BYD: Tesla’s Worst Nightmare

It's a Chinese EV maker called "Build Your Dreams"

Twelve years ago, Elon Musk scoffed at Chinese EV manufacturers. Asked about China’s BYD (BYDDY), Musk chuckled and responded, “Have you seen their car?”

Musk isn’t laughing anymore. In fact, he recently sounded the alarm on the growing influence of Chinese EV makers, saying, “If there are no trade barriers established, they will pretty much demolish most other companies in the world.”

Walking through downtown Shenzhen, China—a modern city of more than 15 million located just inland from Hong Kong—provides a look at what may lie ahead. Most foreign visitors would be surprised by the sound of silence. And it’s not a lack of traffic. Shenzhen has heaps of that. Instead, it’s because of the diminishing presence of internal combustion engines on the city’s streets.

Instead, Shenzhen—often referred to as China’s “Silicon Valley”—is filled with EVs. And to most foreign visitors, especially those from outside Asia, the brands are mostly unfamiliar. In that regard, taking a stroll through China’s largest cities can feel a bit like walking on a different planet, as opposed to just another Earthly city.

Unfamiliar car brands

After decades of prosperity, roads in China have long been filled with high-end cars. It’s been common to see BMWs, Bentleys, Lamborghinis and McLarens in Hong Kong, Guangzhou, Shanghai and Shenzhen. Recently, cars from Tesla (TSLA) joined that list.

But now cars bear the names of manufacturers that include Geely (GELYF), Nio (NIO), Xpeng (XPEV) and, of course, “Build Your Dreams”—better known as simply “BYD.” Plus, there are many more. Wired magazine reported in October that at least 300 companies make EVs in China. But when was the last time you saw those names emblazoned on the bodies of cars traversing America’s highways? Probably never, and there’s a good reason for that.

In 2018, then-President Donald Trump slapped a 25% tariff on Chinese vehicles, which was on top of the existing 2.5% duty on all automobile imports. That made Chinese EVs 27.5% more expensive here than their original sticker price. The European Union levies a more modest 10% tariff on imported Chinese EVs, and as a result sales of Chinese EVs have been rising in Europe.

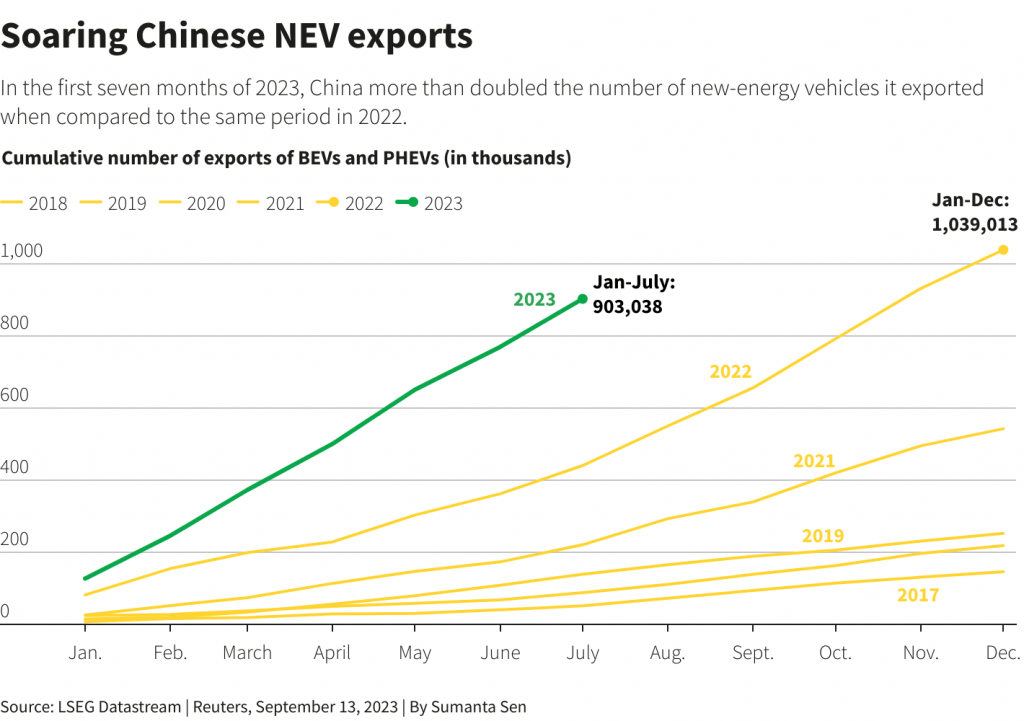

In fact, Chinese EVs have gained such popularity in Europe that the EU is considering raising the tariff to help protect European automobile manufacturers from Chinese competition. That’s why the United States erected the trade barrier. The threat is real. Last year, China became the world’s largest vehicle exporter, surpassing Japan. And new-energy vehicles accounted for a lot of that growth.

BYD in Tesla’s rearview mirror

Politicians in the West have long argued that Chinese EVs enjoy an unfair advantage because they’re subsidized by the Chinese government. At least, that’s how they rationalize the tariffs. Regardless, Chinese manufacturers may soon develop a workaround. BYD, for one, recently announced plans to build an EV factory in Hungary to avoid the high U.S. tariff on cars made in China.

That said, it will cost more for BYD to build EVs in the EU than in China. And it’s likely BYD will be forced to raise its prices in the European market. Right now, the average retail cost of an EV in China is around $33,000, while in the EU it’s closer to $70,000.

When BYD starts manufacturing in the EU, it will undoubtedly raise prices, but it will still be able to undercut most of the competition. And that cost advantage is what’s been keeping auto executives like Tesla CEO Elon Musk awake at night.

EV competition heats up

Even without Chinese EVs saturating the market, the sector has become increasingly competitive, as evidenced by Tesla’s recent Q4 2023 earnings report.

During its most recent earnings call, the company lowered sales expectations for 2024, while also revealing that the company’s margins continue to shrink. Those headwinds have affected Tesla shares, which are down more than 30% year-to-date in 2024, and nearly 60% lower than their peak in November 2021.

Yet Tesla’s current struggles aren’t linked to slumping global demand for electric vehicles. Last year, worldwide EV sales notched a fresh all-time high at just over 14 million units. And the United States is one of the world’s fastest-growing markets. However, stiffening competition has forced many EV manufacturers to lower prices. In 2023, Tesla’s price cuts came to a total average discount of about 25%.

One can only imagine how much deeper those discounts might go if hordes of Chinese EVs invade North America. Chinese manufacturers obviously benefit from lower labor costs, but they also enjoy an advantage because most EV batteries are produced in their home market.

In 2022, China manufactured nearly 80% of the world’s lithium-ion batteries. And in some cases, Chinese EV companies make those batteries in-house. For example, BYD, the world’s second-largest producer of EVs, is also the world’s largest supplier of rechargeable batteries.

BYD manufactures battery-electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

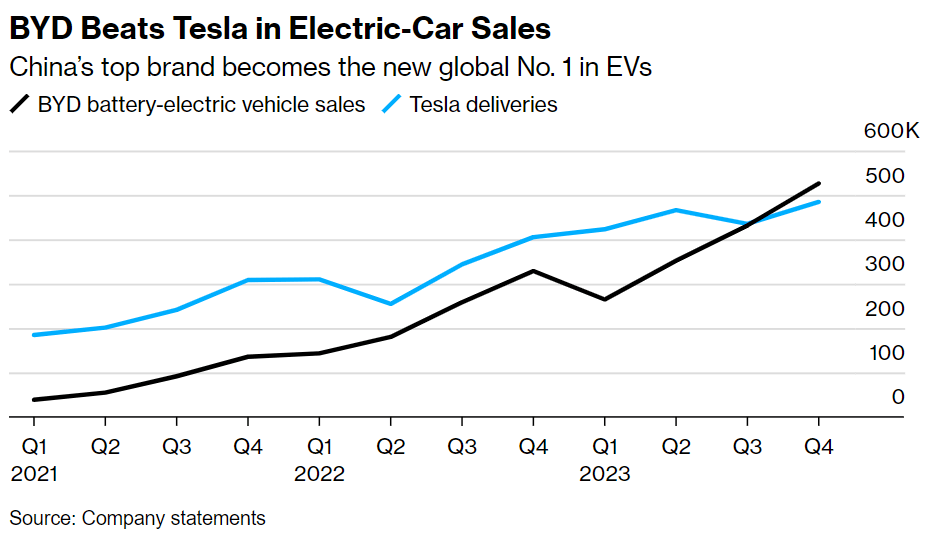

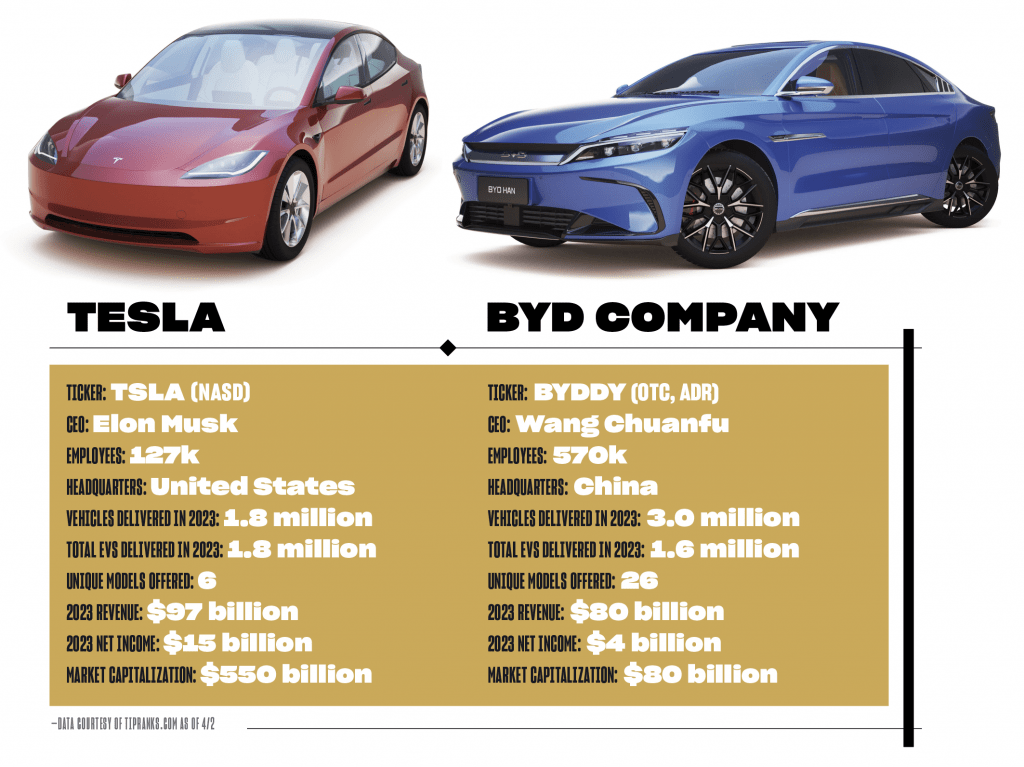

In 2023, BYD made 3 million vehicles, of which 1.6 million were BEVs. In comparison, Tesla manufactured 1.8 million BEVs in 2023, barely edging out BYD on a full-year basis. However, in Q4 of 2023, BYD finally surpassed Tesla in terms of total deliveries in a single quarter.

Note that BYD and Tesla both reported lower than expected vehicle deliveries during the first three months of 2024. Moreover, Tesla reclaimed its BEV crown from BYD in Q1, delivering 386,000 units, as compared to 300,000 for BYD. But in terms of total vehicles (BEVs + plug-in hybrids), BYD was still well ahead of Tesla, delivering closer to 625,000 units.

An EV reckoning in Europe

The statistics show why Musk is getting nervous. The Tesla CEO leaned heavily on federal tax credits to build his EV empire, and new reports suggest that Tesla and other American car manufacturers are now pushing for an outright ban on Chinese-made vehicle imports into the U.S. market.

Musk proclaims himself a staunch supporter of capitalism and free markets, but when it comes to maintaining Tesla’s market share, he displays pronounced protectionist tendencies. And while BYD won’t challenge Tesla anytime soon in North America, there may be an EV reckoning on the horizon in Europe if the EU maintains only a modest duty on imported Chinese EVs.

If Tesla loses significant market share in Europe to companies like BYD, Tesla’s stock could come under further pressure in the coming months. In one scenario, BYD shares could also be re-rated with a higher valuation relative to Tesla. At present, BYD’s market capitalization is a fraction of Tesla’s—$80 billion vs. $550 billion—despite the Chinese company selling many more vehicles annually when EVs and hybrids are combined.

BYD’s hybrid line could also contribute to the company’s competitive advantage. In the United States, hybrids have been selling more quickly than EVs of late. American car dealers reported in January that unsold new EVs were sitting on the lot an average of 114 days, compared to 37 for new hybrids.

Addressing that trend, Akio Toyoda, chairman of Toyota (TM), recently predicted the auto industry of the near future will offer a variety of choices, including hybrids, EVs and hydrogen-powered vehicles. EVs will account for only about 30% of new vehicle sales “at maximum”—far short of the lofty expectations of many in the EV industry.

Because BYD offers both hybrids and BEVs, it may hold a strategic advantage over Tesla. And BYD doesn’t confine itself to passenger vehicles. It also makes electric buses, taxis and vans. BYD also announced recently that it plans to enter the luxury market, starting with an upscale SUV and a high-performance supercar. The new luxury lineup is expected to be marketed under the new “Yangwang” brand.

BYD’s attractive shares

Taken together, these developments help illustrate why Musk is preparing to deploy the full court press in Washington to ensure existing tariffs on Chinese EVs remain in place or move even higher. That may work in the short-term, but what if BYD decides to build a factory in the United States or Mexico?

What’s more, Americans bought only 1.2 million of the 14 million EVs sold worldwide in 2023. That suggests BYD can challenge Tesla in other parts of the world, even if the U.S. remains off limits. It helps explain why BYD has been aggressively expanding its operations in Malaysia and the Philippines.

According to the figures shown above, the price-to-sales ratio for BYD currently stands at 1.0. This ratio is calculated by dividing the company’s market capitalization by its annual revenue ($80 billion/$80 billion = 1). Traditionally, a price-to-sales ratio of 1 (or below) is viewed as a fairly conservative valuation. In comparison, Tesla currently trades with a price-to-sales ratio of closer to 5.7 ($550 billion/$97 billion = 5.7), indicating that shares may be overvalued.

Along those lines, the current trailing 12 months GAAP Price/Earnings for BYD is right in line with the industry average—both are about 18. On the other hand, Tesla’s GAAP Price/Earnings is much higher than that, clocking in at 40+. Taken together, these metrics illustrate that Tesla shares trade at a significant premium to those of BYD. But considering the aforementioned competitive data and information, one could argue that this divergence doesn’t accurately reflect the current dynamic in the industry.

A few years ago, nearly everybody expected Tesla to remain a big winner in the EV revolution, but not many predicted BYD would be ascendant. Warren Buffett, one investor who sensed BYD’s potential early, steered Berkshire Hathaway (BRK.B) into BYD stock. In 2008, Berkshire Hathaway invested about $230 million to buy 225 million shares of BYD—about $1 per share. Today, those same Hong Kong-listed shares of BYD trade for about $25.

BYD’s success serves as a reminder of one of the market’s longest-running axioms—never bet against Buffett or his longtime, recently deceased business partner, Charlie Munger. Last year, Berkshire sold some of its position in BYD (at a huge profit) but still owns roughly 6% of the company. Berkshire’s continuing position suggests there’s still plenty of upside to be had in BYD—especially when one considers the large discrepancy between the current valuations of BYD and Tesla.

Andrew Prochnow, a frequent contributor to Luckbox, has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader.