Hype and Skew

Hyped-up stocks can have unusual option pricing with atypical option skew

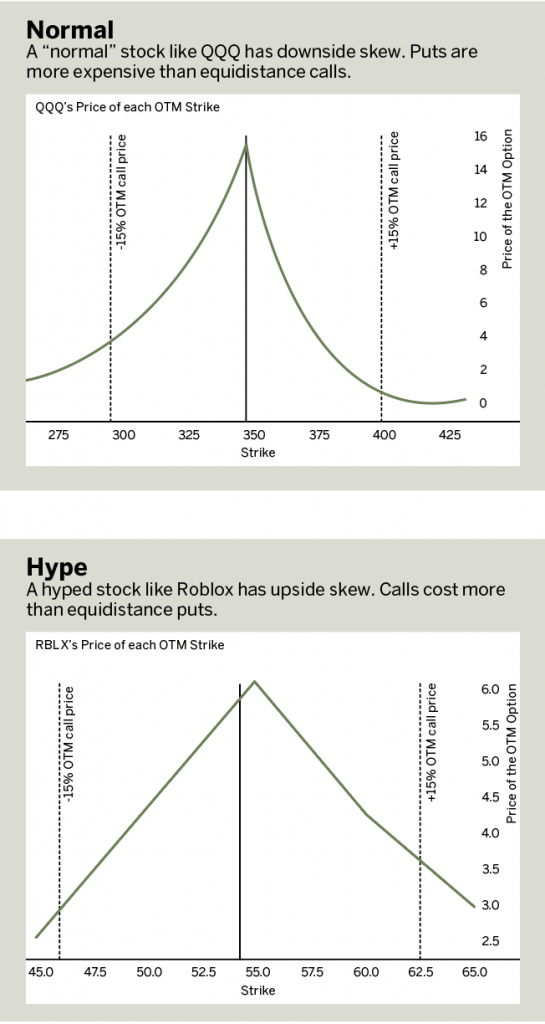

Look at prices of the Nasdaq ETF (QQQ) out-of-the-money (OTM) strikes for the April 14 expiration. They’re highest at the current price of QQQ at 345 and get lower the farther out-of-the-money the strikes are.

Now notice that the 15% OTM put is 5 1/2 times more expensive than the equidistant call: $3.65 for the 295 put versus $0.70 for the 398 call.

This is a classic put skew. According to traders, the risk is that protection is needed to the downside. After all, stocks tend to fall in price further and faster, and then rise. This market behavior makes puts more expensive than calls. Investors seek protection against an adverse move, thus driving up the cost of the option on the side of the perceived risk.

Now look at a “hyped” stock: Roblox Corp. (RBLX). It’s rising and falling with the metaverse craze. It has skew toward the upside. In other words, the market is “bidding” up calls more than equivalent distance puts. In this example, with Roblox selling for $54 per share, the 15% OTM put is selling for $2.15 versus $3 for the call. It’s nearly 50% more costly for the calls.

Skew to one side doesn’t necessarily mean traders are predicting that the stock will move in that direction. It’s where speculation or fear is occurring. Here’s a case in point: Back in November, when Roblox was above $125 per share, the calls were even more expensive compared with puts—much more expensive.

With the price of Roblox considerably lower at press time at $45 per share, the market was pricing the risk incorrectly back in November. This is an important observation because hype stocks often have unusual option pricing with atypical option skew. But that fear of unusual option pricing rarely lasts for long. Options seldom stay with volatilities of 100% to 200%.

So, how does one take advantage of skew and hype? First, take advantage of skew and fear in the market. If the fear is to the downside, then puts will be more expensive. If speculation is causing upside skew, then those calls will be expensive. Depending on your risk tolerance and trading style, the idea is to purchase cheap options and sell expensive options.

To trade this skew with risk-defined strategies (which are strategies that limit profit and loss), the idea is to sell credit spreads on the expensive, skewed side and trade debit spreads on the cheap, non-skew side. Therefore, follow the rules of thumb in Normal, upper right.

By keeping an eye on the skew, traders can take advantage of the market’s perception of risk and make more informed decisions.

Michael Rechenthin, Ph.D., aka “Dr. Data,” is the head of research and development at tastytrade. @mrechenthin