Interest Rates Poised to Fall, High Quality Bonds Look More Attractive

Interest rates are poised to fall this year after the Federal Reserve announced it may cut rates as many as three times in 2024, which makes the bond universe increasingly attractive

- The Federal Reserve recently adopted a more dovish stance on interest rates, indicating that benchmark rates could get cut as many as three times in 2024.

- Falling interest rates tend to be a good thing for the bond market because interest rates and bond prices historically share a strong, inverse correlation.

- Three niches of the bond market—government bonds, investment grade corporate bonds and high yield bonds—look more attractive due to the ongoing shift in interest rate expectations for 2024.

One of the most basic axioms on Wall Street is that when interest rates decline, bonds prices rise. Current projections indicate that interest rates will fall in 2024. Considering that backdrop, bonds are looking more attractive heading into the new year.

Market prognosticators don’t always accurately predict what comes to pass. For example, very few analysts predicted the stock market would pull back so sharply in 2022. At the start of 2023, even fewer analysts predicted that the stock market, Especially the Nasdaq 100, would rally in a strong fashion.

That said, the bond market tends to be a bit more predictable than the stock market, especially when it hits an extreme. For example, heading into the start of the recent rate-hike cycle, many bond analysts correctly predicted that bond prices would slide as the Fed tightened U.S. monetary policy.

Interest rates and bond prices historically share a strong, inverse correlation. When interest rates rise, bond prices fall, which is what was observed during 2022 and much of 2023. But with interest rates poised to fall, bonds could thrive in the coming months.

At the most recent meeting of the Federal Open Market Policy (FOMC)—the group responsible for setting U.S. monetary policy—leaders at the Federal Reserve intimated benchmark interest rates could get cut three times in 2024.

Outlook for interest rates in 2024

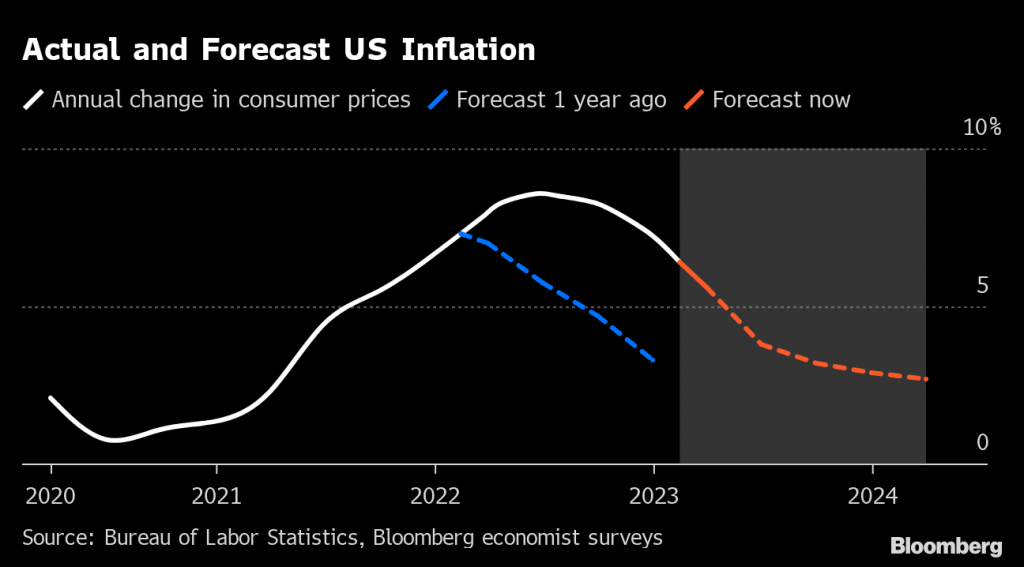

Whether or not the Federal Reserve cuts rates in 2024 will hinge heavily on two primary factors: the ongoing rate of inflation and the health of the underlying economy.

As of right now, inflation is expected to continue to cool in early 2024. Last month, the U.S. consumer price index (CPI) slowed to 3.1%. That was down slightly from the October reading of 3.2%, and within shouting distance of the Fed’s target inflation rate of 2%.

Importantly, 3.2% is also well below the record-high levels of inflation observed in June of 2022, when CPI peaked above 9%.

Based on the aforementioned trends, one could argue that the Fed has successfully reigned in rampant inflation. However, there’s more work to be done.

The Fed can’t afford to overshoot on inflation, because deflationary conditions can be just as bad for the economy as rampant inflation. As such, the Fed needs to try and thread the needle, ensuring that cooling inflation doesn’t devolve into deflation.

The Fed is expected to try and accomplish this goal by gradually lowering benchmark interest rates, which should help foster continued growth in the underlying economy.

If the central bank is able to accomplish this feat—bringing down inflation without bringing down the economy—it will have achieved a so-called soft landing. A term that was first conceived by former Fed Chairman Alan Greenspan, who successfully quarterbacked a soft landing in the mid-1990s by raising, and then lowering, interest rates without derailing the economy.

At present, the interest rates market indicates that the Fed will cut rates by a quarter percentage point in March 2024. That would reduce the federal funds rate from its current range of 5.25-5.50% down to a range of 5.00-5.25%.

By July of next year, the futures market indicates that interest rates could drop to a target range of 4.25-4.50%, suggesting that the Fed will cut rates again at its meetings in June and July.

Many analysts on Wall Street are also expecting interest rates to decline in 2024, based heavily on the aforementioned guidance from the Federal Reserve.

For example, Morningstar recently published its 2024 outlook on interest rates and projected that the federal funds rate could drop as low as 3.75-4.00% by the end of 2024. Morningstar expects that downward trend to persist into the next year, forecasting that interest rates could drop to a range of 2.25-2.50% by the end of 2025.

The outlook for the Pacific Investment Management Company, or PIMCO, matches closely with Morningstar’s projections. To wit, PIMCO expects 75 basis points of net cuts in 2024, which implies the federal funds rate will drop to roughly 4.50% by the end of 2024.

There is no guarantee these projections will come to fruition. If the U.S. economy unexpectedly strengthens in H1 2024, or inflation rebounds, the Federal Reserve might be forced to keep interest rates where they are, or raise them further.

At this time, however, most projections suggest that benchmark interest rates (e.g. the federal funds rate) should drop below 5% this year and close 2024 somewhere between 4.00-4.50%.

Bond products to consider in 2024

If the Federal Reserve does drop benchmark rates in 2024, bond prices are poised to benefit. In fact, it appears that some bond-focused products have already started rebounding, and could climb further if the aforementioned rate cuts materialize as expected in the coming months.

Not long ago, Luckbox wrote that the iShares 20 Plus Year Treasury Bond ETF (TLT) looked attractive heading into the new year. Since bottoming at roughly $82/share in mid-October, TLT has rallied by over 19%.

TLT has clearly benefited from revised expectations for declining interest rates. Those updated expectations have also been observed in the Treasury yields market (e.g. U.S. government debt market).

Since Oct.19, the yield on the 10-year Treasury has dropped from 4.9% down to 3.9%. That’s an incredible move over such a short period and illustrates how interest rates expectations have shifted dramatically.

With most signs pointing to further deterioration in interest rates, it’s highly likely that other niches of the bond universe will benefit during the new year. As highlighted below, the expected returns for government bonds, aggregate bond funds, corporate bonds and high yield bonds have trended above their long-term averages.

The current yield-to-worst (YTW) for each of the aforementioned bond categories has climbed well above its respective long-term average. That’s another promising sign for the 2024 bond market.

Yield-to-worst is a projection for future returns and represents an estimate of the lowest possible yield for a bond by averaging returns across a wide range of different scenarios. Investors use yield-to-worst as a risk management tool to evaluate the potential downside risk associated with a particular bond investment.

As highlighted by Morningstar’s data, the existing conditions in the bond market have created somewhat of a perfect storm, pushing YTW levels to highly attractive levels. That’s another reason to be bullish on bonds heading into the new year.

That said, the financial markets aren’t riskless. If higher interest rates persist, some corporate bond issuers will undoubtedly default. For this reason, bond investors may elect to focus on higher quality companies with long track records of successfully paying their debts. High quality corporate debt is typically referred to as investment grade.

Bonds that are classified as investment grade are generally viewed as less likely to default, making them more attractive to risk-averse investors. Investment grade bonds are typically issued by financially stable and reputable organizations with access to considerable financial resources.

Two well-known ETFs that focus on high-quality corporate debt include the iShares iBoxx Investment Grade Corporate Bond ETF (LQD), and the iShares 5-10 Year Investment Grade Corporate Bond ETF (IGIB), which are both up about 5% over the last 52 weeks. Investors and traders looking for exposure to international corporate bonds can also consider the Invesco International Corporate Bond ETF (PICB), which is up about 10% over the last 52 weeks.

In addition to high-grade corporate bonds, investors and traders may also consider high yield bonds. High yield bonds, often referred to as junk bonds, are a category of corporate bonds that have credit ratings below investment grade. That means the companies issuing these bonds have a higher probability of defaulting on their interest rates, or failing to repay their principal at maturity.

Due to their elevated credit risk, high yield bonds typically offer higher potential returns as compared to investment grade corporate bonds. That said, higher yield bonds also come with higher risk, and the potential for capital losses if the issuer in question encounters financial difficulties.

Two well-known high-yield ETFs include the iShares iBoxx High Yield Corporate Bond ETF (HYG) and the SPDR Bloomberg High Yield Bond ETF (JNK), which were both up around 5% in 2023. Investors and traders interested in internationally-focused high yield bonds can also consider the iShares International High Yield Bond ETF (HYXU), which was up about 12% last year.

Since interest rates expectations started shifting in mid-October, all of the aforementioned bond ETFs have outperformed, as highlighted below (returns from Oct. 19, 2023 through Jan. 3, 2024):

- iShares 20 Plus Year Treasury Bond ETF (TLT), +19%

- iShares iBoxx Investment Grade Corporate Bond ETF (LQD), +12%

- Invesco International Corporate Bond ETF (PICB), +10%

- iShares 5-10 Year Investment Grade Corporate Bond ETF (IGIB), +9%

- iShares iBoxx High Yield Corporate Bond ETF (HYG), +7%

- SPDR Bloomberg High Yield Bond ETF (JNK), +7%

- iShares International High Yield Bond ETF (HYXU), +7%

Considering that TLT focuses on government bonds—which are theoretically less risky than corporate bonds and high yield bonds—the above performance figures illustrate that TLT is arguably still the best bet for investors and traders that want exposure to the bond market but also want to minimize risk.

TLT tracks the performance of U.S. Treasury bonds with maturities of 20 years or more. As such, TLT provides investors with exposure to long-term U.S. government debt, which is generally considered one of the safest assets in the fixed-income universe.

On the other hand, a broadening of the bond rally could trigger significant rallies in the corporate and high yield niches. But as explained previously, these two niches also come with additional risk. Ultimately, investors and traders need to choose the product that best matches their outlook and risk profile.

Speaking to the potential in the 2024 bond market, Rick Rieder, the chief investment officer of Blackrock’s fixed income division, recently told The Wall Street Journal, “This year [2023], the traditional 60/40 portfolio was carried entirely by the stock market before this bond rally. My sense is next year [2024], fixed income will be a bigger part of portfolio return.”

To learn more about the inverse correlation between interest rates and bond prices, check out this installment of Options Jive on the tastylive network. To follow everything moving the markets in 2024, including the options markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.