Trump vs. Harris: The Stage is Set for a Corporate Tax Showdown

The U.S. has a debt problem, which makes tax policy a key theme in the upcoming elections

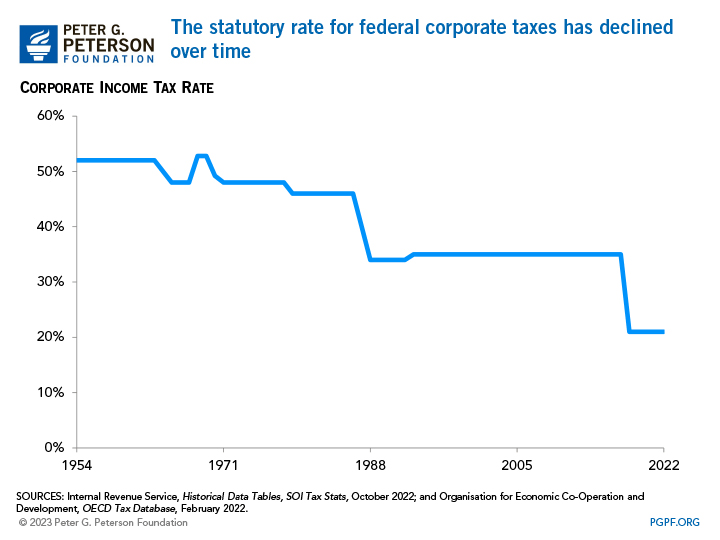

- The 2017 Tax Cuts and Jobs Act reduced the corporate tax rate from 35% to 21% and despite record federal tax revenues that followed, the budget deficit continued to increase.

- Donald Trump proposes further reducing the corporate tax rate to 15%, while Kamala Harris plans to raise it to 28%, reflecting their differences on how to manage the government’s fiscal problems.

- Assuming no curbs on spending, Trump’s plan could boost the stock market in the short term but could result in an increase in the national debt, whereas Harris’s approach might lead to a short-term market dip but offer greater fiscal stability over the long run.

The United States has reached a critical fiscal crossroads. For years, the federal government has been spending far more than it earns, leading to a steadily widening budget deficit—a gap that threatens to undermine the country’s economic stability.

While a certain level of deficit spending can provide economic flexibility, unchecked deficits pose serious risks, as evidenced by recent downgrades to the U.S. sovereign credit rating. To restore balance, the government faces a stark choice: Cut spending or increase revenue. The latter often means tax hikes, which makes the policies of the two leading candidates—Kamala Harris and Donald Trump—crucial.

Harris advocates raising taxes on American corporations to address the growing budget deficit, while Trump suggests deepening his previous tax cuts. The Trump administration’s 2017 tax cut slashed the corporate tax rate from 35% to 21%, and Harris has made clear she intends to increase that percentage to help remedy the fiscal crisis.

The stakes are high, and the implications of these proposals extend far beyond the election. Let’s explore these contrasting strategies and their potential impact on the economy and markets.

Where we are now

The U.S. government’s habit of spending beyond its means has been a longstanding issue, but the situation has become dire in recent years. The COVID-19 pandemic exacerbated this trend because emergency federal spending surged to support the economy during a time of unprecedented crisis.

In 2024, the Congressional Budget Office (CBO) projects a federal budget deficit of approximately $1.9 trillion. Every dollar of that $1.9 trillion will ultimately be added to the national debt, which now exceeds $35 trillion. To put these figures into perspective, that means the budget deficit will be nearly 7% of annual gross domestic product (GDP) in 2024—more than double the generally accepted “healthy” level of around 3%.

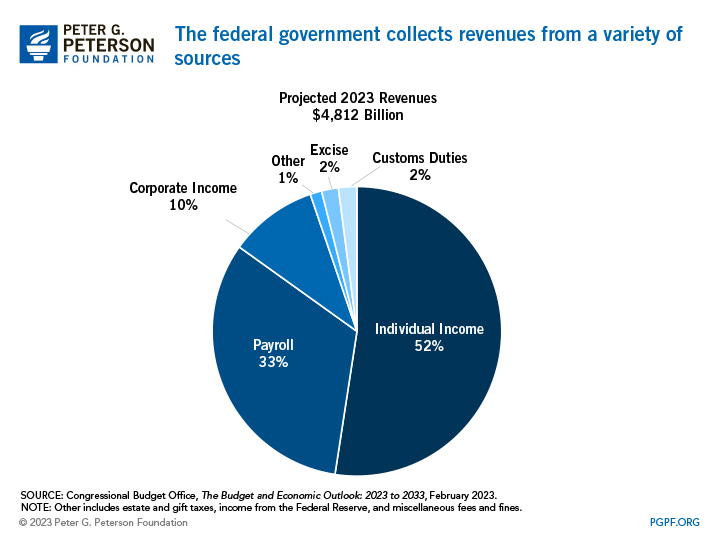

In addition to spending, this ever-growing debt problem is driven largely by insufficient tax revenue.

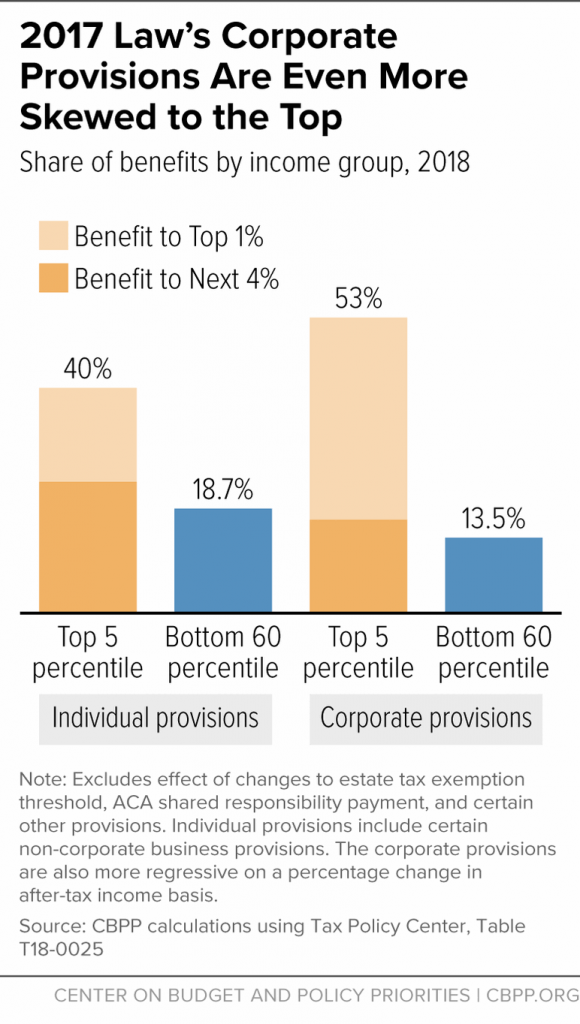

In 2017, Republican lawmakers, in partnership with then-President Trump, enacted a sweeping tax cut for corporations and wealthy individuals—the Tax Cuts and Jobs Act of 2017. Most of the benefits went to the corporate sector, with some calling it the largest corporate tax cut in history. As Sonali Kolhatkar recently noted, the 2017 corporate tax cuts were “the single largest reduction ever in that category.”

As a result, the corporate tax rate dropped from 35% to 21%. Such a dramatic reduction has far-reaching consequences. Ideally, the government should have cut spending to match the reduced tax revenue. However, the onset of the COVID-19 pandemic—and the persistence of subsequent government fiscal support—set spending cuts aside as a policy priority.

Six years later, the federal government has yet to correct the imbalance. Annual budget deficits have increased the national debt, which has now risen above $35 trillion. This debt reflects the total the U.S. owes to creditors, both domestic and foreign.

On the upside, the 2017 tax cuts have undeniably fueled the stock market’s bull run by boosting corporate profitability. Corporate profit margins have climbed to near-record highs since those cuts were introduced. However, this boon has come at the cost of weakening the government’s fiscal position.

Last year, two major global debt rating agencies downgraded the U.S. government’s credit rating. With the national debt rising at an alarming rate, lawmakers and the White House face the daunting task of finding a resolution. It might require a mix of spending cuts and tax increases.

The urgency is heightened because the 2017 tax cuts are set to expire in 2025. If Trump wins a second term, along with Republican control of Congress, extending the tax cuts is expected to be a top priority. However, without corresponding cuts to government spending, the country’s fiscal situation could escalate from critical to imminent crisis. In that scenario, further downgrades to the U.S. government’s credit rating are likely.

The Harris proposal

In speeches and press releases, Harris has described how her administration would tackle this issue. A key element of her strategy is advocating for a tax increase on corporate America. And in some ways, her proposal is viewed as a necessary evil, given the current unsustainable levels of deficit spending.

Before Trump’s tax cuts, the U.S. corporate tax rate was among the highest globally. However, after the 2017 cuts, the statutory corporate tax rate dropped to 21%, now below the global average of around 25%.

Notably, the effective tax rate—the rate corporations actually pay after employing various deductions, credits and loopholes—has fallen even farther. Research shows the average effective tax rate for American corporations has decreased to about 13%, down from roughly 22% before the Trump tax cuts.

So, when the statutory rate was 35%, corporations typically paid around 22% after accounting for tax strategies. The drop to a 21% statutory rate has brought the effective rate down to about 13%.

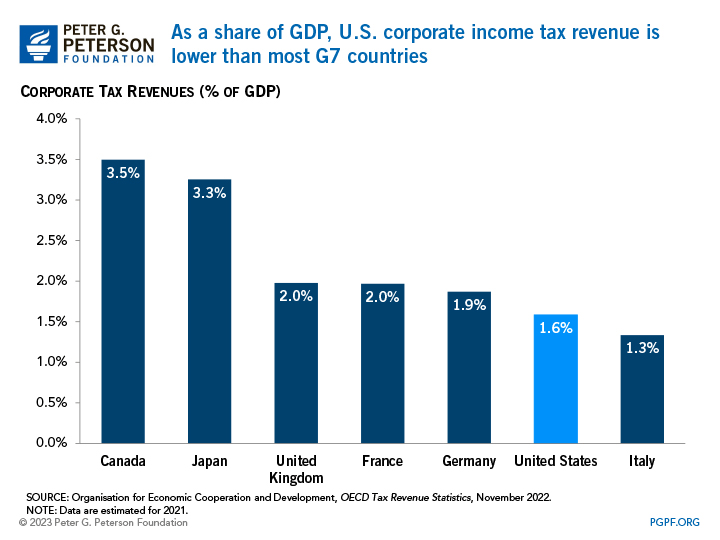

Harris’s proposal would raise the statutory corporate tax rate to 28%, which is expected to increase the effective tax rate to around 19%-20%. Even with this increase, the rate would still be lower than the 22% average corporations were paying before 2017. And this adjustment would bring the tax contributions of American corporations more in line with those of other advanced economies, as illustrated below.

Trump’s proposal

Former President Trump has signaled he would pursue further corporate tax cuts if re-elected, aiming to lower the corporate tax rate from 21% to 15%. This proposal is largely a continuation of the tax policies of his first term.

Such a reduction would inevitably lower the effective tax rate, possibly to below 10%. Many large corporations would pay a lower tax rate than individuals in the lowest personal income tax bracket, which is also 10%.

On top of these ramifications, Trump’s proposed tax cut would further weaken the government’s ability to fund its operations. Trump has suggested that increased tariffs—taxes on imported goods—could help bridge the revenue gap. However, independent analysis indicates this would not be enough to offset the shortfall from reduced corporate tax receipts.

The Tax Foundation estimates that Trump’s plan to extend the tax cuts would reduce government revenue by about $4 trillion over the next decade—much of it to be added to the country’s national debt.

Potential market impact

The choices presented in the upcoming election offer a stark contrast on corporate taxes.

Trump has proposed not only extending but even reducing the statutory corporate tax rate. While he suggests offsetting the loss of revenue with higher tariffs, independent analyses indicate that would fall short, leading to a substantial increase in the national debt.

Trump’s plan could stimulate growth in the corporate sector, but analyses of the 2017 tax cuts suggest they failed to deliver the promised economic benefits. Moreover, the advantages that did materialize were heavily skewed toward the wealthiest individuals and corporations, as illustrated below.

In contrast, Harris has signaled her administration would seek to raise corporate taxes closer to the global average. The goal would be to use the additional tax revenue to help reduce the annual budget deficit.

Each plan carries implications for the stock market. In the short term, Trump’s proposal could potentially boost the market because lower corporate taxes typically lead to higher profits. However, the long-term outlook would be dependent on whether or not lower tax rates actually increase GDP.

On the other hand, the Harris plan to raise corporate taxes might result in a short-term market dip, as valuations adjust to reflect higher taxes and lower earnings. While this could be painful in the near-term, it may offer greater fiscal stability for the country over the long run.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.