Smaller Futures Contracts Put ETFs in the Crosshairs

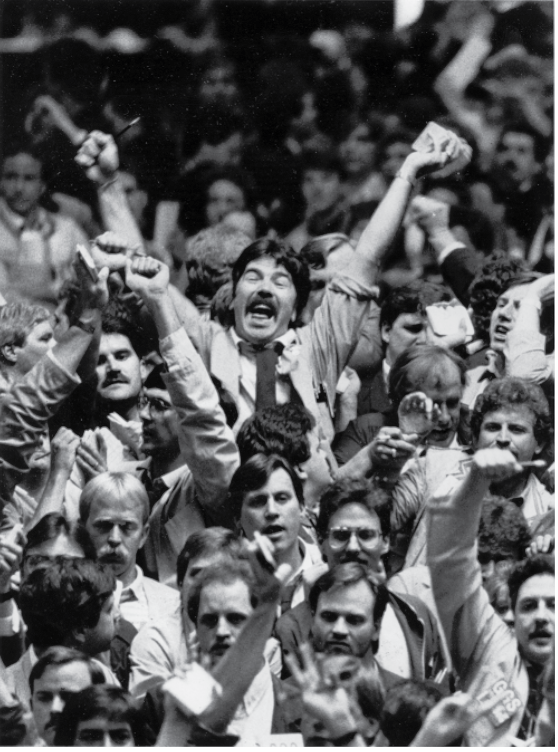

Savvy investors will discover more uses for the smaller futures contracts exchanges are developing

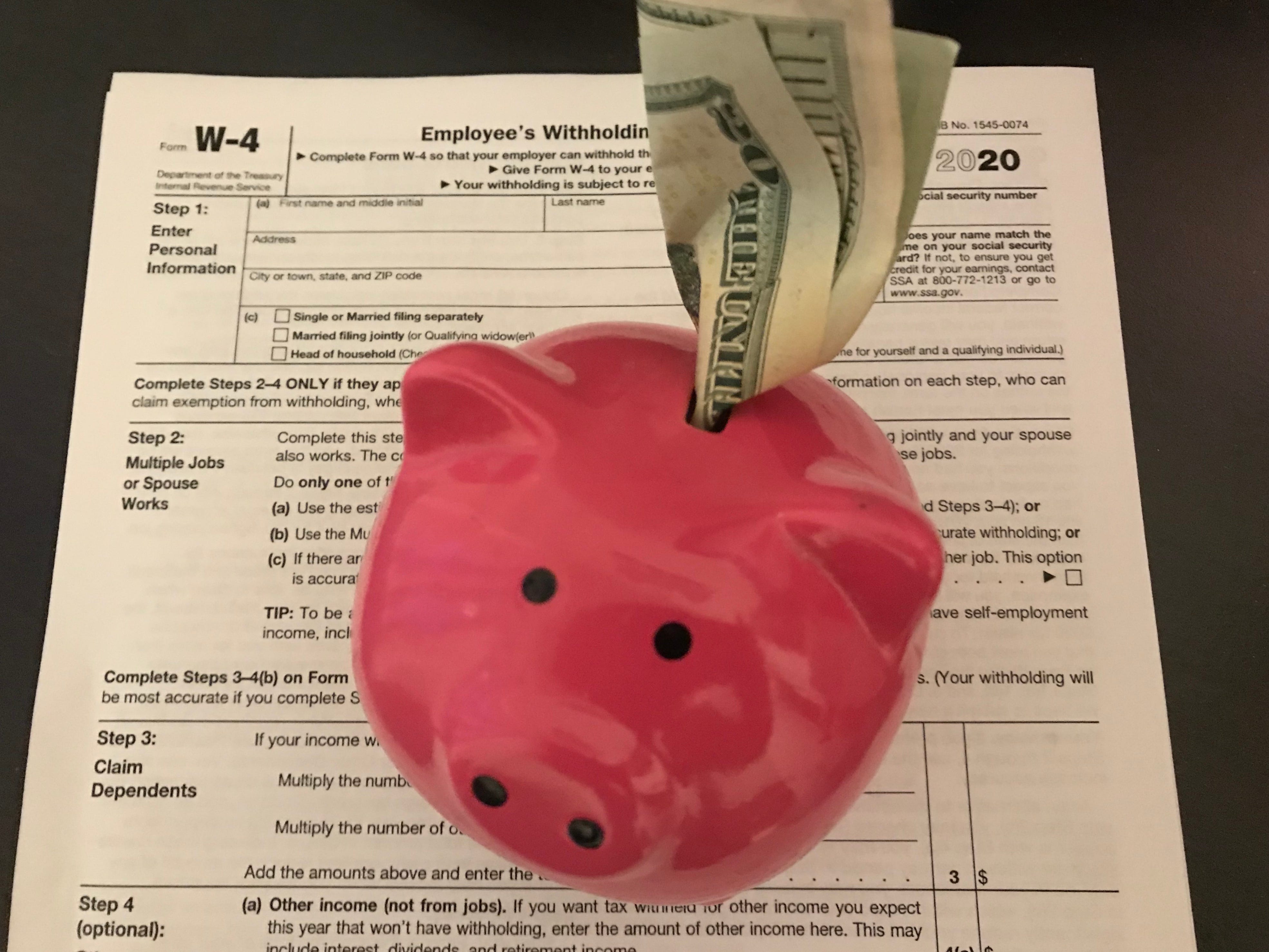

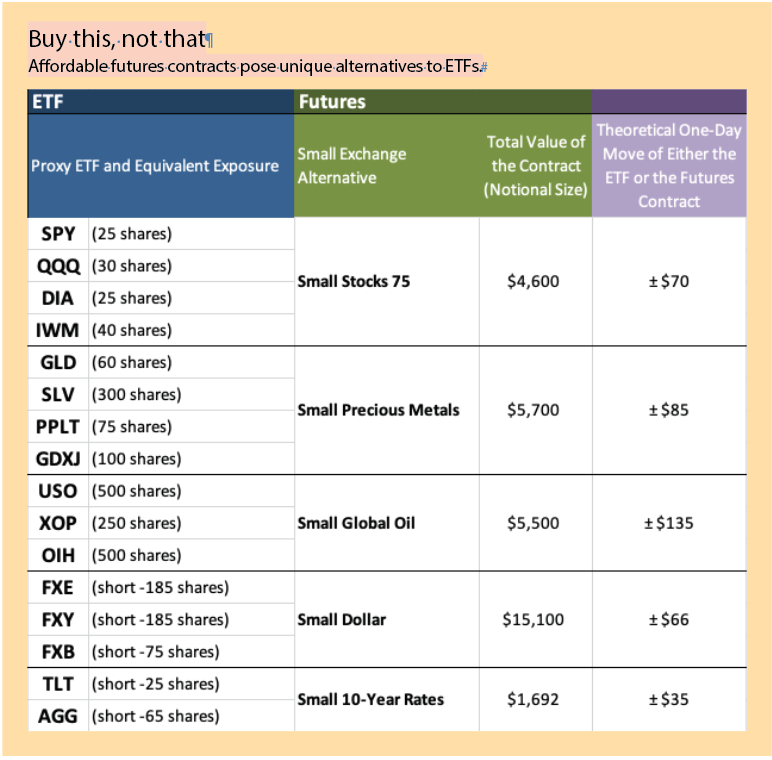

Exchange-traded funds (ETFs) work well for passive investors—but not for short-term traders or sophisticated investors. Still, anyone looking to reduce risk in a portfolio heavy in ETFs will find the new, smaller futures contracts from the Small Exchange an efficient means of trading, requiring just a fraction of the money that would be needed to buy stocks. With futures, leverage often comes to around 10-to-1.

ETF investors, on the other hand, provide margin 2-to-1 (or intraday 4-to-1). But not only is the leverage better with futures, the cost is 50% lower.

Then there are the tax advantages. Whether an investor has owned futures for a second, a minute or a month, gains and losses are marked-to-market and taxed at a blended rate of 60% long-term capital gains and 40% short-term rate (which is ordinary income). But if an investor disposes of an ETF within one year, the government taxes 100% of it at the higher short-term capital gains rate.

Suppose an investor has a portfolio with 100 shares of S&P 500 ETF (SPY) and wants to use a Small Exchange futures product to hedge risk. As shown in “Buy this, not that,” below, 25 shares of SPY are equivalent to one Small Stocks 75. That’s because they both tend to move around $70 per day. To fully hedge 100 shares of SPY, an investor needs four contracts. If the objective is to partially hedge the position, sell one or two of the Small Stocks 75 contracts.

Michael Rechenthin, Ph.D., (aka “Dr. Data”) is head of research and data science at tastytrade.