The Sahm Rule’s Red Alert: Will the Fed Hit the Panic Button?

Two successful methods of predicting recessions are issuing warning signs

- Contrary to expectations, the U.S. economy has shown extraordinary resilience in recent quarters.

- However, a critical labor market indicator, known as the “Sahm rule,” has been signaling warning signs over the past two months.

- If the Sahm rule is triggered, the Federal Reserve might finally be forced to cut benchmark interest rates as soon as September.

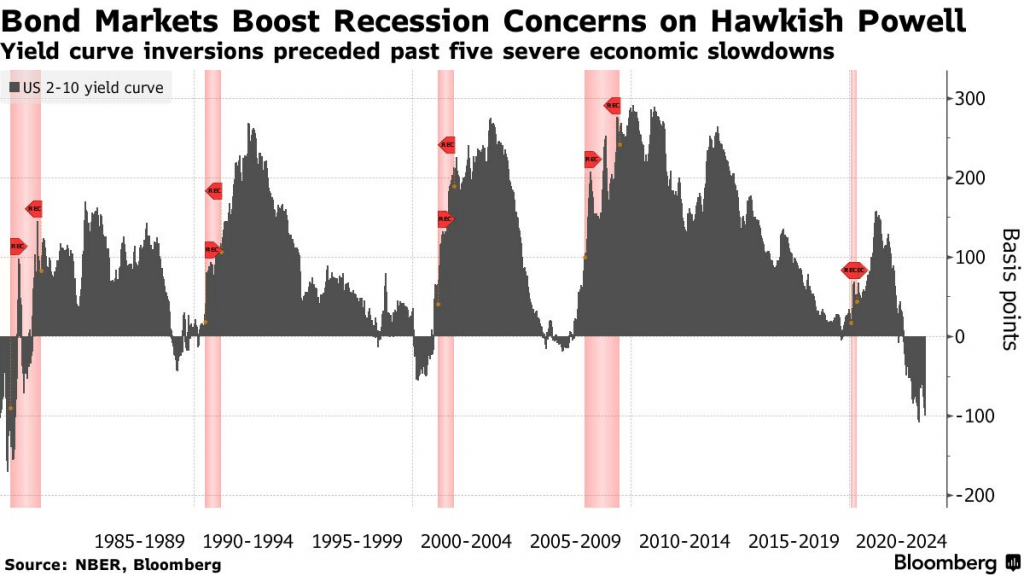

An inversion of the yield curve can indicate impending recession. About two years ago, this phenomenon occurred when the yield on 10-year Treasury bonds dropped below the yield of two-year Treasury bonds, where it has remained ever since.

Since 1955, every U.S. recession, except for one in 1966, has been preceded by an inversion of the yield curve. Some are now speculating the current inversion might be the second exception.

But while the yield curve suggests a potential recession, it doesn’t specify when one might begin. Historically, a recession has started about 12 months after an inversion on average, but the lag can be as long as 22 months, as seen in 2006 before the Great Recession.

This time, the yield curve has been inverted for roughly 24 months and no recession has materialized. Consequently, the Federal Reserve has refrained from cutting benchmark interest rates. It seems more concerned about the persistent threat of inflation than a contraction in the economy.

Moreover, the yield curve isn’t the only reliable recession predictor. The so-called “Sahm rule,” or “Sahm indicator,” has also been accurate at forecasting recessions. And recent developments suggest the Sahm indicator could soon compel the Fed to act, potentially leading to the first cut in benchmark interest rates since July 2019.

The historical accuracy of the “Sahm Rule”

Leaders at the Fed track a wide range of economic statistics, but the Sahm rule holds special status because it was developed by a former employee of the institution.

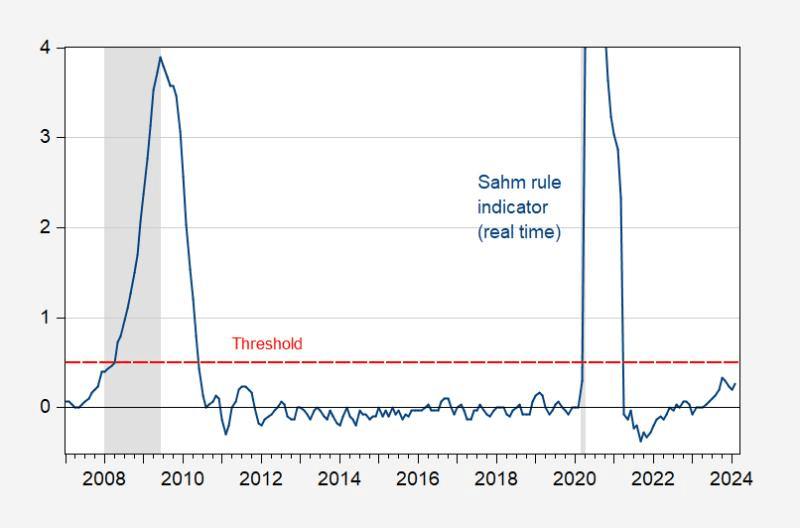

The Sahm rule has also amassed a strong track record in predicting recessions, similar to the yield curve. Since 1948, the Sahm rule has correctly signaled every recession in the U.S. economy.

So, what is the famous Sahm rule, and who created it? Claudia Sahm, a macroeconomist who worked at the Federal Reserve and has served on the White House Council of Economic Advisers, came up with it.

Sahm created this indicator relatively recently—about five years ago. But applying her methodology to past recessions showed it would have predicted all of them correctly. She conducted her research to optimize the timing of hypothetical stimulus payments to American citizens to help mitigate the effects of a potential recession.

Sahm aimed to identify the precise point where a recession started to time the release of these payments accurately. Because of the accuracy of her methodology, the Sahm rule has garnered increased attention since the research was first published in 2019. And this year, it may soon be possible to evaluate the effectiveness of the Sahm indicator in real time.

Unlike the yield curve indicator, which relies on changes in the shape of the yield curve, the Sahm rule depends on data from the labor market. The unemployment rate in the United States is hovering at historically low levels.

However, Sahm’s methodology does not assess the unemployment level on an absolute basis. Instead, it focuses on detecting a noticeable uptick in unemployment over a relatively short period. Specifically, the Sahm indicator is triggered when the three-month average unemployment rate climbs half a percentage point above its lowest reading in the last 12 months.

For example, imagine the lowest unemployment rate over the past 12 months was 5%. That means that if the three-month average in the unemployment rate were to climb to 5.5%, or above, the Sahm rule would technically indicate that a recession had begun. This method aims to quickly pinpoint the onset of a recession, as opposed to traditional approaches that rely on retrospective economic data.

In the past, most recessions have been identified well after they’ve begun. The Sahm indicator has the potential to shift this paradigm.

Where things stand today

The Sahm indicator is relevant now because the three-month average in the unemployment rate is now flirting with that critical threshold—a half percentage point above the 12-month low.

In May, the Sahm indicator rose to 0.37, meaning the three-month average unemployment rate was 0.37 percentage points above the 12-month low. Then, in June, the Sahm indicator climbed further to 0.43.

Given that trajectory, the Sahm indicator could breach the key 0.5 level in the near future. And if that comes to pass, the Sahm rule would “officially” signal a recession is imminent, if not already underway.

What’s surprising to many is the notion that a recession could start with the unemployment rate at such a low level in historical terms. At present the U.S. unemployment rate is about 4.1%—near the lower end of the historical spectrum. But the Sahm indicator doesn’t derive its value from the absolute level of unemployment. Instead, it tracks subtle (but important) changes in the labor market.

To that point, the creator of the rule—Sahm herself—recently told CNBC that “the recession indicator is based on changes for a reason. We’ve gone into recession with all different levels of unemployment. These dynamics feed on themselves. If people lose their jobs, they stop spending [and] more people lose jobs.”

That’s why Sahm has urged the Federal Reserve to act now waiting for her indicator—or other data points—to start flashing red. During her appearance on CNBC, Sahm indicated that she’s still optimistic the economy could ultimately avoid recession, but only if the Fed pivots in the near future.

Speaking to the risks associated with further delay, Sahm warned that ”the worst possible outcome at this point is for the Fed to cause an unnecessary recession.” Emphasizing the need for immediate action, Sahm noted that “the bad outcomes here could be pretty bad. From a risk management perspective, I have a hard time understanding the Fed’s unwillingness to cut and their just ceaseless tough talk on inflation.”

Final takeaways

In the wake of the pandemic, it’s been especially hard for economists to evaluate the state of the economy. Case in point, one of the key recession indicators—an inverted yield curve—has been flashing red for 24 months, but a recession has yet to materialize.

However, the Sahm indicator has also flashed a warning sign, seemingly indicating the risk of recession is rising. The continuing inversion of the yield curve takes on new complexion when viewed through this lens.

The inventor of the Sahm rule believes the U.S. economy can still avoid recession, but only if the Fed pivots soon. And with the Sahm indicator on the verge of crossing its critical threshold, it will be interesting to see whether the Fed waits for this signal to act or moves to cut rates preemptively.

Meanwhile, the interest rate futures market indicates the Fed will cut rates in September.

Reminder that recessions in the United States have usually been accompanied by corrections in the stock market, which is why the possibility of a recession is such a key topic for active investors. To learn more about risk-managing the portfolio in the current environment, readers can review this previous Luckbox article.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.