Range Worry and Other EV Anxieties

An automotive journalist addresses the electric-vehicle market

John McElroy, a print, radio, television and online journalist, serves as president of Blue Sky Productions, producer of the Autoline Daily webcast.

McElroy is a former editor at Road & Track magazine, writes monthly for Ward’s Auto World and has contributed the annual automotive entry for the Encyclopedia Britannica Yearbook.

He was gracious enough to sit down with Luckbox for a wide-ranging Q&A about the state of the electric vehicle industry and automotive world in general.

LUCKBOX: Why do EVs cost so much?

John McElroy:The price of EVs is too high but so far that’s been a deliberate strategy by the automakers. Batteries are still very expensive, and the market for EVs is somewhat limited. They can’t make money on EVs, but they lose a whole lot less on their expensive ones.

Besides, it’s wealthier people who have the disposable income to add an EV to their two-car or three-car garage and keep a couple of ICE (internal combustion engine) vehicles handy for when they want to travel long distances.

But in China, which is a much more mature EV market, it’s quite a different situation. In fact, just last week I drove the BYD Seagull electric car that sells for $11,000 in China. It doesn’t meet U.S. crash standards, and it has limited range. But it’s a very nice car, and it’s very comfortable. It doesn’t feel cheap. There are other Chinese electric cars under $30,000 that are also very nice. So, it can be done.

When will we see more modestly priced EVs in the U.S.?

We’re not going to see inexpensive electric cars in the U.S. without any government subsidies anytime soon, and by that, I mean $25,000 or less. That’s still at least three years away in the U.S. market. And as automakers start to come out with EVs that are more reasonably priced for the mass market, you’ll see far more adoption.

In the U.S., the average EV sells for something like $60,000. The average ICE vehicle sells for about $50,000. So EVs are, rule of thumb, about 10 grand more expensive. That limits who can afford to buy them. Until we see mid-priced or lower-priced EVs, the market cannot be a whole lot bigger than it is.

More carbon is released into the atmosphere in making EVs than in making ICE vehicles. Plus, a lot of the electricity powering EVs is generated by burning coal, oil or natural gas. Are EVs actually greener?

The reality is EVs are far cleaner, but they don’t come off the assembly line that way. EVs start with a much bigger carbon footprint than ICE vehicles do because the battery is very energy-intensive to manufacture.

But for every gallon of gasoline you burn, you release 19 pounds of greenhouse gases. Once an EV travels 20,000 miles, it matches the carbon footprint of an ICE vehicle to that point. After that, the EV is cleaner, and since most cars are scrapped with 200,000 miles on them, EVs come out much, much cleaner than any ICE vehicle.

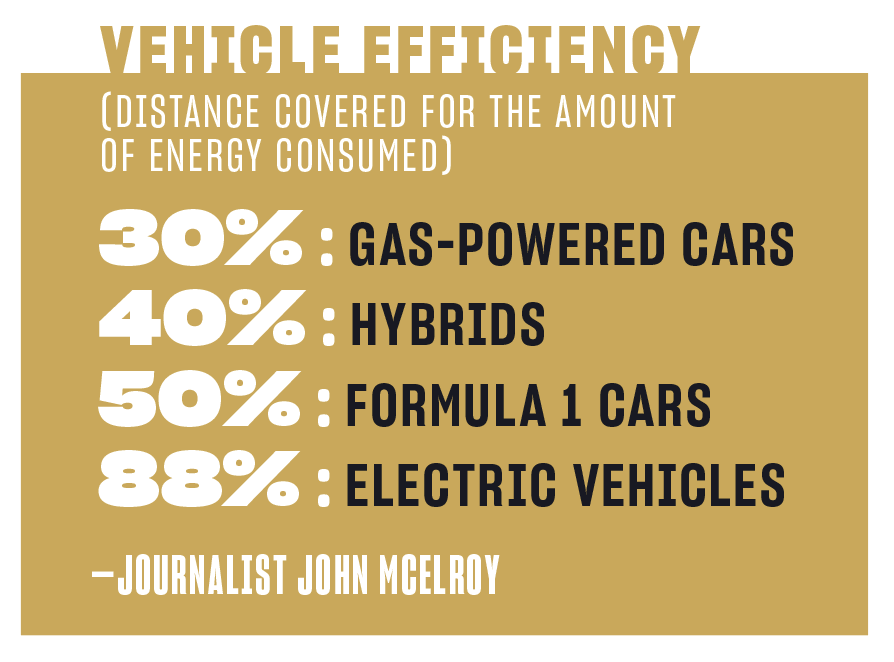

Last year, the U.S. generated more electricity with renewables than it did with coal. Coal is down to like 20% of all electric generation in the United States. But EVs are so efficient that even if you run them on electricity generated fully by coal, they’re about the same or slightly cleaner than ICE vehicles.

So, EVs are green. But are there other reasons to buy them?

Look, EVs offer a better driving experience for a regular everyday driver. Smoother, quieter, faster. What’s not to like about that? Acceleration? Look where you want to go, bang you’re there. It just responds so much better. There’s so little vibration compared to an ICE car.

If you drive for less than 200 miles a day, you can plug in at home and you’re going to love it. You’ll never go back. Every morning when you leave your garage, you’re leaving with a full tank. And gasoline is far more expensive than electricity, so the average person would save about $1,000 a year running on electricity instead of running on gasoline.

Is range anxiety still a problem?

The average American drives under 40 miles a day. So, just about any electric car would easily serve their needs. But people don’t look at it that way. They dream of going over the river and through the woods to grandmother’s house on Thanksgiving, and she might live a state or two over. Here in Michigan, people talk about going up north and trailering their snowmobiles or their WaveRunners.

Americans buy cars with a dream. And it’s not just driving back and forth to work. It involves cross-country trips and vacations. They recognize an EV will not fulfill those needs, or they’re going to have to put up with the hassle of taking a lot longer to charge on their trip than it takes to fill up a gas tank. So, yeah, you bet range anxiety is still an issue.

Let’s shift gears even though most EVs have single-speed transmissions. What effect are federal incentives, grants, regulations and mandates having on EVs?

There’s no EV mandate per se in the United States. There are emission and fuel economy standards that get to be pretty tough for an automaker to meet unless they’ve got EVs in their fleet. So, it’s sort of a de facto EV mandate.

Incentives play a big role in getting people to buy EVs, but they’re not the only determining factor. The first go-around of EV incentives capped an automaker at 200,000 unit sales. As soon as they hit that number, the $7,500 tax credit individual car buyers could claim on their taxes started to phase out. It dropped to half in six months, and then in another six months it was gone altogether.

That didn’t seem to affect Tesla sales very much. Even though the incentives went away, people kept on buying them. I don’t think that was going to be the case with other manufacturers. If you yank the subsidies on GM and Ford and any of the other legacy car makers, you’d see a big hit on sales.

But look at Porsche with the Taycan. The buyers certainly don’t qualify for the $7,500 tax rebate. Still, they went out and bought those things. They bought more of them than they bought 911s [iconic Porsche sportscars]. It shows if you have the right product, you don’t need incentives.

How has the Inflation Reduction Act affected EVs?

There’s a lot of talk about EVs increasing our dependence on China because China controls the supply chain for this. But because of all the money going into the U.S. EV industry, be

cause of the Inflation Reduction Act [IRA], spectacular progress is being made in sourcing the raw materials right here in the United States or among our allies.

In fact, we just reported day before yesterday that the biggest rare earth mineral found in the world was in Nevada. Same with lithium. Now that there’s demand, they’re starting to find this stuff all over the place. While we will not be China-free by the end of the decade, we are going to be very early in the 2030s.

The IRA kicked off an investment frenzy that I call the California Gold Rush or the Oklahoma Land Rush—pick your choice. For every dollar the federal government is investing, three dollars is coming in from private investors. So, there’s a real multiplier effect. Europe is deeply worried because so much is happening here. We’re seeing progress coming far faster than most people are aware of.

The federal government is spending billions to subsidize 500,000 publicly available chargers by 2030. But only three were operating by the beginning of this year. Thoughts?

It doesn’t surprise me at all that it’s going to take a long time. You’ve got to get permits. Depending on where you put these stations, you might have to do environmental impact statements. There are going to be public reviews if you go down that route.

You might need electrical substations nearby. You’ve got to find companies willing to do all this. The first federally funded charging station just went in place a few months ago, and quite a few charging companies are putting in public chargers, too.

Would a second Trump administration be a setback for EVs?

Sure. Trump and many republicans have made an anti-EV stand. It’s one of their talking points. They think the government’s trying to shove them down their throat. So, there’s quite a bit of opposition to EVs.

Let’s shift gears again. Solid state batteries would charge quickly, last longer and provide greater range. What’s the likelihood of having them in cars in the next five years?

Slim to none in five years in any kind of volume. Look, here’s the issue: Lithium batteries are not only good, they keep getting better all the time and the cost keeps coming down while the volume keeps going up. They keep making refinements to these batteries to make them better.

And a solid state’s not even here yet—at least not in cars. It’s going to take them a long time to ramp up. Meanwhile, they’re chasing a moving target because the lithium-ion battery just keeps getting better and better all the time. There’s going to be a place for solid state but not in this decade.

Why aren’t cars with hydrogen fuel cells taking off?

Where are you going to get your hydrogen? Look at the problems we’re having right now with public EV charging. There’s electricity everywhere you go, and there are still all these complaints. There aren’t enough chargers. They’re not reliable enough. Now go start building a hydrogen infrastructure. Lots of luck.

Hydrogen fuel cell vehicles are not going to be in passenger cars or light trucks—maybe long-haul semis. Toyota does a booming business with hydrogen fuel-cell forklifts, and they might make sense for trains as well.

There’s one potential technology that could be a game changer. Most hydrogen is made from water using electrolysis to split it into hydrogen and oxygen. Well, any building that you drive past has got water and electricity running into it. What if you could make hydrogen right on site? You could dramatically slash the cost, but nobody’s done that yet.

What else is going on in the auto industry?

We’re in peak auto right now. The industry sold 17 million new vehicles in 2019, and we’ll never go above that number again by any significant amount. We’ve plateaued here and in Europe and Japan. The only growth left is in emerging markets—South America, Africa, Asia.