This Bubble’s Not in Trouble: Why the 2024 Bull Run Isn’t Ready to Quit

From AI to tax cuts—here's why this rally might be just getting started

- The 2024 stock market rally, driven by resilient corporate earnings, monetary easing and transformative innovation in AI, has defied expectations, with the two major indices up over 25% year-to-date.

- Key drivers, such as accelerating earnings growth, a pro-business policy agenda and increased investment in AI infrastructure, suggest the rally could extend into 2025.

- While risks like elevated valuations, fiscal imbalances and geopolitical tensions persist, the market’s strong foundation continues to fuel bullish sentiment.

The U.S. stock market has surged in 2024, with the S&P 500 and Nasdaq 100 both posting gains of over 25% year-to-date. It’s a rally that has defied doubters and outpaced even the most optimistic forecasts. Yet, beneath the surface of this extraordinary performance lies a critical question: How much longer can this momentum last?

Concerns about overvaluation are increasingly coming into focus. Some key metrics suggest that stock prices have raced ahead of fundamentals, raising fears that the market may be overextended. But in the world of investing, timing the top of a market is as elusive as it is fraught. And as of now, the evidence suggests this bull run has more room to run.

Moreover, the bullish optimism that has propelled the market is not without substance. Resilient corporate earnings, a Federal Reserve that appears more accommodative, transformative technological advancements and the likelihood of new pro-business fiscal policies all support the idea that the rally could extend into 2025. Let’s take a look at several driving forces behind the market’s incredible run, and some of the risks that could challenge its longevity.

Corporate earnings, a key driver of bullish sentiment

Corporate earnings are a cornerstone of stock market performance, offering a direct measure of profitability and growth potential. Strong earnings energize investor confidence, driving market momentum and validating valuations, while weak or declining earnings often signal looming economic challenges. A sharp downturn in corporate earnings—particularly alongside broader economic weakness—would cast serious doubt on the sustainability of current market gains.

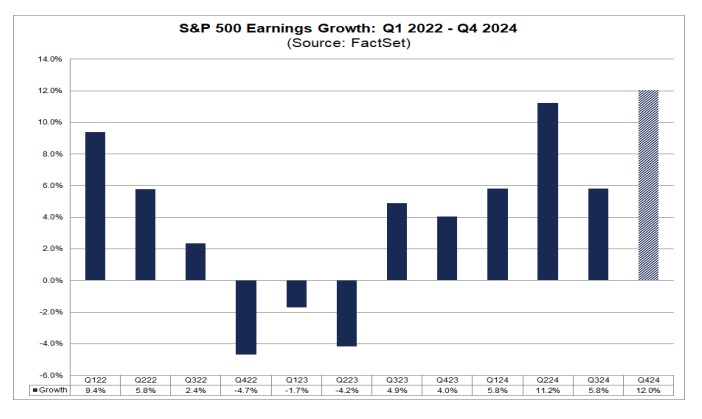

Amid a complex economic backdrop, corporate earnings have remained a bright spot, showcasing remarkable resilience. With 95% of S&P 500 companies having reported Q3 2024 results, the data paints a compelling picture of strength. The blended year-over-year earnings growth rate now stands at 5.8%, comfortably exceeding the initial forecast of 4.2%. This marks the fifth straight quarter of positive earnings growth, highlighting the ability of U.S. companies to navigate higher interest rates and geopolitical uncertainty.

Looking ahead, the outlook becomes even more striking. For Q4 2024, year-over-year earnings growth is projected to accelerate to 12%, more than double the Q3 rate (highlighted below). If the corporate sector delivers, it would represent the strongest earnings growth since Q4 2021, when the economy surged out of the COVID-19 pandemic, delivering an extraordinary 31% year-over-year increase.

The strength in corporate earnings has become a cornerstone of the current rally, acting as a stabilizing force amid concerns over elevated valuations. Resilient profitability across industries has not only bolstered investor confidence but also provided a critical foundation for sustained market momentum.

With year-over-year earnings growth projected to accelerate to 12% in Q4—the fastest pace since the post-pandemic surge—corporate America continues to exceed expectations. This consistent growth trajectory underscores the market’s bullish outlook and reinforces the case for additional gains. In many ways, earnings remain the backbone of this market, offering a compelling reason that the bull run could extend into 2025.

Recent rate cuts by the Fed support the rally

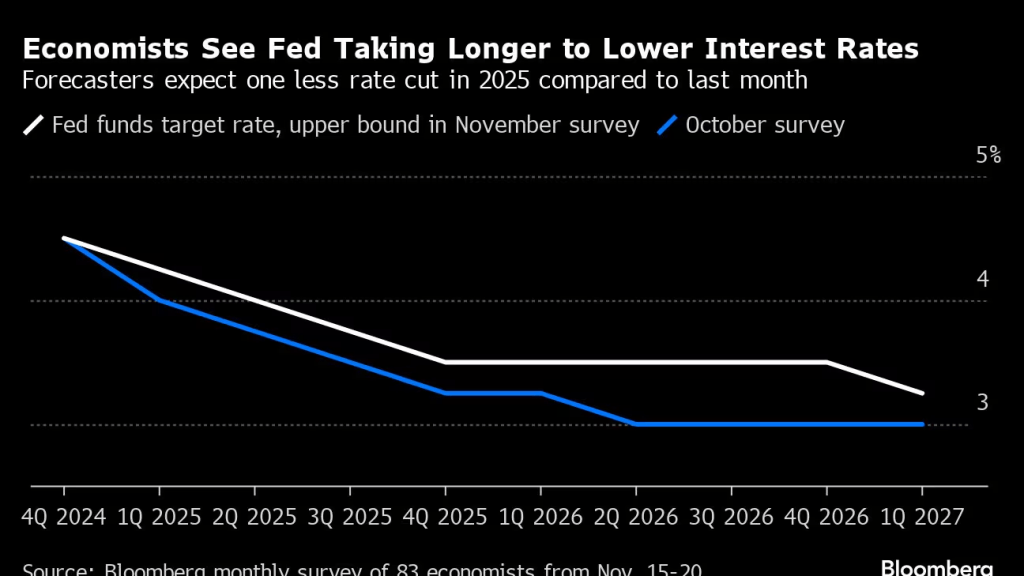

In recent months, the Federal Reserve has pivoted to a more accommodative monetary stance, injecting optimism into U.S. financial markets. And on Nov. 7, 2024, the central bank once again lowered benchmark interest rates by 0.25 percentage points, bringing it to a range of 4.5% to 4.75%. This followed a half-point cut in September, signaling a deliberate effort to support economic growth as inflation pressures moderate. These back-to-back rate cuts reflect the Fed’s attempt to fine-tune its approach, balancing economic strength with the risks of persistent inflation.

Lower interest rates reduce borrowing costs for businesses and consumers, encouraging investment, spending and economic expansion. These measures can bolster corporate profitability, making equities more appealing to investors. Historically, periods of monetary easing have coincided with bullish trends in the stock market, as lower rates boost both confidence and liquidity.

However, Federal Reserve Chair Jerome Powell has made it clear that the central bank is proceeding with caution. While acknowledging the benefits of rate reductions, Powell emphasized that further cuts would not be rushed, citing the resilience of the economy and uneven progress in achieving the Fed’s 2% inflation target. This measured approach underscores the Fed’s intent to avoid overstimulating the economy, which could risk reigniting inflationary pressures for consumers.

While the Fed’s current trajectory bolsters market optimism, it also underscores the precarious balancing act at the heart of monetary policy. Lower rates have undoubtedly fueled confidence and liquidity, but they are not a cure-all. If inflation rebounds, the Fed may find itself in a difficult position—forced to tighten monetary conditions just as the markets have grown accustomed to support.

The Federal Reserve’s decisions are both a driver of the current rally and a potential fulcrum point. Investors should not only monitor the Fed’s actions closely, but also prepare for the possibility that this delicate equilibrium could shift, reshaping the market’s path into 2025.

Incoming Trump administration favors pro-business policies

Donald Trump’s re-election in 2024 has reignited market enthusiasm for tax cuts and deregulation—cornerstones of his economic platform that have historically boosted corporate earnings and stock market performance. Analysts at Goldman Sachs estimate that Trump’s proposed corporate tax cuts could increase S&P 500 earnings by as much as 20% over the next two years. Notably, the bank also projects that every one-percentage-point reduction in the corporate tax rate could lift earnings by nearly 1%, underscoring the significant potential effect of these policies on corporate profitability and investor sentiment.

Deregulation, another key pillar of Trump’s agenda, adds to this optimistic outlook. Industries such as financial services, energy and healthcare stand to benefit from reduced compliance costs and greater operational flexibility. Historically, deregulation has been a boon for equities, as investors price in expectations of improved margins and expanded capital investments. This combination of tax cuts and deregulation reflects a pro-growth agenda that has already drawn strong investor interest.

The market’s response has been immediate and striking. On the day following Trump’s re-election, U.S. equities experienced an influx of $20 billion, marking the largest single-day surge in five months. Financial funds led the charge, with record-breaking inflows of $2.9 billion, as investors piled into sectors primed to benefit from lighter regulations. This surge in capital flows signals more than just optimism—it reflects a recalibration of market expectations as participants anticipate a new era of corporate profitability driven by policy changes.

While these policies provide a clear boost to market optimism, they also raise concerns about fiscal sustainability. Fitch Ratings has already flagged the risk that extending tax cuts and reducing regulations could place additional strain on the federal budget, further exacerbating the deficit and debt challenges facing the U.S. economy. The federal deficit is projected to remain at approximately 7.6% of GDP in 2024, with interest payments on the national debt outpacing spending on defense and Medicare. If deficits continue to rise, they could push up interest rates or limit the government’s ability to respond to future economic challenges, introducing potential headwinds for the market.

Nevertheless, the immediate outlook remains decidedly bullish. With tax cuts and deregulation poised to enhance corporate earnings and improve profitability across key sectors, these policies provide meaningful support for the ongoing rally. As the market weighs the potential risks against the benefits, this pro-growth agenda strengthens the case for continued gains, positioning the market for further upside in 2025.

AI advancements are poised to assist the economy

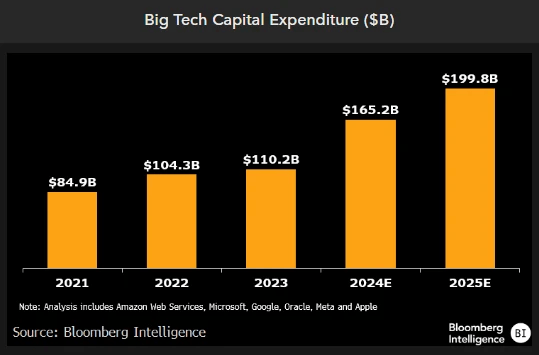

Artificial intelligence (AI) has emerged as one of the most transformative forces of our time, captivating investors and businesses alike with its potential to revolutionize industries and drive sustained economic growth. The integration of AI into business operations promises significant productivity gains, cost efficiencies and innovation—factors that could justify the market’s enthusiasm, even in the face of concerns about elevated valuations.

Along those lines, corporate investment in AI infrastructure is accelerating at an unprecedented pace. Next year, U.S. cloud providers and mega-cap companies are expected to spend over $200 billion on capex, with the majority of the expenditures focused on generative-AI infrastructure. These investments underscore the belief that AI represents a general-purpose technology akin to electricity or the internet—capable of driving innovation across diverse sectors like healthcare, logistics, finance and manufacturing. This explosion in AI spending is fueling optimism that the technology could underpin a new era of economic and corporate growth.

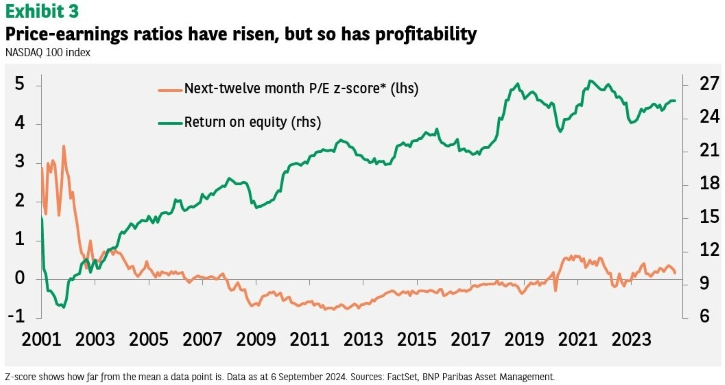

Skeptics, however, point to the stock market’s frothy valuations, particularly in tech-heavy indices such as the Nasdaq 100, which trades at a forward P/E ratio of approximately 26x. Critics warn that these lofty valuations could leave the market vulnerable to corrections, especially if AI investments fail to deliver the expected returns.

Yet proponents counter that such valuations are supported by the sector’s robust earnings potential (illustrated below), with consensus estimates forecasting strong earnings growth in the coming years. The emergence of high-return applications—spanning sectors from AI-powered drug discovery to autonomous systems—could further validate premium valuations.

Additionally, AI holds profound implications for the broader economy. By driving innovation and improving efficiency, AI has the potential to address the long-standing stagnation in labor productivity growth, which has hovered around 1.5% annually. Greater productivity could help lower costs, boost wages and stimulate consumer spending, creating a virtuous cycle that supports both corporate earnings and economic expansion.

All told, the rapid adoption of AI is not only revolutionizing industries, but also fueling tangible economic benefits through increased investments and productivity improvements. These investments, particularly in generative-AI infrastructure, are driving innovation and creating opportunities that are rippling through the broader economy. Looking ahead, increased alignment between corporate innovation and government policy represents another potential catalyst for this sector, providing additional support for bullish sentiment in the markets.

The 2024 bull market has room to run

The current bull run in the stock market is underpinned by a strong foundation: Resilient corporate earnings, accommodative monetary policy, transformative technological innovation, and the potential for fiscal incentives from near-term tax cuts and deregulation. These forces collectively create a compelling case for continued market momentum, as companies demonstrate adaptability and the broader economy remains robust.

However, as history has shown, markets are not immune to risks. A significant economic slowdown or a sharp decline in corporate earnings would pose the greatest threats to this rally, though neither appears imminent. Adding another layer of uncertainty, Donald Trump’s return to Washington and his early policy decisions—particularly on tariffs and immigration—are likely to ripple through the markets. These policies could significantly affect global trade and the U.S. labor market, introducing new variables for investors to weigh as they evaluate the economic outlook.

Along those lines, the European Central Bank’s recent warning about a potential bubble in U.S. equities, particularly those tied to the AI sector, underscores the need for vigilance. Geopolitical risks, such as the ongoing conflicts in Eastern Europe and the Middle East, could further shift the risk paradigm in financial markets, depending on how those crises evolve. The stakes would rise significantly if these conflicts escalate further, pulling in additional regional actors or expanding into broader confrontations with global economic implications.

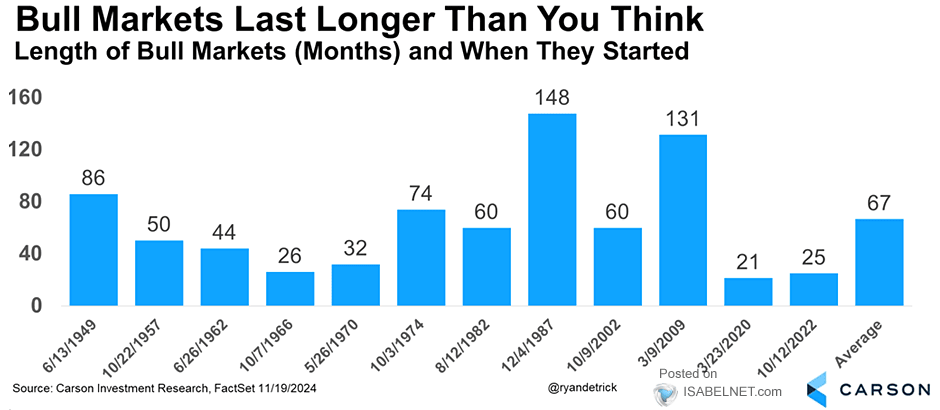

For now, market euphoria maintains a firm grip on U.S. financial markets, with a bull rally that continues to surpass expectations and defy skeptics. While risks persist, ranging from geopolitical tensions to elevated valuations, the underlying drivers of this rally remain compelling. And as highlighted below, some would argue that the current bull market—starting in October 2022—is still in its infancy.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.