Another U.S. Credit Downgrade Appears Likely

No matter who wins the election, lawmakers should act quickly to halt deficit spending

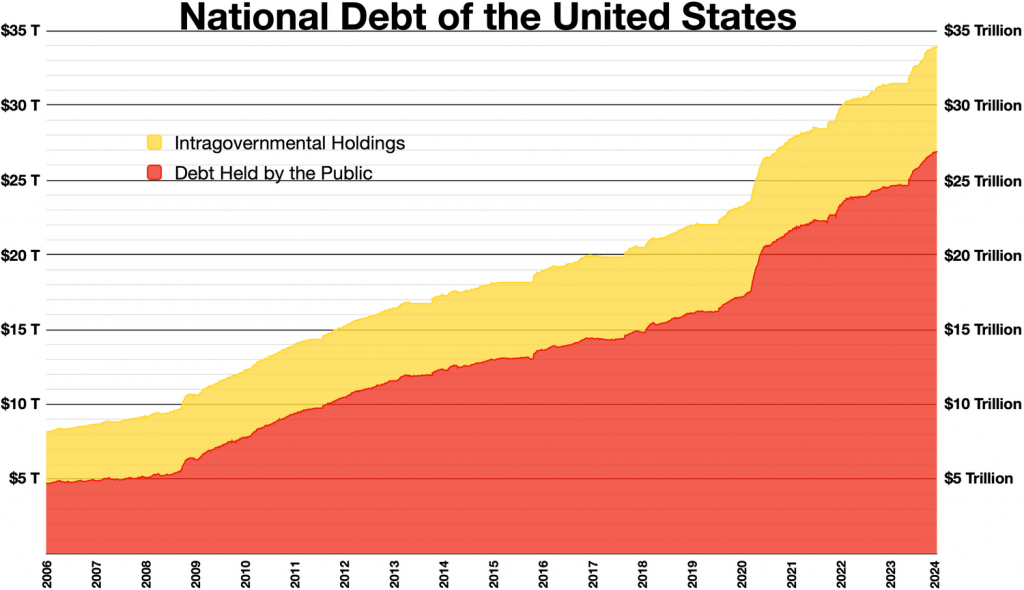

- The national debt, which has soared to nearly $35 trillion, is becoming an albatross.

- America’s sovereign credit rating was downgraded in 2023.

- To prevent another financial crisis, lawmakers should pass bipartisan legislation that ensures the fiscal health of the country.

For decades, America’s sterling sovereign credit rating has been the bedrock of global financial stability, underpinned by the unwavering “full faith and credit” of the United States government. Moreover, long-term strength in the U.S. dollar has fostered a sense of invincibility in the American economy.

That all changed last August when the credit rating agency Fitch downgraded America’s sovereign credit rating from “AAA” to “AA+.” Moody’s followed suit in November, when it changed the country’s outlook to “negative” from “stable,” while maintaining the overall “Aaa” rating. (Note: Moody’s uses a slightly different ratings scale than Fitch, combining both capital and lowercase letters).

These warnings underscore a critical issue: If the government fails to balance income with spending, further downgrades are certain regardless of the outcome of the 2024 elections. And one could argue that the pressing need for fiscal responsibility has never been more urgent, making the so-called “debt crisis” one of the most critical issues facing the United States.

At its core, this issue is all about the widening fissure between government expenditures and government receipts. For instance, the Congressional Budget Office (CBO) forecasts a budget deficit of $1.5 trillion in 2024. That means the government is spending $1.5 trillion more than it receives in tax revenue—a shortfall that adds to the national debt. The U.S. national debt—the amount of money the government owes to internal and external creditors—sits at roughly $35 trillion.

This level of deficit spending is unsustainable. Just as consumers or businesses can’t indefinitely outspend their income without facing dire consequences, neither can the government. And to resolve this problem, the nation must move quickly to reduce the annual budget deficit. This can only be achieved by cutting spending or increasing revenue—ideally through a combination of both.

Without decisive action, another credit rating downgrade looms on the horizon. And regardless of one’s political affiliation, that outcome is unacceptable, underscoring the urgent need to address the “debt crisis” before it spirals further out of control.

Where things stand

To understand the gravity of the U.S. debt crisis, it helps to know how analysts use a couple of financial ratios to assess a country’s debt load.

They evaluate a country’s fiscal health by comparing the annual budget deficit to gross domestic product (GDP). For the United States, the budget deficit was $1.7 trillion in 2023, with a GDP of approximately $27 trillion.

That equates to an annual budget deficit of just over 6% of GDP ($1.7 trillion/$27 trillion = 6.3%). Unfortunately, this figure is significantly higher than the preferred level of 2-3%, which allows for healthy government investment in the economy without excessive borrowing.

On top of that, however, the national debt relative to GDP is also alarmingly high. At the end of 2023, the national debt stood at approximately $33 trillion. By dividing this figure by the GDP of $27 trillion, one finds a debt-to-GDP ratio of roughly 120%.

A national debt exceeding 90% of GDP, is widely regarded as problematic. This high level of debt suggests the country’s financial flexibility is tightening, with an increasingly large portion of its budget allocated to servicing this debt instead of investing in growth and development.

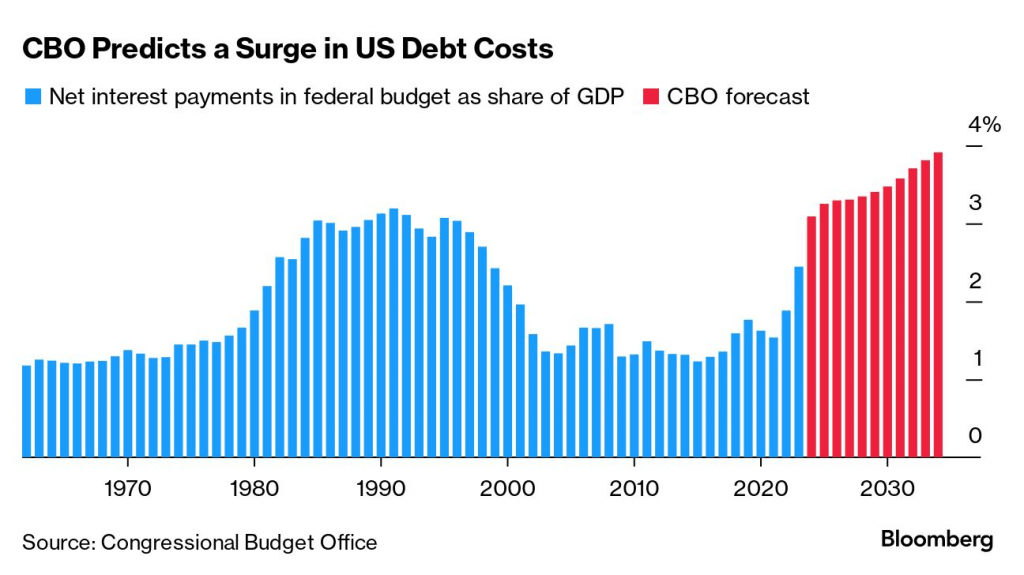

The United States is expected to pay upward of $900 billion in interest to service its national debt in 2024, The Wall Street Journal recently reported. That’s about 3% of annual GDP (illustrated below), which is nearly double the debt service percentage observed for most of the 21st century. As recently as 2011, the United States paid closer to $400 billion annually to service its debt.

It’s easy to see why ratings agencies like Fitch and Moody’s elected to downgrade the credit rating of the United States. The data also highlights the urgent need for the U.S. to adopt more stringent fiscal discipline. If not, the nation’s creditworthiness is certain to erode further, exacerbating a problem that already threatens to produce a domino effect.

Solutions look painful

To stabilize its financial future, the United States federal government must balance spending and income. That requires two difficult choices: cutting spending and/or increasing income. The latter typically means raising taxes, a politically unpalatable move. Historically, politicians who advocate for tax increases face significant backlash.

Cutting government spending presents its own challenges. Any proposed reductions, such as cuts to defense spending, would likely encounter strong resistance in Congress. Additionally, government spending plays a crucial role in driving the economy and contributing to GDP.

If the government were suddenly to reduce spending to bring the annual budget deficit down to $500 billion (from $1.5 trillion), the consequences would be immediate and severe. Many government employees would lose their jobs, contributing to increased unemployment. The government would need to slash investments in infrastructure and technology, impairing the country’s potential.

In 2023, the federal government spent around $6.1 trillion and took in about $4.4 trillion, resulting in a $1.7 trillion deficit ($6.1 trillion – $4.4 trillion = $1.7 trillion). The $900 billion spent on interest represents more than half of the deficit, illustrating the immense burden of the national debt.

The country’s current fiscal trajectory is unsustainable, according to Campbell Harvey, an expert on public finance at Duke University, “The debt will become a problem, but it’s very hard to know exactly when,” he said.

This issue affects all Americans

It’s easy to blame politicians for the debt crisis facing the country, but voters put those politicians in office. Voters should hold politicians accountable (e.g. vote them out of office) if they don’t work in bipartisan fashion to resolve this situation.

After all, both parties have overseen sharp increases in the national debt, so it’s pointless to try and pin the problem on one specific party.

When President Donald Trump took office in January 2017, the national debt was around $20 trillion. When he left, it was closer to $27 trillion. Similarly, when President Joe Biden moved into the White House, the national debt ballooned to nearly $35 trillion. The debt can’t be laid at the feet of just one political party. And the debt crisis doesn’t appear to be a key issue in the 2024 elections.

The long-term fiscal health of the country should be of critical interest to all Americans. If the United States falls off the fiscal cliff, most other problems facing the nation would seem trivial by comparison. The time to act is now, before the situation devolves into a full-blown crisis.

Both parties should brainstorm potential solutions and collaborate in bipartisan fashion to implement them. Without cooperation, another credit downgrade is virtually assured and other problems will probably emerge, as well.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.