Flash Crash: Culprit or Casualty?

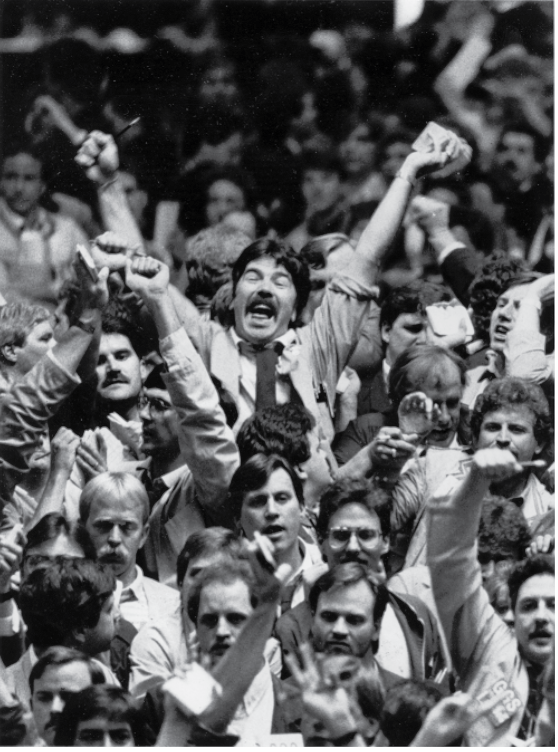

On May 6, 2010 the Dow collapsed 9% only to recover a large portion of the loss almost instantly. The whole move only took about 36 minutes, and is known as the “Flash Crash.” No one quite understood the reasons behind the move when it occurred, but eventually the regulators found a culprit. The U.S. Department of Justice (DOJ) and the Commodity Futures Trading Commission (CFTC) charged Navinder Singh Sarao with fraud and market manipulation for his trading activity during the “Flash Crash.”

Sarao was a high-frequency trader who traded from the basement of his parent’s house in London, and profited $50 million. The CFTC and Justice Department charged Sarao with market manipulation for placing thousands of large sell orders in the E-mini S&P 500 Index futures contract that appeared to trigger some of the panic selling during the “Flash Crash.” The regulators contend that Sarao’s sell orders were never meant to be executed, but were instead placed to fuel the panic-selling that allowed Sarao to buy the E-mini S&P 500 contract at a deep discount. Sarao eventually pled guilty and was indicted on 22 counts of fraud and faces up to 30 years in prison.

The regulators not only charged Sarao, they also charged Jitesh Thakkar, the owner of Edge Technologies, a Chicago software development firm. Edge technologies built a trading tool from specs provided by Sarao, which allowed him to place orders that were displayed in the market, but impossible for other market participants to trade against. Thakkar did not develop this tool himself, it was developed by one of the programmers that worked for him. This feature allowed Sarao to place large sell orders that gave the appearance the market was being aggressively sold, without exposing Sarao to the market risk associated with such large orders. If buyers had tried to buy these offers the orders were quickly canceled before they could be executed, so all other market participants saw was an extremely volatile market being aggressively sold.

The tool was built to order for $24,000 from specs provided by Sarao. Edge Technologies did not share in any of Sarao’s profits, nor did Sarao ever share his trading strategy with Jitesh Thakkar or anyone else at Edge Technologies, according to Sarao’s testimony. Edge Technologies built the tool, but Sarao used the tool to commit the crime.

Thakkar was originally charged with a criminal complaint by the DOJ as well as a civil case brought by the CFTC. The criminal case was withdrawn by the DOJ, but Thakkar is still subject to the CFTC civil suit. The CFTC contends that Thakkar was complicit in the fraud because he should have realized that the tool was developed and used for manipulative purposes.

Thakkar’s reputation and company have been destroyed. His company received $24,000 for the work they did for Sarao, while Sarao made millions. Making $24,000 doesn’t seem to be enough motivation for Thakkar to aid Sarao and risk his livelihood.

The CFTC should follow the DOJ’s lead and drop their suit against Thakkar.