Small Cap Stocks: The Best Case Scenario for 2024 Just Got Better

Small cap stocks have underperformed their large cap peers in 2023, but shifting expectations for the economy have improved the outlook for this niche of the stock market heading into 2024

- Small cap stocks have underperformed in 2023, with the Russell 2000 returning only 8%, as compared to the 21% return in the S&P 500.

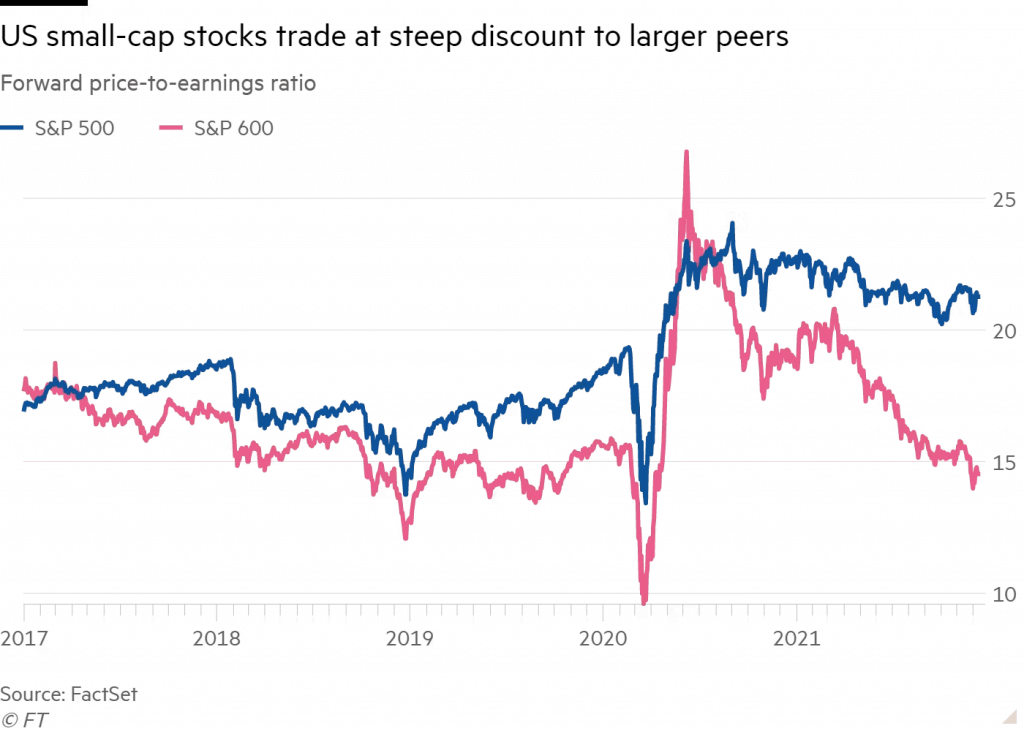

- Small cap stocks also lag their large cap peers in terms of valuations, with the forward price/earnings for small caps clocking in at 14, while the forward price/earnings for large caps is closer to 20.

- However, shifting expectations for the economy have arguably improved the outlook for small cap stocks heading into 2024.

Publicly traded companies with large market capitalizations—especially those levered to the tech sector—have done extremely well in 2023.

So far this year, the S&P 500 index, which includes most of the country’s “best” large cap companies, is up 21%. Moreover, the Nasdaq 100—which encompasses an elite group of large-cap tech companies—is up roughly 50% in 2023.

In comparison, the small-cap focused Russell 2000 has risen by only 8% year-to-date. Considering the disparity in those returns, it’s no great surprise that small cap stocks are currently trading at an extreme when it comes to their collective valuation relative to large-cap peers.

For reference, small cap stocks are usually defined as those with market capitalizations between $250 million and $2 billion. Alternatively, some consider the small cap universe to include the bottom 10% of all publicly-traded stocks in terms of market capitalization.

Interestingly, small caps are not only trading a steep discount to large cap stocks in 2023, but they are also trading at a discount to their own historical valuations.

For example, the average price/fair value ratio for small cap stocks is roughly 0.78 at this time, while the ratio for large cap stocks is closer to 0.95, according to data compiled by Morningstar.

For this metric, a ratio over 1.00 generally indicates that an underlying is overvalued, while a ratio under 1.00 generally indicates its undervalued. Extremes in this ratio are generally viewed as deep discounts to fair value, or exorbitantly overpriced. That indicates that large cap stocks are trading closer to fair value, whereas small cap stocks are trading at a deep discount to fair.

On top of that, a quick review of the price/earnings ratio for both small cap and large cap stocks appears to corroborate those findings. At present the price/earnings ratio for small cap stocks is about 14, while the price/earnings for large cap stocks stands is closer to 20.

The price/earnings metric is commonly used to assess relative valuations and is computed by simply dividing a company’s share price by its earnings per share. Generally speaking, the higher the ratio, the more investors are paying for a smaller chunk of a company’s earnings.

That means investors and traders are willing to pay a significant premium for large cap stocks.

Moreover, the 10-year average in the small cap P/E is about 18 (as compared to the current level of 14), indicating that prices in the small cap universe are depressed relative to their own historical valuations as well.

Additional risk-reward considerations in the small cap universe

A low valuation doesn’t always translate to cheap or inexpensive. Just because small cap stocks are trading at depressed valuations doesn’t necessarily mean they are poised for a rebound.

However, looking at the broader macro picture, there are reasons to be bullish on the future of small cap stocks. In this context, macro refers to macroeconomics, which encompasses the broader economic conditions, trends and policies that impact the financial markets.

From a macro standpoint, small cap stocks have been facing stiffer headwinds than their large-cap counterparts for much of 2023. Two of the primary challenges have been higher interest rates and the threat of a recession.

High interest rates are a net negative for the entire corporate sector, but for small caps the challenge of higher rates can be especially acute. That’s because smaller companies often rely more on credit to grow their revenues and earnings. So when rates go up, small cap stocks have less money to funnel toward growth.

This can be especially challenging when economic conditions are deteriorating, because in that environment, the financial sector is also less motivated to lend to smaller companies. Smaller companies inherently represent a greater credit risk than larger companies (all else being equal).

As most are well aware, the U.S. economy has been threatening to tip into recession for many months. On top of that, the U.S. financial sector experienced a mini crisis earlier in 2023 when some of the country’s regional banks started imploding.

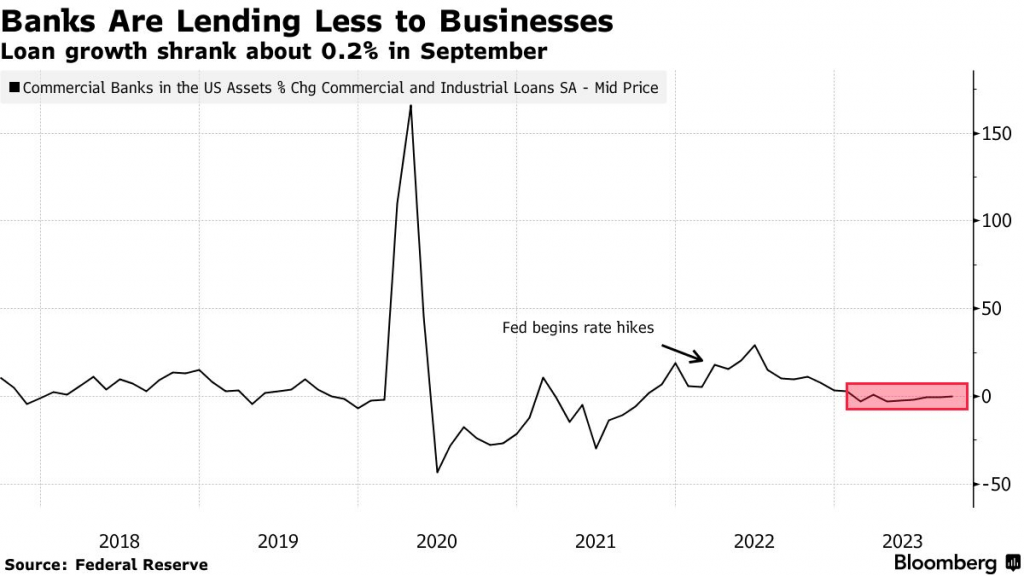

Unfortunately, in response to that crisis, the banking sector has been largely forced to tighten its lending standards. Along those lines, survey data from the banking sector indicated that 50% of respondent firms tightened their lending standards in Q2 of 2023.

Small cap companies have been facing a double whammy when it comes to securing much-needed credit in 2023—higher rates and tougher lending standards. And not surprisingly, this has resulted in an overall contraction in total lending.

Considering all of the above information, one can see how smaller companies might have struggled in 2023, and why small cap stocks have consequently lagged behind large cap stocks in terms of returns.

However, there’s reason to believe that the worst might be over, and that could be a great thing for the small cap universe.

First, it appears that the Federal Reserve is done raising interest rates. On top of that, it also looks like the risks of a 2024 recession are abating. Both of those are key developments because they should ultimately contribute to an improved lending environment.

Historically, recessions have been like kryptonite for small cap stocks because they don’t possess the financial resources to withstand periods of slowing (or negative) sales growth. Assuming that a severe recession is off the table, that means the potential upside for small cap stocks in 2024 has shifted dramatically.

Instead of being viewed as a potential problem area in the markets, small cap stocks might soon be viewed as fertile ground for better-than-expected performance.

Impact of the Magnificent Seven on large cap stocks

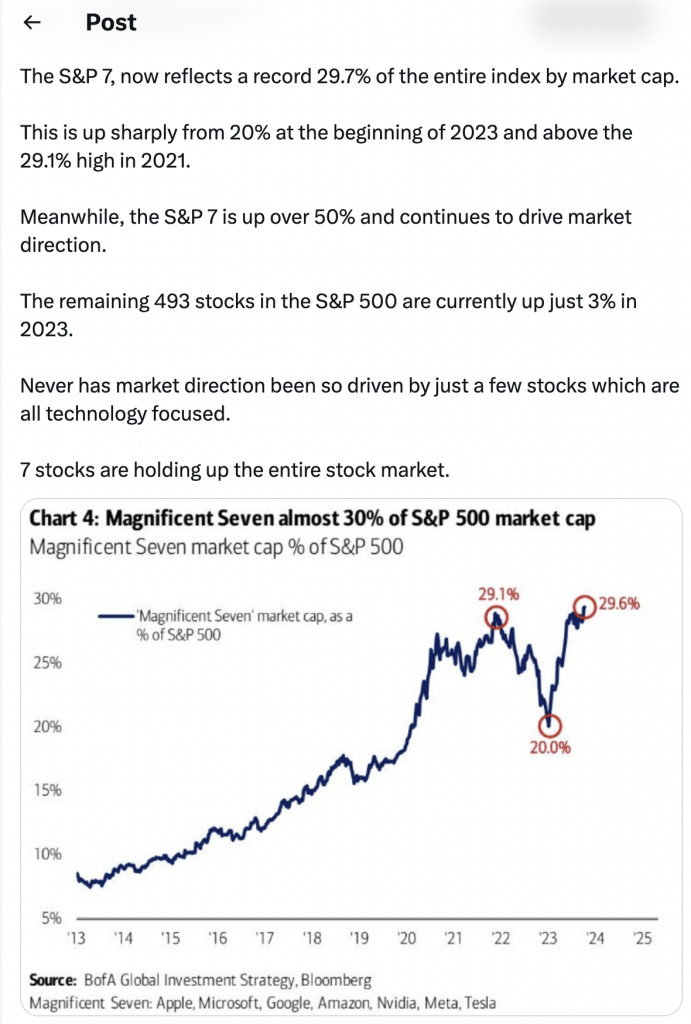

One other factor that can’t be overlooked in 2023 is the impact of the so-called Magnificent Seven (aka S&P 7) on the large cap universe.

The Magnificent Seven is a nickname for seven of the best-known (and often top-performing) stocks from the S&P 500, including Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA).

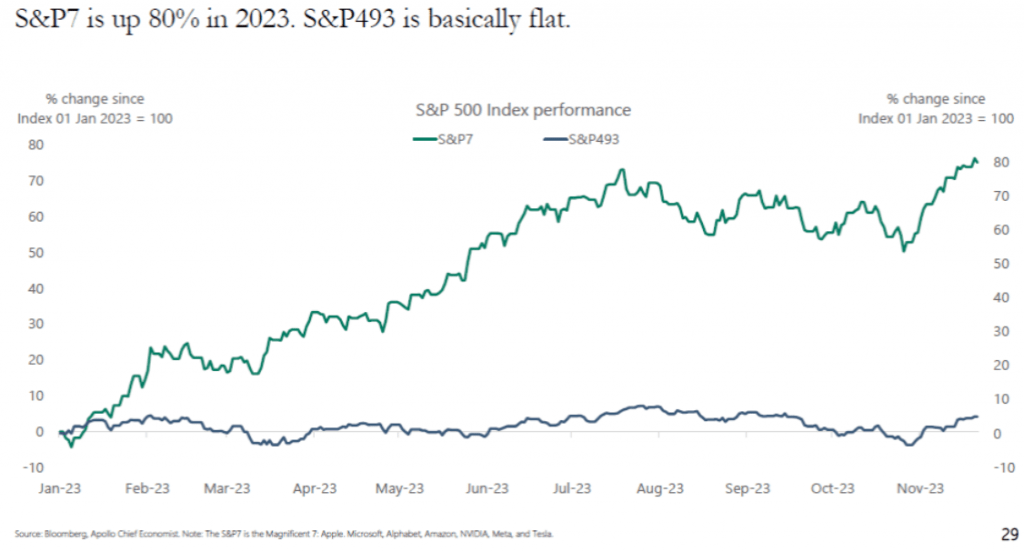

This year, red-hot performance in the Magnificent Seven has dramatically impacted the complexion of the S&P 500—particularly at the top end of the food chain. Due to their surging valuations, the Magnificent Seven now constitute a whopping 29% of the S&P 500’s total market capitalization, which is the highest percentage on record for just seven stocks.

Moreover, the Magnificent Seven have returned 71% on average in 2023, while the balance of the S&P 500 (493 stocks) has returned just 6% on average. That means the Magnificent Seven are the primary reason the S&P 500 is up nearly 20% year-to-date.

The fundamentals appear to support that degree of outperformance. According to Goldman Sachs, the Magnificent Seven are expected to grow sales at a rate of 11% on average through 2025, whereas the balance of the S&P 500 is only expected to grow sales at 3% on average.

These seven companies also dominate to a greater degree when it comes to generating profits. The Magnificent Seven average about 19% when it comes to net profit margins, whereas the remainder of the S&P 500 averages closer to 10%.

In 2023, the Magnificent Seven have undoubtedly benefited from the emerging potential associated with the commercialization of artificial intelligence (AI). And these stocks will likely ride that wave even higher in 2024. But better-than-expected economic growth should actually serve to boost the fortunes of the other 493 companies in the S&P 500, as well.

Taken all together, that means the prospects look bright for both small cap companies and large cap companies in 2024. However, with the small cap universe currently trading at depressed levels relative to large caps, investors and traders should arguably give this niche a closer look heading into the new trading year.

Along those lines, four key ETFs focusing on the small cap universe are highlighted below (sorted by year-to-date return).

- Vanguard Small Cap ETF (VB), +11%

- Vanguard Small Cap Value ETF (VBR), +9%

- iShares Russell 2000 ETF (IWM), +8%

- iShares Core S&P Small-Cap ETF (IJR), +8%

To review some of the top-performing small cap tech stocks from 2023—including those levered to the emerging AI sector—readers can check out this previous article. To follow everything moving the markets, including the options markets, readers can tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.