Inflation is Cooling, But Beef And Olive Oil Prices are Still Surging

Elevated prices for hay have pushed U.S. beef prices to fresh record highs, with the average price for retail beef climbing above $8/lb

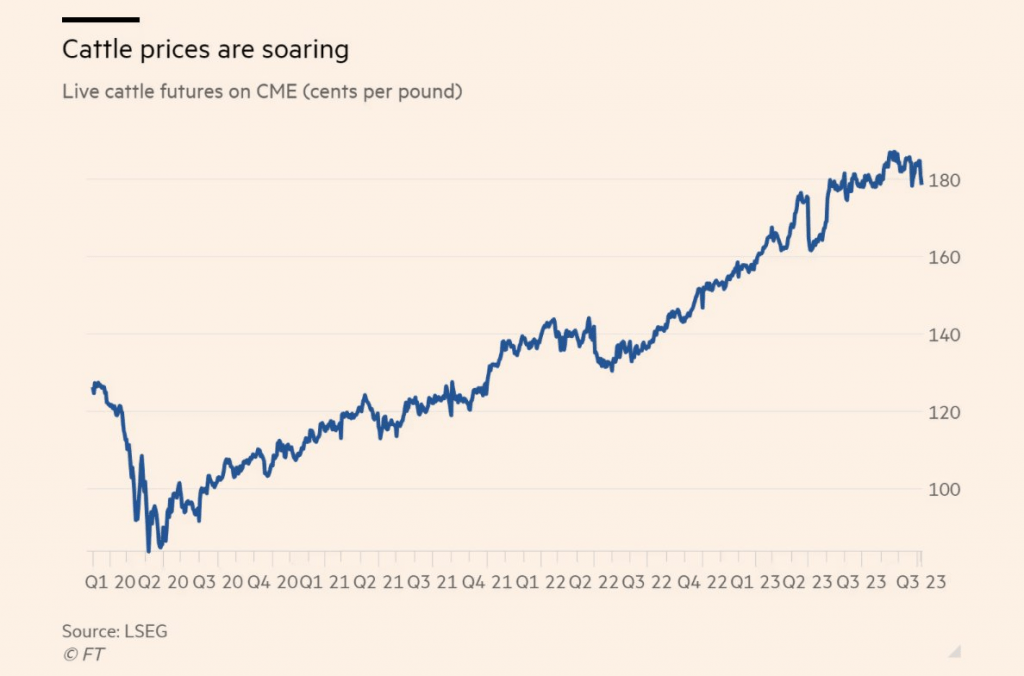

- Live cattle prices have surged toward record highs due to supply concerns in 2024.

- U.S. retail beef prices have climbed in lockstep with live cattle prices—the price of retail beef recently climbing above $8.00/pound for the first time in history.

- Despite recent price action in the beef market, U.S. government data indicates that inflation has been cooling during H2 20223.

Inflation has cooled in the United States, but there are still pockets of the economy battling sky-high prices.

One example is the U.S. market for beef, which recently pushed to a fresh record high. As of early November, the average retail price of beef was just over $8/lb—topping the previous high of $7.90/lb observed during the COVID-19 pandemic.

Not surprisingly, the market price for live cattle has likewise rallied toward fresh all-time highs. Today, live cattle prices are trading at roughly $1.80/lb, well above the $1.50/lb level observed 52 weeks ago.

As is often the case in commodities markets, the primary catalyst for higher prices ties back to supply and demand. In this case, however, the current market dynamics are a little more complicated.

There’s plenty of supply in the market right now, which is a bit unusual considering the steady rise in prices. The reason prices are rising is because the supply side of the market is expected to tighten in 2024. But the complications in the beef market don’t end there.

Rolling droughts throughout the U.S. have contributed to smaller than expected agricultural harvests in recent years. And one crop that’s been significantly impacted by these droughts is alfalfa, more commonly known as hay.

Hay is a key feedstock for beef cattle, and due to the aforementioned droughts, U.S. supplies of hay have tumbled to the lowest levels since 1954. That predicament pushed hay prices toward record highs at the end of 2022.

Tightness in the hay market, combined with higher prices, has been extremely challenging for American ranchers, many of whom are now finding it difficult to economically feed their herds. As a result, ranchers have been forced to send a larger percentage of their herds to the slaughterhouse.

That means there’s plenty of beef available on the market, but a declining number of live cattle in the national herd. According to Alan Suderman, chief economist at StoneX, beef production is expected to drop by about 7% next year as a result of this predicament.

And unlike agricultural commodities such as corn and soybeans, better-than-expected weather won’t immediately translate to increased supplies of beef. It takes time to rebuild a herd, and it’s even more challenging when hay supplies are scarce and/or expensive.

For these reasons, most market pundits expect beef prices to remain elevated for the foreseeable future, possibly even into 2025. For now, that means American consumers can expect to pay more for beef at grocery stores and restaurants.

To track and trade new developments in the beef market, investors and traders can use live cattle futures (/LE), as well as sector-related stocks and ETFs, as highlighted below (sorted by year-to-date return):

- US Foods Holding Corp (USFD), +20%

- PowerShares DB Agriculture Fund (DBA), +11%

- Performance Food Group Company (PFGC), +6%

- iPath Dow Jones-UBS Livestock Subindex Total Return ETN (COW), -14%

- Market Vectors Agribusiness (MOO), -14%

- Tyson Foods (TSN), -27%

Olive oil prices spike to fresh record highs

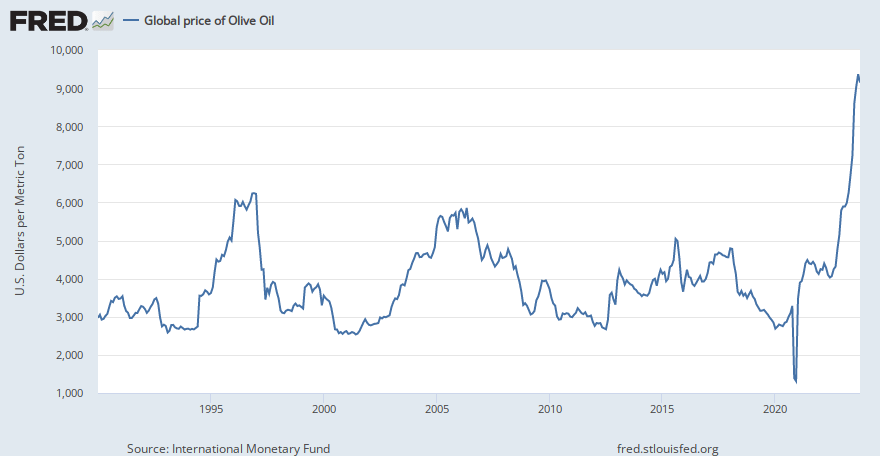

Another commodity that’s been surging lately is olive oil. A key olive oil benchmark recently hit its highest level since October 2013, at roughly $9.10/kg.

About half of the world’s olive oil is produced in Spain, and that country has been battling the same enemy as farmers and ranchers in the U.S.: drought. This year represents the second consecutive year in which Spain’s annual olive oil production has taken a big hit due to drier-than-expected growing conditions.

Spanish producers usually pump out upwards of 1.4 million metric tons of olive oil on an annual basis. But during the most recent growing season, that figure was slashed in half due to reduced rainfall. And the current growing season isn’t expected to be much better.

Growing conditions haven’t been nearly as bad in Greece and Italy—two of the world’s other top producers—but those two countries haven’t been able to significantly increase production, either. As a result, consistent olive oil supply shortages have continued to boost prices.

These days, one metric ton of olive oil costs over $9,000, but as recently as December 2022, that figure was closer to $6,000. That means bulk olive oil prices have surged by about 50% in just ten months.

The complications in the olive oil market have been so severe that some olive growers are considering switching to trees that are believed to be more resistant to drought. But that process would take many years. In the meantime, some end-users are being forced to turn to alternatives, such as grapeseed oil.

Overall, inflation cools in the U.S. economy

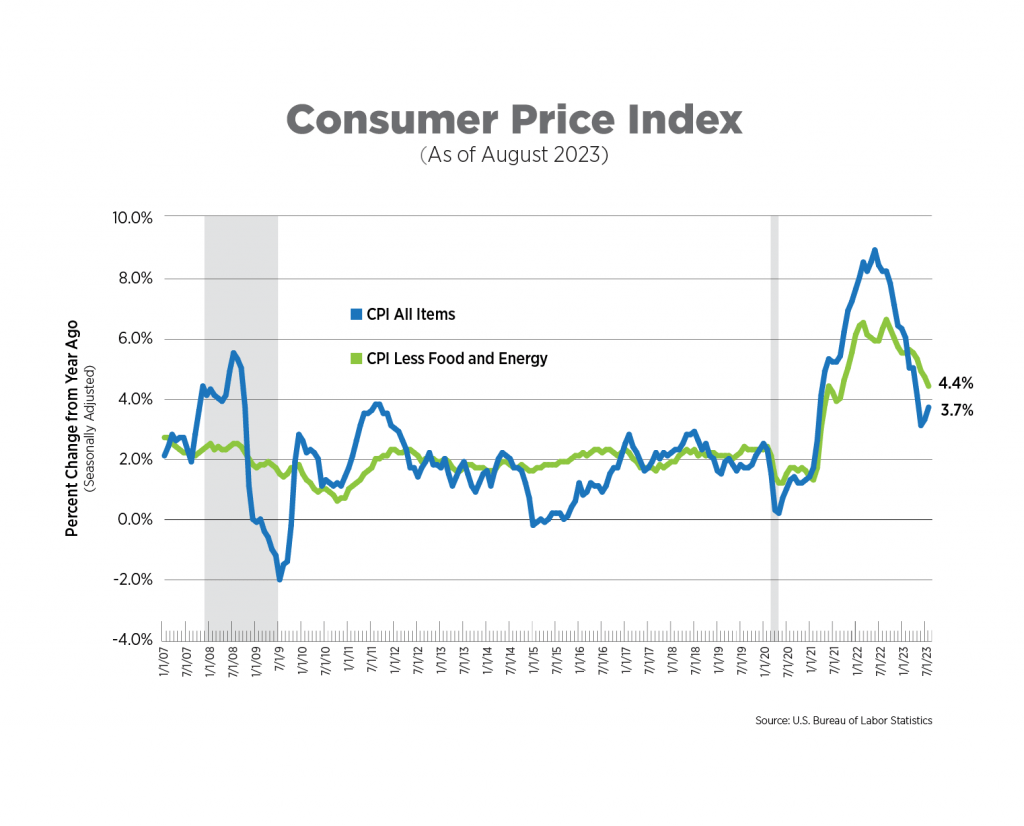

Fortunately, the rapid price appreciation observed in the beef and olive oil markets hasn’t been the norm. Instead, these two markets appear to represent the exception.

For example, the global energy sector has been trending in the opposite direction of the beef and olive oil markets.

Currently, gasoline prices in the U.S. are about $0.37 lower than they were a month ago. And that’s largely due to the recent correction in crude oil prices, which have dropped by about 20% since the end of September.

Significant declines in the price of eggs serve as another indicator that price inflation is cooling. In May, a dozen large eggs were selling for roughly $2.67, which represented a dramatic decline from the January peak of nearly $4.82/dozen.

These examples help illustrate why the consumer price index (CPI) clocked in at 3.7% at the end of summer, which was well below the 9.1% level observed 52 weeks ago.

Overall, it appears that inflation in the U.S. is moving in the right direction, but unique circumstances continue to challenge certain niches of the economy. As of now that includes the markets for beef, cocoa, olive oil and orange juice.

The next inflation report is scheduled for release on Nov. 14 at 8.30 a.m. EST, when the Bureau of Labor Statistics publishes CPI data for the month of October. To follow everything moving the markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.