Trends & Tickers: My Four Favorite Trade Ideas for 2025

These are the most compelling investment themes I see for the coming year—just don’t forget the risks

- Market predictions can be informative, but they’re also tricky because different groups—like investors and traders— have different time horizons.

- In 2025, some compelling themes to watch include quantum computing, big data, biotech and a potential rebound in China. A large stimulus package could trigger the latter.

- Keep geopolitical risks in mind, with critical challenges expected from a near-term longshoreman strike, the U.S. fiscal situation and continuing conflicts in both Eastern Europe and the Middle East.

As we kick off the new year, it’s time to dust off the crystal ball and make some market predictions. It’s always intriguing to consider which asset classes, sectors and stocks will shine (or stumble) in the coming months. However, it’s important to keep in mind that the prediction game can be a slippery slope.

The reason? When it comes to market predictions, the audience isn’t one-size-fits-all. The investing universe is divided into two broad groups: investors and traders. But within these categories, there’s a broad spectrum of differing philosophies and market approaches. That means predictions that excite one group may fall flat with another.

For many investors, the focus is on the long haul. They don’t get caught up in the noise of short-term movements or what might happen in the next few months. Instead, their decisions are driven by a larger vision and the hope the steps they take today will pay off over time.

Traders, on the other hand, are all about the here and now. They live off sentiment and momentum, reacting quickly to shifts that can happen in the blink of an eye. For them, what’s unfolding today—or even tomorrow—means far more than what may play out months down the road.

But here’s the twist: Sometimes the interests of investors and traders overlap. Emerging trends can offer both short-term excitement and long-term potential. Today, I highlight several key themes (and stocks and exchange-traded funds) that could appeal both to traders and investors in 2025, drawing on my 15+ years of experience in the options, futures and equities markets.

Quantum computing

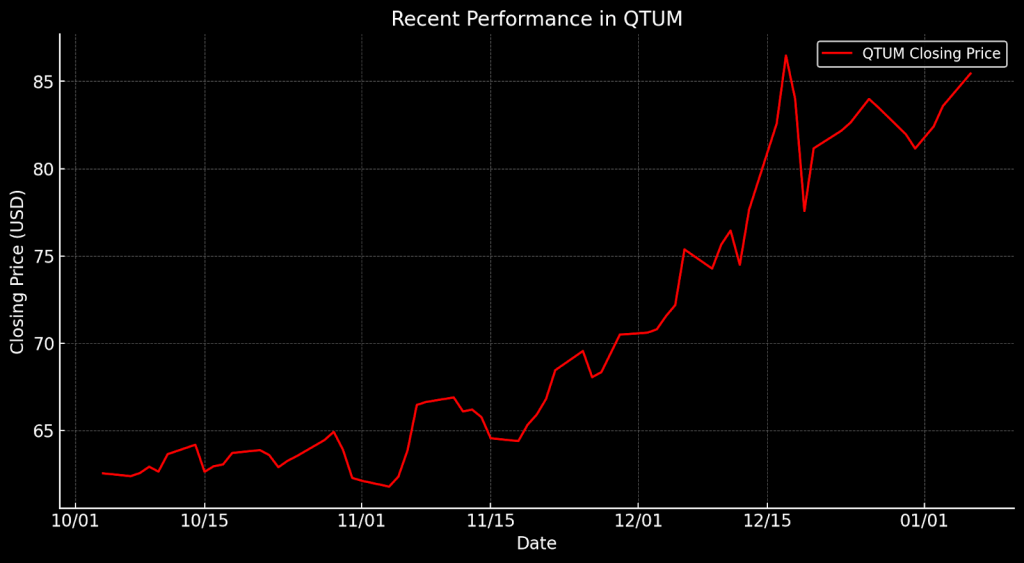

2025 Outlook: Bullish Defiance Quantum ETF (QTUM)

As we step into 2025, quantum computing is quickly emerging as a game-changer in the race to elevate artificial intelligence. The promise of quantum technology lies in its ability to speed up AI algorithms exponentially and tackle complex optimization problems that traditional computers just can’t handle. Think of it as taking machine learning, predictive analytics and AI to the next level.

But here’s the catch—picking individual stocks in quantum computing can be a bit of a gamble. With so many companies taking different approaches to quantum hardware and software, it’s hard to know which ones will actually make it. That’s where the Defiance Quantum ETF (QTUM) comes in. By providing diversified exposure to leading companies in the quantum world, QTUM offers a more balanced way to tap into the sector’s potential without the risks tied to picking individual stocks.

Readers should note that Jensen Huang, CEO of Nvidia (NVDA), recently poured cold water on the quantum computing sector. On January 8, Huang asserted that “very useful quantum computers” are still years away, predicting it could take 15 years or longer before commercially viable products emerge.

Given Nvidia’s pivotal role in the AI revolution, his opinion carries significant weight on Wall Street, and following his remarks, the sector experienced a sharp pullback. Companies like Rigetti (RGTI) and IonQ (IONQ) saw their shares drop 45% and 39%, respectively. However, shares of QTUM fared much better, with only a modest decline of less than 5%.

While it’s tough to take a position counter to Huang’s, the CEO of D-Wave Quantum (QBTS), Alan Baratz, did exactly that, claiming Huang was “dead wrong” about the industry’s near-term prospects. Baratz pointed out that some of D-Wave’s clients are already “using our quantum computers today in production to benefit their business operations.”

What’s most intriguing here is that Huang didn’t dispute the central thesis—that quantum computing will ultimately be transformative for the tech industry. The only point of contention is timing. Huang sees a longer timeline, while Baratz believes the industry’s potential is much closer to being realized.

All things considered, the above reinforces the notion that early investors in quantum computing could be handsomely rewarded. To learn more about QTUM, readers can check out my full article on this topic. Read it here.

Big data

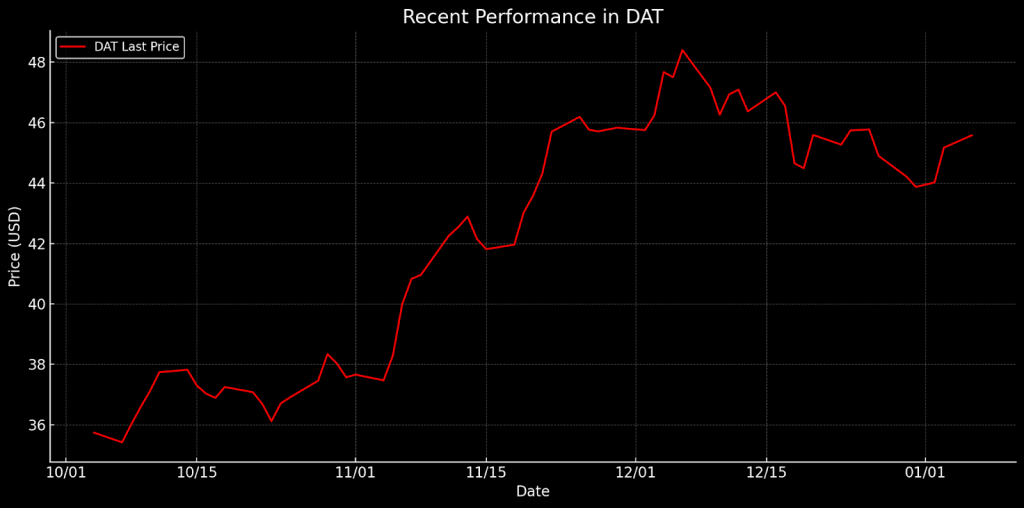

2025 Outlook: Bullish ProShares Big Data Refiners ETF (DAT) and Palantir (PLTR)

One theme that’s impossible to overlook heading into 2025? Data. More precisely, its critical role as the driving force behind the AI revolution. If AI is powering the future, then data is the vital resource that keeps it running—fueling progress at a pace we’ve never seen before.

As the world continues its shift toward AI, companies that specialize in big data are reaping the benefits. Take Palantir Technologies (PLTR), for example. Known for its pioneering data integration and analytics, the company has delivered a jaw-dropping 360% return over the past year. Pegasystems (PEGA), leveraging AI to enhance customer engagement, has seen a 102% return. Datadog (DDOG), a leader in cloud-based monitoring and analytics, has grown by 22%, while Workiva (WK), specializing in data governance, has seen a 21% rise. These returns don’t just reflect growth—they reflect surging demand for data, as companies attempt to harness this critical resource to drive AI advances.

And big-data companies should get a boost in the near future. The impending Databricks initial public offering (IPO) is highly anticipated— and for good reason. With its powerful platform for data engineering, machine learning and analytics, the future of Databricks is intertwined with the future of AI. As Databricks moves toward its public debut, the company embodies the immense potential in big data—not just as an investment theme for 2025, but as a foundational pillar in the next wave of technological innovation.

For more on the expected Databricks IPO, readers can check out this Luckbox article.

China Rebound?

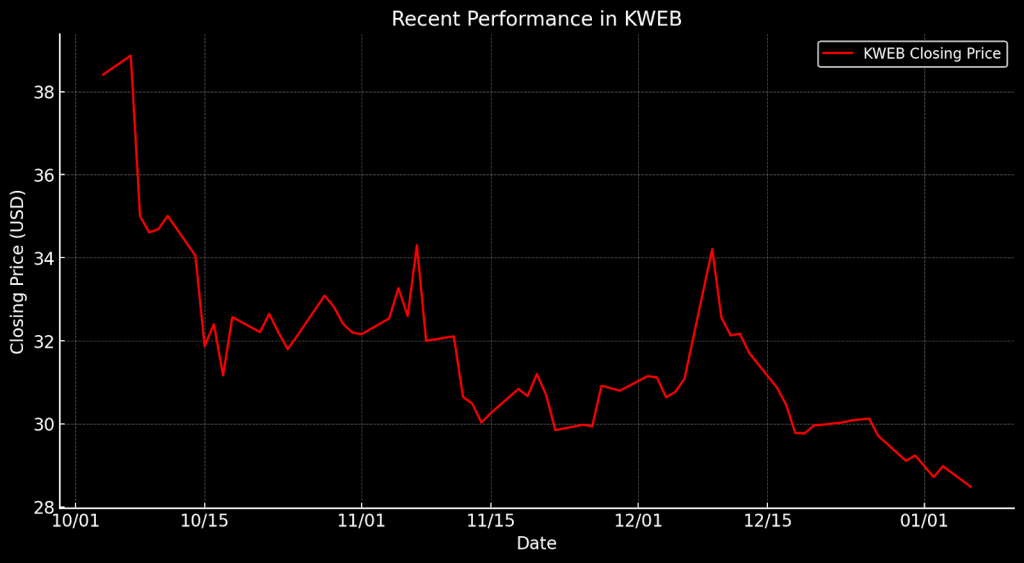

2025 Outlook: Bullish KraneShares CSI China Internet ETF (KWEB)

Turning to the international markets, China’s economy presents a fascinating puzzle for investors in the coming year. There’s growing speculation the Chinese government may roll out a large-scale stimulus package to reignite growth, especially as domestic demand continues to slow and external pressures mount. Whether in the form of infrastructure spending, tax incentives or other policy moves, this stimulus could provide a much-needed boost to China’s recovery, and help accelerate its pivot toward a more consumption-driven economy.

Still, the timing and scale of any potential stimulus package remain uncertain, particularly against the backdrop of escalating geopolitical tensions. President-elect Trump has signaled a continued hardline stance on China, and the prospect of higher tariffs remains an ominous headwind. Increased trade tensions could dampen the effectiveness of any stimulus, blunting some of its intended benefits. That said, some Chinese stocks are trading at attractive multiples compared to their American counterparts. So, any positive shift—whether in the form of stimulus or a thaw in trade relations—could spark a substantial rally.

As the year unfolds, the dynamics surrounding China’s economic policies, including the potential stimulus, remain fluid. For both investors and traders, staying attuned to any policy shifts will be critical, because meaningful developments could open up attractive opportunities in the region. To monitor performance in Chinese tech stocks—one of the groups that should benefit most from a market rally—readers can add the KraneShares CSI China Internet ETF (KWEB) to their watchlists.

Biotech: A potential dark horse in 2025

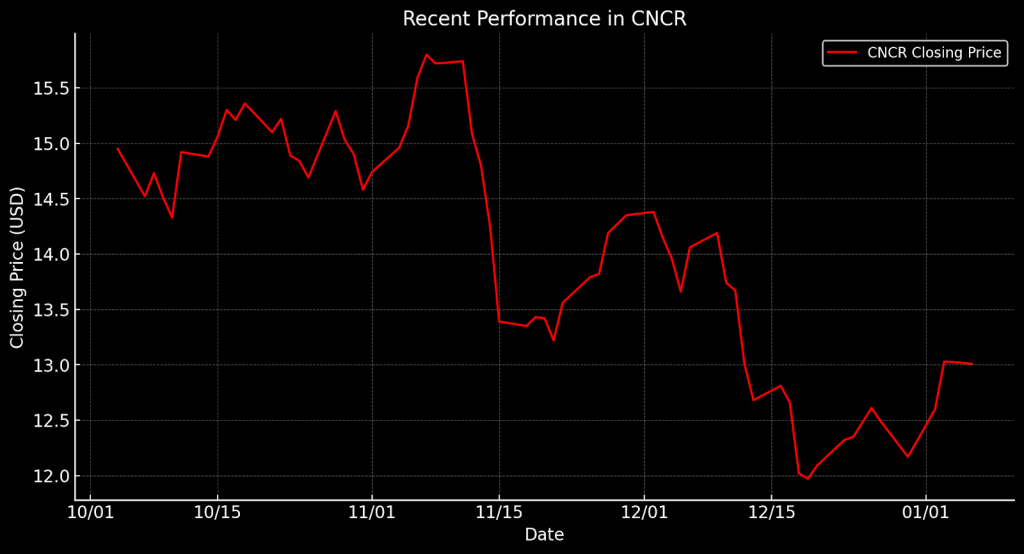

2025 Outlook: Bullish iShares Biotechnology ETF (IBB) and Cancer Therapeutics ETF (CNCR)

Turning to the biotech sector, it’s hard to ignore the disappointment of recent years. Over the past five years, the iShares Nasdaq Biotechnology ETF (IBB) has risen a modest 13%, while the S&P 500 has surged more than 80%. This underperformance has led many to wonder if 2025 might finally be the year the sector catches up.

During Trump’s first term, the biotech business faced its share of challenges. Despite efforts to streamline Food and Drug Administration (FDA) approvals and encourage R&D, biotech didn’t experience the anticipated boom. But with a new administration taking charge in Washington, there’s renewed optimism. Hopes abound that the new regime will bring positive change, implementing innovative policies that could benefit biotech firms. While this new era at the Department of Health and Human Services (HHS) and the FDA represents an unknown, forthcoming changes could ultimately end up favoring the sector.

The Loncar Cancer Immunotherapy ETF (CNCR) stands out as a compelling option in the biotech sector in 2025. CNCR offers exposure to a highly specialized and innovative area of biotech, particularly companies that are pioneering new immunotherapy treatments for cancer. With expected future advancements in targeted therapies and immuno-oncology, this segment continues to attract significant attention and investment capital. Currently, the ETF’s top holdings include Recursion Pharmaceuticals (RXRX), Monte Rosa Therapeutics (GLUE), ImmunityBio (IBRX) and Ginkgo Bioworks (DNA)—all companies contributing to new, innovative ways to treat cancer.

Much like other ETFs, CNCR provides exposure to potential gains in this sector, without the need to pick an individual winner. Recently, the ETF has dropped from a high of nearly $16 per share down to around $13, which may represent a buying opportunity, especially for those awaiting an attractive entry point into this sector. All told, CNCR looks well-positioned for growth in 2025.

Besides IBB and CNCR, readers may also want to check out Novo Nordisk (NVO), which looks more attractively priced after a big selloff in late December.

Geopolitical risks and other considerations

As we look ahead into 2025, several geopolitical developments could influence market dynamics, either propelling bullish sentiment or introducing new challenges. A potential strike by U.S. longshoremen is one such issue, with negotiations set to resume this week, and the current contract extension expiring on Jan. 15. If an agreement isn’t reached, a strike could disrupt operations at East Coast and Gulf Coast ports, which handle over 50% of the nation’s container traffic. This could result in major supply chain disruptions, higher shipping costs and widespread delays in the delivery of goods and materials.

Another potential narrative that could fuel increased volatility in the markets is the U.S. fiscal situation. Not only is the federal government nearing its debt limit (reinstated at the start of 2025), but also broader, deeper issues are affecting the country’s finances. The U.S. continues to run substantial budget deficits, with annual spending far outpacing revenue, pushing the national debt above $36 trillion. Treasury Secretary Janet Yellen has warned that the U.S. could hit its borrowing limit as early as mid-January 2025 unless Congress takes action to raise or suspend it. While this represents a critical near-term hurdle, the larger challenge will be addressing the continuing fiscal imbalance—whether through spending cuts, revenue increases or more likely a combination of both.

Last, the conflicts in Eastern Europe and the Middle East continue to create uncertainties for global markets. While the paths to resolution remain unclear, material developments—such as a cease-fire—could boost investor confidence, while an intensification of these conflicts might trigger increased market volatility. Depending on how these critical situations unfold, there may be both market opportunities (or risks) that emerge as a result. This underscores a key reality in 2025—market sentiment could shift quickly, making many predictions for the year ahead potentially moot.

Honorable mention: Nvidia

We were bullish on Nvidia (NVDA) after the company reported Q3 earnings and remain that way today.

Andrew Prochnow, Luckbox analyst-at-large, has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.