It’s a ‘Goldilocks Rally,’ But Will it Last?

Recession poses the greatest threat to the markets’ current record highs

- A “Goldilocks” rally has taken hold in the U.S. financial markets, but there’s no guarantee it will persist.

- The average bull market lasts around 3.8 years, according to Kiplinger, and the current rally is less than two years old, having started in October of 2022.

- An economic recession poses the greatest threat to the current rally, but predicting when one might develop is complex and uncertain.

The financial markets are notoriously unpredictable, yet after the tumultuous trading year of 2022 few could have anticipated the market’s remarkable rebound over the following 18 months. Since the end of 2022, the S&P 500 has surged by 43%, while the Nasdaq Composite has skyrocketed by 70%. Notably, a significant portion of these gains have been realized since the fall of 2023.

Active investors have been taken aback by the rally’s strength, given the multi-decade high interest rates in the United States. Since last autumn, the stock market has also weathered other challenges, including the outbreak of war in the Middle East, an ongoing conflict in Eastern Europe, and high inflation. Of these three headwinds, only inflation has shown signs of easing in recent months.

Against this backdrop, the current bull run might best be described as a “Goldilocks” rally. This term refers to economic and financial conditions that are “just right.”

The Goldilocks moniker is of course derived from the famous children’s story “Goldilocks and the Three Bears.” In the story, Goldilocks wants everything to be “just right”—not too hot, not too cold, but perfectly balanced. In that same spirit, a Goldilocks market describes an environment that is balanced and ideal for investment, where conditions are neither too extreme nor too weak, but “just right” for sustained growth and stability.

Still,, not everyone may agree that everything is “just right.” However, the results in the stock market speak for themselves. This is also evidenced by record-high complacency in the market, which indicates many view the current investment climate as ideal, or “just right.”

In that sense, it’s the associated performance that has defined the recent rally as a Goldilocks market—not just the opinions of analysts and pundits. But why has this market developed, and what could potentially derail it?

New industrial revolution, increased capital investments

The health of the underlying economy has always been closely linked to stock market performance, but this relationship is nuanced. Case in point, the latest bull run demonstrates the economy doesn’t need to be growing at historically high levels for the stock market to rally. In 2024, moderate economic growth has been sufficient to fuel significant gains.

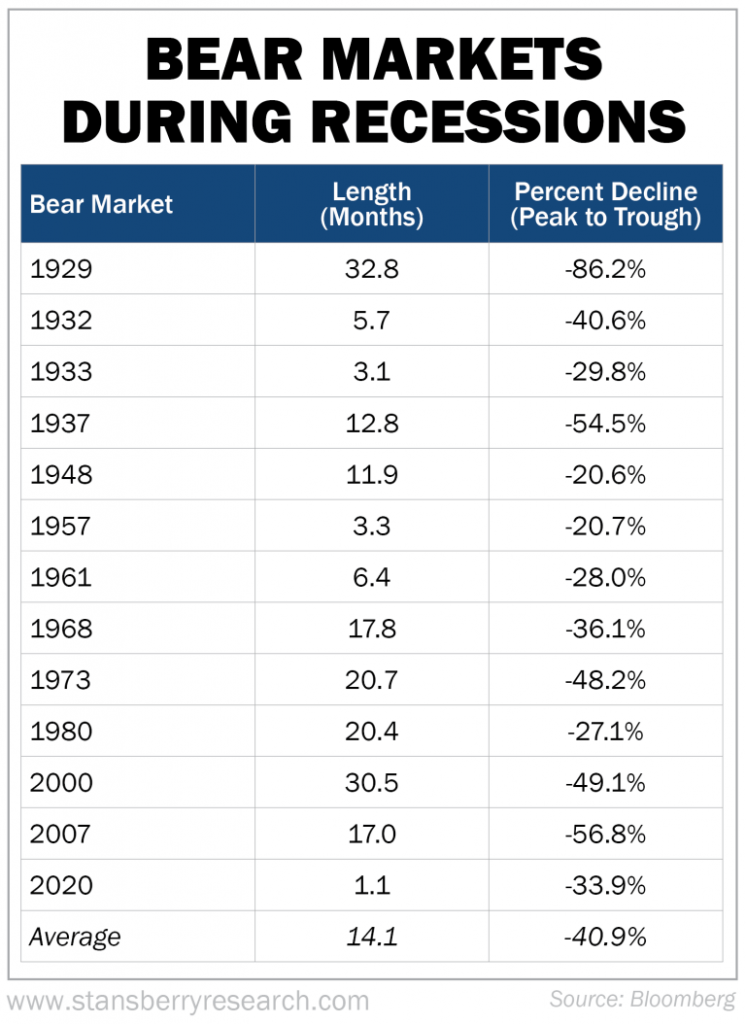

However, deteriorating economic conditions—especially recessions and depressions—typically weigh heavily on stock market valuations. The U.S. stock market has experienced 11 major bear markets since 1946 (peak to trough declines of more than 20%). Only two of those bear markets (1987 and 2022) did not coincide with an economic recession.

Taken together, that means the economy on its own hasn’t been completely responsible for recent outperformance in the stock market. Similarly, historically high interest rates would typically be viewed as a headwind for the stock market. But in 2024, the stock market has rallied despite higher rates.

The current landscape, driven by the new industrial revolution and increased capital investments in AI, therefore presents a unique context. This revolution is spurring a wave of innovation and efficiency, creating new avenues for growth, even amid moderate economic conditions. For example, it’s estimated that an additional $154 billion in fresh capital was invested in the global economy in 2023 because of AI.

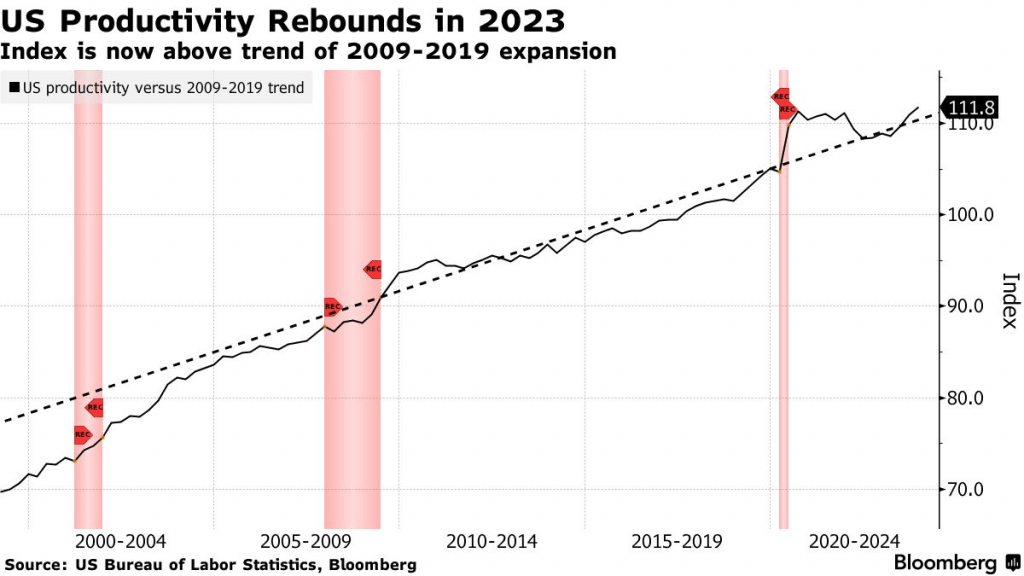

Companies are using that capital to invest in AI, robotics and other digital technologies, aiming to enhance productivity and drive future profitability. According to the U.S. Bureau of Labor Statistics, productivity in the U.S. workforce increased by 2.7% last year, which was considerably higher than the 1.5% average gain in productivity observed from 2004 to 2022. This boost in productivity can be attributed at least partly to advances in generative AI.

Considering all of the above, it’s probably no coincidence that the Goldilocks rally has coincided with the release of ChatGPT in late 2022. The advent of commercialized AI is arguably the most critical aspect of the recent market rally, as evidenced by the top-performing stocks, such as Nvidia (NVDA), Super Micro Computer (SMCI) and other companies offering key products and services related to AI.

The new industrial revolution, characterized by the integration of advanced technology like AI, is reshaping industries and creating new market dynamics. And this technological transformation could help sustain the stock market rally, provided the economic backdrop remains stable and supportive.

Strong labor market, benefits of immigration

Another critical component of the current rally has undoubtedly been the strong labor market.

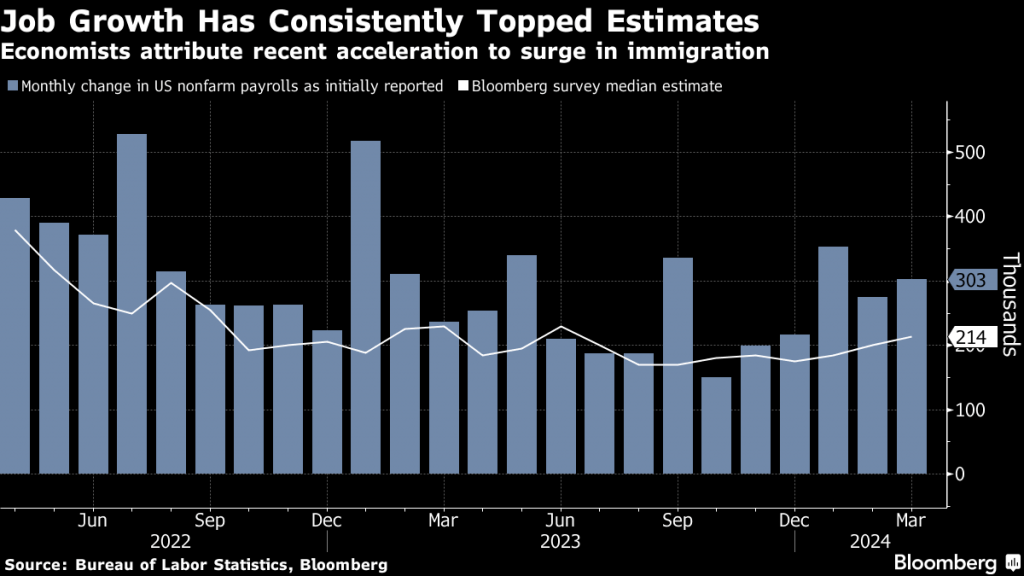

During the last six months alone, the U.S. economy has generated more than 1.5 million new jobs, including 272,000 in May. These numbers are consistent with a robust labor market—the type that typically coincides with a strong economy.

However, there’s more to the story, particularly the unexpected benefit associated with immigration, both authorized and unauthorized.

Immigrants have been filling job openings in sectors facing critical employment shortages, according to a CNBC report,. Underscoring this trend, Goldman Sachs noted that “recent immigrants have flowed disproportionately into the parts of the labor force that were particularly tight in 2022, contributing to labor supply in places where it was most badly needed.”

Lower-paid jobs that require in-person attendance, without a remote work option, continue to be the hardest to fill. Two sectors with numerous such openings are leisure/hospitality and healthcare, both of which saw large increases in May.

Additionally, shortages of worker are plaguing employers looking to fill jobs openings in legal services, scientific research, landscaping, cleaning and waste disposal, the U.S. Chamber of Commerce reports. Immigrants are undoubtedly filling some of these roles, as well, helping to alleviate gaps in the labor market.

Since President Biden took office in January 2021, the United States has added more than 15.5 million new jobs. Moreover, the unemployment rate has remained historically low—at or below 4% for 30 straight months—the longest such stretch in around 50 years.

All told, the influx of immigrant labor has helped address gaps in the workforce, supporting economic growth and stability. And a robust labor market has undoubtedly represented a key building block for the ongoing market rally.

Potential risks to the Goldilocks rally

Risk management is a critical aspect of portfolio management, which means most active investors are likely questioning how long this Goldilocks market can last. Historically, bull markets vary widely in length, with some lasting a few years and others extending over a decade.

The average length of a bull market is approximately 3.8 years, based on data going back to 1932, according to Kiplinger. The current bull market has been running since October of 2022—less than two years—which may indicate it has more room to run.

Predicting exactly when and how it will end is challenging, but a recession is a likely candidate.

Historically, recessions have been like kryptonite for the stock market. The U.S. stock market has experienced 11 major bear markets since 1946 (peak to trough declines of more than 20%). Notably, only two of those bear markets (1987 and 2022) did not coincide with an economic recession, which is why they don’t appear in the list below.

Excluding 1987 and 2022, most major stock market corrections have been accompanied by recessions, including the COVID-19-induced correction in early 2020.

Central bankers in the United States recently elected to leave benchmark interest rates at record-high levels. It appears the Federal Reserve is more concerned with a rebound in inflation, than a slowdown in the economy. That says a lot about the current state of the economy.

Historically, the Fed has used interest rates to stimulate—or dampen—investment in the economy. And by leaving rates at historically high levels, the Fed is essentially saying that business investment remains high—likely because of the aforementioned impact from the AI revolution.

In turn, that implies the Fed will cut rates when it feels a need to stimulate further investment in the economy. Traditionally, the Fed has cut rates to combat deflationary (aka recessionary) forces in the economy. As such, a pivot by the Federal Reserve—from hawkish to dovish—could ultimately be a bearish signal for the stock market.

Additionally, a decrease in demand for AI-focused products and services could be seen as a bearish indicator. In Q1, several high-profile companies faced earnings disappointments because of their inability to capitalize on their AI aspirations, further highlighting potential market vulnerabilities.

Final takeaways

The Goldilocks rally may have more room left to run. The economy isn’t ideal, but it’s also not a disaster—it’s somewhere in between. And for the stock market, that’s apparently “just right,” especially with another industrial revolution potentially underway.

That said, there’s a crucial presidential election in November. And with major wars in Eastern Europe and the Middle East, there’s the possibility an unexpected geopolitical event will inject uncertainty into the global financial markets. One example is the risk that the sinking commercial real estate sector triggers a broader banking crisis.

So, active investors should remain vigilant of the “three bears.” And to navigate a potential shift in sentiment, they should monitor economic indicators, maintain diversified portfolios and employ robust risk management strategies.

While the Goldilocks rally has lifted investor spirits, uncertainties persist in the financial markets, even with major indices bumping against all-time highs. For additional insight into the markets, readers can check out this new installment of The Price of Truthon the tastylive financial network.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.