Breaking the Butterfly’s Wings

Transform a low-profit, low-risk trade into one with higher profit but higher risk

The butterfly, a low-probability, low-risk options trading strategy, doesn’t maximize profit, but it lessens risk. That’s why investors use it for speculation.

Say a trader thinks Amazon (AMZN) priced at $3,500 isn’t going to move much by expiration. Then, the trader could buy a traditional butterfly. It would cost roughly $350 but have a possible profit of $3,600. That’s an approximate return of 10 times the amount at risk. But the probability of it hitting that price will be low, making it a “speculative” trade.

A traditional three-step butterfly setup is as follows: 1. Buy one in-the-money (ITM) option; 2. Sell two at-the-money (ATM) options; 3. Buy one out-of-the-money (OTM) option.

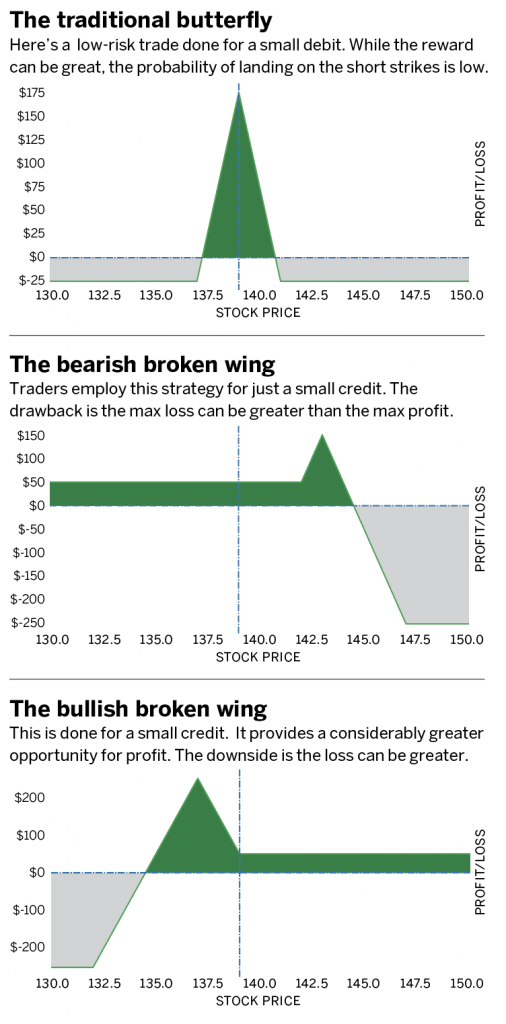

The entire trade is done for a small debit. Traders use this strategy in higher implied-volatility environments. The credit received for selling the two ATM options lowers the costs. The cheaper the butterfly, the less capital is used, and the max loss is minimized. For example, the bond exchange-traded fund (ETF) TLT is trading for 139: Buy one 137 put using the June expiration; sell two 139 puts using the June expiration; and buy one 141 put using the June expiration.

Traders can do that for a 0.25 debit, or a total price of $25. (See The traditional butterfly, below.) Calculate the max profit by taking the amount paid and subtracting by the width of the long ITM and OTM strikes from the two ATM strikes. Because the width is two and the amount paid is 0.25, the max profit is $175. The max loss will always be the amount paid, which is 0.25, or $25. The butterfly strikes can be shifted up or down, depending on whether a trader feels bullish or bearish at expiration. The idea is to place the short strikes where you expect the stock to land.

The butterfly, in this example, will profit when it lands between 137.25 (ITM plus debit paid) and 140.75 (OTM minus debit paid). The breakeven is narrow, but the risk is small, and the potential is large.

To increase the probability of success, the butterfly can be “broken” so that the spread width is uneven and done for a credit instead of a debit. This makes the butterfly change from a low probability of profit, low-risk trade to a higher probability trade with higher risk.

Here’s the reason: Instead of profiting only if the stock “hits” a particular price at expiration, traders can make a smaller profit if the stock goes in one direction as well. So, the position can profit from two scenarios instead of just one.

The bearish broken wing shows an example of a bearish broken-wing butterfly using calls: Buy one 142 call using the June expiration; sell two 143 calls using the June expiration; and buy one 147 call using the June expiration for a 0.50 credit.

This example of a bullish broken-wing butterfly (see The bullish broken wing, below) uses puts: Buy one 132 put using the June expiration; sell two 137 puts using the June expiration; and buy one 139 put using the June expiration for a 0.45 credit.

Notice these are unlike the previous “traditional” butterfly where the long strikes are of an equal distance from the short strike. By “breaking” the wings on the butterfly, this adjustment can turn the trades from a debit to a credit and thus drastically improve the probability of making money on the trade.