History Implies Stocks Will Rally if the Fed Pulls Off Another Soft Landing in 2024

The Fed is expected to gradually lower benchmark interest rates in 2024 to help foster a gradual rebound in the economy

- In the mid-1990s, the Federal Reserve orchestrated a perfect soft landing for the U.S. economy.

- Back then, the stock market performed well in the wake of the Fed’s rate hike cycle and ensuing rate cuts, and the underlying economy remained resilient.

- If the Fed is able to pull off another soft landing in 2024, the stock market will likely produce another year of positive gains. But if a hard landing materializes, the stock market could correct by 15%-20% at some point this year or early 2025.

It’s been nearly 30 years since the Federal Reserve pulled off the last soft landing in the U.S. economy.

In the mid-1990s, the Federal Reserve raised benchmark interest rates to fight inflation, much as it has done over the last couple of years. Once inflation was tamed, the Fed proceeded to gradually lower rates back to normal levels.

That period is often viewed as a soft landing because the Fed successfully raised rates without crashing the economy. The central bank was also largely successful in its goal to rein in inflation.

In 2024, the Fed is attempting to thread the needle on rates and inflation for the second time in 30 years. This is a critical period for stock market investors because the stock market has historically responded very differently to soft and hard landings.

Dot-com bubble

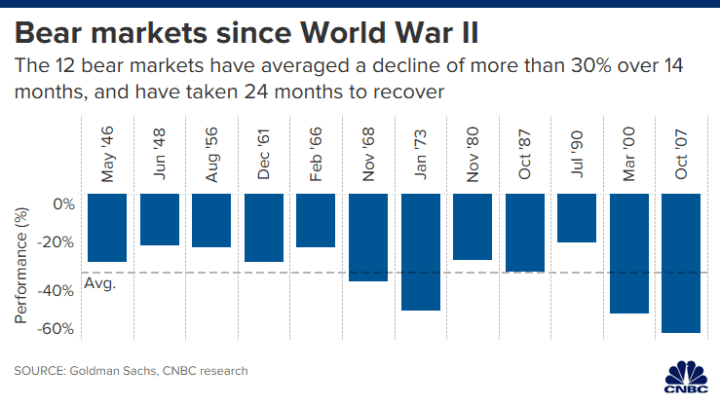

The last two hard landings in the economy were the dot-com bubble and the Great Recession, both of which involved sharp corrections in the stock market.

In contrast, the soft landing in the mid-’90s produced far more attractive returns in the stock market, largely because the economy avoided falling into recession. That will undoubtedly be a key to success this time around, as well, with the Federal Reserve hoping it can maintain positive growth in the economy during the next six-12 months.

As it did in the ’90s, the Fed is expected to gradually lower benchmark interest rates in 2024 to help foster a gradual rebound in the economy. During the Fed’s December policy meeting, central bankers intimated they will cut rates as many as three times this year.

Today, the current target range for the country’s primary interest rates benchmark—the federal funds rate—is 5.25%-5.50%. Three rate cuts of a quarter percentage point each would consequently drop that range to 4.50-4.75%.

The net amount of expected cuts, approximately 0.75%, is almost identical to the degree to which the Fed cut rates back in the mid-’90s. From June 1995 to February 1996, the effective federal funds rate fell from roughly 6% to about 5.2%.

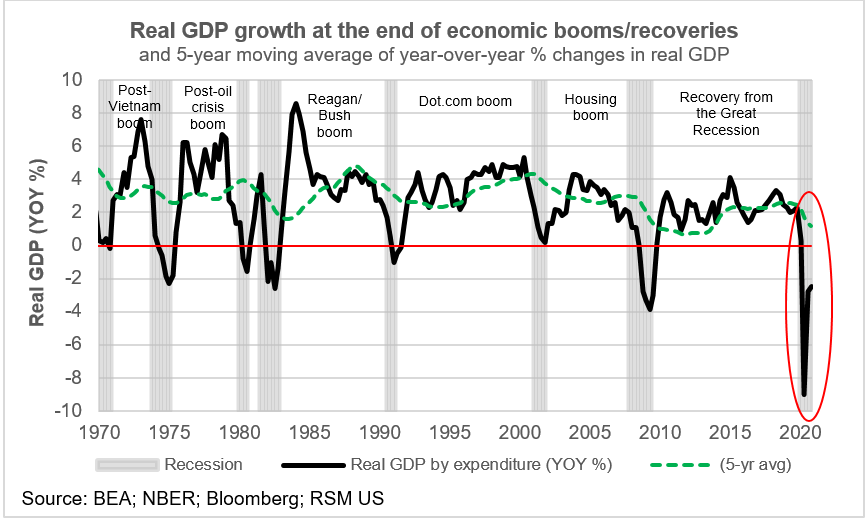

The gross domestic product (GDP) of the United States continued to grow during that period. From 1994 to 1997, the lowest quarterly GDP growth rate for the United States was +2%. When the Fed started cutting rates in the summer of 1995, GDP growth actually surged back toward +4%, as highlighted below.

In hindsight, many economists refer to the mid-’90s as the perfect soft landing. It’s also arguably the only successful soft landing that’s been observed in modern economic history.

In 2024, the Fed is poised to try and pull off another soft landing, and if it does, it will likely be regarded as perfect, too. Because any rate hike cycle that doesn’t result in a recession/depression is likely to be remembered as an ideal outcome.

One of the big things the U.S. economy has going for it this time around has been its resilience. Even in the face of sharply higher interest rates, the U.S. economy has continued to grow. In the mid-’90s, the U.S. economy exhibited similar strength, which is why these two periods have drawn so many comparisons in recent months.

If the U.S. economy does avoid falling into recession during the next six-12 months, it’s highly likely the stock market will avoid a sharp correction.

How the stock market has historically responded to soft and hard landings

At the start of a new trading year, most investors and traders are concerned with the direction of the stock market. And based on historical returns in the stock market, it appears that two different scenarios could play out in the coming year.

If the Fed successfully pulls off a soft landing, history suggests the stock market will produce another year of positive gains in 2024.

However, if the Fed fails to pull a rabbit of the hat, and the economy falls into recession, it’s highly likely that the stock market corrects at some point in 2024, or early 2025. And that would likely be a pull back of at least 15-20%, as opposed to a garden variety 10% correction.

Through a glass half-full perspective, the stock market could rise by as much as 10-20% in 2024 if the Fed is able to successfully pull off a soft landing. That level of return is similar to what was observed during the soft landing in the mid-1990s.

Back then, the Fed first started cutting rates in July of 1995. Six months later, the S&P 500 had rallied by about 11%. And by July of 1996 (12 months later), the S&P 500 was up closer to 19%.

The U.S economy also held up during this period, producing at least +2% positive GDP growth from 1995 to 1997.

Looking ahead into 2024, the Fed is currently expected to cut interest rates in March. If history repeats itself, the stock market would rally by roughly 10% during the six month period after that rate cut. By March of 2025, the stock market could rise by as much as 15-20% (from the date of the rate cut).

Alternatively, a hard landing in the economy would almost certainly fuel additional volatility in the financial markets and likely trigger a severe correction in the stock market.

At least that was the case back in 2000 and 2007-2009. During those hard landings the stock market pulled back by -49% and -57%, respectively.

The aforementioned corrections in the stock market were also accompanied by sharp recessions in the U.S. economy, especially in the case of the Great Recession. From December 2007 to June 2009, the country’s real gross domestic product (GDP) fell 4.3% on a peak-to-trough basis, which was the largest decline in the post-war era.

In comparison, U.S. GDP growth has remained relatively strong in recent quarters, much as it did back in the mid-’90s. Over the last four quarters, U.S. GDP has grown by +2.6%, +2.2%, +2.1% and +4.9%.

If the economy remains resilient, it’s difficult to envision a severe correction hitting the market during the foreseeable future. That said, history doesn’t always repeat itself. The financial markets can be unpredictable, especially during Presidential election years.

To stay abreast of the economy, investors and traders may therefore want to track the forthcoming earnings season extremely closely. If 2024 earnings guidance starts to deteriorate, that may be an early sign that the chances of a hard landing are increasing.

To follow everything moving the markets in 2024, including the commodities markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.