Vertiv Holdings (VRT): A Q1 Earnings Beat is Paramount

Vertiv Holdings (VRT) looks well-positioned to capitalize on the emerging AI revolution. But after a subpar Q4 2023 earnings report, the company still has a lot to prove heading into Q1 earnings.

- Shares of Vertiv Holdings (VRT) have skyrocketed due to the investor euphoria linked to artificial intelligence (AI), and are up nearly 500% over the last 52 weeks.

- Vertiv offers cutting-edge data center infrastructure products, which are well-suited to the heavy computing workloads required by AI platforms.

- Vertiv may ultimately be a winner in the AI niche, but based on the company’s disappointing earnings outlook for 2024, the current valuation looks overextended.

With Q1 earnings season set to take flight on April 12, investors and traders will be watching closely to see if upcoming earnings data backs up the strong bull run observed in the stock market since last October.

Along those lines, companies with heavy exposure to artificial intelligence (AI) will be closely watched to assess whether forward earnings guidance matches the lofty valuations observed in this niche of the market.

This includes chip makers such as Nvidia (NVDA) and Advanced Micro Devices (AMD), as well as AI-focused data center infrastructure companies such as Super Micro Computers (SMCI) and Dell Technologies (DELL). Another company from the AI sector that has seen its shares skyrocket in recent months is Vertiv Holdings (VRT), which also focuses on data center infrastructure.

What’s most interesting about Vertiv is that the company reported weaker than expected earnings for the last three months of 2023. As such, Vertiv arguably has more to prove during H1 2024, in comparison to companies like Supermicro and Dell, which both comfortably beat earnings expectations last quarter.

Future potential is a key driver of valuation in the marketplace, but if that potential never materializes, shares usually get punished. Looking ahead, shares of Vertiv look susceptible to a potential pullback, especially if the company delivers another earnings disappointment in Q1.

Background on Vertiv’s operations and exposure to AI

Vertiv Holdings specializes in the design, manufacturing and servicing of electronic components that are typically consumed by data centers and communication networks. This encompasses powering, cooling, securing and maintaining the electronics that are fundamental to processing, storing and transmitting data.

In terms of end markets, Vertiv is more heavily focused on data centers than communication networks. According to data compiled by Bank of America, roughly 70% of Vertiv’s business revenues are derived from data centers, while 20% is derived from communication networks. More details on the four major operational divisions at Vertiv Holdings are outlined below:

- Data center solutions: This division focuses on providing comprehensive solutions for data centers, which typically includes power management, thermal management, IT management and other related services. Through this division, Vertiv offers a wide range of products and services designed to optimize the performance, reliability and efficiency of data center operations. The typical clients of this division are large, standalone enterprises, hyperscale cloud providers, colocation facilities and other data-intensive organizations.

- Networks and telecommunications: Vertiv’s networks and telecommunications division specializes in delivering infrastructure solutions for communication networks, including wireless/wireline networks, broadband services and telecommunications infrastructure. Through this division, Vertiv offers a suite of products and services designed to enhance network performance, reliability and scalability. The company’s goal is to support the constantly evolving demands of telecommunications operators and service providers.

- Commercial and industrial solutions: The commercial and industrial solutions division focuses on delivering unique infrastructure solutions for companies that aren’t from the traditional data niche of the technology sector. Through this division, Vertiv offers a diverse portfolio of products and services tailored to the unique requirements of commercial and industrial customers, enabling them to optimize operations, improve productivity and ensure business efficiency/continuity.

- Services and support: Through a combination of proactive maintenance and responsive support, Vertiv helps customers minimize downtime, mitigate risks, and optimize their investments in critical infrastructure. Along those lines, Vertiv’s services and support division offers installation, maintenance, monitoring, and optimization services, as well as remote monitoring and management solutions, training programs and technical support services.

Vertiv: A Potential AI Winner?

One of the key differentiators for Vertiv in the emerging era of AI is that its products and solutions provide valuable support for heavy computing workloads. Not coincidentally, AI and machine-learning platforms involve vast datasets and intensive computational algorithms which require significant computing resources.

Importantly, Vertiv’s products and solutions help enhance the scalability, efficiency and reliability for heavy-duty computing workloads, which is why they are especially well-suited for the AI niche. At a high level, this involves the continuous delivery of adequate power, effective temperature control and dynamic software support.

Additional details on the unique suitability of Vertiv’s products to the AI niche are highlighted below:

- Power management solutions: AI workloads require high-performance computing (HPC) infrastructure and Vertiv’s power management solutions ensure reliable and uninterrupted power supply to these critical components, minimizing the risk of downtime and ensuring continuous operation.

- Thermal management solutions: Due to the intensity of the computing processes, AI-focused data centers produce more heat than their traditional counterparts. Vertiv’s thermal management solutions—including precision cooling systems and airflow optimization technologies—help to dissipate heat, which contributes to optimized temperatures and improved stability.

- IT management solutions: Vertiv offers a range of IT management solutions that are designed to optimize the performance and efficiency of AI infrastructure. These offerings include infrastructure management software, monitoring software, intelligent rack systems and advanced data center infrastructure management (DCIM) solutions. Together, these products and services allow organizations to monitor, analyze and optimize their IT resources to manage their AI workloads in the most efficient manner possible.

- Services and support: Vertiv offers a comprehensive suite of lifecycle services that focus on extending the useful life of the infrastructure. This encompasses installation, commissioning and maintenance services, as well as remote monitoring and predictive analytics capabilities.

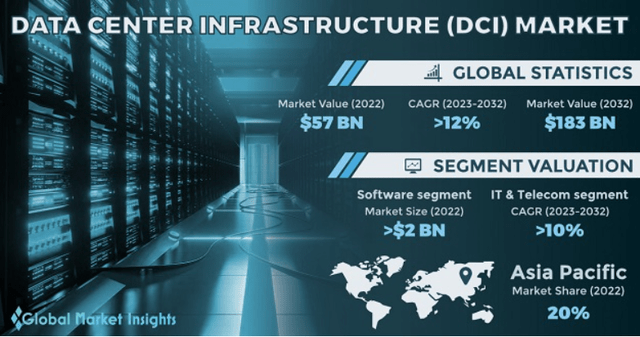

Since generative AI took flight at the end of 2022, Vertiv has experienced increased demand for the aforementioned products and services. With the data center infrastructure sector expected to grow in robust fashion in the coming years (illustrated below), Vertiv looks well-positioned to capitalize on the current market dynamics.

The implications of a weak Q4 earnings report

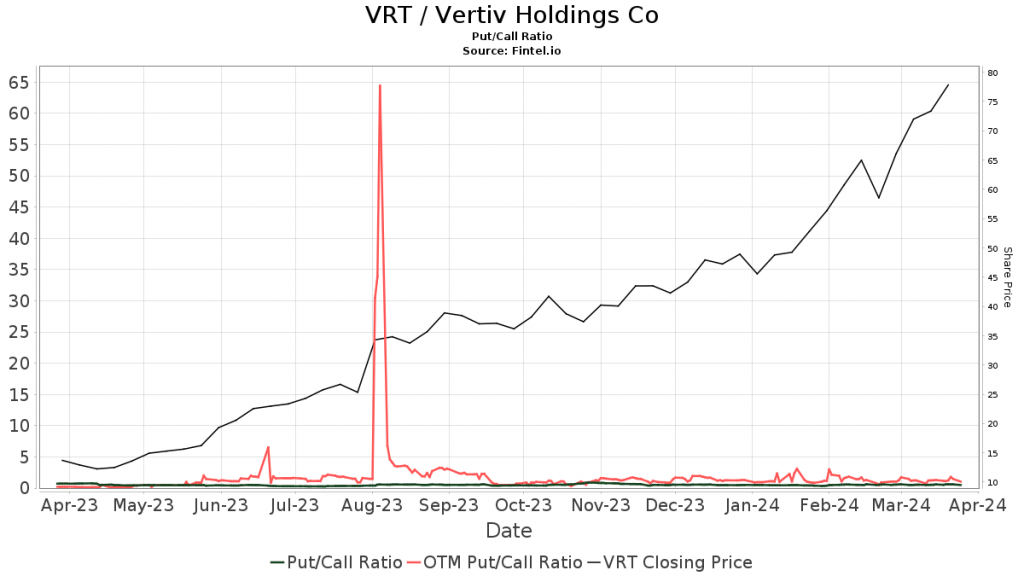

Vertiv Holdings looks like a promising player in the AI niche. And that has been reflected in the underlying shares of Vertiv, which have rallied by nearly 500% over the last 52 weeks.

On the other hand, the company’s most recent quarterly earnings report wasn’t exactly the “shot heard around the world.” In fact, Vertiv’s Q4 2023 earnings report would be better characterized as a mild disappointment. Even worse, the company guided down financial expectations for 2024, representing another incremental negative.

On a top-line basis, Vertiv reported earnings per share of $0.56 last quarter, which was nearly in line with the consensus expectations. But looking ahead into Q1 2024, Vertiv actually guided earnings expectations lower, indicating that earnings per share would fall somewhere between $0.32 and $0.36. Analysts were expecting Q1 earnings to clock in at closer to $0.37/share.

Unfortunately, the full-year 2024 earnings guidance doesn’t look that rosy, either. During the calendar year 2024, Vertiv expects to grow its organic revenues by about 9-11%, which is actually lower than last year, when revenues grew by 13%.

All told, these figures paint a picture of solid growth, but are well behind the torrid pace of the leaders in the AI niche, such as Nvidia and Supermicro. For example, in its most recent quarter, Nvidia reported revenues that were 256% higher than the same quarter a year prior. Similarly, Supermicro saw its revenues rise by 133% during the last three months of 2023, as compared to the same quarter 12 months prior.

Taken all together, one can see why shares of Vertiv pulled back after the company’s most recent earnings report was released on Feb. 21. But that turned out to be a minor speed bump, as the rally in Vertiv’s stock resumed shortly thereafter. The stock is now up nearly 80% year-to-date, as illustrated below.

Final takeaways: Vertiv’s valuation looks overextended

Based on the heavy computing requirements of AI-focused data centers, Vertiv Holdings looks poised to benefit from rising demand for the company’s products and services. As such, the company appears well positioned for solid growth in 2024 and beyond.

But one could argue that Vertiv’s underlying valuation has gotten ahead of itself, relative to the company’s expected revenue and projected earnings growth. During the last three months of 2023, Vertiv produced a disappointing earnings report, especially as compared to the sky-high expectations implied by the strong surge in the company’s underlying shares.

One also has to consider that Vertiv carries a relatively high debt load. At present, the company has roughly $3 billion in total debt, of which about $2 billion is designated “current.” In terms of cash and cash equivalents, the company has about $780 million. That means the company’s cash ratio is roughly 0.40 ($0.78/$2 = 0.40). Generally speaking, cash ratios above 0.50 are preferred, indicating that Vertiv’s current capital structure is suboptimal.

Based on Vertiv’s overall financials, Seeking Alpha currently assigns the company an overall valuation grade F. This is based on a scale ranging from A to F, with A representing the most attractive, and F representing the least attractive. One of the primary drivers of that valuation is Vertiv’s trailing 12-months price/earnings (P/E) ratio, which currently stands at 45—more than double the sector average, which is closer to 20.

After surging by roughly 470% over the last 52 weeks, Vertiv shares currently trade at about $82/share, implying a market capitalization of roughly $31 billion. If Vertiv’s P/E was trading in-line with the industry average, the market capitalization would be dramatically lower. In that scenario, Vertiv’s valuation would be under $15 billion.

In actuality, Vertiv’s valuation probably hovers somewhere between those two points. And that’s underscored by the current outlook on Wall Street. Of the eight analysts that cover Vertiv stock, the highest price target assigned to the stock is $80/share, while the lowest is $50/share. Somewhat amazingly, Vertiv shares already trade above that high water mark.

These valuation figures are especially interesting when one considers that Vertiv’s most recent earnings report was a mild disappointment. In terms of the company’s P/E ratio, and the outlook of professional analysts, that means a fair valuation for the company is likely closer to $20-$25 billion.

For the time being, Vertiv’s valuation looks overextended and could be susceptible to a sharp pullback in the event of a marketwide correction. If that comes to pass, investors and traders bullish on the future of artificial intelligence may want to consider initiating a new position in this stock—or adding to an existing one.

Until then, market participants should tread carefully with shares of Vertiv. The stock appears to have benefited greatly from investor exuberance linked to recent developments in the AI sector. But history illustrates that stocks rarely move straight up, especially those in the ever-changing technology sector. And with an already lofty valuation, the risk-reward proposition in VRT appears imbalanced, suggesting that profit-taking may be warranted at this time.

To follow everything moving the markets, including the options and futures markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

Note: Vertiv disputed some of the numbers in this article. Please click here for our response.