Why Millennials Should Love Futures

Simple access to low-cost, pure plays on commodities resonates with a new generation of investors

As a member of the millennials, the age group now in our 20s and 30s, I can attest to the accuracy of at least one generalization about our generation: We prefer “access,” not costly and cumbersome “ownership.” And we value the pure play.

We’d rather grab an Uber or Lyft than commit to onerous car payments and ruinous depreciation. Who needs the parade of bills for gas, oil, tires, batteries, parking, insurance and repairs? Ride-sharing offers door-to-door transportation without undue expense—a pure play.

We also prefer the freedom of renting over the slavery of a home mortgage. Who wants to take responsibility for dripping faucets and leaky roofs?

And why not forget about those pricey resorts? We’d rather spend vacation time in an affordable Airbnb. It’s a roof. And it’s likely to have more personality and more local character than a hotel room—another pure play.

These changes have combined to recast many companies as low-fee businesses providing direct and immediate access to the pure play.

At the same time, purchasing stocks has become increasingly inexpensive and easy. To acquire stock in Starbucks (SBUX), for example, just open a Robinhood or Dough app, search SBUX and hit “buy.”

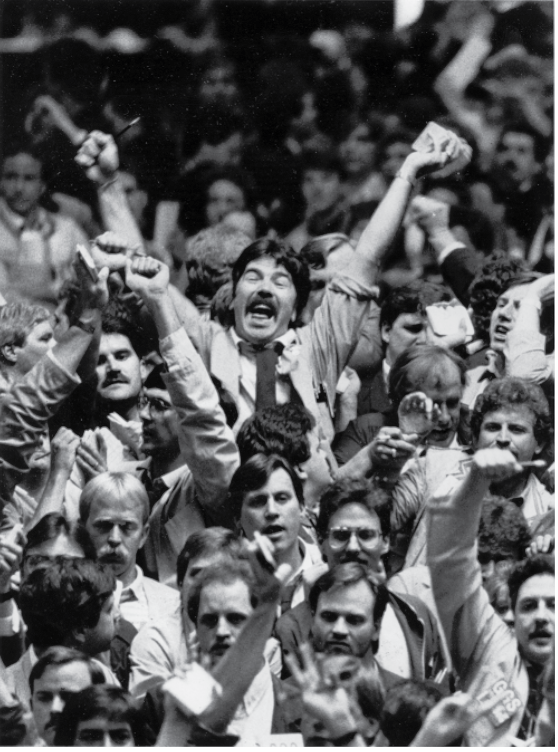

But before the new products from the Small Exchange, no one had come up with an easy way to trade the price of precious metals. Decades of legacy financial infrastructure still make it difficult to trade the most popular commodities such as oil, gold and interest rates. What’s the symbol for oil? Well, on a stock trading app there isn’t one.

Sure, we could buy Exxon Mobil stock, but that’s not the pure play. I don’t care about Exxon’s production capacity or quarterly earnings. I just want to make money when oil moves. I could also buy an oil mutual fund, but that’s just a basket of companies burdened with an unnecessary management fee.

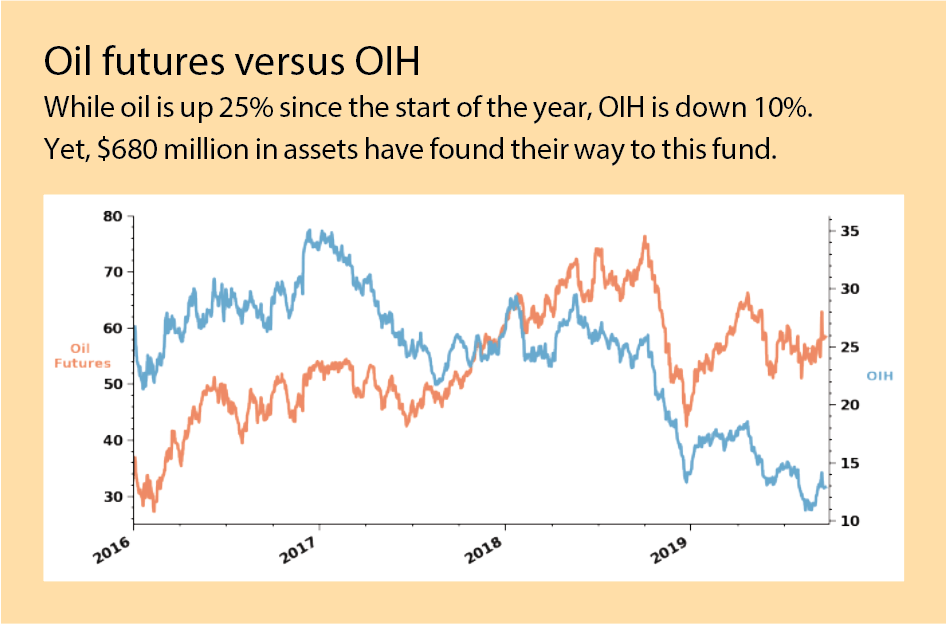

Why should we pay a management fee when we can manage our own money? Look at the discrepancy in performance between crude oil and OIH, an oil services fund in “Oil Futures versus OIH,” below. While oil is up 25% since the start of the year, OIH is down 10%. Yet, $680 million in assets have found their way to this fund, as opposed to the pure play on the price of oil.

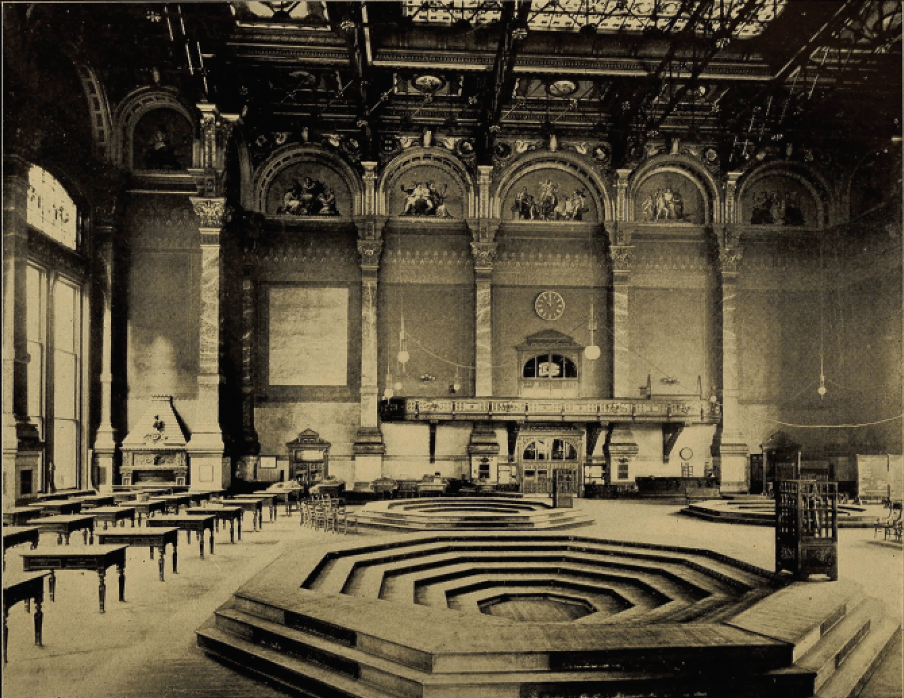

Expressing an opinion about oil, interest rates or foreign exchange requires something called a futures contract. These big, fat, legacy financial products provide direct exposure but are also so large they can make a $500 profit one minute and lose $1,000 in the next.

Wall Street had given us two choices: Either zig-zag to pure exposure with a convoluted fund, or trade it all-in with an oversized derivative. Why not go small? It’s something the new Small Exchange makes possible.

The Small Exchange brings innovation to futures, a market offering capital efficiencies, tax advantages and pure price exposure. It’s time for cost-effective, pure-play, straightforward futures products for all generations, not just those with large sums of money to invest.

Michael Gough enjoys retail trading, running, reading and writing code. He works in business and product development at the Small Exchange, building index-based futures and professional partnerships.