What You Need to Know About the 2023 Rally in the Nuclear/Uranium Sector

Stocks and ETFs exposed to the nuclear/uranium sector have been charging higher in 2023 as world leaders have pledged to dramatically expand fission-based energy capacity

The United States plans to generate 100% of its electricity using carbon-free energy by the year 2035. And in order to realistically meet that goal, the country will need to build and operate new nuclear power plants.

Ideally those would be fusion-powered plants, because fusion doesn’t theoretically produce any type of environmental waste. However, fusion power isn’t expected to be successfully commercialized for at least another 5-10 years.

For the time being, that means the country is going to need to increase its reliance on fission-powered nuclear plants.

2023 Performance in the Nuclear Energy Sector

Not surprisingly, increased political support and interest in the nuclear energy sector has catalyzed upward movement in associated stocks and ETFs. And this niche has actually been one of the market’s strongest performers in 2023.

For example, the VanEck Uranium+Nuclear Energy ETF (NLR) is up 36% year-to-date. In addition, four other key nuclear/uranium ETFs have also posted impressive gains this year, as highlighted below:

- Sprott Physical Uranium Trust (SRUUF), +60%

- Sprott Uranium Miners ETF (URNM), +56%

- Global X Uranium ETF (URA), +43%

- VanEck Uranium+Nuclear Energy ETF (NLR), +36%

- Sprott Junior Uranium Miners ETF (URNJ), +22%

As one might expect, the single-stock universe has also seen a plethora of big winners in 2023.

In North America, one of the best-known nuclear stocks—Cameco (CCJ)—is up 94% so far in 2023. And Centrica PLC(CNA) out of the United Kingdom is likewise up 65% year-to-date.

On top of that, E.ON SE (EOAN) out of Germany, Engie SA (ENGIY) out of France and Endesa SA (ELE) out of Spain are up 22%, 15% and 10%, respectively, in 2023.

These returns are especially impressive considering that the utilities niche of the global markets has generally been out of favor this year. Despite an 18% rally in the S&P 500, the Utilities Select Sector SPDR ETF (XLU) is down about 12% so far in 2023.

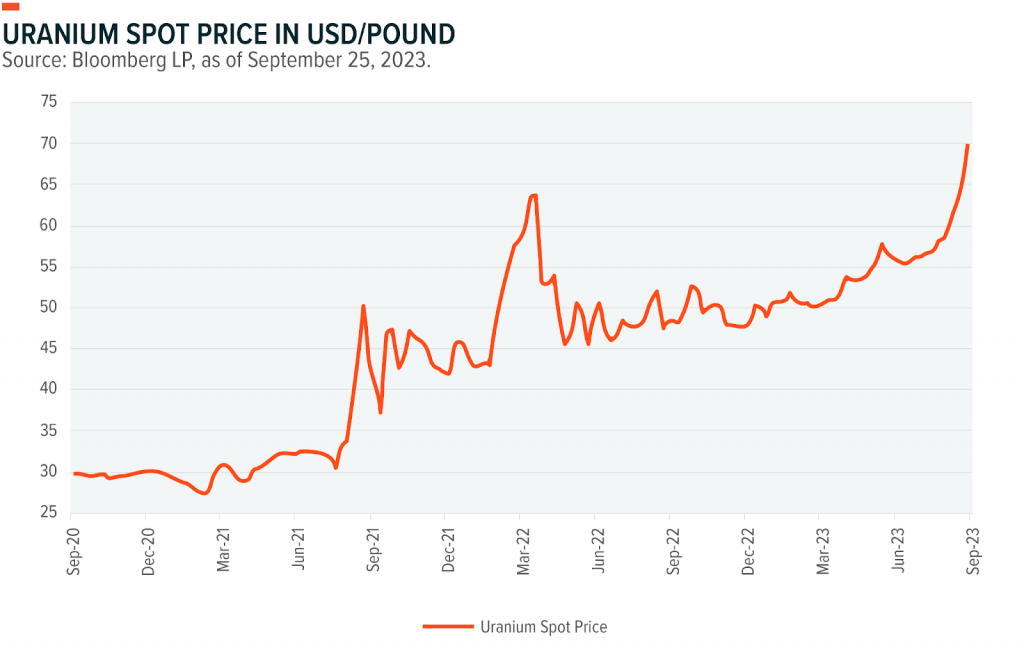

Outperformance in nuclear-focused stocks is primarily attributable to renewed interest in building out global nuclear capacity. But another key factor is rising uranium prices, which has boosted the fortunes of companies that mine and refine this key nuclear resource.

So far in 2023, uranium prices are up almost 50%—uranium now trades for roughly $75 per pound. At the start of 2023, uranium was priced closer to $50/pound.

Looking further back, uranium was trading for as low as $20/pound at the start of 2020. The breadth and length of the current uranium rally is therefore notable, considering that the rallies in many other commodities markets have reversed course in 2023 (e.g. oil and lumber).

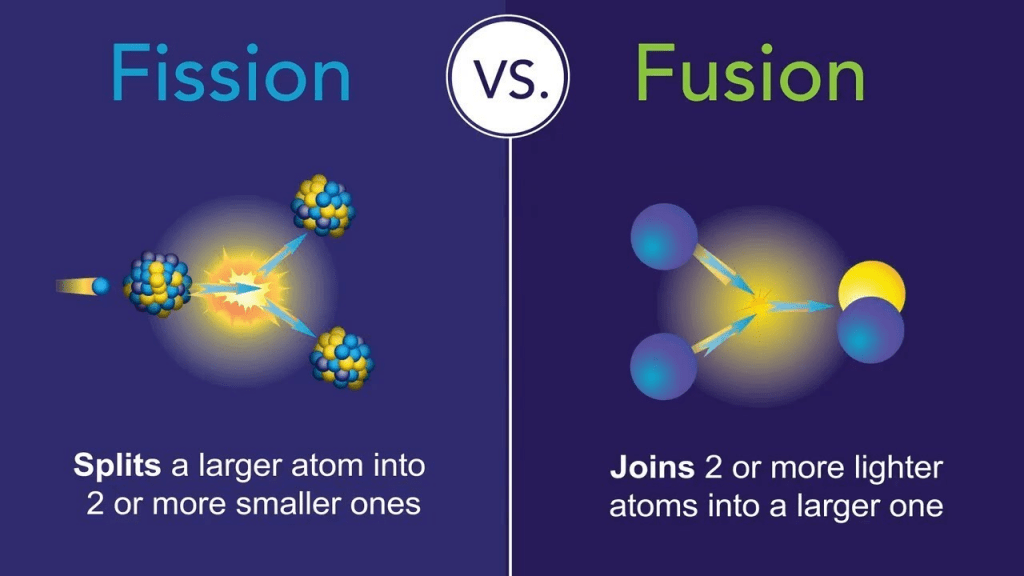

What is fission ?

Fission involves splitting the nucleus of an atom to generate energy, a process which is accompanied by the release of energy. Fusion, on the other hand, hinges on the successful combination of two nuclei into a heavier nucleus, which also generates a tremendous amount of energy.

The world’s first fission-powered nuclear plant went into operation in December of 1957 in Shippingport, Pennsylvania. At present, there are 92 commercial nuclear reactors in operation in the United States. And the U.S. currently generates approximately 19% of its annual electricity needs using those nuclear facilities.

Nuclear science is undoubtedly complex, but the method of generating electricity using fission is not. Basically, heat from the nuclear reactor is used to boil water, which is then transformed into high pressure steam.

The next step is to funnel that steam into a turbine, which catalyzes movement in the turbine’s blades. The motion of the turbine then induces the generation of electrical current.

Importantly, nuclear power plants do not release carbon emissions during the electricity generation process. In contrast, fossil fuel-reliant power plants, which typically burn coal or natural gas, are notorious for emitting large amounts of carbon dioxide and other greenhouse gasses into the atmosphere.

Unfortunately, fission-powered plants do produce radioactive waste. This stems from the use of uranium-based fuel rods in the reactor’s core, which are responsible for the nuclear reaction. That means the spent fuel rods are highly radioactive, and difficult to dispose of.

That’s why fusion-based nuclear power is so attractive, because there’s minimal environmental impact from these reactions.

Renewed Interest in Growing the World’s Nuclear Capacity

The United States is not alone when it comes to its aggressive plan to expand its use of nuclear energy. This month, Sweden announced it was also planning an extensive build-out of its nuclear capacity. And Sweden’s decision to go all-in on nuclear energy may represent just the tip of the iceberg.

The U.S. is currently spearheading a global pledge to triple the world’s nuclear capacity by 2050. And it’s been reported that countries such as Finland, France, Japan, South Korea, Sweden and the United Kingdom are in full support of this initiative, and will likely join the U.S. in pledging to achieve the aforementioned 2050 production goal.

That means new global initiatives—like the one out of Sweden last week—will likely be announced in the coming months.

Along those lines, the U.S. recently announced it would be partnering with the Philippines to help the country develop nuclear power. The Philippines does not currently produce energy using nuclear reactors, but did attempt to build a facility back in the 1980s.

Assuming Congress approves the deal, this partnership would involve the transfer of equipment, materials and information to help kick-start the development of nuclear power in the Philippines.

Another key development in the U.S. was the recent advancement of the “Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy (ADVANCE) Act” out of bipartisan Senate committee.

According to Senator Shelley Capito of West Virginia, the ADVANCE Act has the potential to “reestablish America’s preeminence as the global leader in nuclear energy in the twenty-first century.” This bill is part of the broader National Defense Authorization Act (NDAA), which could be enacted in the near future.

And according to surveys conducted by Pew, 57% of Americans are now in support of building additional nuclear capacity, as compared to 43% back in 2016.

Near Term Outlook for the Nuclear Fission Industry

After many years out of the limelight, the nuclear energy sector appears to be going through a bit of a renaissance. That’s in part due to the future promise of fusion energy, which could become one of civilization’s most important technological breakthroughs.

However, due to the urgent need for carbon-free energy, there’s also renewed interest in fission-based nuclear power. And as a result, expectations for the sector are rising, as new projects inflate the potential revenues/profits available to nuclear and uranium-focused companies.

Along those lines, the International Atomic Energy Agency (IAEA) now projects that the total installed nuclear fission capacity on earth will more than double by 2050, rising from 369 gigawatts electric to 890 gigawatts electric.

And some of that future potential is already being realized. For instance, the aforementioned uranium mining company—Cameco (CCJ)—currently projects that its 2023 revenues will be 30% higher than they were last year.

Uranium is used to build the fuel rods that are housed in the reactor’s core, and are responsible for generating the nuclear reaction which in turn heats up the water and creates the steam necessary to spin the turbines. And judging by the 90%+ rally in the shares of CCJ this year, the outlook for uranium companies is equally bright.

However, one must also recognize that pledging to aggressively expand capacity is one thing, but actually doing it is another.

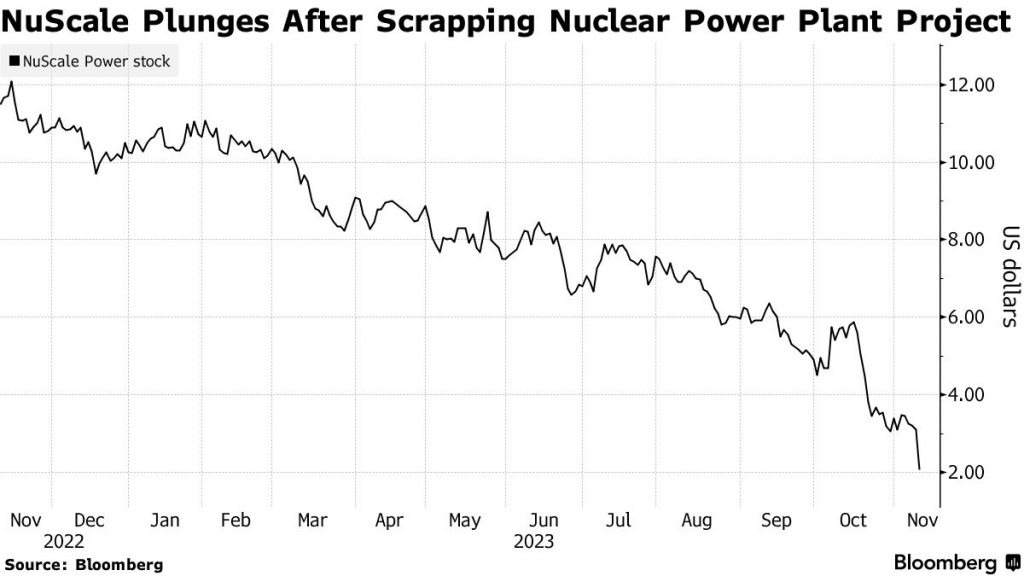

Unfortunately, one of the most promising emerging entrants in the nuclear fission sector—NuScale (SMR)—was recently forced to abandon its effort to build fresh nuclear capacity in the western United States.

NuScale had previously agreed to build six small nuclear reactors in partnership with Utah Associated Municipal Power Systems—the latter of which supplies electricity to public utilities in seven western states. Back when the project was originally agreed upon, the cost of those reactors was estimated at around $5.5 billion.

But due to a variety of factors, those costs recently ballooned to an estimated $9 billion, which made the project economically unfeasible. This setback has weighed significantly on the shares of NuScale, which are down roughly 75% year-to-date.

What’s even more concerning is the fact that the NuScale project was part of a broader trend to install smaller nuclear reactors around the country to help reduce the costs associated with traditional large-scale reactors. These systems are referred to as small modular reactors (SMR), which by no coincidence are the same letters in NuScale’s ticker symbol.

It should be noted that back in 2017 the state of South Carolina also abandoned an effort to build two new nuclear plants due to the astronomical costs associated with the project. In that instance, a total of $9 billion was spent on the project, and it achieved only 40% of completion.

In fact, the only major nuclear project to be completed in the last seven years is the Alvin W. Vogtle Electric Generating Plant in Georgia, which officially went into operation in July of this year. That project involved building two new nuclear reactors to supplement the existing pair of reactors at the facility.

In total, the project cost some $35 billion, which was double the original estimate. The Vogtle facility is now the largest nuclear power facility in the entire country.

These examples help illustrate the unique challenge associated with building nuclear reactors, and how the proposed expansion of the country’s nuclear capacity will require additional thinking when it comes to the involvement of the government. As will the method(s) used to actually build out additional capacity, in terms of both technology and financing.

Investment Takeaways

Considering all of the above, investors and traders need to tread cautiously when it comes to investing in single-stocks associated with this industry, especially companies that are pursuing new approaches to fission-based energy, such as NuScale.

So far this year, some of the primary ETFs in this sector have produced outsized gains, which suggests that nuclear/uranium ETFs represent a viable investment alternative to single stocks.

Market participants that are bullish on the sector might therefore instead focus on nuclear/uranium ETFs which spread risk across a more diverse group of investments. ETFs are generally less risky than single stocks because they offer diversification across multiple assets, and are therefore better insulated from the risks associated with a single company.

For those investors and traders that do prefer single stocks over ETFs, it may be prudent to stick to companies with long histories in the sector, or those with larger market capitalizations. For example, Cameco (CCJ) is one of the world’s largest publicly traded uranium companies, and is also one of the world’s largest uranium producers.

Large utilities with nuclear investments also represent a potential investment choice in this sector. However, investors and traders need to keep in mind that these companies often trade in-line with the broader utilities sector, as opposed to the nuclear/uranium niche.

Several examples of such companies include Brookfield Renewable (BEP), Duke Energy (DUK), Entergy (ETR) and Exelon (EXC). And much like the aforementioned utilities ETF (XLU), which is down about -12% this year, shares in BEP, DUK, ETR and EXC are down -6%, -13%, -10% and -10%, respectively, so far in 2023.

One exception is Constellation Energy Group (CEG), which was formerly a part of Exelon, but is now a standalone utility that primarily focuses on carbon-free energy. Shares in CEG are up nearly 50% in 2023, which means this particular utility has traded more in-line with the nuclear/uranium sector, as opposed to the broader utilities sector.

Constellation is part of the S&P 500 and also pays a quarterly dividend of about $0.14. That said, one has to consider that shares in Constellation have already rallied considerably in recent months, which may indicate there’s limited upside potential in the immediate future. Constellation’s market cap currently stands at around $38 billion.

Aside from the aforementioned single stocks and ETFs, investors and traders can also consider the smaller cap uranium miners, many of which have also outperformed in 2023, as highlighted below.

- Uranium Energy (UEC), +69%

- Denison Mines (DNN), +60%

- Centrus Energy (LEU), +57%

- NexGen Energy (NXE), +46%

- Ur-Energy (URG), +45

- Isonergy (ISENF), +42%

- Energy Fuels (UUUU), +37%

- Fission Uranium (FCUUF), +23%

However, the risks associated with the stocks listed above are arguably more acute because many of these companies have smaller market capitalizations, which makes them more susceptible to large-magnitude moves.

These companies are also highly levered to the uranium market, which means any significant pullback in uranium prices could weigh heavily on this group in particular.

Taken all together, investors and traders bullish on the long-term prospects of the nuclear industry may be better served steering towards companies that have demonstrated sustained success in the industry (e.g. Cameco, CCJ), or larger-capitalized companies that are better insulated from company-specific risk (e.g. Constellation Energy, CEG).

Another possibility is the aforementioned nuclear/uranium ETFs, which offer increased diversification (e.g. the VanEck Uranium+Nuclear Energy ETF, NLR).

The nuclear/uranium sectors have already rallied considerably in 2023, but if the world remains serious about dramatically increasing fission-based nuclear capacity, there will probably be further upside ahead.

But if fusion energy is commercialized more quickly than expected, or another nuclear disaster unfolds, the relative attractiveness of fission-focused investments (including uranium mining) would undoubtedly be diminished.

To follow everything moving the markets on a daily basis, including the global energy markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.