Don’t let Stocks Ruin Your Day

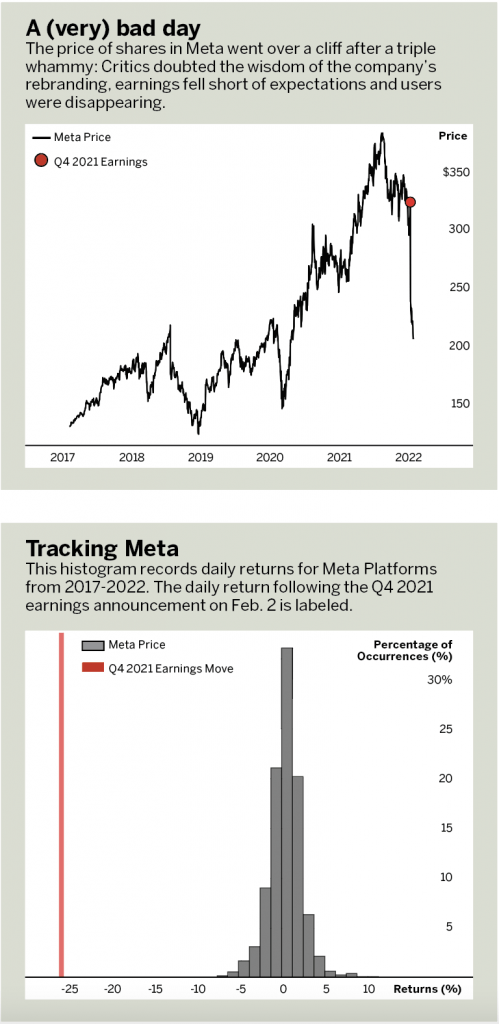

Meta Platforms (FB), formerly known as Facebook, experienced a historic loss in stock price after a lackluster 2021 Q4 earnings report. The company’s stock depreciated by more than 26% by the end of the following day, reducing Meta’s market capitalization by $230 billion. That’s a very bad day.

It’s nearly unprecedented for a stock that constitutes roughly 3.4% of the Nasdaq-100’s value to experience an extraordinary 12 standard deviation move. But this kerfuffle was hardly an isolated incident of extreme stock volatility since the sell-off of 2020. Events like the Tesla surge of 2020 and the GameStop squeeze have helped make idiosyncratic risk increasingly relevant to the financial landscape.

Financial risk generally falls into two categories: idiosyncratic or systemic. Idiosyncratic risk is specific to an individual company or sector, and traders can reduce it through diversification, the process of spreading capital across a variety of relatively uncorrelated assets. Systemic risk is inherent to the market as a whole. Because every market, sector and company has the capacity to fail, systemic risk cannot be diversified away.

But diversified instruments, such as exchange-traded funds (ETFs) and mutual funds, tend to be more stable and less prone to outlier moves, compared with non-diversified instruments, such as stocks.

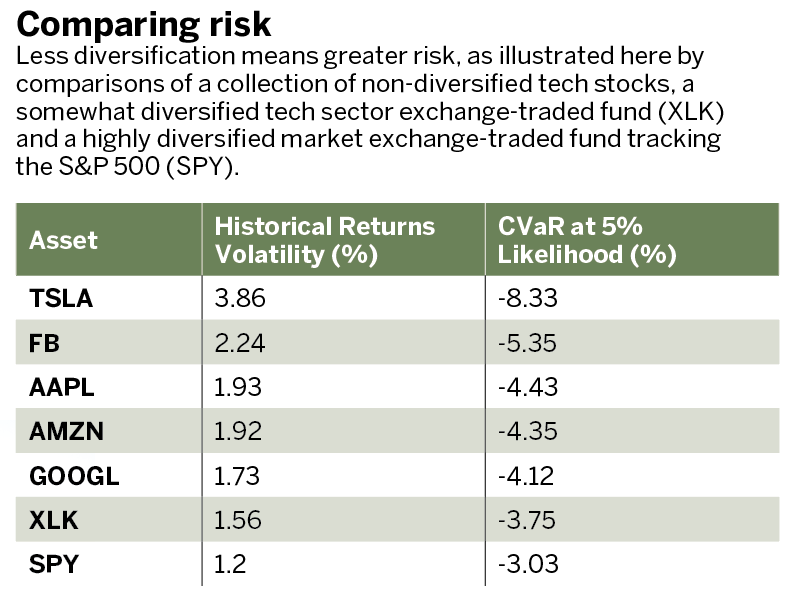

Historical return volatility measures the dispersion of returns over a given time frame and is typically larger for riskier assets. Conditional value at risk (CVaR), also known as expected shortfall, quantifies the tail risk of an investment. This metric estimates the expected loss of an asset in an “extreme” event at a given level of likelihood. In other words, Apple (AAPL) can expect to return losses exceeding 8.3% on the worst 5% of days.

Observe the historical volatilities among instruments, and it immediately becomes clear that the more diversified assets, SPY and XLK, are generally more stable in typical market conditions.

Note that SPY stands for the SPDR S&P 500 ETF, an exchange-traded fund that tracks the Standard & Poor’s 500, and that XLK refers to the Technology Select Sector SPDR Fund.

Diversification also noticeably reduces the severity of extreme loss events. In one example, extreme losses were more than eight times larger for Apple than for the historical results for SPY.

Diversified assets are less sensitive to exceptional events, such as the loss Meta experienced in early February. Focusing on diversified instruments and maintaining a well-diversified portfolio minimizes exposure to single-company risk factors and leads to more dependable expectations for future performance.

However, avoiding stocks entirely isn’t always the best choice for investors, particularly short-options traders. Although stocks tend to carry more risk than diversified instruments, they also offer high-IV opportunities more often than diversified underlyings, resulting in larger credits and more profit potential for premium sellers.

Short options traders can limit exposure to tail events by adopting risk management techniques

⊲ Keep stock options position sizes small. A single position should not occupy more than 5% to 7% of portfolio capital, and stock options should occupy at most 25% of the capital allocated to short premium.

⊲ Stick with defined risk strategies, such as wide iron condors, for stock underlyings.

⊲ Avoid earnings plays entirely or keep positions exceptionally small.

Julia Spina, a member of the tastytrade research team and author of The Unlucky Investor’s Guide to Options Trading, holds degrees in engineering physics and applied mathematics and a master’s in physics.

@financephoton