Reliable Strategies for an Unpredictable Future

Options help savvy investors avoid the worst consequences of drama on the world stage

From a worldwide surge in inflation to the largest armed European conflict since World War II, recent events have contributed to a year-long bear market and left investors with significant uncertainty heading into 2023.

But regardless of whether U.S. markets have bottomed out or remain under the sword of Damocles, investors can still use options to build reliable strategies for an unforeseeable future.

So, let’s highlight high probability of profit (POP) strategies that are relatively insensitive to directional swings.

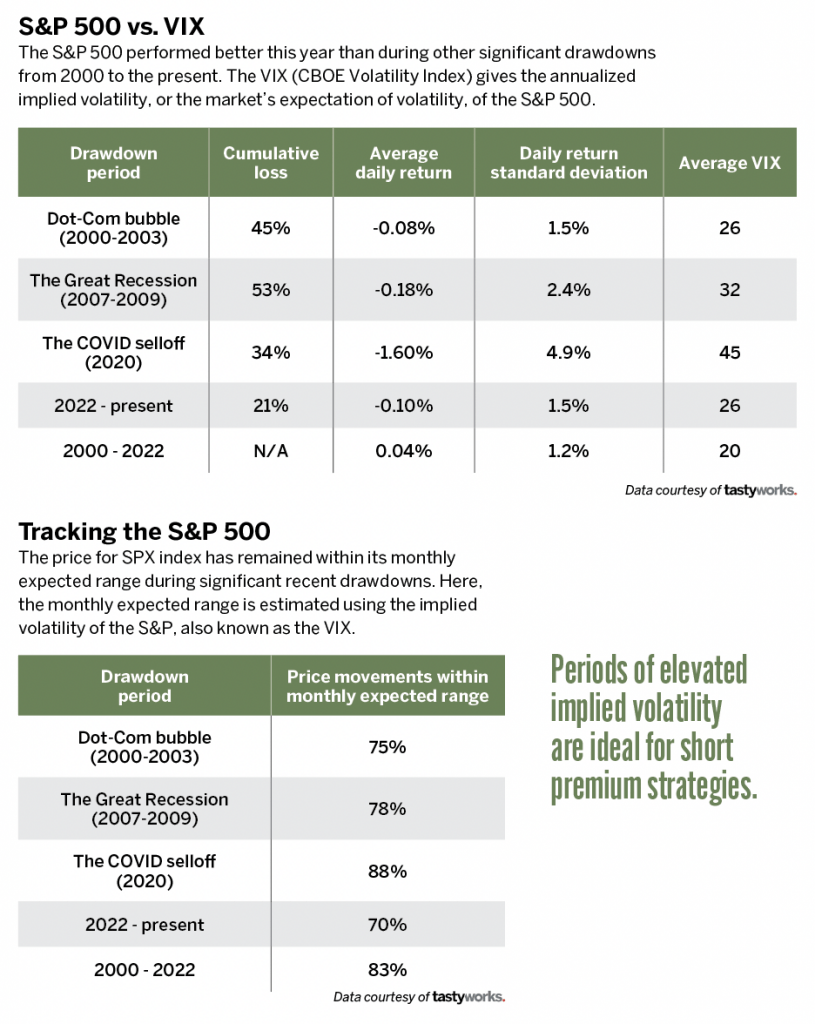

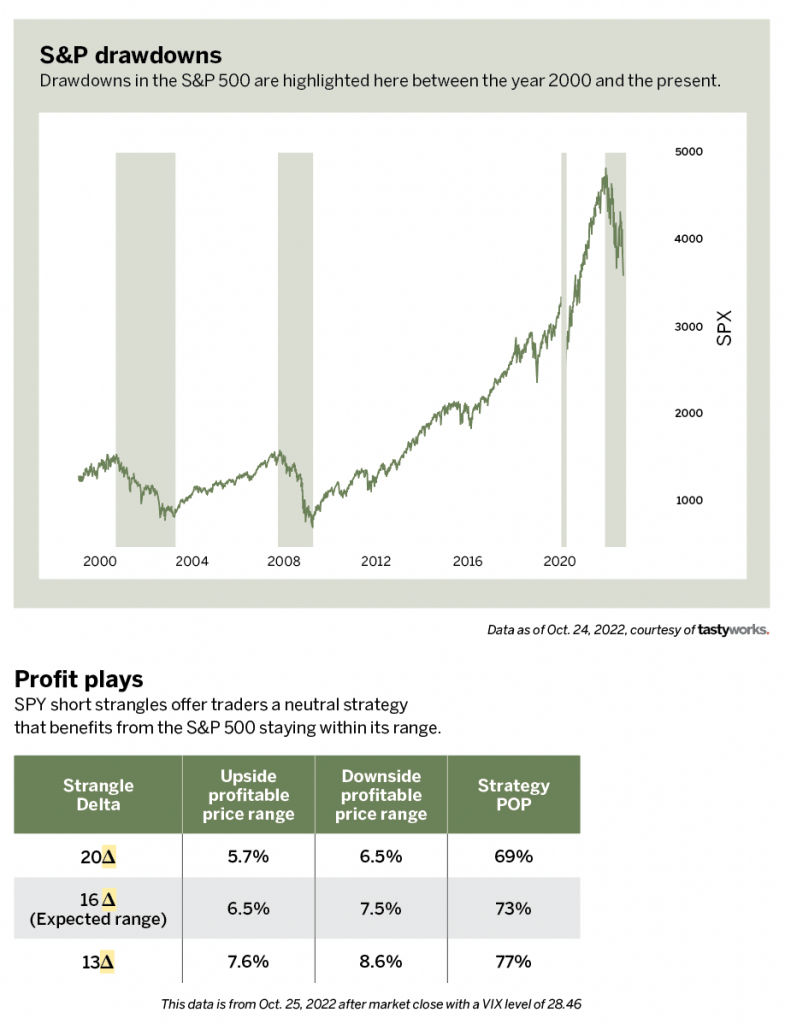

First, let’s contextualize the U.S. market’s behavior over the past year, noting that analyzing past performance doesn’t necessarily grant powers of prediction. The S&P 500 (SPX) deflated by 21% from January 2022 to mid-October, as shown in the table S&P 500 vs. VIX, below.

The cumulative loss in the S&P during the bear market of 2022 hasn’t been as severe as in previous major drawdowns. What’s happening now resembles the gradual burn of the dot-com bubble.

In 2022, S&P averaged a loss of about 0.1% per day with roughly 25% higher volatility of daily returns than during typical market conditions. The perceived (implied) volatility during 2022, as measured by the Chicago Board Options Exchange’s Volatility Index, or VIX, averaged 30% higher than in typical market conditions and significantly lower than in more volatile selloffs.

The table called Tracking the S&P 500 shows how often it remained within its expected monthly price range (the approximate range that the asset price should remain within 68% of the time) throughout different drawdown periods.

One observation is that the price of SPX exceeded its monthly expected range more often throughout the dot-com bubble burst and 2022, possibly a consequence of implied volatility being only moderately elevated during these periods of increased market volatility.

So, how does one build a viable strategy based on this analysis of current market conditions?

Elevated periods of implied volatility are ideal for short premium strategies because contract sellers can potentially collect higher profits from inflated contract prices.

In addition, neutral short premium strategies may be suitable for this market because they’re high-POP trades that profit from time and volatility decay rather than large directional moves.

Take the example of a short strangle, a neutral strategy consisting of a short out-the-money (OTM) put and a short OTM call, which can profit regardless of whether the market trends moderately upward, downward, or sideways.

The short strangles shown in the table titled Profit plays, will make money if the price of the S&P 500 ETF (SPY) doesn’t drift more than 5.7% to 7.6% to the upside or more than 6.5% to 8.6% to the downside over the next 24 days.

The S&P 500 has been less likely than usual to remain within its expected range recently, so strangles with strikes wider than the expected range (such as 10 and 13 Delta strangles) may be more appropriate for today’s market conditions—especially if unforeseen events of the magnitude seen this year continue to explode onto the scene in 2023.

Julia Spina, a member of the tastytrade research team and author of The Unlucky Investor’s Guide to Options Trading, holds degrees in engineering physics and applied mathematics and a master’s in physics.

@financephoton