OpenAI’s Sam Altman Fuels Oklo’s Public Debut with SPAC Merger

Oklo, which recently debuted on the New York Stock Exchange via a SPAC merger, aims to build on previous nuclear energy innovations by producing small-scale reactors, known as SMRs

- With the demand for electricity expected to increase significantly in the coming years, fresh players have emerged in the nuclear sector, aiming to supply innovative and environmentally friendly solutions.

- One such company is Oklo, which is backed by OpenAI’s Sam Altman, and recently went public via a SPAC merger.

- Oklo plans to build and operate small modular reactors (SMRs) that utilize traditional nuclear fission technology, but on a more economical scale.

Artificial intelligence is expected to reshape human civilization in the coming decades, but to do so, it will require immense amounts of energy.

According to one estimate, the demand for power from global data centers will grow 160% by 2030. Today, global data centers consume between 1% and 2% of the world’s power, but that will grow to 3% to 4% in the next five or six years.

However, due to the impact of climate change, fossil fuels probably won’t meet those needs. Instead, energy companies are looking to utilize “green” energy sources to power the technology sector’s next stage of development, such as solar, wind and hydropower.

Using fission until fusion arrives

Experts are optimistic that a new form of energy—fusion power—will one day provide limitless amounts of carbon-free energy. But that day hasn’t arrived. And that is why some innovators in the energy sector are pursuing novel approaches for using traditional forms of energy.

One such novel approach to creating power involves nuclear energy, typically referred to as “fission power,” using a new breed of small nuclear reactors.

With commercialized fusion energy still five to 10years away, companies in the nuclear fission sector are experimenting with so-called small modular reactors, or SMRs, to help bridge the gap to the fusion era.

SMRs are small-scale fission reactors that are designed to be more flexible and efficient than traditional nuclear reactors. SMRs typically are modular in nature, which allows manufacturers to build them as a series of smaller, combinable segments, rather than one large unit. This modularity is also expected to provide greater scalability, while offering reduced costs, and an overall superior value proposition.

Oklo goes public via a SPAC merger

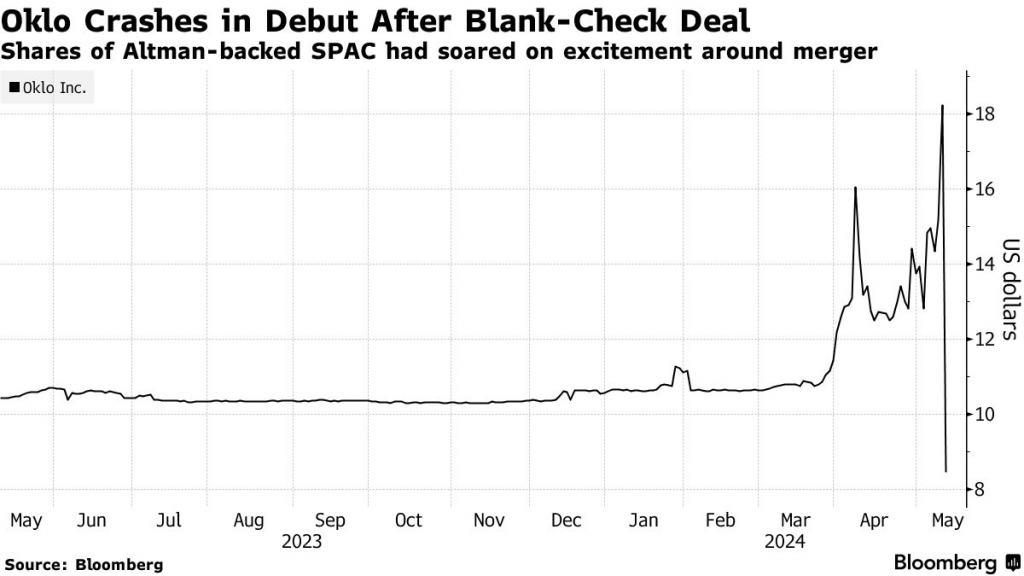

SMRs are in the news right now because Oklo Inc. (OKLO), a start-up company focused on this niche, recently went public via a merger with a special purpose acquisition company (SPAC). The company debuted on the New York Stock Exchange on May 10, trading ticker “OKLO.” Oklo backed by Sam Altman, the well-known CEO of OpenAI, who also serves as the chairman of Oklo’s board.

Adding further complexity to the transaction, Altman is also a co-founder and investor in the associated SPAC that merged with Oklo—AltC Acquisition Corp. AltC was co-founded by Sam Altman and Michael Klein in 2021—the latter being a former banker at Citigroup with deep experience creating so-called “blank check” companies. In sum, that means both parts of the combined Oklo come from Altman’s direct sphere of influence.

The Oklo transaction means Altman is now indeed the head of a publicly traded company, but it’s not OpenAI, which remains privately held. Notably, Altman also backs a fusion-focused start-up, named Helion Energy.

As part of the SPAC transaction, the newly formed Oklo was valued at roughly $1.4 billion, according to The Wall Street Journal. Altman reportedly owns 7% of the new entity’s total shares. However, Oklo’s debut in the public markets wasn’t warmly received, at least thus far. Oklo shares currently trade for about $9/share, implying a market capitalization of roughly $1.1 billion.

Oklo derives its name from a region of Gabon, Africa where naturally occurring nuclear fission reactions are believed to have occurred billions of years ago.

More about fission power

Nuclear fission energy is created by splitting the nuclei of heavy atoms, such as uranium or plutonium, which triggers the release of immense amounts of energy. Fission is hardly new. It dates to the 1950s, starting with the first nuclear power plant in Obninsk, Soviet Union, in 1954.

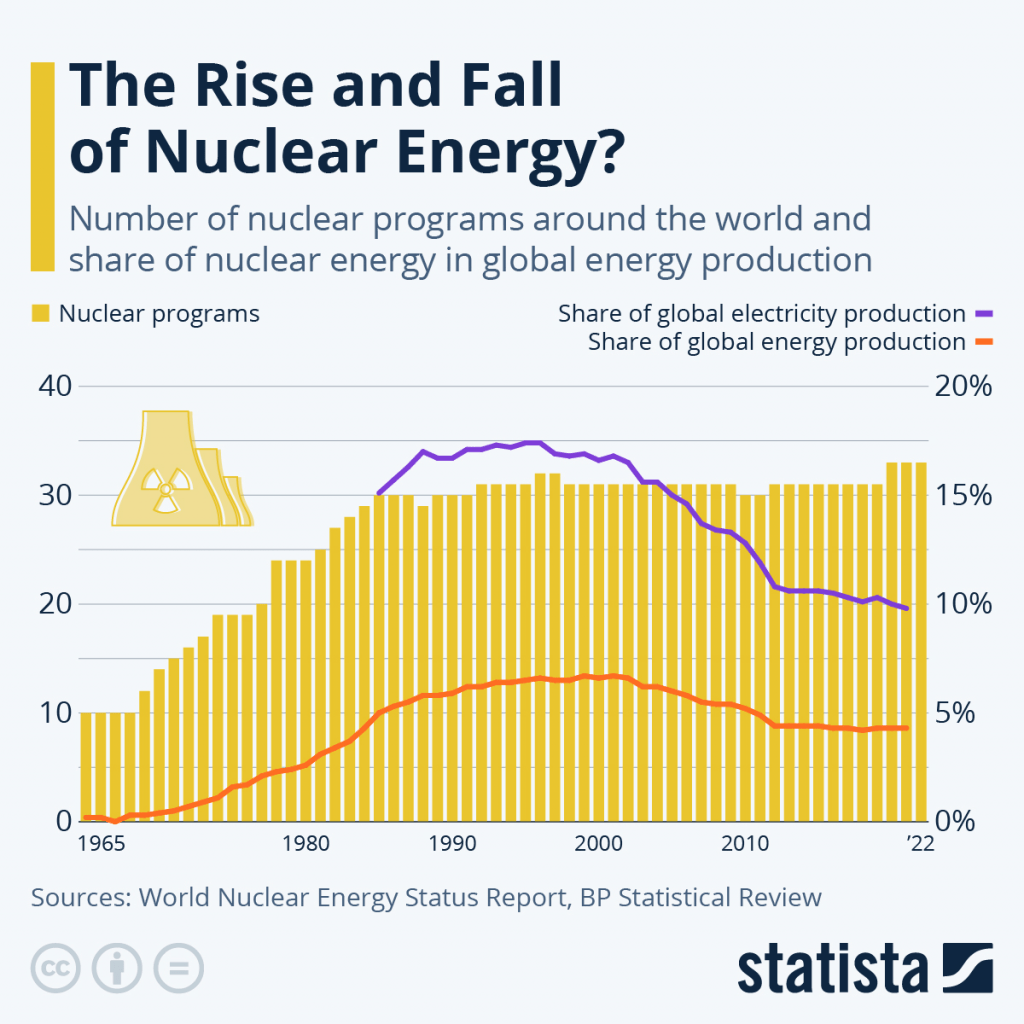

On the plus side, fission energy provides a sizable portion of the world’s electricity while producing low greenhouse gas emissions. Current estimates suggest that approximately 10% of the world’s total electricity is produced using nuclear fission energy. But of late, increased reliance on green energy, combined with the aging of the world’s nuclear fleet, has slightly reduced the amount of nuclear output as a percent of the overall total, as illustrated below.

One challenge for the nuclear industry has been the disposal of the spent fuel from these reactors. which is extremely dangerous due to associated levels of radioactivity. Current methods of disposal are mostly limited to temporary storage in cooling pools or dry casks, while permanent disposal solutions, such as deep geological repositories, remain out of reach.

This significant drawback represents a key reason that fusion power is viewed as the optimal solution for the future, because the environmental impact of this energy source is believed to be minimal.

Oklo’s Place in the broader nuclear sector

As of now, Oklo has no material revenues, and no nuclear reactors in operation. During a May 9 appearance on CNBC, Oklo CEO Jacob DeWitte said the company’s first reactor wouldn’t come online until 2027. Importantly, the company plans to operate its own facilities, meaning Oklo won’t sell the reactors—at least not initially—and will instead generate revenue by selling the energy generated by its reactors.

At present there are 92 operational nuclear facilities in the U.S. market. The two most recent additions to the fleet are Vogtle Unit 3 and Vogtle Unit 4, which came online in July 2023 and April 2024, respectively, as additions to the broader Alvin W. Vogtle Electric Generating Plant in Georgia. Units 1 and 2 at Vogtle were completed in 1987. Together, all four units now have the capacity to produce 4,536 megawatts (MW), making the facility the largest nuclear power plant in the United States.

For context, each nuclear unit at Vogtle has the capacity for 1,100-1,200 megawatts of power. In comparison, the Oklo microreactors are expected to be capable of supplying closer to 50 megawatts of power. However, that could eventually be increased to between 200-300 megawatts, which is the level that targeted by sine other SMR producers.

Importantly, Oklo plans to not only generate nuclear energy, but also to recycle spent fuel, helping to alleviate one of the biggest negatives stemming from the fission energy sector. Eventually, Oklo intends to not only recycle its own fuel, but also to recover and utilize spent nuclear fuel from other facilities in the United States.

It should be noted that one of Oklo’s competitors—Nuscale Power Corp (SMR)—has already secured approval from the Nuclear Regulatory Commission (NRC) for the design of its own small modular reactor. Nuscale selected its associated trading ticker in homage to the broader small modular reactor movement.

The NRC denied Oklo’s initial application to build an SMR in Idaho. However, the company is preparing to re-apply for approval, and expects to activate its SMR in Idaho by 2026 or 2027.

Because Oklo doesn’t yet generate revenues, one would expect that the performance of the underlying shares will depend heavily on the company’s ability to meet its near-term goals. For example, receiving approval for its SMR design, and an approval to build a reactor in Idaho. If the company is eventually able to recycle spent nuclear waste, as it intends, that could also be a key competitive differentiator.

None of these milestones will likely be achieved in the imminent future, however, so investors bullish on the future of Oklo—and the broader SMR niche—may need to be patient for the time being. In addition to single stocks like OKLO and SMR, investors and traders can also consider utilities companies with significant nuclear investments. Several examples include Brookfield Renewable (BEP), Duke Energy (DUK), Entergy (ETR) and Exelon (EXC).

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.