Semiconductors, Crypto and Cannabis Lead the ETF Universe in Early 2024

The stock market has outperformed so far in 2024, which has boosted the fortunes of many ETFs—particularly those levered to cannabis, cryptocurrencies, marine shipping and semiconductors

- After a strong start to the 2024 trading year, the ETF universe has seen a large number of offerings post impressive gains year-to-date.

- So far in 2024, some of the sector themes exhibiting the strongest performance include: cannabis, cryptocurrencies, marine shipping and semiconductors.

- The stock markets in Egypt and Turkey have also started fast in early 2024, but in those cases, it appears that instability in other parts of the Egyptian and Turkish financial systems have triggered panic buying in the stock markets.

After a strong start to the 2024 trading year, the ETF universe has seen a large number of offerings post impressive returns during the first couple of months of the year.

The technology sector has been one of the standouts, especially the semiconductor stocks. However, AI-focused semiconductor stocks haven’t been the only early winners in the 2024 trading year.

Alongside tech-focused ETFs, there’s also been strength in cryptocurrency and cannabis-focused ETFs, such as the Grayscale Bitcoin Trust (GBTC) and the Roundhill Cannabis ETF (WEED). And due to increased risks in the global shipping industry, rising shipping rates have also boosted ETFs such as the Amplify Commodity Trust (BDRY).

Interestingly, the Turkish country ETF—iShares MSCI Turkey ETF (TUR)—is also up in impressive fashion year-to-date, as is the VanEck Egypt Index ETF (EGPT). As highlighted below, the aforementioned themes account for most of the leaders from the ETF universe in early 2024:

- ProShares Ultra Semiconductors (USD), +67%

- Grayscale Bitcoin Trust (GBTC), +38%

- Amplify Commodity Trust (BDRY), +36%

- ProShares Ether Strategy ETF (EETH), +35%

- Bitwise Ethereum Strategy ETF (AETH), +34%

- Roundhill Cannabis ETF (WEED), +32%

- Valkyrie Bitcoin and Ether Strategy ETF (BTF), +31%

- Range Cancer Therapeutics ETF (CNCR), +30%

- Amplify U.S. Alternative Harvest ETF (MJUS), +26%

- VanEck Semiconductor ETF (SMH), +24%

- ProShares Bitcoin Strategy ETF (BITO), +23%

- VanEck Egypt Index ETF (EGPT), +22%

- ProShares Ultra Communication Services (LTL), +18%

- AdvisorShares Pure Cannabis ETF (YOLO), +17%

- Amplify Seymour Cannabis ETF (CNBS), +16%

- iShares MSCI Turkey ETF (TUR), +15%

In addition to the above, it should be noted that there have also been a large number of leveraged and inverse ETF winners so far 2024.

However, many of those winners reflect the same core themes as those shown above, such as the T-Rex 2X Long NVIDIA Daily Target ETF (NVDX) and the 2x Bitcoin Strategy ETF (BITX).

More details on each of the aforementioned themes—cannabis, semiconductors, cryptocurrencies and Turkey/Egypt—are outlined below.

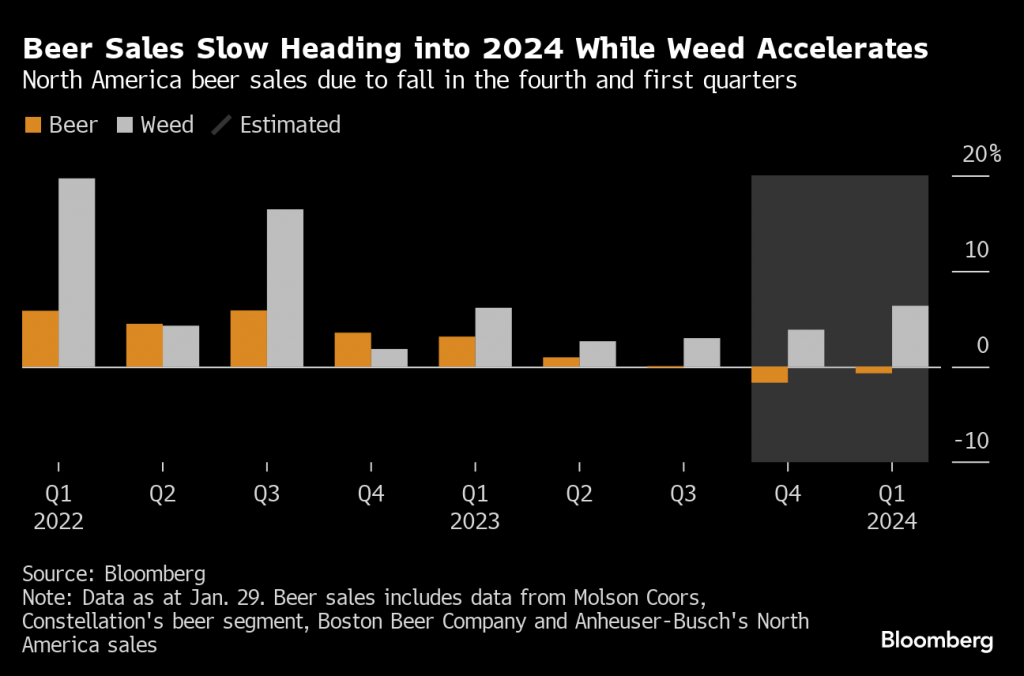

Cannabis sector

One of the surprise winners in early 2024 has been the cannabis sector. The primary catalyst for higher stock prices has been widespread anticipation relating to the full legalization of cannabis at the federal level. In the near future, the U.S. Drug Enforcement Agency (DEA) is expected to reclassify cannabis from a Schedule 1 substance to a Schedule 3 substance.

This is important because Schedule 1 substances are classified as having no accepted medical use and a high potential for abuse, which severely limits research opportunities and medical access.

By rescheduling to Schedule 3, cannabis would hence be recognized as having accepted medical uses, allowing for easier access to research funding and expanding opportunities for medical treatment options.

The rescheduling of cannabis by the DEA would therefore represent a big step forward for the industry. However, cannabis stocks have been buoyed by other positive developments, as well.

In Europe, Germany recently legalized the possession and consumption of cannabis in limited quantities. That’s a monumental development because Germany’s approach could eventually serve as a framework for the broader European Union (EU)—boosting the fortunes of the cannabis industry on the entire European continent, not just in Germany.

These positive developments appear to have snowballed, triggering additional momentum that’s spilled over into other areas of the industry.

In addition to getting closer to full legalization at the federal level, the rescheduling of cannabis by the DEA is also expected to provide a tax boost to the cannabis sector. That’s because the DEA rescheduling would also make it possible for cannabis businesses to start writing off business expenses.

Currently, cannabis businesses are now allowed to write off business expenses because it’s expressly prohibited by the IRS, due to the fact that the industry technically traffics in a controlled substance.

As a result of that situation, cannabis companies currently pay exorbitantly high tax rates—sometimes as much as 70%. As such, it’s easy to see how this tax change could provide an immediate boost to the profitability potential of the industry.

Considering all of the above, it’s easy to see why cannabis stocks have been flying high in early 2024, and why they could move even higher once these potential developments become reality.

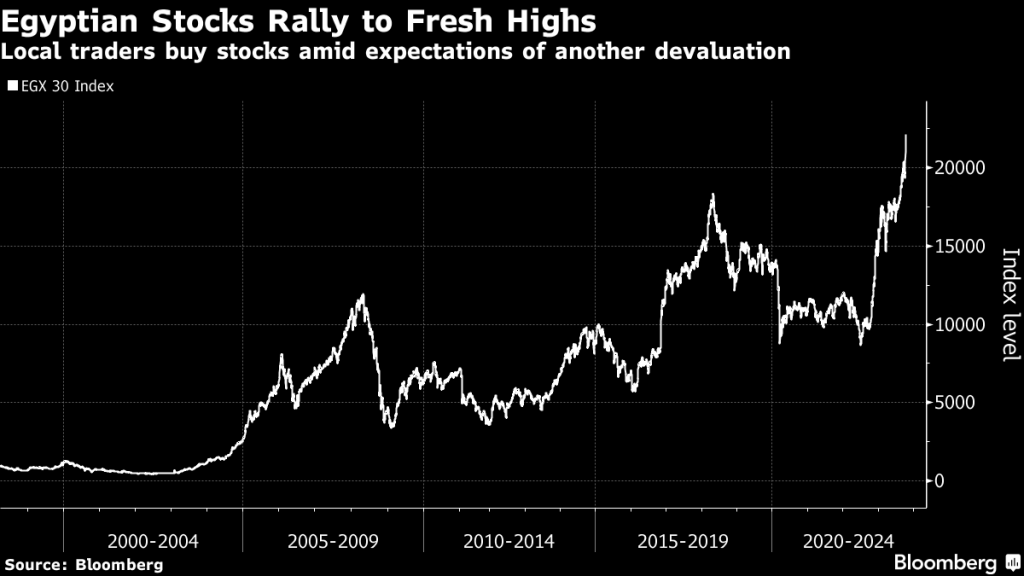

Turkish and Egyptian country-focused ETFs

Analyzed in a vacuum, the early 2024 gains in the Turkish and Egyptian country-focused ETFs would undoubtedly be viewed as a substantial positive. So for this year, the VanEck Egypt Index ETF (EGPT) and the iShares MSCI Turkey ETF (TUR) are up 22% and 15%, respectively.

However, these gains appear to stem from concerns over the financial stability of the Turkish and Egyptian economies, which casts an ominous shadow over gains that would otherwise be viewed with exuberance.

In the case of both Egypt and Turkey, significant depreciation in the sovereign currencies of these countries have driven the aforementioned gains in the stock market, because citizens have been divesting of their cash holdings in favor of stocks.

In Turkey, the country’s sovereign currency—the lira—has depreciated by more than 80% against the U.S. dollar over the last five years. Back in autumn of 2021, nine Turkish lira would have bought a single dollar, but as of today, that number is up to 31.

In an effort to protect their wealth from the slumping lira, many Turkish citizens have piled their savings into the Turkish stock market. As a result, the primary Turkish index—the BIST 100—set a fresh all-time high last year, and is already up about 20% in 2024.

For Egypt, the situation is much the same. Since the start of 2022, the Egyptian pound has depreciated by about 50% against the dollar. The situation has gotten so bad in Egypt of late that the country is expected to conduct a planned devaluation of the Egyptian pound at some point in the next several months. If that comes to pass, it would represent the fourth devaluation in the pound since the start of 2022.

By devaluing its currency, Egypt would theoretically make its exports relatively more attractive, but the process would also make imports more expensive. This double-edged sword is especially sharp in Egypt’s case, because the country is so heavily reliant on food imports.

Egypt is the world’s largest importer of grain, which means its current shortage of foreign currency reserves has contributed to increased instability in the underlying economy.

Egypt’s economy has become so embattled that it is now the second-largest borrower from the International Monetary Fund (IMF), behind only Argentina. And the country’s most recent inflation report revealed that prices are rising at an annualized rate of about 39%. That’s a key reason that Egyptian investors have flocked to the stock market, to try and keep pace with rampant inflation.

This background and context helps illustrate why the stock markets in Turkey and Egypt are somewhat akin to “lucky losers,” benefiting from the chaos spreading through other parts of their respective financial systems. As such, global investors and traders should tread carefully when considering positions that contain exposure to either region.

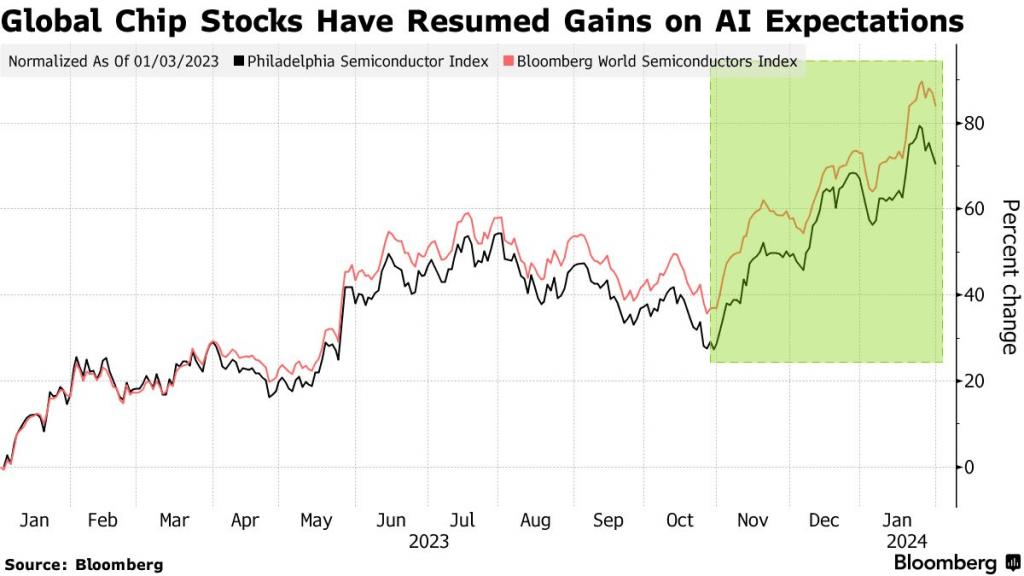

Semiconductor sector

As evidenced by outperformance in the ProShares Ultra Semiconductors (USD) and the VanEck Semiconductor ETF (SMH), the semiconductor sector continues to be one of the hottest corners of the broader stock market.

Due to recent advancements in artificial intelligence (AI), most experts forecast that the demand for semiconductors will continue to surge during the next several years. Obviously, chipmakers with the most advanced AI technology, such as Nvidia (NVDA) and Advanced Micro Devices (AMD), have experienced the strongest gains.

It should be noted, however, that a rising tide hasn’t necessarily floated all boats. In many cases, the semiconductor companies that lack advanced AI-suitable offerings have seen their shares trade sideways, or lower, during the early part of 2024. This group includes companies like Intel (INTC) and ON Semiconductor (ON), which are down -11% and -6%, respectively, so far in 2024.

Due to this divergence, investors and traders have been scrambling to identify other winners in the broader AI value chain. That’s one reason that shares of Super Micro Computer (SMCI) have rocketed higher in 2024.

Super Micro operates in a lower margin niche of the broader AI value chain, building servers and other hardware/software for data centers. The company has experienced a sharp surge in demand for its products, as many data centers are being re-outfitted with AI-capable technologies.

Cryptocurrency sector

In the cryptocurrency sector, performance in Bitcoin (BTC) and Ethereum (ETH) usually sets the tone for the broader sector. So with both of those digital coins posting impressive returns year-to-date in 2024, it’s no great surprise that crypto-focused ETFs have also outperformed to start the year.

In January, the creation of new spot Bitcoin ETFs ended up being a sell the news moment for the cryptocurrency sector. Since that time, however, the crypto sector has been surging, with Bitcoin (BTC) and Ethereum (ETH) posting impressive year-to-date gains. Thus far in 2024, Bitcoin has rallied by about 34%, while Ethereum has rallied by 42%.

Bullish sentiment has also spilled over into the broader sector. Listed below are some of the top-performing large cap and small cap digital coins in 2024 (year-to-date returns through mid-February 2024).

Top performing cryptocurrencies in 2024 (small cap)

- Ritestream (RITE) +2,100%

- Badmad Robots (METAL) +1,200%

- Rocky (ROCKY) +1,000%

- Bomber Coin (BCOIN) +900%

- Three Kingdoms (TTK) +725%

- Dopex Rebate Token (RDPX) +630%

- AXL INU (INU) +630%

- Heroes TD (HTD) +560%

- Bomb Money (BOMB) +550%

- Covenants (UNIFI) +460%

Top performing cryptocurrencies in 2024 (large cap)

- Sui (SUI) +135%

- Bittensor (TAO) +110%

- Flare (FLR) +80%

- Beam (BEAM) +65%

- Celestia (TIA) +60%

- Stacks (STX) +41%

- Immutable (IMX) +41%

- ChainLink (LINK) +33%

- Sei (SEI) +31%

- Arbitrum (ARB) +31%

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.