas Prices Are Looking More Like a Buy

Natural gas prices have corrected more than 70% since August 2022, making this commodity more attractive as a potential long investment

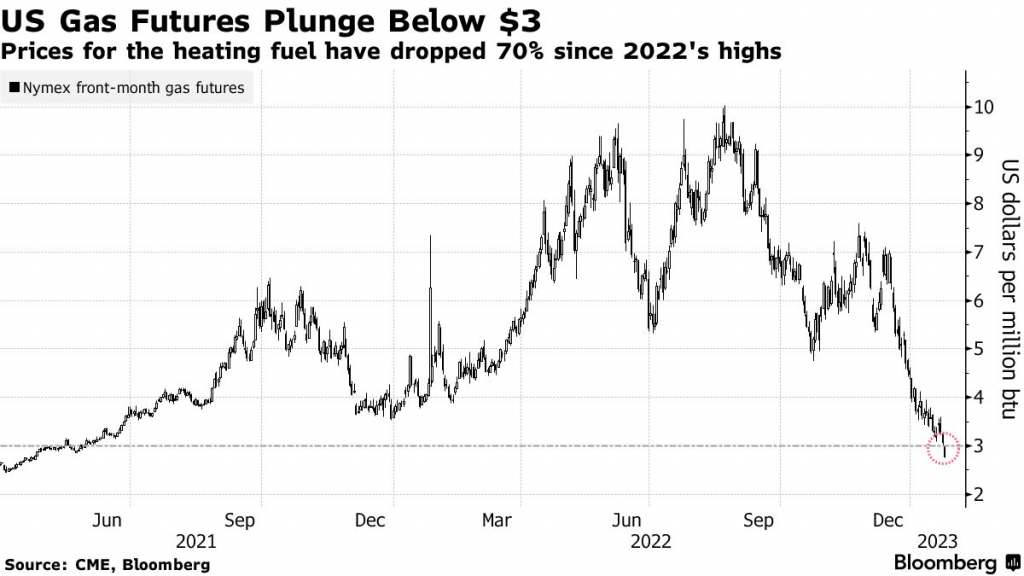

- Natural gas prices have corrected by more than 70% since peaking back in August 2022 above $9/MMBtu.

- Prices have been under pressure as a result of record production and above average inventories in the United States.

- The recent cold snap in North America has eaten into existing inventories, which could help push prices higher in the coming weeks, especially with natural gas sitting at multi-year lows.

The natural gas market (/NG) has been routed in the last 16 months, but there are signs that prices have finally reached oversold territory. Commodity prices often overcorrect when they reach extremes, as the market struggles to find equilibrium.

After the recent 70%+ correction, natural gas prices now appear poised to level off, or possibly even stage a reversal. Since August 2022, natural gas prices have fallen from roughly $9.25/MMBtu all the way down to $2.50/MMBtu. And during the last 52 weeks, the United States Natural Gas Fund (UNG) is down roughly 53%.

Many commodities spiked in value as a result of shortages associated with the COVID-19 pandemic. But price action in the energy sector has been especially chaotic, due the ongoing military conflict in Eastern Europe.

For background, natural gas prices were trading about $2/MMBtu at the end of 2019, leading up to the pandemic. But by the end of 2021, prices had risen above $4/MMBtu. And within two months of Russia invading Ukraine in early 2022, prices had skyrocketed above $8/MMBtu.

During the last decade, natural gas prices have ranged between about $1/MMBtu and $9.50/MMBtu. And with prices now trading as low as $2.50/MMBtu, natural gas is starting to look interesting from a long perspective, especially with the war still raging in Ukraine.

Current supply and demand dynamic

Much like crude oil, natural gas prices are heavily influenced by the prevailing supply and demand dynamics in the market. That means production levels, existing inventories and the relative strength of demand are the major factors that dictate pricing in the market.

For some time, those three factors have been pushing prices lower. To wit, natural gas production in the United States is currently thriving. Moreover, the amount of natural gas in storage is above the five-year average, while natural gas demand was weaker than expected during the early part of winter.

Considering that bearish setup, it’s no great shock that natural gas prices have trended lower during the last couple of months. Since the start of November, natural gas prices have fallen by about 33%, from $3.75/MMBtu down to $2.50/MMBtu.

That said, there’s reason for fresh optimism in the market, and that’s primarily due to the recent cold snap that’s gripped much of the United States. Natural gas is used to heat and cool homes and businesses, so when temperatures reach extremes—on either end of the thermometer—demand for natural gas usually rises.

Since early January, much of North America has faced frigid conditions. As a result, the production of natural gas has slowed, while existing inventories have been drawn down at an increasingly rapid pace. During the week of Jan. 12, the U.S. saw a drawdown of roughly 154 billion cubic feet (Bcf), which has helped push existing inventories back down toward the five-year average.

As of mid-January, natural gas inventories stood at roughly 3,182 Bcf, while the five-year average is closer to 2,900 Bcf. So, if temperatures remain low during the next four to six weeks, existing inventories could actually drop below the five-year average, which would be a positive development for natural gas prices.

Importantly, extreme cold also makes it harder on producers. So the recent cold snap has not only eaten into existing inventories, it has also reduced the pace of output. Demand for natural gas has also increased, as evidenced by the recent drawdowns in inventories.

All told, that means the supply-demand dynamic in the natural gas market may be shifting, which should help to slow the recent correction in prices, and possibly even trigger a rebound.

Geopolitical considerations in the natural gas market

Another key consideration in global energy markets is the ongoing war in Eastern Europe.

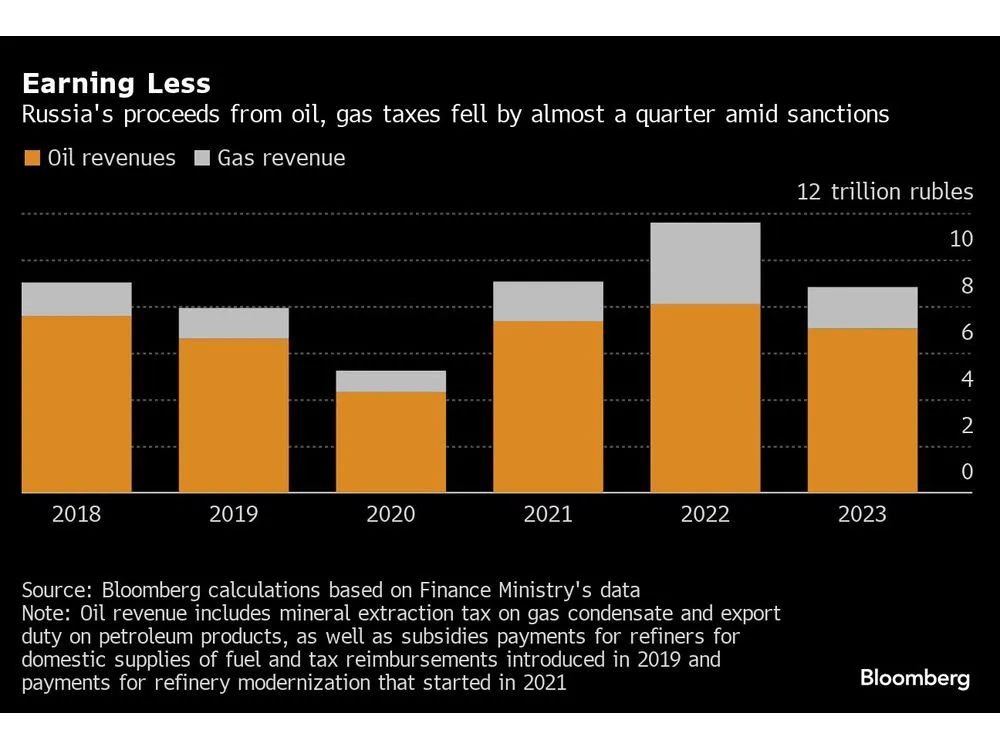

Leading up to the war, Russia was one of the world’s top exporters of oil and gas. However, much of the West has instituted widespread boycotts of Russian energy exports.

At the start of the war, both crude oil and gas spiked to historically high levels. But as the world has adapted to the new paradigm, prices in both markets have weakened. At present, oil and natural gas are both trading at the lower end of their five-year ranges. One reason for that is because the United States has dramatically increased its natural gas exports to Europe, which has helped to alleviate shortages and push down prices.

For example, in 2022, the U.S. exported on average 6.8 billion cubic feet per day (Bcf/day) of liquified natural gas (LNG) to Europe. That figure was 140% higher than the average amount exported in 2021. As highlighted below, Europe’s increased reliance on U.S. gas exports has eaten into the revenues that Russia collects from its energy sector.

That situation wouldn’t have come to pass if it weren’t for record natural gas production in the States. Case in point, U.S. natural companies averaged around 104 Bcf/day of daily production last year, which represents a new all-time record, and was 4% higher than the average from 2022.

That means the impact from the war in Ukraine—at least from a natural gas perspective—has been minimized. But there’s no guarantee things won’t change in the future. For example, if the war in Ukraine intensifies—pulling in other countries—that would almost certainly trigger a strong rally in oil and gas prices.

On the other hand, if the war in Ukraine suddenly comes to an end, that would likely be a bearish signal for oil and gas prices—at least temporarily. Under that scenario, one could envision a rollback of the boycotts on the Russian energy sector, which would in turn raise the available supplies of oil and gas in the marketplace.

That means the war in Ukraine remains a significant wild card in the global energy markets.

Going forward, however, the most immediate question for the natural gas market pertains to the weather. If temperatures remain frigid for the next 4-6 weeks, the existing inventory of natural gas in the United States will undoubtedly be drawn down further, which should help to slow, or even reverse, the recent downward trend in prices. Moreover, one can’t discount the fact that natural gas prices are now trading at the lower end of their 10-year range.

For some investors and traders in the energy sector, that probably makes natural gas-associated investments relatively more attractive. That’s certainly the case here at Luckbox, where we view long investments in natural gas (such as UNG) favorably—especially if frigid conditions remain in the forecast.

To track and trade the natural gas sector, readers can add the following symbols to their watchlists:

- Antero Resources Corporation (AR)

- Cabot Corporation (CBT)

- Cheniere Energy (LNG)

- Chesapeake Energy (CHK)

- Chevron Corporation (CVX)

- Enbridge (ENB)

- EQT Corporation (EQT)

- Kinder Morgan (KMI)

- ProShares Ultra Bloomberg Natural Gas (BOIL)

- Range Resources Corporation (RRC)

- United States 12 Month Natural Gas Fund LP (UNL)

- United States Natural Gas Fund LP (UNG)

Investors and traders looking for energy-focused investments might also consider companies operating in the Permian Basin, which has become one of the country’s most important production zones.

To learn more about trading the natural gas sector, check out this installment of Options Jive on the tastylive network. And to follow everything moving the markets in 2024, including the options markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.