This is the Hottest Biotech ETF to Start 2024

After two years of underperforming, the biotech sector appears to be rebounding with a strong performance in the Loncar Cancer Immunotherapy ETF (CNCR)

- The biotech tech sector has underperformed the last several years, but appears to be rebounding in early 2024.

- One of the leaders has been the Loncar Cancer Immunotherapy ETF (CNCR), which is up roughly 30% year-to-date.

- If interest rates decline in 2024, that could also jumpstart the biotech IPO market, which could provide an additional boost to valuations in the sector.

Unlike the broader tech sector, the biotech niche of the financial markets has underperformed in the last several years.

During the last three calendar years, the SPDR S&P Biotech ETF (XBI) posted the following returns: +7%, -26% and -20%. And over the last five years, the XBI is up only 17%. In comparison, the S&P 500 is up about 90% over the past five years, while the Nasdaq 100 is up about 160%.

A 17% return over five years isn’t terrible, but it’s not likely to turn heads, either. Especially considering that the biotech sector had been one of the hottest corners of the stock market. From the start of 2017 through the end of 2020, the XBI posted annual gains of more than 30% in three of those four years.

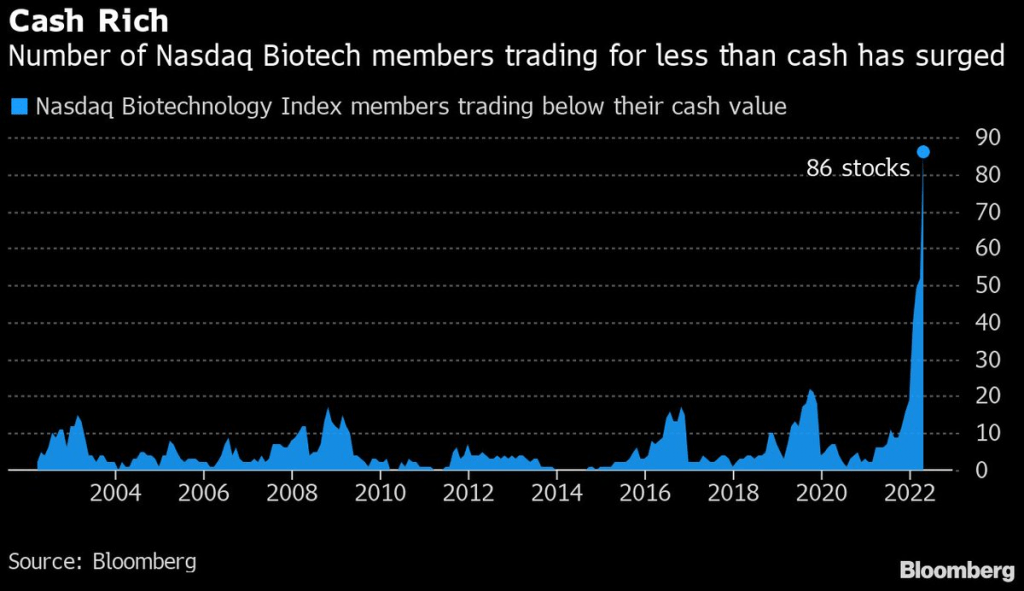

Recently, one of the biggest headwinds for the biotech sector has been higher interest rates. Many small and mid-cap biotech companies rely on debt financing in the early years of development, so higher financing costs are biting into the available capital of this group.

Another challenge for the biotech sector has been the slowdown in the market for initial public offerings (IPOs). During the last two years, IPO activity has been severely depressed as compared with historical averages. This development has been especially troublesome for the biotech sector, which relies heavily on the IPO market to raise capital.

Early stage biotech companies often tap the IPO market to fund their operations during the drug/therapy development process, because they aren’t able to generate the revenues and profits necessary to fund these activities from their own operations.

A slowdown in the IPO market therefore makes it harder for early stage biotech companies to access the capital they need to advance their drug development pipelines.

Signs of a potential 2024 rebound

Despite these challenges, there are signs that the biotech sector may be starting to rebound. In 2024, the XBI is already up 12% year-to-date. Moreover, there have been a couple of standouts in the broader biotech ETF universe. Specifically, the Loncar Cancer Immunotherapy (CNCR), which is already up 30% this year. (Note: Google finance lists the name of this ETF as the “Range Cancer Therapeutics ETF.”)

Amazingly, the top four holdings in CNCR are all up more than 80% in 2024, respectively. In the biotech universe, that’s akin to one player hitting four homeruns in the same baseball game.

This is an indicator that the fund manager of CNCR possesses unique insight into the industry, because this particular niche of the stock market is often characterized by a sharp divergence between the big winners and the big losers.

For example, during the last 10 years, the gap in returns between the top five performing biotechs and the bottom five was +287% versus -78%. In comparison, the software industry has seen a divergence of about +140% versus -46% for the average returns of the top five performers as compared to the bottom five—according to data compiled by The Wall Street Journal.

The boom and bust nature of the biotech industry makes superior analyst research and a knack for stock picking especially valuable for fund managers operating in this sector. According to the manager of CNCR—Range Fund Holdings—the Loncar Cancer Immunotherapy ETF (CNCR) “provides exposure to a wide range of cancer therapeutic modalities,” including the entire lifecycle of drug development and distribution.

As highlighted previously, the top four holdings of CNCR are all up more than 80% so far in 2024. These four stocks include MacroGenics (MGNX), Ambrx Biopharma (AMAM), Fate Therapeutics (FATE) and Y-mAbs Therapeutics (YMAB). Each of the four holdings represents about 3% of the fund’s total assets, meaning that together the four positions account for about 12% of CNCR’s total holdings.

Additional details on each of the aforementioned CNCR outperformers is covered in greater detail below.

MacroGenics, Inc. (MGNX), +87% year-to-date

MacroGenics, Inc. (MGNX) is a biopharmaceutical company that develops and commercializes antibody-based therapeutics to treat cancer and autoimmune diseases. The company is headquartered in the United States. Shares of MacroGenics currently trade for about $19/share with an associated market capitalization of roughly $1 billion.

One of the company’s best-known therapies is Margenza, which is used in conjunction with chemotherapy to treat metastatic HER2-positive breast cancer. Margenza was approved by the Food and Drug Administration (FDA) back in 2020.

However, recent optimism in the company’s shares appears to stem from the company’s numerous successful partnerships with larger players in the broader pharmaceutical universe. MacroGenics currently collaborates with Incyte (INCY), Gilead (GILD), Sanofi (SNY) and Zai Lab.

The partnerships have already produced upwards of $200 million in upfront and milestone payments for MacroGenics, and could ultimately yield hundreds of millions more.

Aside from finding additional success with drug approvals, the company could ultimately be acquired by one of its partners, which is a fairly common occurrence in this sector.

Barclays recently raised its target price on MGNX from $12/share to $23/share. According to TipRanks, five analysts currently cover MacroGenics, with four rating shares a “buy” and one rating them a “hold.” The average price target for these five ratings is about $17.50/share.

Ambrx Biopharma (AMAM), +105% year-to-date

Ambrx Biopharma (AMAM) is a clinical stage biopharmaceutical company that focuses on discovering and developing antibody drug conjugates (ADCs) that are designed to target multiple cancer indications. The company is headquartered in the United States. Shares of Ambrx currently trade for about $28/share with an associated market capitalization of about $1.75 billion.

On Jan. 8, 2024, Johnson & Johnson announced that it would acquire all of the outstanding shares of Ambrix for $28/share in cash, implying an overall valuation of roughly $2 billion. The transaction is expected to close during the first half of 2024.

Fate Therapeutics (FATE), +109% year-to-date

Fate Therapeutics (FATE) is a clinical-stage biopharmaceutical company that develops programmed cellular immunotherapies for cancer and immune disorders. The company is headquartered in the United States. Shares of Fate Therapeutics currently trade for about $8/share with an associated market capitalization of roughly $750 million.

Positive momentum in shares of Fate Therapeutics appears to stem from newfound optimism in the company’s drug development pipeline. Earlier this year the company initiated a phase I study to treat patients with HER2-expressing advanced solid tumors.

However, recent bullish momentum in shares of Fate Therapeutics also appears to derive from a recent filing by Steve Cohen’s Point 72 hedge fund. In late January, a Point 72 filing revealed that Cohen had acquired a 5% passive stake in Fate Therapeutics.

The fact that a billionaire and well-known investor has taken an interest in Fate Therapeutics has undoubtedly contributed to recent momentum in the shares.

On top of that, Morgan Stanley recently raised its target price on Fate Therapeutics from $3/share to $7/share. According to TipRanks, 13 analysts currently cover Fate, with four rating shares a “buy” and nine rating them a “hold.” The average price target for these thirteen ratings is about $7.50/share.

Y-mAbs Therapeutics (YMAB), +170% year-to-date

Y-mAbs Therapeutics (YMAB) is a biopharmaceutical company focusing on the development and commercialization of novel antibody based therapeutic products for the treatment of cancer. The company is headquartered in the United States. Shares of Y-mAbs currently trade for about $19/share with an associated market capitalization of roughly $800 million.

The company restructured itself in early 2023 and in the process freed up cash reserves that are expected to last the company through 2027. As it relates to the company’s drug development pipeline, Y-mAbs primary asset is Danyelza, which is a monoclonal antibody used for the treatment of neuroblastoma.

Neuroblastoma is a type of cancer that develops from immature nerve cells found in several areas of the body, primarily in infants and young children.

The FDA granted accelerated approval for Danyelza on November 25, 2020. However, it wasn’t until last year that sales of this drug really started to ramp up. In the company’s recent Q4 earnings report, it indicated that sales of Danyelza grew by 71% in 2023 as compared to 2022. The company also raised its sales guidance for 2024, from $85 million to nearly $100 million.

That positive earnings guidance, combined with larger than expected revenues in Q4 2023, appear to have triggered added optimism in shares of Y-mAbs. Shares of Y-mAbs were recently upgraded to a “strong buy” by Zacks.

According to TipRanks, two analysts currently cover Y-mAbs, with both rating shares a “buy.” The average price target for these two ratings is about $19.50/share.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.