Market Volatility Hits Chinese Stocks, but PDD Holdings (PDD) Continues to Climb

PDD Holdings reported impressive Q1 earnings, but the company’s valuation remains depressed due to continuing geopolitical risks

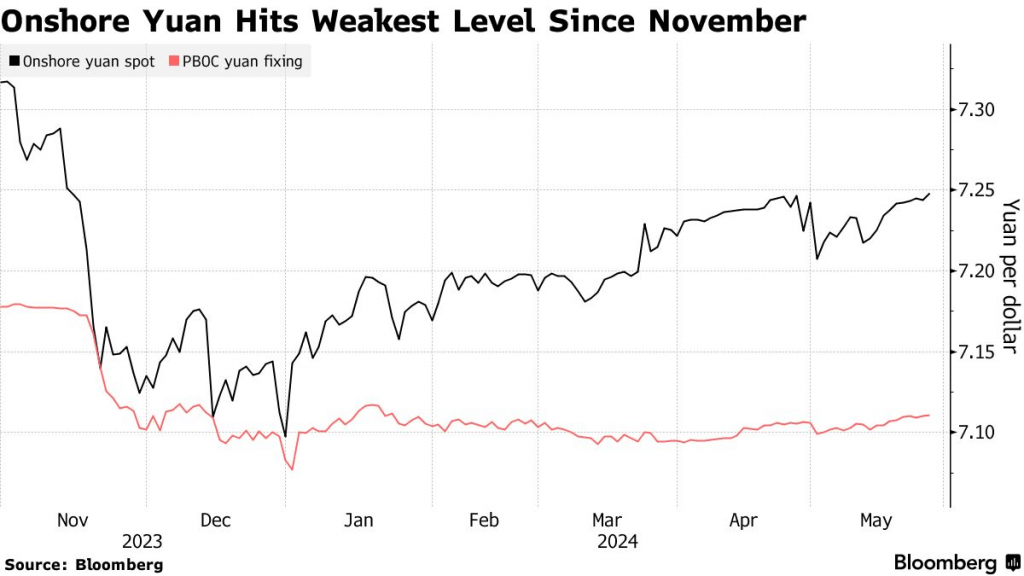

- The Chinese yuan has declined to a six-month low against the U.S. dollar, reflecting ongoing concerns in the Chinese economy.

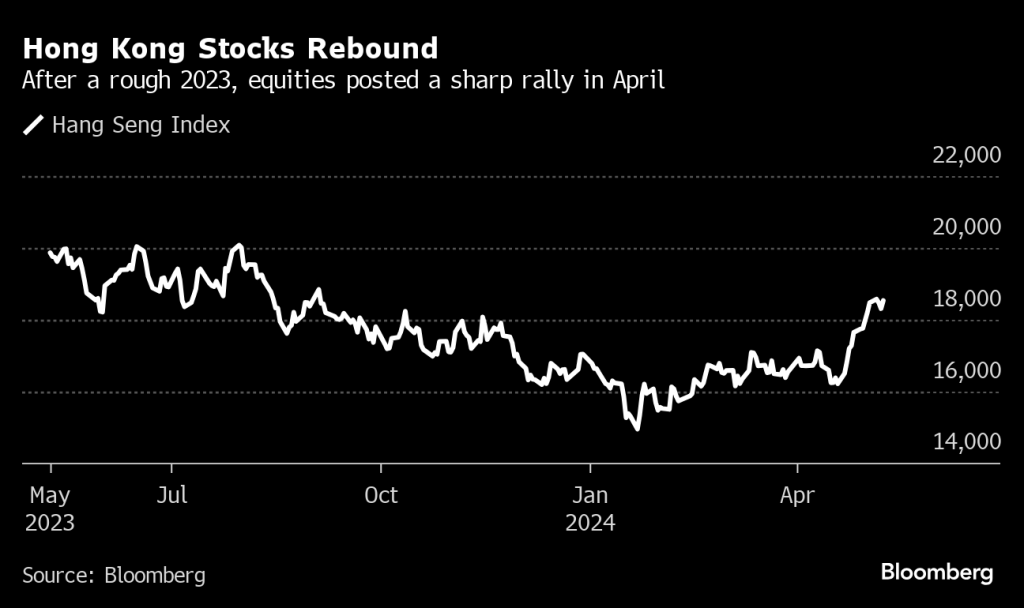

- Chinese stocks staged a rebound in 2024 but have fallen off their best levels.

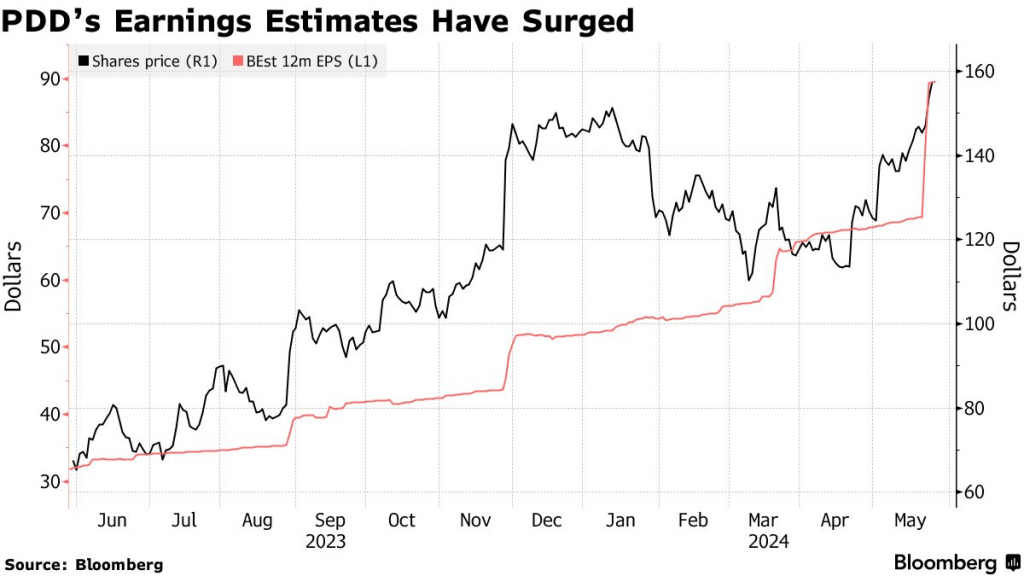

- PDD Holdings reported strong Q1 earnings, and bucked the broader trend, rallying by more than 30% since mid-April.

Elevated interest rates have pressured American consumers and businesses, but the effects of “higher for longer” continue to reverberate outside the country’s borders. Case in point, the Chinese yuan recently slipped to a six-month low against the dollar.

At present, the dollar/yuan exchange rate (USD/CNY) is trading at roughly 7.24, which is somewhat significant from a historical perspective. Over the last five years, the USD/CNY exchange rate has ranged between roughly 6.30 and 7.40, indicating that the yuan is nearing its weakest levels over that span.

Unless the Federal Reserve pivots soon, or the Chinese economy picks up steam, the yuan could suffer additional losses. The USD/CNY exchange rate hasn’t traded above 7.50 on a consistent basis since 2007, which makes this a key level to monitor in the coming weeks.

Exchange rates are typically quoted using the format “ABC/DEF,” and are interpreted to mean that the first currency listed is a single unit, while the exchange rate itself represents the amount of the second currency that is required to purchase a single unit of the first currency.

Sluggish growth still plagues Chinese economy

Unfortunately, a weakening currency isn’t China’s biggest problem, at least not yet. The country has been grappling with a severe slowdown in its real estate sector, as well as sluggish economic growth. The two are undoubtedly linked.

Prior to 2020, China’s annual GDP growth usually clocked in at around 7%, making it one of the fastest-growing economies on earth. However, the COVID-19 pandemic was especially disruptive to China’s economy, and GDP growth was limited to 5% and 3%, respectively, over the last couple of years.

Not surprisingly, this has served to weaken consumer confidence in China. Not long ago, Chinese consumer confidence was significantly higher than it is today. For example, one gauge of consumer confidence was hovering around 120 back in early 2022. Today, however, that same consumer confidence index has fallen to around 90, representing a decline of 25%.

As one might expect, this pessimism has altered the behavior of consumers in China. In response to a deteriorating economy, Chinese citizens have been hoarding cash, as opposed to deploying it in the economy. As of late last year, Chinese citizens had amassed 138 trillion yuan in savings (~$19 trillion dollars), which was 14% higher than the year prior.

To right the ship, the Chinese government is working to bolster consumer spending and restore confidence in the economy. One of the government’s primary strategies has been to reduce key lending rates, which is the opposite of what’s been going on in the United States. These divergent—but arguably necessary policy responses—help explain why the dollar has been strengthening, and the yuan has been weakening.

Officials in China implemented other measures, as well. In mid-May, the Chinese government announced that local governments would be incentivized to buy local real estate, with the intent of repurposing it as affordable housing. Pundits believe the real goal of the program is to reduce available inventory, in hopes of better balancing the supply-demand dynamic in the housing market.

If these measures are successful, then Chinese stocks could see further upside in 2024.

Chinese stocks lose some 2024 gains, but PDD Holdings keeps shining

Despite the headwinds in the economy, the Chinese stock market has performed better in 2024 than it did last year.

During 2023, the Shanghai Composite (SSE index) declined by about 4%. But thus far in 2024, the Shanghai Composite is up about 4%. Performance in the Hang Seng index—which tracks key listings in Hong Kong—has been even better. The Hang Seng index has rallied by about 10% in 2024, after falling by 14% last year.

Importantly, performance in the Chinese stock market was even stronger through the first four months of the year, but in the last couple of weeks, some of those gains have evaporated. In mid-May, the widely followed KraneShares CSI China Internet ETF (KWEB) was up close to 25% on the year, but after the recent retreat, it’s up only 13%. At the end of last year, Luckbox suggested that KWEB might be primed for a rebound in 2024.

One of the top holdings in KWEB is PDD Holdings (PDD), which is better known as Pinduoduo. This company is the parent of Temu, a digital shopping platform that quickly gained steam in the U.S. Last year, Temu struck the U.S. market like wildfire, with the app receiving 123 million downloads, and the #1 ranking in that category. Estimates indicate that the Temu app now has 52 million active monthly users in the U.S. market.

Shares of Pinduoduo are up just about 4% on the year, but they have rebounded sharply from the lows of the year. And the stock has bucked the recent trend, and continued to rally, despite the pullback in the major Chinese indices. Since April 19, shares of PDD have rallied by roughly 33%, climbing from about $113 per share all the way to $150 per share. Over the last 52 weeks, shares of PDD have ranged between roughly $62 per share and $164 per share, providing further perspective on the recent rally.

Pinduoduo continues to grow fast, but risks remain

One of the key differentiators at PDD is its torrid rate of growth, which was underscored during the company’s most recent earnings report.

On May 22, PDD announced that its revenues had doubled during the first quarter, compared to the same period last year, rising from about $5 billion to $12 billion. The company also announced that its quarterly profit had tripled, clocking it at around $5 billion, as compared to just over $1 billion during Q1 of last year.

These numbers help explain why the stock received several fresh upgrades in the wake of its glowing earnings report. For example, Goldman Sachs upgraded shares of PDD from “hold” to “buy” after earnings and raised their associated price target from $145 per share to $184/share. Ahead of earnings, Jeffries also upgraded shares of PDD from “hold” to “buy,” and raised their price target to $157 per share.

PDD’s business model has been especially effective in the current environment because it’s a discount-focused online retailer.

Early in its development, Pinduoduo focused on group discounts, which rewarded shoppers that recruited additional buyers with lower prices. Its focus on budget-conscious shoppers also differentiated the company from companies like Alibaba (BABA) and JD.com (JD).

While these are certainly exciting developments, there’s reason for caution, as well.

Activists have accused Pinduoduo of selling goods produced with forced labor. And a congressional report from 2023 found that there’s an “extremely high risk that Temu’s supply chains are contaminated with forced labor.” While it’s unknown how this issue could ultimately impact the company, lawmakers have indicated that an import ban could one day be enacted against Temu.

Another potential issue is Temu’s exploitation of the “de minimis” trade rule, which dictates that shipments under $800 in value are excluded from certain import taxes and duties in the United States.

The U.S. originally implemented the rule to assist Americans traveling abroad, so they could ship souvenirs and other gifts back home. These days, companies like AliExpress, Shein and Temu use the de minimis rule to avoid paying taxes on direct shipments to U.S.-based customers. As a result, a bill in Congress could close the current loophole, forcing Chinese exporters (including Temu and its suppliers) to pay associated taxes and duties.

Final takeaways

Looking beyond the risks, there’s plenty to like about Pinduoduo’s current valuation. At present, the forward price/earnings (P/E) ratio for PDD is about 20% lower than the sector average. That discount likely exists due to the risks and ongoing geopolitical tensions between the United States and China.

Bloomberg recently highlighted that PDD’s forward earnings is about half the level of the Nasdaq 100, marking PDD’s “steepest discount on record” to its tech peers. The relative attractiveness of PDD’s forward P/E probably helps explain why Goldman Sachs and Jeffries are so bullish on the stock, as well.

Former President Donald Trump says he would deploy a fresh round of tariffs against China and other U.S. trade partners, if he’s re-elected to the White House in November. As a result, one must consider the potential ramifications of a resurgence in the U.S.-China trade war on shares of Chinese listings such as Pinduoduo.

For reference, data compiled by The Wall Street Journal indicates that 47 analysts currently rate shares of PDD a “buy” or “overweight,” while one analyst rates the shares a “hold.” At present, zero analysts rate shares of PDD a “sell” or “underweight.” According to the WSJ, the average price target for PDD is roughly $200/share, while TipRanks indicates that the average price target is closer to $220/share, based on 13 analyst opinions.

For those bullish on a continued rebound in the Chinese stock market, the KraneShares CSI China Internet ETF also presents an attractive option. The diversification offered by an ETF like KWEB theoretically reduces the risks associated with individual stocks, while offering significant exposure to the future potential of the Chinese technology sector.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.