After Tariff-Related Selloff, Are Shares of the ‘Big 3’ Auto Stocks a Buy?

Who’s in the trade-war driver’s seat—Ford, GM or Stellantis?

- The 25% tariffs on imported vehicles are a major problem for U.S. automakers, raising production costs and potentially driving up vehicle prices.

- Shares of American automakers have been under pressure, with Ford’s stock down over 25% and Stellantis down nearly 60% over the last 52 weeks.

- The ‘Big 3’—Ford, General Motors and Stellantis—exhibit attractive valuation metrics, but uncertainty around electric vehicles, geopolitical risk and fluctuating trade policies make it difficult to recommend any of the stocks as a clear “buy.”

The Big 3 American automakers are caught between the demands of a rapidly changing electric vehicle market and the unpredictability of U.S. trade policy. As international trade dynamics shift and the race for EV dominance intensifies, these companies must balance innovation and cost-cutting efforts. Amid this turbulence, a question remains unanswered: Can these giants recalibrate their strategies and emerge stronger, or are the risks too great for investors to bet on their recovery?

Shifts in the American auto industry

The global automotive industry is undergoing a transformation shaped by changes in technology, geopolitics and consumer preferences. In 2024, worldwide vehicle sales totaled around 89 million, with 17 million of them electric or hybrid—a clear sign of the growing demand for sustainable options. With annual sales of 15.9 million, the U.S. market remains the world’s second-largest, but it’s only half as big as China with its 31 million in yearly sales. And now the U.S. faces an added challenge: the Trump administration’s protectionist trade policies, which introduce new complexity for an already turbulent scene.

At the epicenter of this upheaval, you’ll find the so-called “Big 3″—Ford (F), General Motors (GM) and Stellantis (STLA). Once dominant in the U.S. and in much of the world, these legacy automakers are now contending with the twin pressures. The Trump administration’s decision to impose a 25% tariff on vehicles now and 25% on auto parts within the next month adds another layer of complexity. Nearly half of the vehicles sold in the U.S. are imports and nearly all of those made here rely heavily on imported parts. The new tariffs are expected to raise the average price of a vehicle by roughly $6,000, including American-made models. While the policy aims to bolster U.S. manufacturing, experts warn it could backfire, dampening demand and disrupting supply chains and production schedules.

These challenges arise as the “Big 3” work diligently to meet the growing demand for electric and hybrid vehicles. General Motors, for instance, is scaling up its EV production in North America. However, its heavy reliance on Mexican production for key electric models, such as the Chevrolet Equinox, leaves it exposed to the new tariff policy. Ford, on the other hand, faces the dual challenge of transitioning to electric vehicles while managing rising production costs driven by tariff-induced price hikes on critical parts. Meanwhile, Stellantis, struggling with declining market share and profitability, is focused on regaining momentum in 2025 by launching a wide array of new models.

For investors, the pivotal question is whether to buy, hold or sell. With recent pullbacks in shares of the Big 3, many are left pondering whether it presents a compelling buying opportunity or a signal of continuing struggles. To help navigate this uncertainty, we’ll dive into the valuations of the Big 3, evaluating both the risk and rewards.

Ford feels the pressure of the EV transition

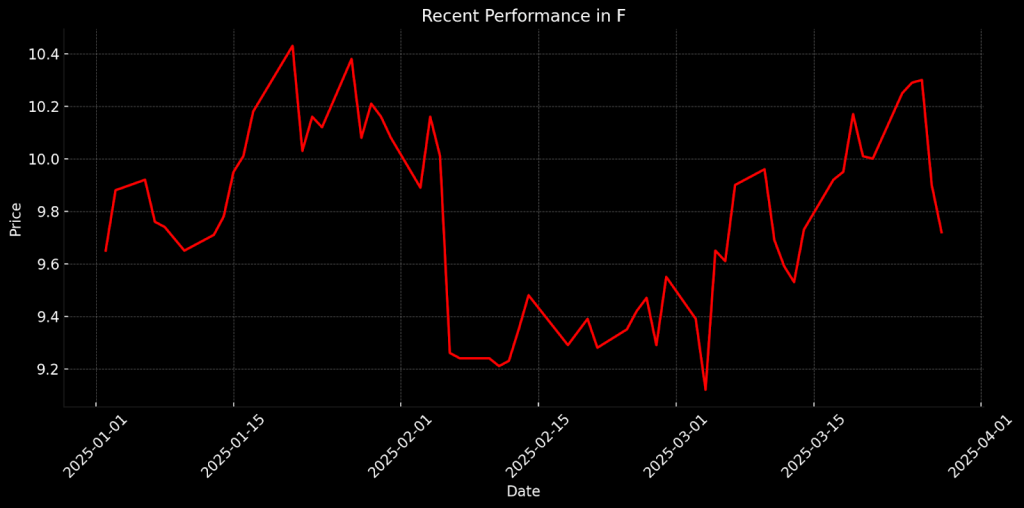

Ford is navigating a challenging phase, with its stock down over 25% in the past 52 weeks, reflecting investors’ concern about its future. Despite posting record global revenue of $185 billion in 2024, Ford’s electric vehicle (EV) segment continues to face hurdles. The company forecasts a loss of up to $5.5 billion for its EV and software operations in 2025, underscoring the difficulties it faces in the increasingly competitive EV market. While Ford’s traditional internal combustion engine (ICE) and Ford Pro fleet businesses remained profitable, contributing $1.8 billion in net income in Q4, the company’s EV strategy remains a critical challenge. Ford’s Q4 earnings surpassed Wall Street expectations, reporting adjusted earnings per share (EPS) of $0.39, beating the forecast of $0.33. However, the 2025 outlook is more cautious, with adjusted EBIT projected between $7 billion and $8.5 billion, a sharp decline from the $10.2 billion reported in 2024.

A major concern for Ford in 2025 is the effect of the 25% tariffs on imports. Many of the company’s vehicles and parts are produced in Mexico and Canada. For instance, models such as the Bronco Sport and Maverick are produced in Mexico, while the Mustang GTD is produced in Canada. The company has made strides in cutting costs, but those efforts could be offset by the new tariffs. As such, Ford’s near-term outlook hinges on its ability to overcome challenges to profitability in its EV division, while also managing shifting consumer preferences and newfound problems in its supply chain.

From a valuation standpoint, shares of Ford are trading at a notably low multiple, with a P/E ratio of 6.7, well below the sector median of 18. This low P/E suggests the market is pricing in a high level of risk or uncertainty regarding Ford’s future performance, potentially offering an attractive entry point for value-focused investors. Additionally, Ford’s price-to-sales (P/S) ratio of 0.2 is well below the sector average of 0.9, indicating the stock is being valued at a substantial discount relative to its sales, further underscoring its undervaluation. The price-to-book (P/B) ratio of 0.9, compared to the sector’s typical 2.0, suggests the stock is trading below the value of its assets, indicating the market may be discounting its potential too much.

Despite Ford’s appealing valuation, analysts remain cautious. Of 26 analysts covering the stock, only seven rate shares a “buy” or “overweight,” and the average price target of $10 per share suggests limited upside from its current price, which is on par with that figure. While the stock’s low multiples point to potential value, continuing challenges—such as the uncertain EV transition, global economic pressures and the effect of the tariffs—keep investor sentiment muted. Given these headwinds, it’s hard to recommend Ford as a “buy,” unless global economic conditions improve or trade tensions ease.

Bullish analysts recognize General Motors’ operational resilience

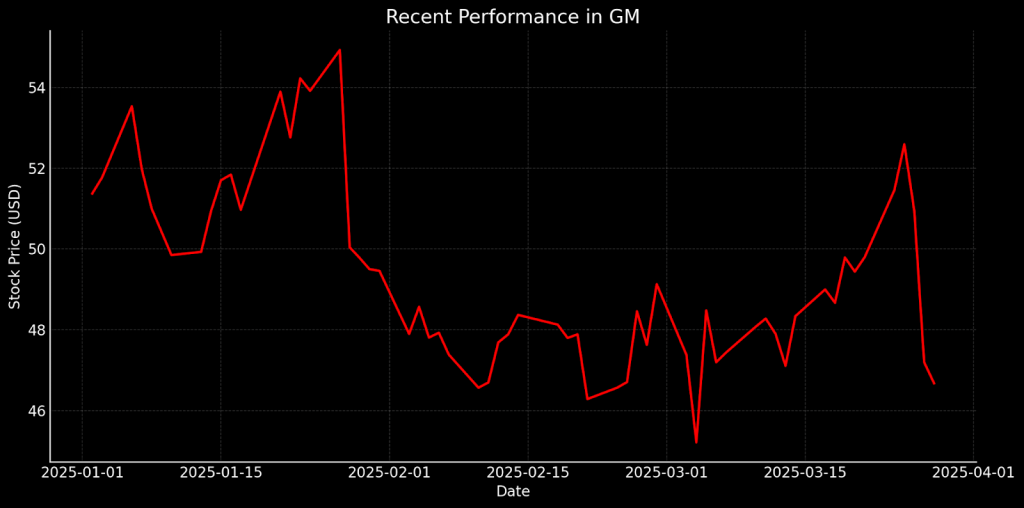

General Motors has also faced challenges this year, with shares down 9% year-to-date. The company is navigating a critical phase as it accelerates its transition to electric vehicles while working to sustain the profitability of its ICE vehicles. Despite these pressures, GM achieved strong financial performance in fiscal 2024, surpassing Wall Street’s expectations with a 9% increase in revenue, reaching $187 billion, and adjusted EPS of $1.92. However, net income fell by 40%, primarily because of restructuring charges and significant losses in its international operations.

Notably, GM’s North American business showed resilience, with an 18% increase in adjusted earnings, highlighting the strength of its core operations. Still, concerns remain about the potential impact of the 25% tariff on vehicles imported from Mexico and Canada. The tariffs will almost certainly increase production costs and disrupt GM’s supply chains.

Like Ford, General Motors’ valuation metrics present a compelling case for those looking for potentially undervalued stocks. The company’s P/E ratio stands at 7.0, well below the sector median of 18, signaling the market may be undervaluing the stock relative to its earnings potential. GM’s P/S ratio of 0.3 is significantly lower than the sector’s average of 0.9, suggesting the stock is trading at a substantial discount to its revenue base. And its P/B ratio of 0.7 also points to the stock as undervalued compared to the industry average of 2.0. That indicates investors may be pricing in more risk than the company’s fundamentals suggest. These low valuation multiples show the market’s cautious stance on GM, particularly as the company navigates the challenges of its EV transition and other operational hurdles.

GM’s stock appears to offer a more favorable outlook than Ford’s, driven by stronger analyst sentiment and greater implied upside potential. Of the 30 analysts covering GM, 18 maintain a “buy” or “overweight” rating on the stock, with an average price target of $60 per share—well above its current price of $47. While this signals confidence in GM’s prospects, the company still faces competitive pressures in EVs, as well as broader economic and trade uncertainties. In short, while GM’s stock appears more attractive than Ford’s, its true upside potential likely hinges on a rebound in global economic growth and an easing of trade tensions—or both.

Stellantis is a high-risk, high-reward opportunity

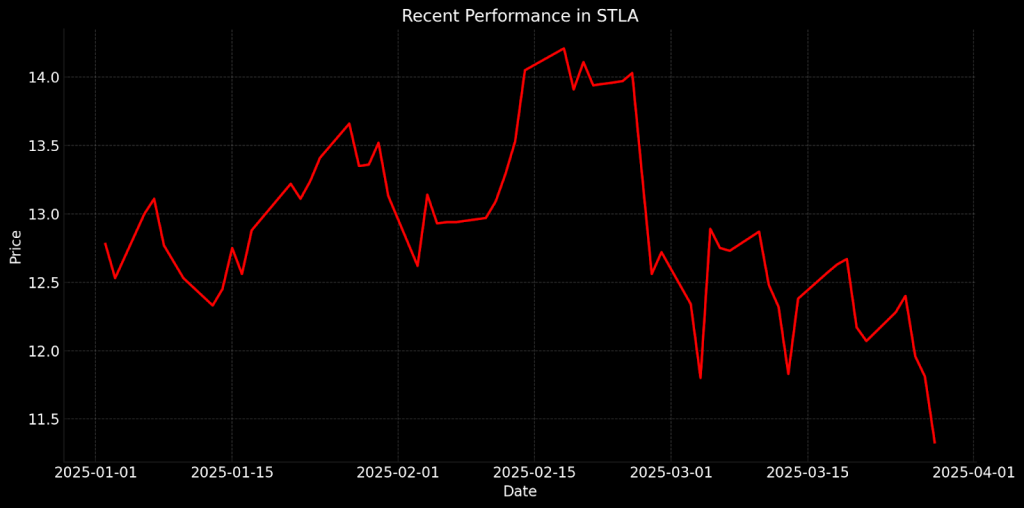

Stellantis is grappling with considerable challenges, reflected by the 60% drop in its stock price over the past 52 weeks. The company experienced a sharp 70% decline in net profit in 2024, falling from €18.6 billion in 2023 to €5.5 billion. This dramatic downturn is primarily because of a 12% drop in vehicle shipments and a 17% decline in net revenue. With a recovery plan in place, Stellantis is aiming to revitalize its operations by launching 30 new products, including EVs like the Jeep Compass EV and the Dodge Charger, and making strides to reduce dealer inventories .

However, Stellantis’ recovery efforts face hurdles. Despite a solid balance sheet, with €49 billion in liquidity, the company is in a difficult position as it transitions to EVs. Scaling EV production profitably remains a challenge, especially as the company seeks to fill a leadership void following the departure of Carlos Tavares. The Ramcharger 1500, a range-extended electric vehicle (REEV), could be crucial to addressing consumer range anxiety and expanding Stellantis’ presence in the competitive U.S. EV market. Yet, the company has little room for error.

Despite the challenges, Stellantis’ stock appears to offer a compelling case for those seeking undervalued opportunities. With a P/E ratio of 6.0, significantly lower than the sector median of 18, the company is priced well below its earnings potential. Moreover, its P/S ratio of 0.2 and P/B ratio of 0.4 further suggest the stock is trading at a steep discount compared to the industry averages of 0.9 and 2.0, respectively. These attractive valuation metrics indicate the potential for considerable upside, especially if the company can successfully execute its recovery strategy and capitalize on its new products.

Not surprisingly, analysts remain cautious on the stock. The company is climbing out of a deep hole, positioning itself as a higher-risk, higher-reward play. Of the 29 analysts covering Stellantis, only eight recommend a “buy” or give it an “overweight” rating, with 18 taking a neutral stance. This neutral outlook may actually be a positive sign because it reflects a measured view that acknowledges the company’s potential for recovery. With an average analyst price target of $14 per share, those ratings do suggest some upside from its current price of around $11 per share.

While Stellantis’ valuation metrics look attractive, the company faces greater challenges than its peers, positioning it as a higher-risk, higher-reward investment. Its solid balance sheet and ambitious product launch pipeline offer the foundation for a recovery, but profitability struggles with EVs, combined with the transition in leadership, create notable uncertainty. Investors considering this stock should be ready to embrace elevated risk, recognizing the potential for strong returns likely comes with heightened volatility.

Takeaways

The automotive industry is at a pivotal moment, with U.S. automakers caught in the middle of a rapid changes, where shifting consumer preferences, new technology and geopolitical turbulence all play roles. As these manufacturers race to embrace EVs, they are burdened with rising production costs and the necessity of navigating the murky waters of uncertain trade policy. The tariffs, in particular, threaten to squeeze margins, disrupt supply chains and push vehicle prices higher—compounding the challenges automakers already face as they strive to remain competitive.

Given this complex backdrop, it’s tough to unequivocally recommend any of these stocks as a clear “buy.” However, among Ford, General Motors and Stellantis, GM stands out as potentially the most compelling choice. Its strong performance in North America, promising EV trajectory and favorable analyst sentiment suggest it possesses slightly more upside potential than its peers. That said, all three manufacturers would probably benefit from a rebound in the U.S. economy. Until that materializes, however, investors should approach with caution because the risk remain substantial.

Andrew Prochnow, Luckbox analyst-at-large, has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.