The Wisdom of Crowds

To predict next year’s stock prices, look where investors are putting their money

New variants of COVID-19 might drive stock prices lower, or President Joe Biden’s infrastructure plan might push them higher. But what do the markets themselves suggest about the coming year? Let’s estimate 2022 price ranges based on the “wisdom of crowds” by looking at where thousands of traders are actually placing money.

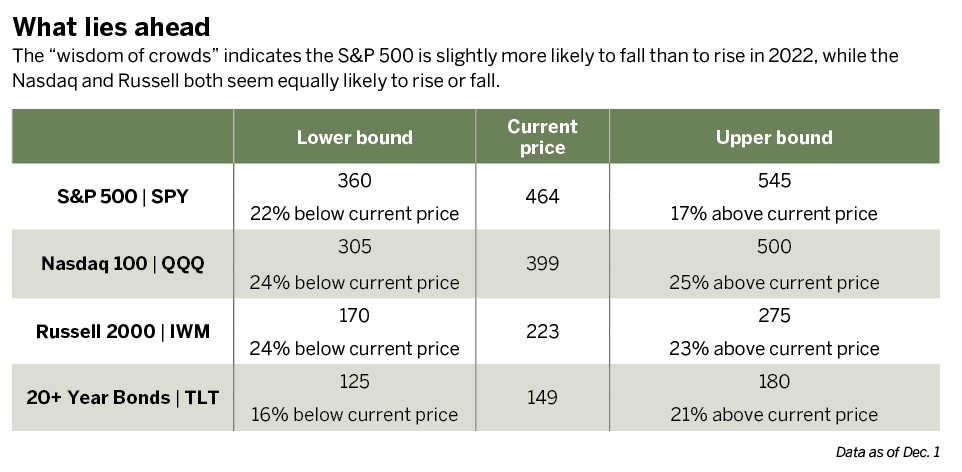

The S&P 500, Nasdaq and Russell 2000 are expected to rise or fall by roughly 25% by the end of December 2022. But notice that the S&P 500 is slightly skewed to the downside, with observers expecting a greater fall (22%) than rise (17%). They view the Nasdaq and Russell as almost equally likely to rise or fall.

But what’s the source of those estimates? Look at the options Greeks—especially the delta, which traders can use as a proxy for probabilities. A 16 delta is an estimated 16% probability of an option being in the money on expiration. Thus 100% – 16% = 84% probability of being out of the money on expiration.

The table “What lies ahead” shows the price of SPY at 464, and the 16 delta put is 360. Thus, there’s an 84% probability that the market will be above that point on the expiration of December 2022. And the 16 delta call is 545, so there’s an 84% probability the market will be below that upper bound on expiration.

About 68% of prices fall between the upper and lower bounds, which is -1 and +1 standard deviation. See here for more. So by the end of next year, the best estimate is that prices will fall between 360 and 545 for the

S&P 500 ETF (SPY).

How often do prices fall within the lower and upper ranges? At this time last year, SPY and QQQ fell above the upper bound. They performed slightly better than the upper range the options market was expecting.

In fact, 30% of stocks in the S&P 500 fell above their expected upper bound from last year’s estimates—and it was an average of 8% above that upper range. But wait. That doesn’t necessarily mean traders should buy options. While 30% fell outside the upper range, only 17% would actually have been profitable.

That’s why selling options is generally an ideal strategy when pursued conservatively. Think of it this way: An options buyer is looking to either offload risk or spend some money with the potential for a large payday. An options seller is looking to receive money by taking on risk from someone looking to offload it.

Taking on risk should be rewarded. It’s why insurance companies are generally quite profitable. They’re paid premiums for taking on risk. Occasionally a loss occurs, but over time it’s a profitable endeavor.

Don’t believe it? Test a trade idea by scanning the QR code to use Lookback, a free options backtesting application. It draws upon more than a dozen years of data to test any options strategy.

Michael Rechenthin, Ph.D., aka “Dr. Data,” is the head of research and development at tastytrade. @mrechenthin