The Signal in Noise

Understanding and measuring investor sentiment helps fill the gap left by fundamental and technical analysis

Markets abhor extremes. That means the current era will end, and investors should prepare for the retracement—a phenomenon Investopedia defines as “the temporary reversal of an overarching trend in a stock’s price.”

To get ready, they’ll need to separate the signal from the noise, which takes more than the standard tools of fundamental and technical analysis. It requires understanding and measuring market emotions expressed as sentiment.

But let’s begin with some thoughts on two types of analysis: fundamental and technical. Traditionally, investors have used both to shape trades.

Fundamentals provide a longer-term diagnosis of the forces at play. They include but aren’t limited to inflation, employment, economic growth and the money supply. Central banks pay close attention to changes in those metrics.

Technical investors focus on price action itself. The toolbox of indicators is applied to identify whether prices are in a trend or exhibit momentum and congestion.

So, which has better tools—fundamental analysis or technical analysis? Well, the battle between fundamental and technical analysis never ends, and there’s no clear winner. Both face a key gap in identifying why prices are moving. The causal link between fundamental forces and price action is often too long-term to guide traders effectively. Technical analysis, at best, provides an X-ray of what’s happening but doesn’t explain why.

But there’s hope. Sentiment provides the bridge between fundamentals and price levels. Sentiment, as an indicator for markets, has been around for decades. For example, the Michigan Consumer Sentiment surveys and the New York Federal Survey of Consumer Expectations provide general longer-term measures of expectations.

Business sentiment indicators known as diffusion indicators, (i.e., purchasing manager indexes) provide a measure of optimism in the business sector. Documents like 10-Ks that companies provide to the Securities and Exchange Commission are also important for tracking investor sentiment.

Those sources of sentiment fail to help investors plot near-term trading strategies. But sentiment based on YouTube talking heads and social media chatter provide a fairly new, nearly real-time tracking of market emotions.

In other words, social media-based sentiment fills the gaps left by both fundamental and technical analysis. Nobel laureate Robert Shiller noted in his recent book, Narrative Economics: How Stories Go Viral and Drive Major Economic Events, that story arcs are an important way to understand price movements.

Marshall McLuhan’s prophetic comment that “the media is the message” has come to full fruition. Social media and internet-based sentiment are important because they help extract the reason behind a price surge or sell-off.

It’s time for investors to track the emotions that trigger price movements. Words become the new tool for understanding and predicting price movements.

Consider the following formula: Price = fundamentals x sentiment

In this general equation, if fundamentals were positive but sentiment was negative, prices would have downward pressure. If fundamentals were negative but sentiment was positive, prices would reflect a bullish pressure. There are many variations.

Every trading decision results from an investor’s subjective judgment of the positivity or negativity of fundamentals and sentiment. The challenge is to quantify both fundamental and sentiment expectations properly. Sentiment analytics has become a third bucket of analysis for trading currencies and other markets.

Let’s take a high-level view of currency pair extremes and apply sentiment thinking to shape some trading scenarios.

Inflation and king dollar

Most of the planet’s economic interflows are priced in U.S. dollars, making it the most important currency. A surging dollar has increased costs and decreased profits. In particular, multinational companies have been hurt by exchange rate risk.

If leaders at those companies paid attention to sentiment, it would not have come as a surprise. Understanding why the rising dollar has occurred can help prepare for the coming decline.

It’s a question of fundamentals and timing. But the path ahead for the dollar will depend not only on the level of inflation but also on expectations that inflation and rate hikes will continue. Trading the dollar is also trading sentiment.

U.S. dollar traders face the key sentiment question of the duration of inflation, as well as expectations for the rate of change in the coming months. Markets want to know whether peak inflation has occurred.

Statements by the Federal Reserve provide a good source of dollar sentiment expectations. The Fed has been wrong many times, but trading the dollar requires making a judgment on Fed sentiment and expectations.

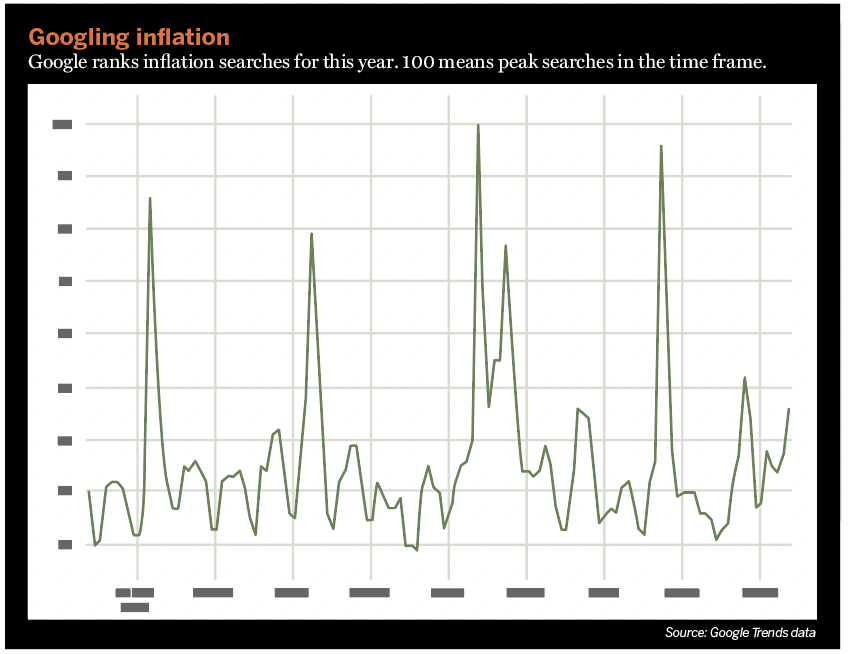

Google Trends, a site that analyzes search volume, can help with that judgment. Entering the search term inflation shows that the frequency of mentions continues a rocky road of peaks. Maybe Google Trends is telling investors something.

The dollar and the euro

The euro’s parity with the U.S. dollar is the focus for traders. It’s also a play on whether the U.S. economy grows faster than the eurozone economy. At any moment in time, a sustained level at parity with the U.S. dollar depends on the result of a battle of expectations.

The exchange rate between the euro and U.S. dollar, or EUR/USD, could also strengthen against the U.S. dollar when market expectations favor a dovish Fed compared with a more hawkish European Central Bank (ECB). EUR/USD traders should track what the ECB says in its rate decisions.

In fact, one of the best tools for reading the tea leaves of central bank sentiment is actually reading the key statements. Words count and can catalyze and crystalize the narratives that follow. One of the best examples of the power of words is when Italian Prime Minister Mario Draghi said the ECB will do everything to save the euro.

Gold

But let’s not ignore gold and crypto. Both have emotionally linked, cult-like followings.

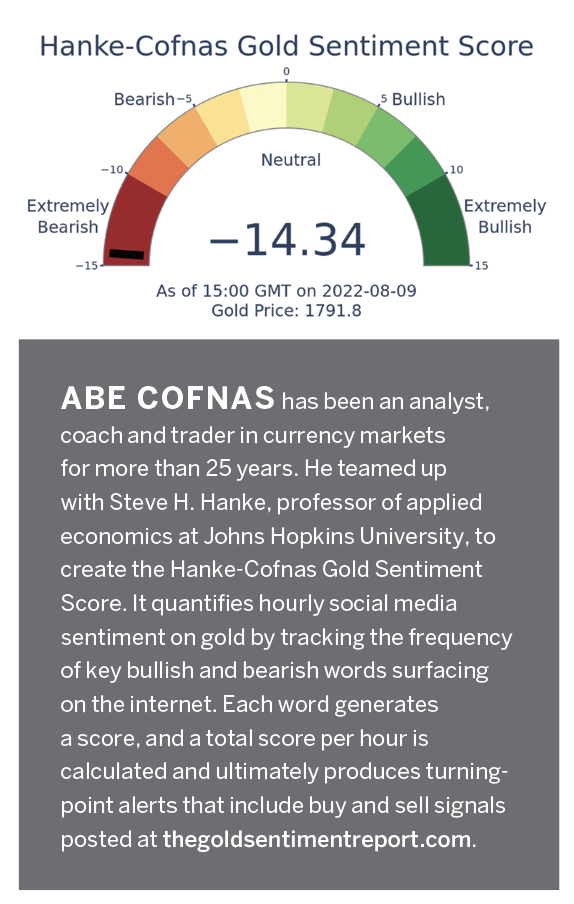

But how does the often fervently bullish gold crowd explain downward swings in the precious metal? The answer lies in understanding gold sentiment. Gold is bullish when expectations of dovish Fed policy prevail. It swings bearishly when markets fear an increased rate of tightening.

Think of gold as an emotional barometer of anxiety about the effectiveness of the Fed. One of the best ways to trade gold is right after a Fed Statement, or a nonfarm payroll report. The direction gold takes will immediately reveal bullish or bearish sentiment.

What to expect

In the next three to six months, up to one year, investors who understand the underlying sentiment narrative will gain an edge. Here are four forecasts based on the integration of fundamentals, technicals and sentiment.

First, sentiment about the U.S. dollar won’t shift in the short term because of expectations that the currency will remain volatile. In the longer term of one year, the U.S. dollar appears likely to decline with expectations of peak inflation and cessation of the Fed’s rate increases.

Second, the euro will be battling to remain near parity with the U.S. dollar, reflecting uncertainty of the dollar’s direction and the ability of the eurozone to achieve positive growth. If the ECB keeps raising rates while the Fed stops, bullish sentiment will emerge for the euro/U.S. dollar currency pair (EUR/USD).

Third, the yen seems likely to strengthen both in the near term and long term. Sentiment regarding the Japanese economy is that inflation there will stay above 2%. With U.S. inflation and interest rates flattening, the U.S. dollar exchange rate with Japanese yen, or USD/JPY, is positioned to drop significantly.

Fourth, gold traders who analyze sentiment will expect gold to swing up and down, as expectations for the U.S. economy remain in search of consensus. However, gold will rise to $1,900 within a year as the current rate-hike regime will pause and the Fed may even begin stimulus.

It’s all a matter of coming to an understanding of sentiment and adding its wisdom to fundamental and technical analysis.