Low Expectations for this High Flyer

Analysis of a contrarian take on Aurora Cannabis, a favorite marijuana stock among younger investors

Aurora Cannabis (ACB) has been on a tear for the last two years, but the company still has a long way to go to justify the market hype. Unrealized derivative gains led the company to an accounting profit last year, but real economic losses continue to mount.

Meanwhile, the company’s deceptively high revenue growth rate has been driven primarily by large acquisitions that burn cash and dilute shareholders. Share count has increased by more than seven times in recent years. Long-term, Aurora needs to grow revenue by 67% compounded annually for nine years and achieve net operating profit after tax (NOPAT) margins of ~20% (equal to Pfizer) to justify its $7.50 per share valuation.

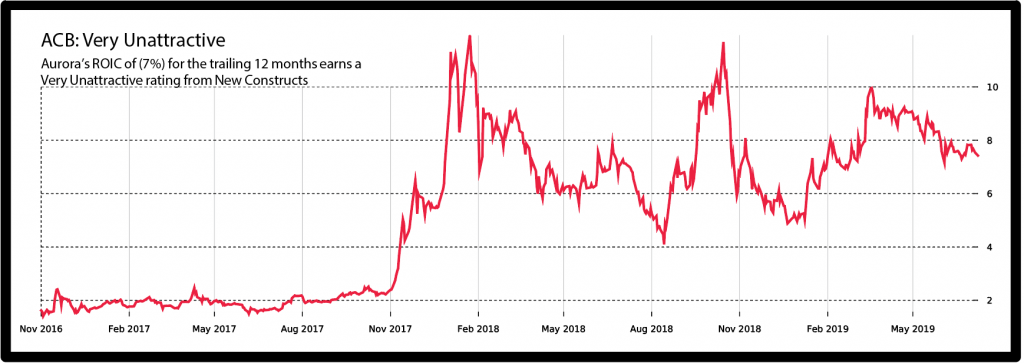

“Very Unattractive” return on invested capital

Return on invested capital (ROIC) measures a company’s return on all cash invested in the business. It’s the truest measure of profitability. Stock valuations are more highly correlated to ROIC than any other metric.

Weighted-average cost of capital (WACC) is the average of debt and equity capital costs that all publicly traded companies with debt and equity stakeholders incur as a cost of operating.

Companies must earn an ROIC greater than WACC to generate positive economic earnings and create value for shareholders.

Aurora’s ROIC of (7%) for the trailing 12 months

“Very Unattractive” free cash flow

Free cash flow (FCF) reflects the amount of cash free for distribution to all stakeholders (including debt and equity). FCF Yield divides free cash flow by enterprise value, which measures a company’s total value.

Using free cash flow yield to pick stocks is not a new strategy. However, there’s strategy that yields better results because it uses a better measure of free cash flow. In the same way New Constructs’ EEPS is a better measure of profitability than reported EPS, the New Constructs measure of FCF is better than traditional accounting-based FCF.

Aurora’s FCF is ($3.09 billion) for the trailing 12 months, and its current enterprise value is $8,3 billion. FCF Yield is (37.2%) and earns a Very Unattractive rating.

EBV book value is “Unattractive”

Price-to-economic book value (EBV) measures the difference between the market’s expectations for future profits and the no-growth value of the stock.

EBV measures the no-growth value of the company based on the company’s NOPAT.

When prices are higher than EBV, the market predicts the company’s NOPAT will increase and expectations for profit growth are reflected in the stock. If the stock price equals EBV, the market predicts NOPAT will remain the same and there are no expectations for profit growth reflected in the stock.

When stock prices are lower than EBV, the market predicts NOPAT will decrease and expectations for permanent profit decline are reflected in the stock.

In general, New Constructs likes to buy stocks with low expectations for profit growth and sell/short stocks with high expectations for profit growth.

Aurora’s current price-to-EBV per share is (2.3) and earns an Unattractive rating. Aurora’s stock price is $7.48, and its EBV per share for the trailing 12 months is ($3.30).

Making adjustments

New Constructs made 18 adjustments to convert Aurora’s reported 2018 earnings to net operating profit after tax, for a net impact of $106 million. Seven income adjustments of $172 million were made against 11 expense adjustments of $65 million.

Only 1% of companies requires more adjustments to reported earnings as a percent of revenue than Aurora to calculate NOPAT.

New Constructs made four adjustments for a net impact of $733 million to the discounted cash flow model for Aurora in the trailing

12 months, consisting entirely of adjustments that decrease value.

The most notable accounting distortion to the valuation metrics for Aurora in the trailing 12 months was the value of outstanding employee stock options (ESO) after tax. It was necessary to adjust shareholder value by $129 million, which is 2% of the firm’s market value. ESOs represent a liability based on future share dilution as employees exercise their options and add to the number of shares outstanding.

We believe Aurora embeds a Very Unattractive level of market expectations because of the large difference between the expected financial performance implied by its market price and the company’s historical performance. We recommend investors sell ACB.

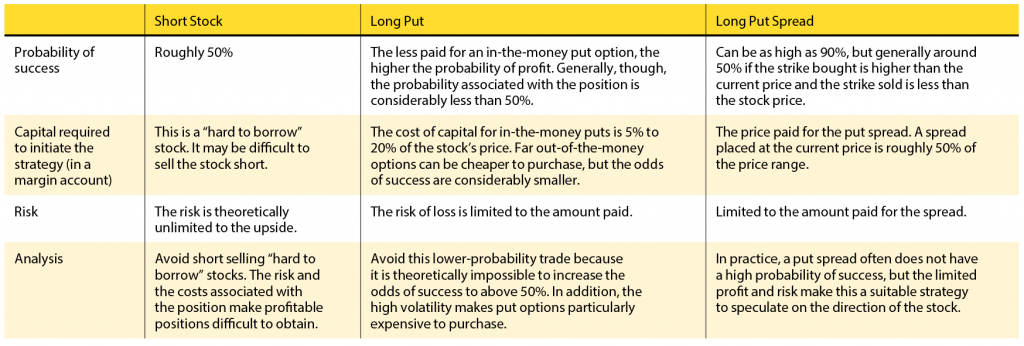

Ways to get sort Aurora Cannabis (ACB)

The implied volatility (IV) of Aurora Cannabis (ACB) is approximately 46%. That means the stock is expected to increase or decrease in price by 46% over the next year. Compared with other cannabis-related stocks, it has

David Trainer is CEO of New Constructs, an independent equity research firm that uses machine learning and natural language processing to parse corporate filings and to model economic earnings.

Sam McBride is an investment analyst at New Constructs. @newconstructs