Crypto’s Collapse Devines Aussie Dollar’s Decline

Keyword searches and risk-off sentiment in crypto suggest more movement to the short side for the Aussie Dollar

Traders often default to a ticker-centric view of financial markets. “Which stock should I buy?” they ask. “Will this currency or that currency outperform this year?”

It makes sense: The long-term rise of global equity markets helped the appetite for risk prevail over risk aversion for at least the past half-century. Most of the time, traders are operating in markets where asset prices overall are rising.

Most of the time, but not always. Market-wide downtrends can span multiple years and have done so in recent memory (2000-03, 2007-09). Such episodes are almost always marked by regime change in the credit markets, both at their start and end. That ought to be intuitive: The cost of money inherently shapes traders’ willingness to risk losing it. So, the markets tend to turn defensive if interest rates are expected to rise.

A broad de-risking of portfolios in such an environment—where capital flows from riskier to safer bets—drives market-wide changes in behavior across tradable securities. That can make for seemingly strange bedfellows as most assets focus on a single system-wide narrative. It seems no different in the early days of 2022 as the Federal Reserve gears up to fight inflation by raising interest rates and shrinking its asset holdings to reduce the money supply.

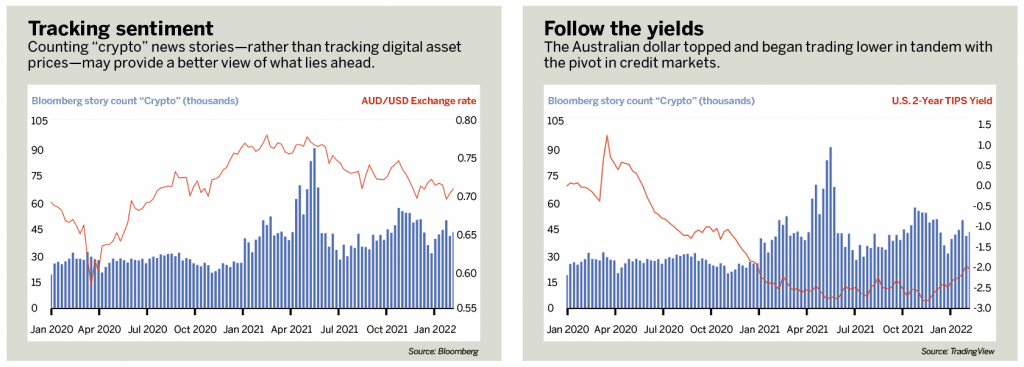

The latest bout of speculative fervor for cryptocurrency—tracked by the number of Bloomberg news stories featuring the keyword “crypto”—appeared to peak mid-2021. (See below.) Tellingly, that happened just as near-term real interest rates, nominal yields less expected inflation, represented by the two-year TIPS rate, bottomed after a long decline. That happened as the Fed relaxed its insistence on waiting out “transitory” price growth and set the stage for action.

Counting “crypto” news stories instead of simply tracking digital asset prices, like that of bitcoin, for example, seems to provide a richer view of what is afoot. It’s revealing that chatter about a non-interest-bearing and highly volatile asset class peaked and began to wane just as borrowing costs stopped falling. That speaks to a broader shift in trader psychology, a trend beyond what can be gleaned from price action in relatively illiquid cryptocurrency markets.

Underscoring as much, the Australian dollar topped and began trading lower in tandem with the pivot in credit markets. The currencies of commodity-exporting countries tend to be especially sensitive to changes in overall market mood. That’s because their home economies’ position toward the beginning of the global supply chain can make for an outsized influence from changes in global growth expectations.

x

Priced-in market expectations for Fed policy now call for 225 basis points in rate hikes through 2024, with most of the rise (150 basis points) front-loaded to 2022. Recent comments from Fed officials suggest that proactive reduction of asset holdings on the central bank’s balance sheet may also begin to tighten credit conditions further as soon as this year. The synchronized de-risking this implies suggests that the Aussie has room to continue lower.

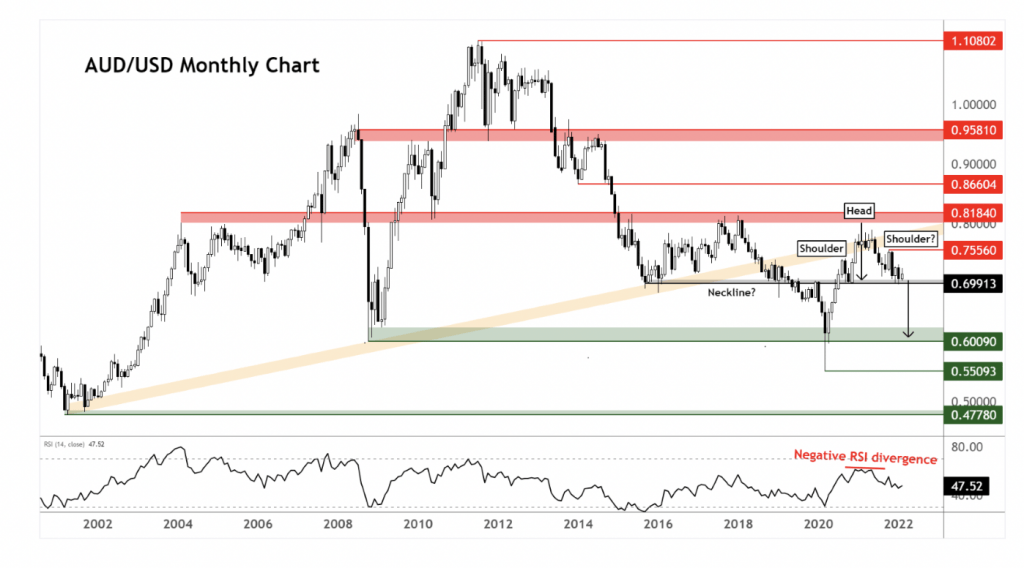

Appropriately enough, the Australian dollar/U.S. dollar (AUD/USD) currency pair appears to be forming a bearish head-and-shoulders chart pattern after retesting former support in the 0.80-0.82 area. (See AUD/USD, below).

Confirming the setup seems to call for a break of “neckline” support just below 0.70. That would imply a measured move down to revisit the 0.60 figure, where sellers ran out of steam before the Great Financial Crisis in 2008 and the onset of the COVID-19 outbreak in 2020.

Ilya Spivak is head strategist for Asia-Pacific markets at DailyFX, the research and analysis arm of retail trading platform IG. @ilyaspivak