These Tickers Have Something in Common in 2024

Stock splits are common during bull markets, and LULU, NFLX, NVDA are poised to split their shares in H1 2024

- During bull markets, companies are more likely to conduct stock splits—breaking up existing shares to create a higher number of lower-value shares.

- In September, the Danish firm Novo Nordisk (NVO)—the most valuable company in Europe—executed a 2-for-1 stock split.

- If the current bull run continues, we view these three companies as strong candidates to announce a split: Lululemon (LULU), Netflix (NFLX) and Nvidia (NVDA).

If the stock market’s current bull run extends into next year, it’s highly likely that another big name company will announce a stock split in the near future.

Companies often split their stock after strong rallies, especially when their shares get prohibitively expensive for the average retail investor. Recently, Novo Nordisk (NVO)—the maker of the popular weight-loss drug Ozempic—split its shares 2-for-1 on Sept. 20.

With a 2-for-1 stock split, investors receive one additional share for each share they already own. So, investors holding 100 shares of Novo Nordisk now own 200 shares. And after a 2-for-1 split, each share trades for half of what it did before.

Prior to the split, Novo Nordisk was trading at roughly $200/share. Today, shares trade for about $100/share. With a market capitalization of roughly $450 billion, Novo Nordisk recently became the most valuable company in Europe.

Looking ahead into 2024, we view three companies as likely candidates to announce stock splits, especially if the current bull run continues:

- Lululemon (LULU)

- Netflix (NFLX)

- Nvidia (NVDA)

An introduction to stock splits

Much like mergers and acquisitions, stock splits are a form of corporate action.

Corporate actions generally constitute any activity that causes a material change in an organization. Corporate actions are therefore defined as changes that impact stakeholders in material fashion, whether they be shareholders or bondholders.

Stock splits occur when companies break up existing shares to create a higher number of lower-value shares. This is technically known as a forward stock split.

The intent of a forward split is to make shares more affordable to a wider pool of market participants, which in turn can improve the relative attractiveness and liquidity of the shares in the marketplace. Forward stock splits usually occur after a strong bull run pushes a company’s underlying shares into the hundreds of dollars per share.

The most common types of forward stock splits:

- 2-for-1 split: For every one share an investor holds, they receive an additional share, effectively doubling the number of outstanding shares.

- 3-for-1 split: For every one share, investors receive two additional shares, tripling the number of outstanding shares.

- 3-for-2 split: For every two shares, investors receive three additional shares, increasing the number of outstanding shares by 50%.

- 4-for-1 split: For every one share, investors receive three additional shares, quadrupling the number of outstanding shares.

Alternatively, some companies also pursue reverse stock splits. Reverse stock splits are typically pursued by companies that experience a dramatic correction in the value of their underlying shares.

A reverse stock split reduces the number of outstanding shares and increases the share price by consolidating existing shares. For example, in a 1-for-10 reverse stock split, every 10 shares a shareholder owns would be converted into one share.

Companies typically execute reverse stock splits to increase their share price, making it more attractive to investors and potentially meeting listing requirements on stock exchanges.

Reverse stock splits are more characteristic of bear markets, whereas forward stock splits are often associated with bull markets.

For example, during the post-COVID market rebound, some of the country’s largest and best-known companies have conducted stock splits, as highlighted in the list below:

- Monster Beverage (MNST): 2-for-1 split in March 2023

- Tesla (TSLA): 3-for-1 split in August 2022

- Alphabet (GOOGL): 20-for-1 split in July 2022

- Shopify (SHOP): 10-for-1 split in June 2022

- Amazon (AMZN): 20-for-1 split in June 2022

- Nvidia (NVDA): 4-for-1 split in July 2021

Top stock split candidates for 2024

Looking ahead into 2024, there are three companies that represent strong candidates to split their shares: Lululemon (LULU), Netflix (NFLX) and Nvidia (NVDA). Additional details on each of these companies, including their prior stock splits, is highlighted below.

Lululemon (LULU)

Lululemon designs, manufactures and sells premium athletic and athleisure wear. Their products include yoga pants, leggings, tops and accessories. In addition to its extensive network of brick-and-mortar retail stores, the company has a significant online presence, allowing customers to shop through its website and mobile app.

The year 2023 has been a strong year for Lululemon and demand for the company’s products continues to grow. It is expected to book total revenues of about $9.5 billion in 2023, which would represent an increase of 20% from last year. Impressively, that’s also about 100% higher than three years ago.

Shares in Lululemon have also been outperforming. Year-to-date, Lululemon shares are up nearly 60%. During the last five years, performance in Lululemon stock has been even stronger, returning roughly 345%.

That strong bull run has pushed shares of Lululemon into the hundreds of dollars per share territory. Today, Lululemon trades for about $506/share. The absolute value of those shares is a key reason that management at Lululemon may pursue a stock split in 2024.

Lululemon has been a publicly traded company for roughly 16 years, and last split its shares in 2011. Back then, shares were split 2-for-1.

Netflix (NFLX)

Netflix is one of the world’s largest entertainment companies and is a global leader in the video streaming market. Netflix operates a subscription-based business model with nearly 250 million paying customers across 190 countries.

Netflix invests heavily in acquiring and producing a wide range of content, including licensed movies and TV series, as well as its own original programming. This extensive library caters to a diverse audience, spanning various genres, languages and demographics.

Much like Lululemon, Netflix has had a strong year in 2023. In its most recent quarterly earnings report, Netflix reported that it had signed on nearly 9 million new subscribers. That was due, in part, to the success of its discounted subscription plan, which comes with ads.

Revenue growth at Netflix has been strong, but not as impressive as Lululemon. This year, annual revenues are expected to grow by about 11%. In 2024, however, revenue growth could stretch to 17%, climbing to nearly $40 billion.

Interestingly, an economic contraction—if one materializes in 2024—wouldn’t necessarily be the worst outcome for Netflix. Under this scenario, Netflix could actually benefit from increased spending on in-home entertainment, as more consumers cut back on going out.

Much like Lululemon, shares in Netflix have outperformed so far in 2023. As of late December, the stock is up nearly 60%. Coincidentally, the stock is up 345% over the last five years—the same return as Lululemon over that period.

Shares of Netflix went public in 2002 at a price of $15/share. In 2004, the company executed a 2-for-1 stock split that cut the stock from $72/share to $37/share. In 2015, Netflix split its stock once again, this time 7-for-1.

Considering that Netflix currently trades for nearly $500/share, it’s highly likely the company will split its shares again in the near future. That’s virtually guaranteed if Netflix shares climb anywhere close to the upper end of existing analyst forecasts, which are as high as $700/share.

Nvidia (NVDA)

Nvidia is a leading manufacturer of graphics processing units (GPUs), which are specialized microchips used for rendering images, processing data and accelerating various computational tasks. GPUs are used in a wide range of applications, including gaming, artificial intelligence (AI), data centers and autonomous vehicles.

The emergence of generative AI has been a boon for Nvidia because its GPUs are especially well-suited for this niche of computing. Nvidia’s data center GPUs are optimized for AI workloads, deep learning and scientific computing, making them strategically important tools in the current AI-driven environment.

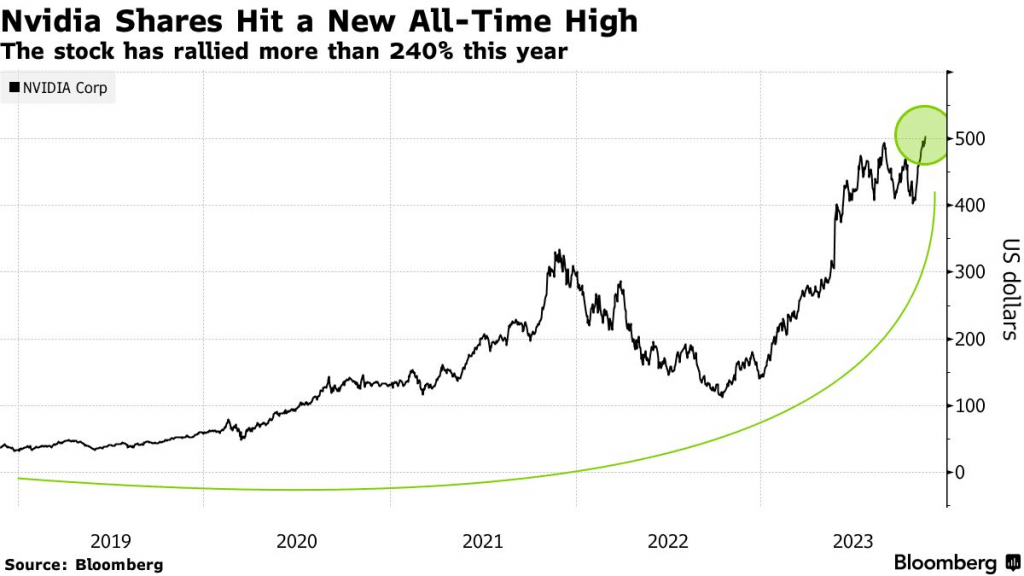

Nvidia has been one of the market’s best performers in 2023, gaining more than 240% through late December. Over the last five years, shares of Nvidia are up a jaw-dropping 1,400%.

Nvidia first went public back in 1999 at roughly $12/share. Since that time, the company has executed five stock splits, including the most recent 4-for-1 split back in July of 2021.

The relative recency of the 2021 stock split is one reason Nvidia may not split its shares in the immediate future. On the other hand, if the stock continues to skyrocket higher in 2024, it’s hard to imagine the company wouldn’t execute a split.

Much like Lululemon and Netflix, Nvidia currently trades for nearly $500/share. And much like those two companies, shares of NVDA appear primed for a split if they climb into the $600-$700 per share range.

Performance after a stock split

As with most things in the financial markets, there aren’t many guarantees when it comes to stock splits, especially as it relates to the underlying performance in a company’s shares.

Most companies announce stock splits during bull markets, but sentiment can shift quickly, as observed in 2022. Moreover, there’s no telling how a business will perform in the future. Lehman Brothers was one of the country’s best-known financial institutions before it went bankrupt during the 2008-2009 Financial Crisis.

Ultimately, stock performance varies widely after a split, meaning there’s no guarantee that a given stock will outperform after the official split date. Just as there’s no guarantee that a given company will outperform after completing a merger or acquisition.

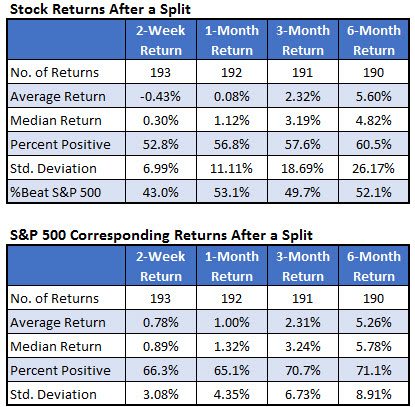

To wit, a recent analysis by Schaeffer’s Research showed that stocks rose by 5.60%, on average, six months after a stock split. This research covered 190 companies that split their stock from 2010 to 2022, and the ensuing six-month returns of those stocks.

The average performance of those 190 stocks are highlighted in the first table below. The second table highlights the return for the overall S&P 500, assuming that an investor bought into this index as opposed to the stock split.

As shown above, the average six-month return in post-split stocks was 5.60%, whereas the six-month return in the S&P 500 was 5.26%. From this perspective, post-split shares don’t offer much incentive beyond the broader market.

However, as investors and traders know quite well, not all stocks are created equal. Just look at the returns in Lululemon, Netflix and Nvidia, which have all risen by at least 350% over the last five years. In comparison, the five-year return in the S&P 500 is closer to 100%.

From this perspective, post-split stock performance has a lot more to do with the overall trajectory of a company’s business prospects than it does with the actual split.

Looking at Nvidia, for example, it’s highly likely that the company’s revenues, earnings and underlying shares will continue to climb. Alternatively, it’s a lot harder to project how the average company will perform in the next several years, because so many companies fortunes are tied to the ebb and flow of the broader business cycle.

It’s probably better to stick with high-quality investments/trades, as opposed to gravitating toward one-off stock splits because the former offer a superior value proposition over the long term.

For more background on stock splits, check out this installment of Options Jive on the tastylive financial network. To follow everything moving the markets on a daily basis, readers can tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.