Equities Too Volatile? Consider Some New Shorts (Bonds, Currencies, and Precious Metals)

With equities making big moves in both directions during the first five months of 2020 (underscored by a 1,800 point drop in the Dow Jones on June 11), it’s reasonable for investors and traders to be looking for new ideas when it comes to short premium positions.

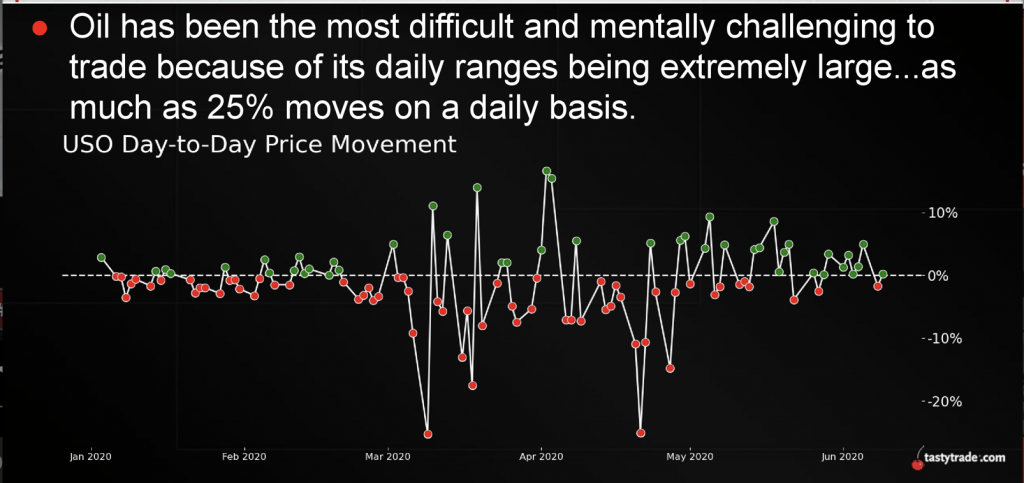

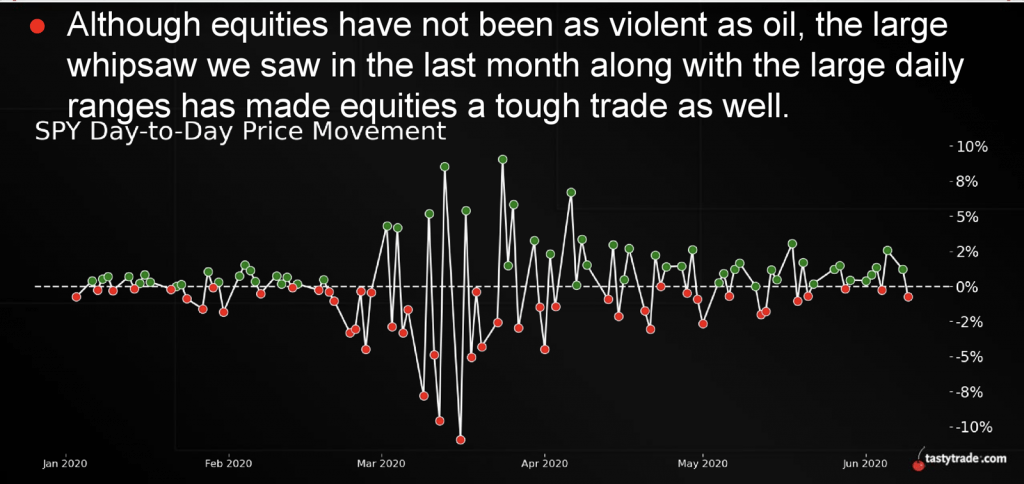

The graphics below illustrate how both equities and crude oil have both traded with relatively wider ranges in 2020, making short premium positions a bit harder to stomach:

While the above data may not be encouraging for those that like to sell options, recent research conducted by tastytrade suggests that premium sellers may not need to give up on 2020 altogether.

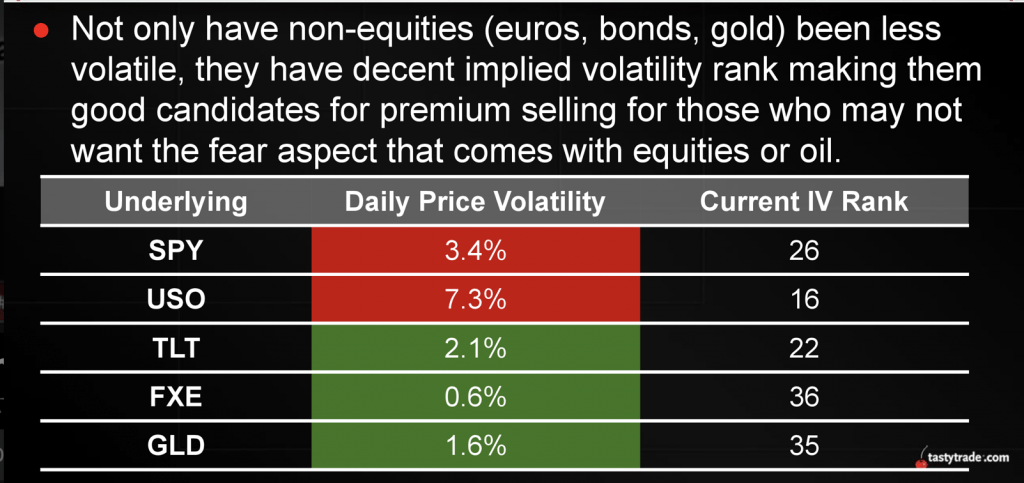

According to data compiled by tastytrade, there are three sectors of the market that have been exhibiting far less volatility than equities and crude oil this year, and therefore may deserve a second look when it comes to deploying short options. These market categories include: bonds, foreign currencies, and precious metals.

The chart below summarizes how daily price volatility in bonds (TLT), foreign currencies (FXE), and precious metals (GLD) has been much lower as compared to equities and crude oil in 2020. Likewise, these three sectors also offer heightened levels of implied volatility, as indicated by Implied Volatility Rank (IVR), which means that premium may also be “rich:”

It should be noted that premium sellers generally target an IVR of 50 or above when selling options, but that paradigm has shifted somewhat in 2020 given that extreme outliers exist in the historical 52-week data set.

For more insight on how corrections can impact Implied Volatility Rank, readers may want to review this previous installment of Market Measures on the tastytrade financial network.

Investors and traders that aren’t comfortable trading underlyings with exposure to bonds, foreign currencies, and precious metals, can also consider the Sector ETFs for short premium exposure.

As a reminder, the sector ETFs are a class of exchange-traded funds that invest in the stocks and securities of a specific sector, typically identified in the title of the fund. For example, the XLF is called the “Financial Select SPDR ETF,” and consists of 62 underlying symbols that operate in the financial sector and are represented in the S&P 500.

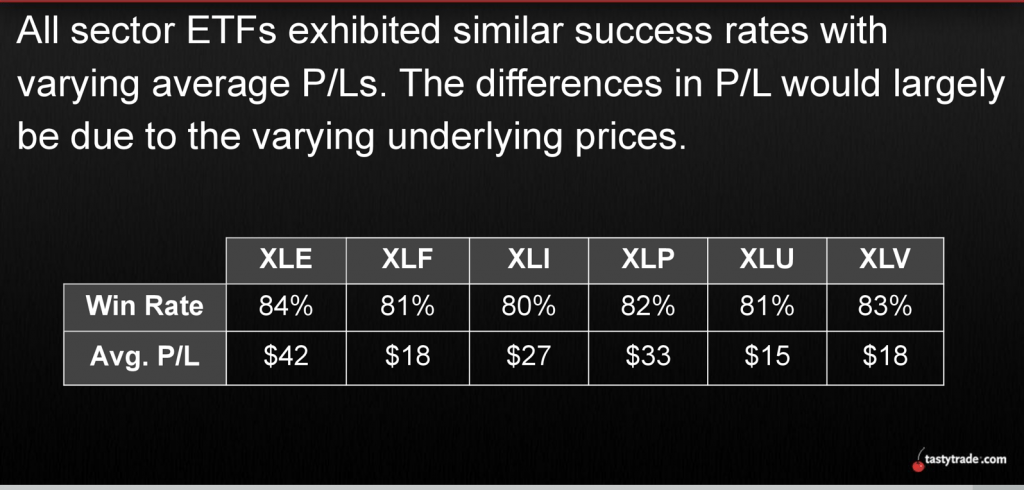

The tastytrade research team backtested selling premium in sector ETFs from 2005 to present using short strangles, an approach which on average produced highly attractive results.

The results of this research are summarized in the graphic below:

With win rates above 80%, the above research supports the notion that the sector ETFs remain a relatively safer haven for short premium as compared to single stocks, which generally trade with significantly higher levels of realized volatility.

To learn more about trading the Sector ETFs, readers may want to review this recent installment of Market Measures when scheduling allows.

To better understand why single stocks offer heightened levels of risk, this new episode of Market Measures may also be of interest.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.