This Tech Stock is Up More Than Nvidia (NVDA) Over the Last 5 Years

During the last five years, the share price of Super Micro Computer (SMCI) is up more than shares of Nvidia (NVDA), climbing by more than 4,000% over that span

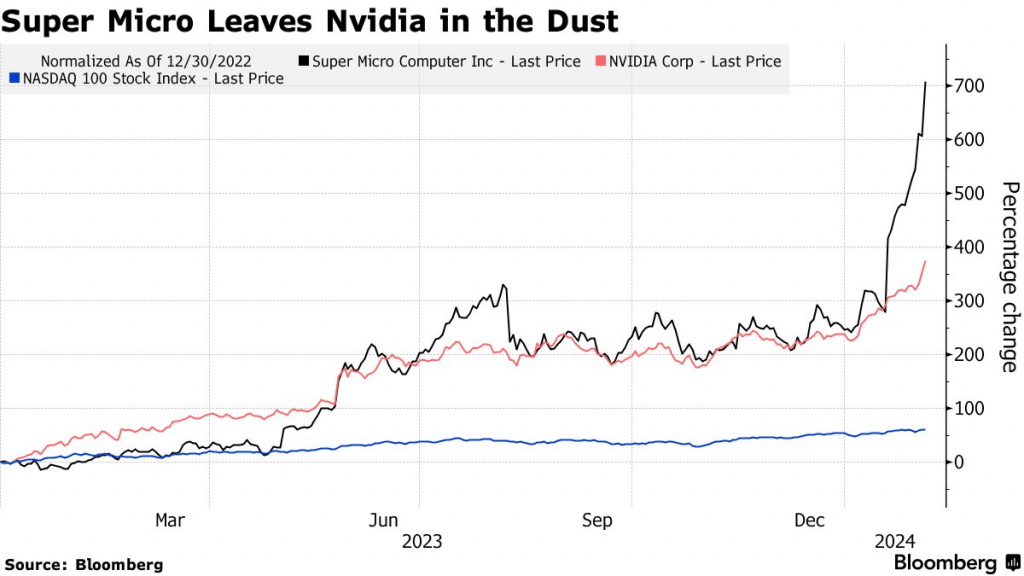

- Though hard to believe, shares of Super Micro Computer (SMCI) have outperformed those of Nvidia (NVDA) both year-to-date and over the last five years.

- Year-to-date, SMCI is up 140%, while NVDA is up 45%, and over the last five years SMCI is up more than 4,300%, while NVDA is up approximately 1,800%.

- SMCI builds servers for data centers, and the company’s innovative approach has equipped it with a strong competitive advantage in the current era of rapid AI adoption.

- Supermicro is positioned to produce highly attractive revenues and earnings during the foreseeable future, but its P/E has arguably gotten overextended—especially for a company operating in a lower profit margin business segment.

Nvidia (NVDA) has been a market darling for more than a year, but there’s another stock that’s arguably eclipsed Nvidia in recent months—Super Micro Computer Inc. (SMCI).

Since the start of 2024, shares of SMCI have more than doubled in price, climbing from roughly $320/share all the way to $680 per share. That’s a gargantuan move, even considering the current AI craze.

In comparison, Nvidia’s stock is *only* up about 45% since the start of the new trading year. Prior to the COVID-19 pandemic, 45% would have been a great return over a year’s time, much less a month’s time. Amazingly, SMCI has outperformed NVDA over the long term as well—the 5-year return in SMCI is roughly 4,300%, whereas the 5-year return in Nvidia is closer to 1,800%.

Considering those returns, it’s probably no surprise to hear that Super Micro Computer (typically stylized as simply “Supermicro”) is another major player in the AI niche, and one that’s also arguably lightyears ahead of its competition. However, Supermicro operates in a completely different segment of the semiconductor industry.

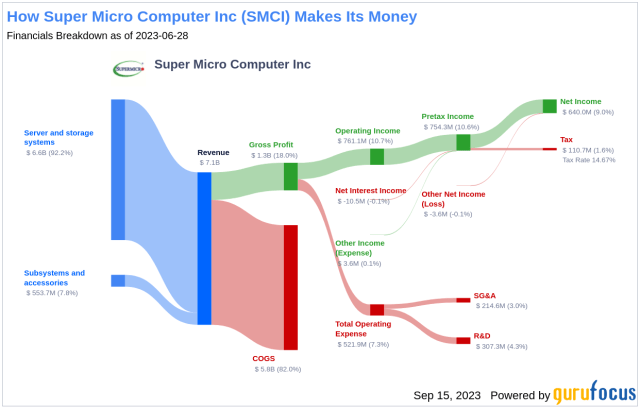

SMCI is basically an infrastructure company that specializes in data center hardware and software. As such, SMCI provides the physical/digital ecosystem that cradles and enables the microchips—the latter of which provide the computational and processing capabilities necessary to manage, secure, and optimize the flow of data and services within the broader data center environment.

Data centers are currently in the spotlight because recent AI advancements are viewed as especially suitable for upgrading the capabilities of data centers.

As a result, the products and services of companies like Nvidia and Supermicro are in exceptionally high demand at this time.

For Supermicro, that encompasses the company’s data center-focused computers, servers and associated software. Of course, the chips that serve as the foundation for the data centers are also being upgraded, primarily with Nvidia’s HGX H100s.

The forthcoming upgrades to the world’s data centers are viewed as such a large undertaking that Nvidia’s CEO Jensen Huang recently compared the forthcoming buildout to a new-age industrial revolution. And based on the jaw-dropping performance in the many of the stocks levered to the AI niche, that certainly seems like an apt metaphor.

Looking at the broader semiconductor industry, that means chip designers, chip manufacturers, data center software/hardware providers and data center property owners are poised to benefit in the coming months and years.

Supermicro’s competitive advantage

Much like Nvidia, Supermicro is known as a top innovator in its field, and is constantly pushing the envelope to improve its products and services. That approach probably helps explain why its infrastructure solutions are especially well-suited to cradle and enable the most advanced AI chips, such as those produced by Nvidia. SMCI-built servers power the cloud, telecom networks and edge/accelerated computing platforms.

Supermicro actually partners closely with some of the world’s most advanced tech companies—such as Nvidia, Advanced Micro Devices (AMD) and Intel (INTC)—to ensure that SMCI hardware and software work efficiently with the most advanced offerings from these companies.

After an incredible run in the company’s shares during the last several months, Supermicro needed to back up that performance with a blockbuster quarterly earnings report, and on Jan. 29 it did just that. In its most recent earnings quarter, Supermicro said it generated around $3.70 billion in revenues, which was 77% higher than the previous quarter, and more than 100% higher than the same quarter one year ago.

In the investment world, growth is the stuff that dreams are made of, and Supermicro surpassed the market’s already lofty expectations. For the most recent quarter, SMCI posted adjusted earnings per share (EPS) of $5.59 versus the market’s expectation of roughly $4.93/share.

On top of that, the company raised its full-year revenue guidance to around $14-$15 billion, which was significantly higher than its previous guidance of $10-$11 billion.

It’s important to note that somewhere around 50% of SMCI’s revenues are levered to the emerging AI niche. And that helps explain why shares of SMCI have been on such a strong run amidst the current AI craze.

That’s all well and good, but elevated levels of demand also requires the production capacity to meet that demand. And the fact that Supermicro is poised to significantly expand its production capacity is likely another reason the shares have spiked in early 2024.

Supermicro’s future potential

Last year, SMCI had the capacity to produce 4,000 server racks per month. However, that is expected to grow to 5,000 per month in the near future

Even more impressively, however, the company’s CEO indicated on the most recent earnings call that a new production facility coming online at some point in 2024 could eventually double the company’s production capacity.

That figure was quoted in terms of potential revenues, implying that the company could generate $30 billion in annual revenue from sales, as compared to the $14-$15 billion in annual revenue that the company is guiding for the current fiscal year. Supermicro’s fiscal year ends on June 30, 2024.

Calendar dates aside, investors and traders appear especially exuberant over Supermicro’s future potential because the company will theoretically be able to satisfy a surge in demand—assuming one materializes.

In addition to its existing production facilities in California, the Netherlands and Taiwan, Supermicro is currently building a new manufacturing facility in Malaysia, which is where the bulk of the new production capacity is expected to come from.

SMCI currently holds about 7% of the market share in the global server market, and it appears that some investors and traders believe SMCI is now poised to grow its market share in 2024 and beyond. A couple of the other large players in the server industry include Dell Technologies (DELL) and Hewlett Packard Enterprise (HPE), which account for roughly 17.2% and 16.8% of the server market, respectively.

Considering SMCI’s unique market positioning in the AI niche, the aforementioned information suggests that SMCI may have entered its own “goldilocks” period. The company’s products and services are in extremely high demand and it is poised to significantly expand its production capacity.

Why the current rally in SMCI is starting to look overextended

After a strong quarterly earnings beat, there’s no doubt that Supermicro should enjoy a higher valuation than it did several months ago.

However, it’s not necessarily easy to estimate a fair valuation for Supermicro at this time, because so much of that depends on whether or not the company can maintain these absurdly high levels of growth.

Super Micro recently increased its quarter-over-quarter revenue by more than 77%, which is astounding. However, that’s not likely to persist. As of now, Supermicro has said that it expects its revenues to grow by about 11-12% in the current quarter, which is a lot more modest.

As such, it’s hard to accurately predict where this quarter’s revenues will actually clock in. It could be significantly higher than the company’s own guidance, which is what happened last quarter.

As a result, it’s difficult to evaluate the company’s shares from the standpoint of a traditional discounted cash flow analysis—at least with any high degree of confidence. Because it’s almost impossible to predict the company’s associated revenue/earnings growth rate over the foreseeable future, much less over the long-term.

Alternatively, one can examine Supermicro’s current price/earnings ratio (P/E) to get a sense of the company’s current valuation as compared to some of its peers.

At the end of the day, most investors are most interested in a given company’s ability to generate profits, and the P/E ratio provides important insight into a company’s stock price relative to its earnings.

Higher gross margins

Generally speaking, companies with higher gross margins generally possess better pricing power and/or superior product differentiation, which allow them to generate more profits from each unit of sales.

Companies with higher gross margins therefore often trade at higher P/E multiples because investors are willing to pay a premium for the higher profitability and growth potential associated with these companies. As a result, these companies often command higher valuations in the stock market.

One important point about Supermicro is that the company’s gross margins are on the lower end of the spectrum in the tech industry. And that’s because SMCI operates in a segment that’s generally less profitable than other subsectors.

As a result, SMCI produces gross margins in the range of 15-16%, whereas a company like Nvidia boasts gross margins of greater than 60%.

For this reason, Supermicro shouldn’t arguably trade with a sky-high earnings multiple. And from this perspective, one could argue that shares of Supermicro Computer are overextended at this time.

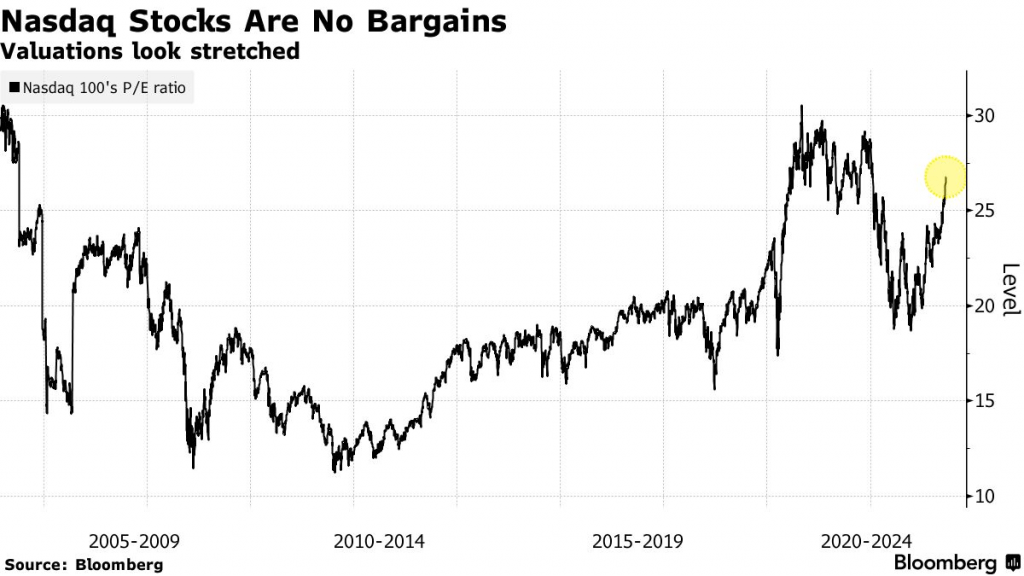

At present, the GAAP Price/Earnings (P/E) for SMCI is over 50. In comparison, the P/E for Dell—one of Supermicro’s key competitors—is closer to 23, while the P/E for HPE is closer to 10.

In this sector, the median P/E is closer to 28. Just for context, Nvidia’s P/E is closer to 90.

The only way that Supermicro can rationalize such a high P/E is if the company continues to obliterate its quarterly revenue and earnings expectations/guidance. And in the uber-competitive tech industry, it’s unlikely that Supermicro’s peers are going to sit idle on the sidelines and watch SMCI dominate the industry. It doesn’t help that overall valuations in the Nasdaq 100 are also trending back toward recent highs, as illustrated below.

On top of the above, the U.S. could easily enter a period of economic contraction at some point in 2024, which would almost certainly compress Supermicro’s sales potential. For the aforementioned reasons, investors and traders may want to tread cautiously with SMCI shares at this time. If the stock pulls back to a more reasonable P/E level, that may represent an opportunity to enter a position in Supermicro at more attractive levels.

It’s never easy to discount the upside potential of a stock like SMCI, which has clearly benefited from an influx of momo-oriented investors and traders.

But for the time being, Supermicro shares should be viewed as especially risky, considering the jaw-dropping run in the company’s shares over the last 52 weeks, and its current P/E multiple, which is elevated as compared to its peers.

This is especially true for a company that operates in a lower-margin business segment, and for a stock that’s exhibited extreme price volatility in recent weeks.

To follow everything moving the markets in 2024, including the options markets, readers can tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.