Sugar Prices Expected to Build on Last Year’s Record Rally

Sugar prices surged to 12-year highs in 2023 as poor growing conditions cut into global crop yields

- Sugar prices rallied to 12-year highs in 2023 due to poor growing conditions in key production regions such as Brazil, India and Thailand.

- Sugar prices are now trading at roughly $0.22/pound, which is 100% higher than where they traded back in 2020.

- Sugar prices are expected to rise further in 2024, because the current supply deficit is expected to persist through the current growing season.

Inflation has come down significantly from the record highs observed last summer, but the latest inflation readings suggest that the cooling phase may be over. After steadily moving lower during 2023, the consumer price index (CPI) rebounded slightly during the first two months of 2024. In January and February, the U.S. government reported that CPI was up 0.4%.

Looking at the broader picture, CPI is up about 3.2% over the last 12 months. That’s well below the levels observed last summer, when CPI peaked at around 9%, but still above the Federal Reserve’s preferred figure of 2%. And the fact that inflation appears to be rebounding must be a concern for central bankers in the United States.

Additional data from the U.S. economy appears to corroborate the recent CPI figures. The cost of a dozen eggs in the U.S. market has been rising since the start of 2024, as has the price of coffee and sugar. Commodities that are grown instead of mined are typically referred to as the softs (soft commodities).

When it comes to the softs, one of the most widely followed agricultural commodities in the world is sugar. Last year, sugar prices bucked the broader cooling trend and surged to 12-year highs. Much like the narrative in the cocoa, orange juice and coffee markets, recent price advances in the sugar market appear to have been catalyzed by suboptimal growing conditions.

The two largest global producers of sugar are Brazil and India, which together account for about 42% of the world’s annual production. During the current growing season, Brazil is forecasted to produce around 41 million metric tons, while harvest is expected to clock in at around 36 million tons.

Overall, the global producers pump out somewhere between 175-180 million metric tons of sugar per year. During last year’s growing season, however, production dipped down to the lower end of that range.

One of the primary challenges has been widespread global droughts linked to El Niño. The latter is a climate phenomenon characterized by the abnormal warming of sea surface temperatures in the central and eastern equatorial Pacific Ocean. It occurs irregularly, typically every two to seven years, and can have significant impacts on weather patterns around the world.

El Niño can lead to increased rainfall and flooding in some areas, while causing drought conditions in others. In the case of the world’s largest sugar producers—Brazil and India—widespread droughts have contributed to drier than expected growing conditions, which has weighed negatively on crop yields. The same can be said for Thailand, which is also a Top 5 global producer, typically harvesting 9 million to 10 million metric tons of sugar per year.

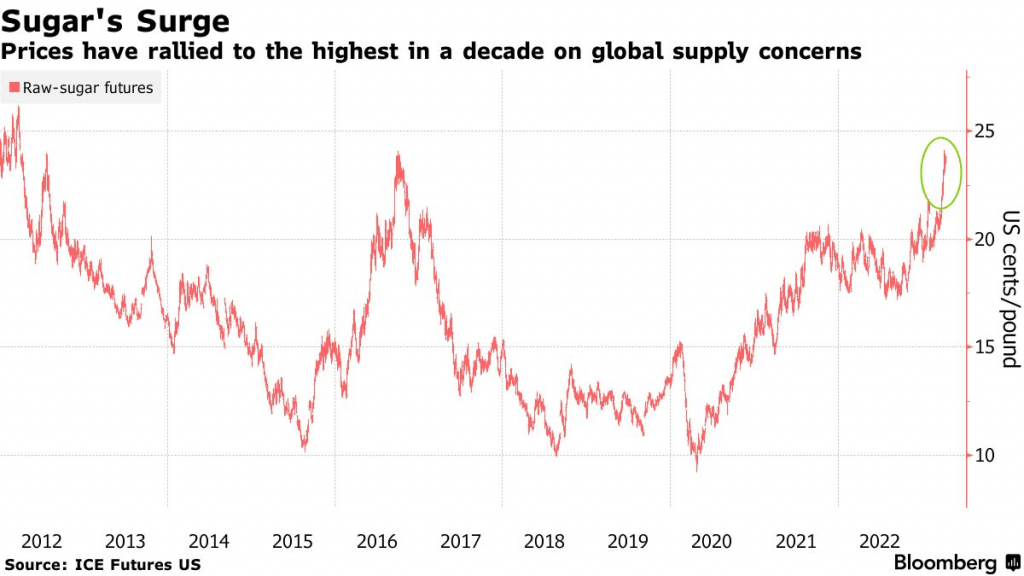

Reduced global supplies of sugar have pushed prices significantly higher. Since August of 2020, sugar prices have more than doubled, rising from around $0.10/pound to over $0.20/pound (illustrated below). Due to persistently strong demand—alongside below average production forecasts—most experts expect sugar prices to rise further in 2024.

The India x-factor

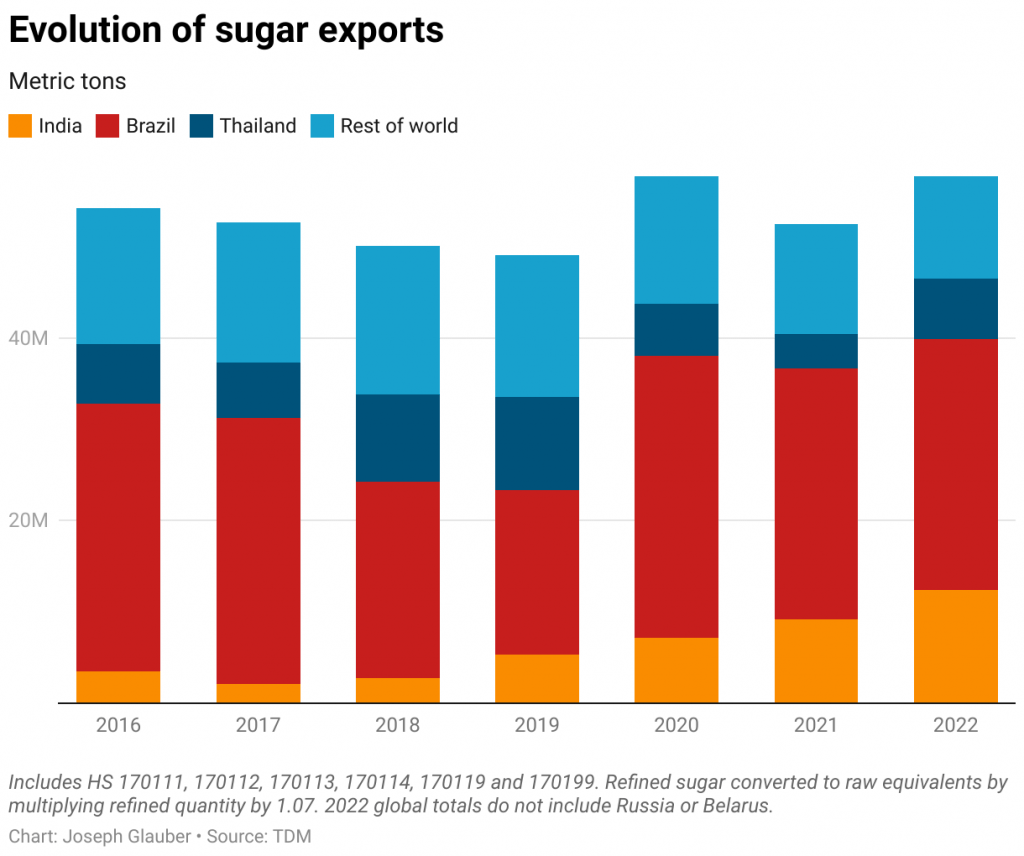

One of the wildcards in the global sugar market is the amount available for export. That’s because sugar production is heavily concentrated in several key countries, with most regions of the world relying on sugar imports to meet their domestic requirements. A breakdown of the world’s largest sugar exporters is shown below.

As a result, the amount of sugar available for export is usually a key driver of prices. That means any developments that materially impact crop yields in the world’s key growing regions will often catalyze movement in the price of sugar.

For example, production in Thailand dropped by about 4 million metric tons over the last two growing seasons, which significantly reduced the amount of sugar available for export from Thailand. Reduced exports from Thailand have undoubtedly provided upward support to prices. For one of the other large global sugar producers, the situation has been even more complicated.

In India, it’s not only the growing conditions that dictate the amount of sugar that’s available for export, but also the government. The Indian government imposes export quotas on the quantity of sugar that can be exported from India during a particular period. These quotas are determined by factors such as domestic production, the availability of sugar stocks, and the government’s assessment of domestic demand.

As such, the Indian government’s intervention in its domestic sugar market can exacerbate global sugar shortages, and contribute to increased price volatility. For example, when global supplies are critically short, India typically implements tighter restrictions on exports, which can compound the supply problem, and trigger anxiety-fueled buying in the market.

That was certainly the case last year, when India set an export limit of about 6 million metric tons of sugar during the first nine months of 2023. The year prior to that, India exported closer to 11 million metric tons. India’s reduced export volume clearly contributed to upward movement in sugar prices during 2023.

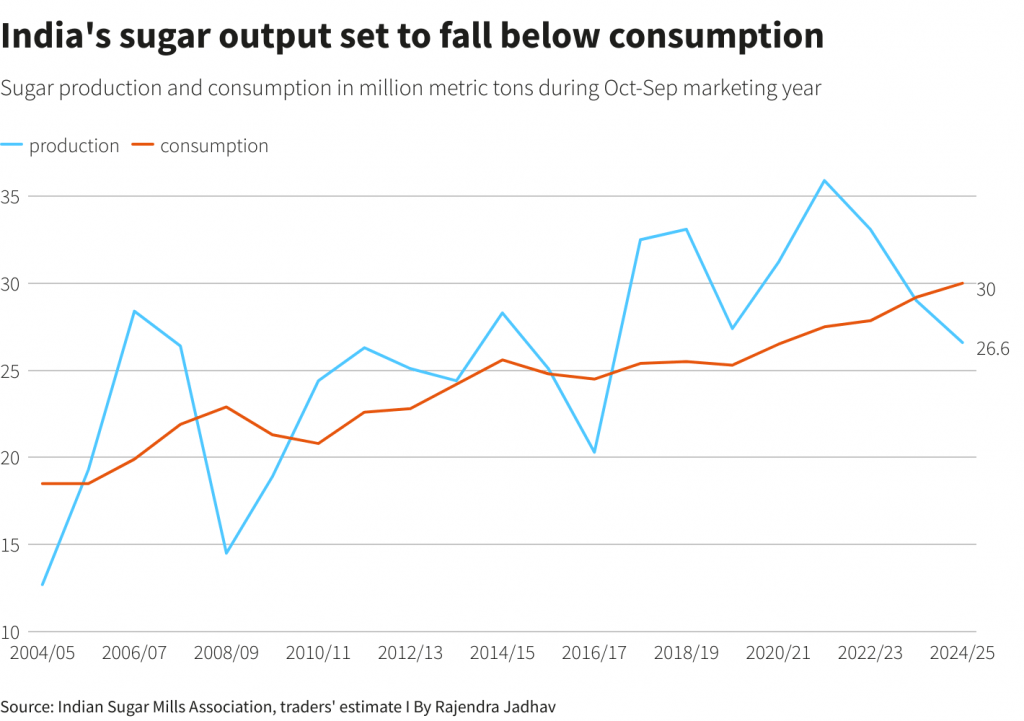

Unfortunately, that problematic situation doesn’t look like it will be resolved anytime soon. Due to deteriorating production forecasts, some experts are forecasting that India will export even less sugar this year than it did last year. And that’s one reason many analysts are expecting prices to move even higher during 2024.

Bullish momentum could push sugar prices higher in 2024

Demand for sugar remains robust, and due to suboptimal growing conditions, global producers haven’t been able to increase their output. This is especially troublesome because poor growing conditions have cut into the crop yields of several top producers, including Brazil, India and Thailand. That situation has reduced the amount of sugar available for export, which is one of the primary reasons sugar prices rallied so intensely in 2023.

Looking ahead, it appears that the supply deficit in the international sugar market will probably persist through the current growing season. Due to this dynamic, sugar prices are expected to continue to rise in 2024, possibly by as much as 20%. However, if the specter of inflation returns, the sugar market may be primed for even larger gains.

The one caveat to the aforementioned outlook is the risk of recession. If a global recession materializes, demand for sugar would almost certainly weaken, and under that scenario, sugar prices would likely retrace. If that occurs, sugar prices could fall back to around $0.17/pound. But if the recession is severe, then sugar prices could drop further—potentially to the pre-pandemic level, which was closer to $0.11/pound.

China is the world’s top sugar buyer, importing more than $2 billion worth of sugar products annually. Investors and traders interested in tracking and trading the sugar market can use sugar futures or commodity-focused ETFs such as the Teucrium Sugar Fund (CANE) for exposure to this niche of the soft commodities market. Shares of CANE are up 6% year-to-date.

To follow everything moving the markets in 2024, including the commodities markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.