Zillow (Z): Rate Cuts Expected to Boost Real Estate Sector

Higher demand for houses could raise prices and thus negate the benefit of lower interest rates

- The Fed’s decision to cut interest rates by 50 basis points should benefit the real estate sector.

- In anticipation of the cut, stocks like Redfin and Zillow have already trended toward 52-week highs.

- However, lower rates could push real estate prices higher.

The real estate market, particularly residential housing, could be the big winner from Federal Reserve’s decision to cut interest rates by 50 basis points—the first reduction since 2020. That’s because lower rates should provide consumers immediate relief by bringing down borrowing costs.

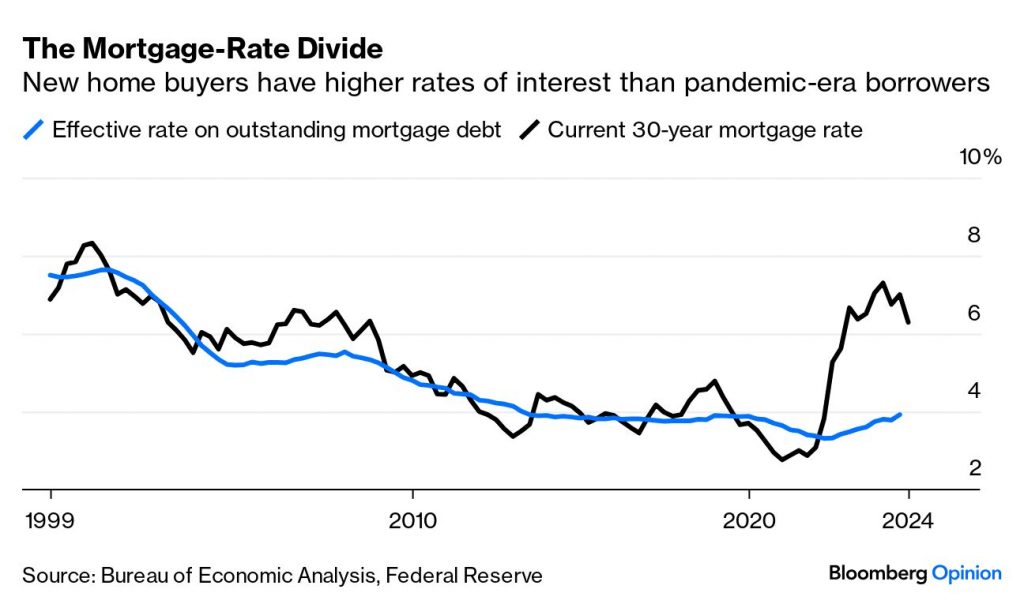

Mortgage rates, recently falling back toward 6%, are expected to drop further. The Fed indicated benchmark rates could be cut by another 50 basis points before the end of the year.

But investors should keep in mind that rate cuts aren’t always bullish for the economy, especially a “super-sized” cut like this one. Significant cuts often signal broader economic concerns, raising questions about the Fed’s rationale.

Potential effects on residential real estate

In real estate, the prevailing level of interest rates often dictates activity in the market. High rates can stifle activity, and relatively low rates can provide a boost.

In September 2024, the players that stand to gain from more favorable market conditions include real estate technology platforms like Zillow (Z) and Redfin (RDFN), brokerages like RE/MAX (RMAX) and Compass (COMP), homebuilders like Lennar (LEN) and Toll Brothers (TOL), real estate investment trusts, or REITs, like Realty Income (O), and construction material suppliers like Owens Corning (OC).

For example, real estate platforms like Zillow and Redfin should see increased traffic and more transactions, while brokerages like RE/MAX are likely to experience a higher number of closings, translating to more commissions.

Homebuilders, meanwhile, could see a rise in home orders, while REITs and materials suppliers could benefit from rising property values and increased demand for construction supplies.

The rate cut has already stirred positive reactions in residential real estate stocks. Wedbush has upgraded Zillow to “outperform” with a price target increase to $80. Its shares have risen by about 26% over the last month. Redfin stock has also surged, climbing by an impressive 45% in the last 30 days, while shares of RE/MAX are up about 11% over the same period.

For its part, SPDR S&P Homebuilders ETF (XHB) has rallied by about 7% over the last month.T

These gains underscore newfound confidence that declining interest rates could fuel increased activity in the residential real estate sector.

What to watch in the near-term

As lower rates open the door to more buyers, investors can track several indicators to see whether the housing market is gaining momentum. Mortgage applications, often a leading indicator of homebuying activty, are released weekly by the Mortgage Bankers Association (MBA). And of late, application figures have been rising, signaling increased buyer interest (highlighted below).

Existing home sales, tracked monthly by the National Association of Realtors (NAR), are another key metric. As mortgage applications convert to purchases, these sales provide a clear picture of how much housing activity is increasing.

Investors should keep an eye on housing inventory levels. Increased buyer activity can push more homeowners to list their properties, creating more fluidity in the market and fueling transaction growth.

Ultimately, those indicators will suggest whether the rate cut is delivering the expected boost to housing. And by monitoring this data, investors can assess whether the cuts are delivering sustained growth to the sector or if other challenges—such as housing inventory shortages and rising home prices—are tempering the positive effects of lower rates.

Potential drawbacks of lower rates

While lower interest rates can stimulate the housing market, they aren’t always a sign of economic health. The Federal Reserve typically cuts rates when the economy shows signs of weakness, such as rising unemployment or slower growth of the gross domestic product (GDP). And if those scenarios play out, they can negate the advantages of cheaper borrowing.

Lower rates also often lead to higher home prices. As demand for homes rises because of cheaper financing, the limited supply of available properties can drive up prices, making homes more expensive even as borrowing becomes more affordable.

So, some buyers may still be priced out of the market, even with lower mortgage rates. On top of that, this trend could dampen activity in the housing industry despite lower rates.

After the rate cut decision was announced, Fed Chair Jerome Powell addressed these risks, saying that the real issue with housing is that we don’t have not enough. The rate cut itself won’t eliminate all of the problems facing the housing market.

Considering these factors, there’s no guarantee lower rates are a net positive for everyone. There will be winners and losers. Predicting the net effect isn’t a slam dunk, and outcomes will most likely vary by region and industry niche. Note that commercial real estate is also expected to benefit from lower rates, and we’ll cover that in a subsequent post.

Takeaways

The Fed’s rate cut presents opportunities and risks for the real estate industry. On the plus side, lower borrowing costs are likely to boost demand, making homeownership more attractive for buyers who have been waiting on the sidelines. This should drive increased activity for real estate platforms, brokers and homebuilders, all of whom thrive on high transaction volume and rising demand.

On the other hand, the potential for higher home prices is a concern. And with demand poised to increase, limited housing inventory could put upward pressure on prices, negating some of the affordability gains associated with lower rates. This dynamic could limit the benefits from the rate cut, especially in high-demand markets where buyers might still struggle with steep prices despite reduced borrowing costs.

Rate cuts have at times corresponded with slowdowns in the underlying economy. As a result, any material deterioration in U.S. GDP growth could diminish the positive effects of lower borrowing costs, as consumers retrench and avoid making large financial commitments.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. He is a frequent contributor to Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.