Synopsys (SNPS)-ANSYS (ANSS) Merger: Two Key Partners of Nvidia Unite

Nvidia announced at its annual GPU Technology Conference (GTC) that it is expanding its partnership with ANSYS (ANSS)

- Nvidia announced at its annual GPU Technology Conference (GTC) that it was expanding its partnership with ANSYS (ANSS).

- Synopsys (SNPS) is in the process of acquiring ANSYS, which means the net benefit of this announcement could ultimately go to SNPS shareholders.

- If approved by regulators, the future potential of the combined Synopsys-ANSYS organization looks very promising.

Nvidia’s (NVDA) annual GPU Technology Conference (GTC) usually makes a splash, and in that regard, the 2024 edition was no exception. And much like E.F. Hutton, when Nvidia speaks, people listen.

During the keynote address, Nvidia CEO Jensen Huang painted an optimistic picture of the future of AI, hinting at advancements like artificial intelligence-powered robotics (e.g. project “GR00T”) and the potential arrival of artificial “general intelligence” within five years.

More importantly—especially for management at Nvidia and the company’s shareholders—Huang implied that Nvidia will continue to be one of the key forces guiding the “invisible hand” of artificial intelligence (AI) development and adoption.

Some of the long-term prospects for the AI industry gained the largest degree of attention, but there were several other key developments that have more immediate ramifications.

Of particular note was Nvidia’s intention to deepen its collaboration with ANSYS (ANSS), signaling a strategic move with far-reaching consequences. Going forward, the two companies intend to expand and accelerate the integration and use of each other’s products.

At a high level, that means Nvidia will rely more heavily on ANSYS proprietary platforms to optimize hardware, while ANSYS will weave Nvidia’s AI offerings into its software.

This strategic collaboration aims to leverage the strengths of both companies to push the boundaries of innovation in hardware optimization and engineering simulation.

Down the road, that means the simulation software produced by ANSYS will be AI-equipped, allowing for enhanced simulation capabilities and more accurate predictions of real-world behavior.

By integrating Nvidia’s AI offerings into ANSYS’ software, engineers will also gain access to advanced tools that can analyze complex data sets, identify patterns, and optimize designs more efficiently. This partnership marks a significant step towards unlocking new possibilities in design, simulation, and optimization across various industries, ultimately driving forward the pace of technological advancement.

Beyond AI integration, Nvidia and ANSYS are also poised to expand collaboration in other domains, including accelerated computing, 6G communication systems, autonomous vehicles, digital twins, and enhanced graphics rendering.

However, it should be noted that this partnership comes amidst ANSYS’ pending acquisition by Synopsys (SNPS).

Announced on Jan.16, and expected to close in the first half of 2025, the terms of the deal dictate that ANSYS shareholders will receive $197.00 in cash and 0.3450 shares of Synopsys common stock for each ANSYS share. That represents a total deal value of approximately $35 billion.

Considering that context, it certainly appears that Synopsys has scored a crucial victory. Nvidia’s partnership with ANSYS not only strengthens ties between Nvidia and Synopsys, but also enhances the value of the proposed Synopsys-ANSYS merger.

Nvidia’s endorsement underscores the quality of ANSYS’ products and services, further bolstering Synopsys’ position in the market. Consequently, the recent Nvidia-ANSYS collaboration represents a positive development for Synopsys, potentially enhancing the combined enterprise’s valuation and strategic positioning in the evolving tech landscape.

Synopsys (SNPS) acquisition of ANSYS (ANSS) unlocks significant value

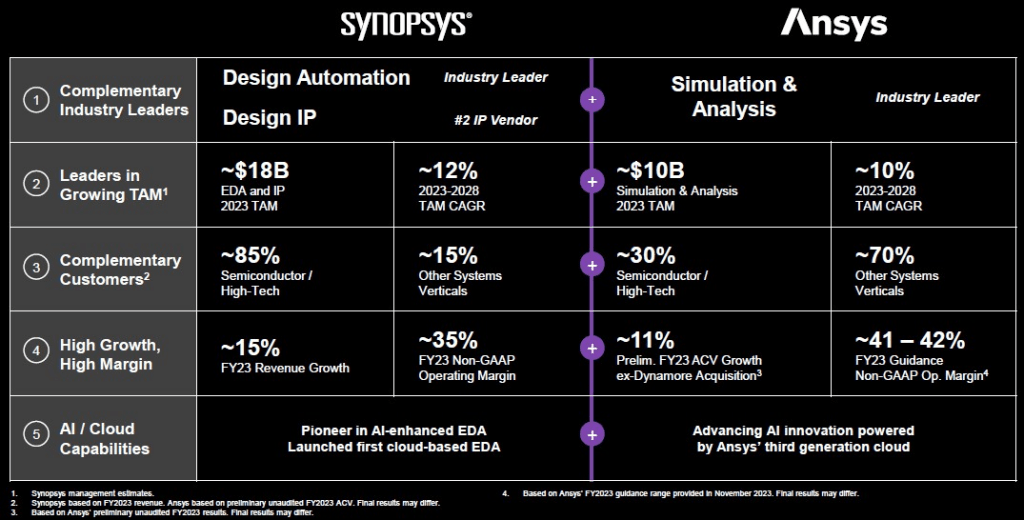

The Synopsys (SNPS) acquisition of ANSYS (ANSS) heralds a significant milestone in the convergence of two key technologies: electronic design automation (EDA) and engineering simulation software.

Synopsys specializes in electronic design automation (EDA) software and services, catering to semiconductor companies and electronic systems manufacturers. Its offerings encompass a wide array of solutions, including design automation tools, verification tools, and intellectual property (IP) cores, which aid in designing and verifying complex integrated circuits (ICs) and electronic systems.

On the other hand, ANSYS is renowned for its expertise in engineering simulation software and services. Their solutions enable engineers and designers to simulate the behavior of products and systems in various real-world conditions such as structural mechanics, fluid dynamics, and electromagnetics.

ANSYS’ software finds extensive application across industries like aerospace, automotive, electronics, energy, and healthcare, facilitating the optimization of product designs, reduction of development costs, and acceleration of time-to-market.

The combination of Synopsys and ANSYS presents a compelling opportunity due to the potential synergies and the enhanced potential of the combined enterprise.

First and foremost, by integrating Synopsys’ EDA tools with ANSYS’ simulation capabilities, the merged entity can offer comprehensive end-to-end solutions to customers.

This integrated approach should help streamline the product development process, allowing users of the intterated Synopsys-ANSYS platform to seamlessly transition from design to simulation, thereby facilitating superior design quality and faster time-to-market.

Moreover, the combined company can leverage cross-selling opportunities by offering Synopsys customers access to ANSYS’ simulation software and vice versa. The expanded product portfolio should strengthen the overall customer value proposition, consequently opening up new revenue streams for the combined entity.

Additionally, by pooling resources and expertise, the two companies should generate superior research and development, fostering an innovative environment that’s better positioned to generate the products and services which better serve the needs of the customers.

Furthermore, the integration of Synopsys and ANSYS should facilitate an expansion into new industries where their individual offerings weren’t as competitive or compelling.

For instance, the integrated solutions can be particularly attractive to companies designing complex electronic systems for automotive, aerospace, or Internet of Things (IoT) applications.

Also, the integration and consolidation of the two companies’ operations—such as accounting, sales and marketing—should produce cost savings for the combined entity, leading to improved operational efficiency and the potential for higher profit margins.

It should be noted that Synopys is also partnered with Nvidia, and the company’s impressive potential was also highlighted by Jensen Huang during the GTC conference.

In conjunction with the Taiwan Semiconductor Manufacturing Company (TSMC), Synopsis is working to “accelerate manufacturing and push the limits of physics for the next generation of advanced semiconductor chips.”

This project focuses specifically on computational lithography, which is a key element in the semiconductor manufacturing process—especially for advanced chips.

Synopsys has long been a leader in this field, as evidenced by its partnership with Nvidia. That means that Synopsys’ ongoing collaboration with Nvidia is also extremely valuable and factors heavily into the future potential of the combined Synopsys-ANSYS entity.

If the merger is approved, the future looks bright for Synopsys-ANSYS

The future potential of the combined Synopsys-ANSYS entity looks extremely promising. And Nvidia’s decision to expand its partnership with ANSYS appears to be the icing on the cake.

Since the merger was first announced in January, the combined market capitalization of Synopsys and ANSYS has risen by about $15 billion, climbing from roughly $105 billion to $120 billion. That’s represented through a $90 billion market capitalization for Synopsys and a $30 billion market capitalization for ANSYS.

A rising valuation for this combined entity appears to be driven by general euphoria in the AI space, combined with the incremental positive represented by Nvidia’s expanded partnership with ANSYS.

However, there’s another important factor that can’t be overlooked. The Synopsys-ANSYS merger may also provide the company with strong competitive advantage over other companies operating in the same niche.

In this specific case, one company appears especially susceptible to a loss of market share: Cadence Design Systems (CDNS).

Both Cadence and Synopsys dominate in the semiconductor electronic design automation (EDA) software universe, as evidenced by their respective 30% market shares. The next closest competitor is Siemens EDA, which controls about 13% of this market.

Intriguingly, Cadence and Synopsys both currently trade with market capitalizations of around $90 billion. And much like Synopsys, Cadence is also partnered closely with Nvidia.

In fact, the brands are so similar that they have even been referred to as the “Coke” and “Pepsi” of the EDA universe.

Considering the similarity between the two businesses, it shouldn’t come as much of a surprise that Cadence also tried to acquire ANSYS.

However, that effort ultimately failed. And one can bet that management at Cadence is none too happy with the prospective merger between Synopsys and ANSYS.

Taking on cadence systems

If all goes as planned, and the Synopsys-ANSYS merger receives the required regulatory approvals, the acquisition of ANSYS by Synopsys should present an opportunity for the combined entity to strengthen its competitive position against Cadence Systems.

By integrating ANSYS’ expertise in engineering simulation software with Synopsys’ established offerings in electronic design automation (EDA), the combined entity could offer customers a comprehensive suite of tools covering a broader spectrum of the design and verification process.

This expanded product portfolio would provide customers with a more integrated solution, potentially giving the combined entity an edge over Cadence.

Additionally, ANSYS’ strong presence in industries such as aerospace, automotive, and manufacturing would complement Synopsys’ focus on semiconductor and electronic systems design, allowing the combined entity to expand its market reach and customer base.

This increased market penetration could make the combined entity more resilient to market fluctuations, and better positioned to capitalize on emerging opportunities as compared to Cadence.

However, that potential will only be realized if the two companies successfully integrate their operations, which is by no means guaranteed.

Moreover, the planned merger is also dependent on a green light from regulators. As such, these two factors also represent the most significant risk factors for the promising future of the combined entity.

SNPS valuation: Wait for a better entry point

Based on recent developments, Synopsys has a lot going for it. The company is a key partner of Nvidia, and is in the process of merging with another of Nvidia’s key partners—ANSYS.

If that merger is approved by regulators, the Synopsys-ANSYS combined entity should be well positioned for growth.

However, that future path is by no means guaranteed. Synopsys will not only need to successfully navigate the regulatory approval process, but it will also need to efficiently integrate with ANSYS.

As a result of those risks, shares of Synopsys look more attractive in the long-term, than they do in the present. That uncertain near-term outlook appears to be reflected in the valuation of ANSYS, which currently trades at a discount to the value of the proposed deal with Synopnsys.

Recall, for example, that the offer for ANSS shareholders includes $197 in cash and 0.3450 shares of SNPS, the latter of which is currently trading at about $605/share. At this time, that equates to a deal value of approximately $405.73 per ANSS share ($197 + (0.3450 * $605) = $197 + $208.73 = $405.73).

However, ANSS shares are currently trading for about $350 each in the market.

Taken together, that means the implied discount of ANSS shares to the deal price is roughly 13.75%. To find the implied discount, one simply subtracts the current trading price from the offer price, and then divides by the offer price, and multiplies by 100. Doing the math, that equates to a discount of 13.73% ($405.73 – $350 = $55.73, and $55.73 / $405.73 * 100% ≈ 13.73%). Consequently, ANSS shares are trading at a discount of around 13.75% as compared to the Synopsys offer price.

As evidenced by the current market dynamics, the likelihood of the Synopsys-ANSYS merger lies somewhere below 100%. And the steep discount at which ANSS shares are currently trading—as compared to the offer price—indicates there’s significant uncertainty over the fate of the deal.

This discrepancy suggests that investors believe that regulatory obstacles are significant, and could ultimately prove insurmountable.

Synopsys valuation overextended?

When evaluating the investment potential of Synopsys, one also has to consider the company’s current valuation. And based on the current Price/Earnings ratio (P/E ratio) of Synopsys, that valuation is looking overextended.

At present, Synopsys trades with a 12-months trailing GAAP P/E above 60, which is more than twice the industry average.

If the merger with ANSYS was guaranteed, and the company expected to reap immediate benefits from that union, that P/E might be well deserved. But that’s simply not the case at this time.

Synopsys recently guided down its earnings outlook for the first quarter of 2024. As part of that March 20 update, the company indicated its quarterly and full-year 2024 revenues will be lighter than expected.

In normal trading conditions, that negative guidance would have represented a significant negative for shares of Synopsys. And the fact that the shares weren’t driven lower in the wake of that update serves as an early indication that the current bull run in the stock market may have reached “bubble” territory.

Had the company done the opposite, and guided its revenues higher, it would be a lot easier to rationalize the company’s current sky-high P/E ratio.

That’s a big reason that companies like Nvidia and Super Micro Computer (SMCI) have been able to justify elevated valuations. But for companies like Synopsys, that are guiding their revenue expectations lower, there could be a reckoning.

We rate shares of Synopsys a near-term hold. However, we view any significant pullbacks as an opportunity to potentially initiate a new position, or add to an existing one.

Along those lines, if the potential merger between Synopsys and ANSYS starts looking increasingly likely, that would be another incremental positive, which could help rationalize the current valuation.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.