Green Shoots Appear to be Sprouting in the U.S. Bond Market

The bond market has shown signs of a revival, reflecting increasing optimism about a potential rate cut.

- Since bottoming earlier this year, the iShares 20+ Year Treasury Bond ETF (TLT) rallied by about 7% in recent weeks.

- The rally in TLT appears to be indicative of a bullish shift in the bond market due to the potential for a forthcoming rate cut.

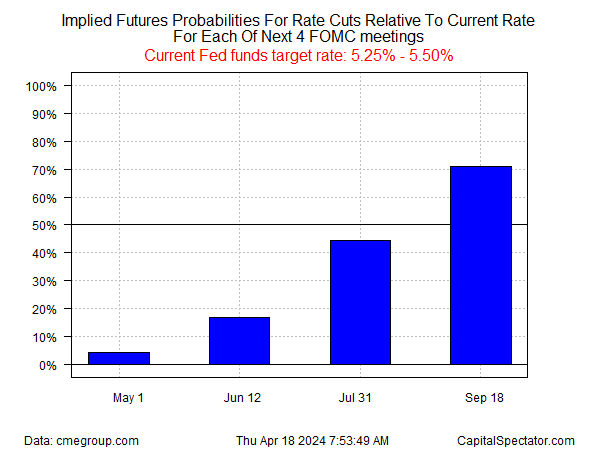

- At present, the interest rate futures market indicates that the U.S. Federal Reserve will cut benchmark rates in September.

- So far in 2024, the Bank of Canada instituted one rate cut, while the European Central Bank is expected to follow suit soon.

After months of uncertainty, the bond market may soon find more stable footing, primarily because analysts expect the U.S. Federal Reserve to cut interest rates during the second half of 2024.

As most investors and traders are aware, bond prices share an inverse correlation with interest rates. So, when the Fed cuts rates, that typically boosts valuations. Of course, the knife cuts both ways—if inflation heats up again, the Fed might be forced to raise rates, which could weigh on bond prices.

At present, however, some “green shoots” have appeared in the bond market. And that’s likely because some market participants are starting to position for a Fed pivot. After bottoming around $87 per share earlier in spring, the iShares 20+ Year Treasury Bond ETF (TLT) is now trading closer to $93 per share, an increase of roughly 7%.

TLT tracks the performance of U.S. Treasury bonds with maturities of 20 years or more. TLT is especially sensitive to changes in interest rates because of the long duration of those bonds. If rates fall, TLT would benefit.

As highlighted below, TLT increased dramatically in value when the Fed cut rates in response to the COVID-19 pandemic. It then declined in value when the Fed raised rates to fight inflation.

Annual Performance iShares 20+ Year Treasury Bond ETF (TLT), 2019-2023

- 2019: +14.93%

- 2020: +17.92%

- 2021: -4.76%

- 2022: -31.41%

- 2023: +2.96%

Many experts expected the Fed to cut rates earlier in 2024. And in anticipation of those cuts, TLT rallied from about $82 per share in late 2023 to $100 per share. However, as hopes for a rate cut diminished, TLT fell back toward its 52-week low. Today, TLT is once again rallying on hopes for a near-term rate cut.

For the year to date, TLT is down roughly 5%, but over the last five trading days TLT is up nearly 4%.

First rate cut could come in September

As of early June, the interest rate futures market is signaling that the Fed might cut rates in September.

However, it’s crucial to remember that the futures market previously anticipated a rate cut in March, which did not materialize. More recently, expectations have shifted multiple times—from June to July, and now to September. This pattern of shifting predictions underscores the uncertainty surrounding the Fed’s next move, and there’s no guarantee that a rate cut will occur in September.

Unless the economy experiences a significant downturn, it seems unlikely that the Fed will cut rates during the summer. Currently, the interest rate market anticipates that the Fed will lower benchmark rates by a quarter percentage point in September, bringing the federal funds rate target range down to 5.00% to 5.25% from its current level of 5.25% to 5.50%, as illustrated below.

In addition to the anticipated rate cut in September, the futures market is projecting another quarter-point reduction before the end of the year. This could bring the target range down to 4.75% to 5.00% before the start of 2025.

However, the actual number of rate cuts will depend on the trajectory of inflation and the underlying strength of the U.S. economy.

Recent data indicate a manufacturing slowdown

The U.S. economy has shown resilience in recent months, but there are emerging signs that elevated interest rates may be starting to take a toll.

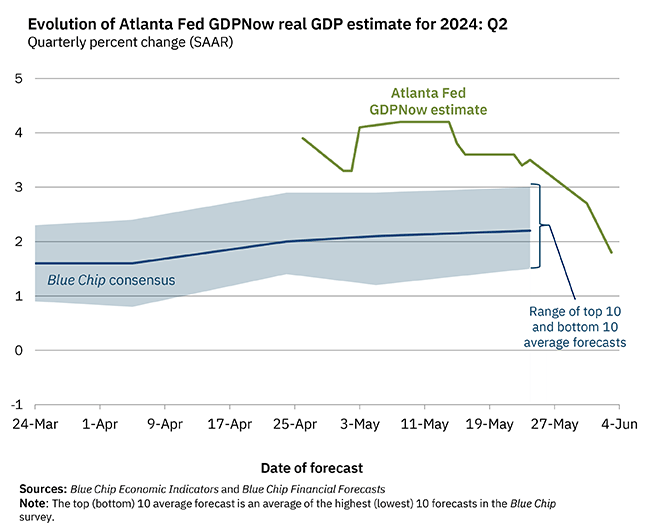

At the end of May, the government revised the Q1 gross domestic product (GDP) growth figure downward from 1.6% to 1.3%. Currently, Q2 GDP growth is expected to come in around 1.8%. However, the GDPNow forecast from the Federal Reserve Bank of Atlanta has been steadily declining throughout May, as highlighted below.

Importantly, the above Q2 GDP forecast is still in positive territory, meaning the U.S. economy should continue growing, but at a slower pace.

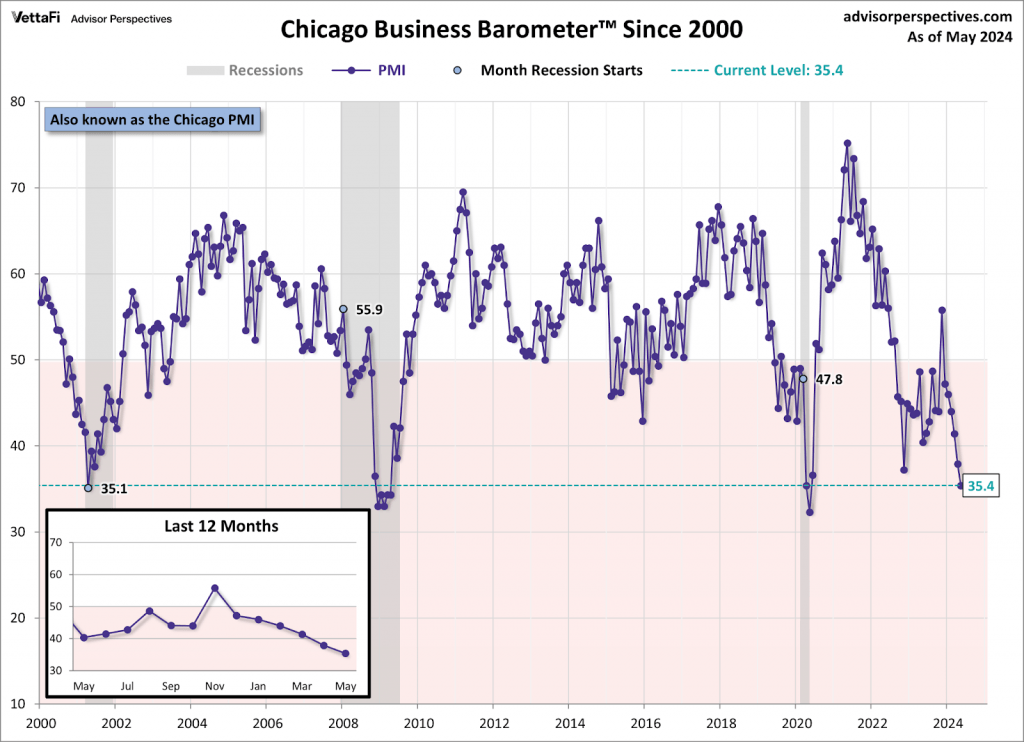

Recent manufacturing data supports these downward revisions in Q2 GDP. For instance, the Chicago PMI (Purchasing Managers’ Index), a key indicator of manufacturing activity, recorded its worst reading since May 2020.

In May, the Chicago PMI fell to 35.4, which was a couple of points below the April level. A PMI reading below 50 signals slowing activity. May marked the sixth consecutive month of declines in the Chicago PMI. A reading as low as 35 is particularly ominous, because similar levels have been observed ahead of recent recessions in the U.S. economy, as illustrated below.

Importantly, the broader Institute for Supply Management (ISM) Manufacturing PMI, which gauges manufacturing activity at the national level, is also below 50. New data indicates the index fell to 48.7 in May, down slightly from April’s level of 49.2.

Notably, this marks the 18th decline in the past 19 months. However, it is important to note that the current ISM PMI level has not yet reached crisis territory.

A critical threshold to monitor in the ISM index is 43.5. Since 1948, the U.S. economy has entered a recession on 12 out of 13 occasions when the ISM PMI has fallen to 43.5 or below. The sole exception was during the 1950s, when the U.S. economy avoided recession due to the post-World War II economic momentum and increased government spending associated with the Korean War.

Activity in the services sector surprises to the upside

Assessments of the U.S. economy have become increasingly complex in the wake of the COVID-19 pandemic, and recent developments in the services sector only add to the challenge.

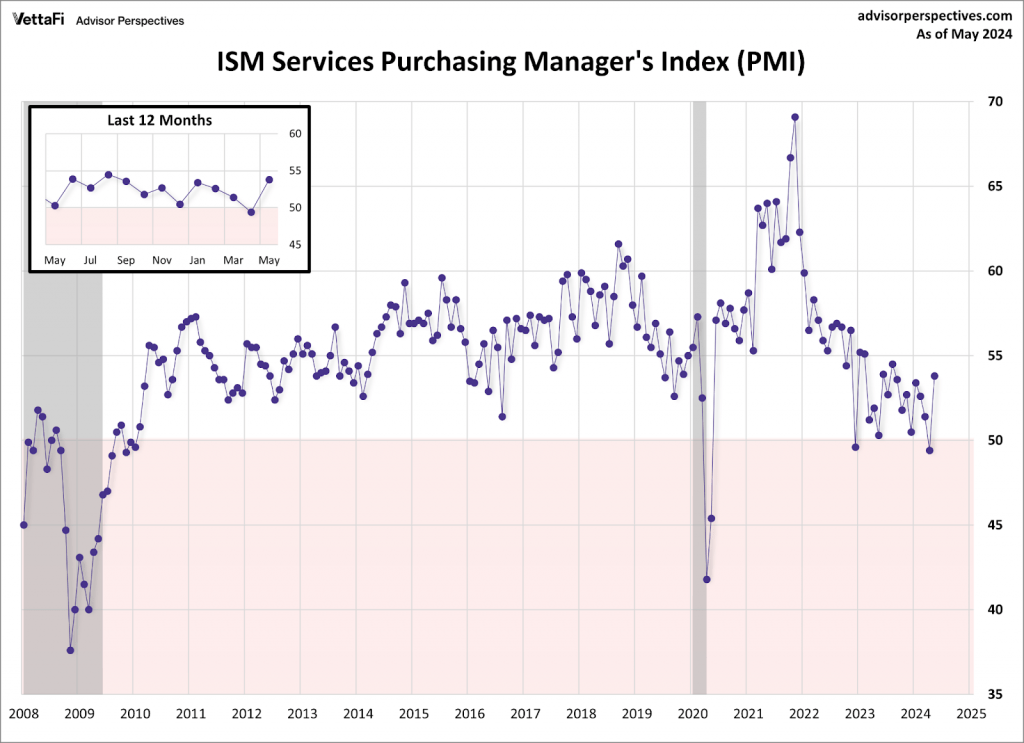

In a surprising turn, the ISM Services PMI, which measures activity in the services sector, indicated an unexpected uptick in May. This is particularly noteworthy because the Services PMI had slipped into negative territory in April, causing concern among analysts. However, in May, the services PMI rebounded strongly, printing at 53.8—well above the critical threshold of 50, which signifies expansion.

This unexpected growth in the services sector, despite broader economic headwinds, highlights the sector’s resilience. The recovery also indicates that demand in the services sector remains robust, even as other parts of the economy show signs of strain.

Final takeaways

All told, the data paint a confusing picture for the U.S. economy.

Manufacturing activity has been steadily declining, albeit at a gradual pace, while the services sector is expanding. These contradictory trends will undoubtedly continue to confound economists, and potentially make it more difficult to pinpoint when a rate cut might materialize.

In contrast, central banks in other major economies are taking decisive actions. The Bank of Canada just cut interest rates for the first time, and the European Central Bank has signaled that a near-term rate cut is imminent. These developments suggest that the United States might follow suit soon.

As a result, the nascent recovery in the bond market observed over the last several weeks could potentially broaden in the coming months. For this reason, investors and traders may want to continue monitoring the iShares 20+ Year Treasury Bond ETF for potential entry points.

Those interested in corporate bonds might also consider an ETF like the Vanguard Short-Term Corporate Bond ETF (VCSH) or the iShares 1-5 Year Investment Grade Corporate Bond ETF (IGSB), which are both trading in positive territory this year.

For more background on trading bonds and interest rates, readers can check out this installment of In This Economy on the tastylive financial network.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.