A Clean Break From Energy Stocks

Renewables account for an increasing share of energy production, but liquidity limits their tradability

Fossil fuels have dominated the global energy sector for a century and a half and have defined how investors trade energy stocks for decades. But these days they’re getting some competition—renewable sources now account for 29% of global energy production.

That’s why clean energy stocks and exchange-traded funds (ETFs) are poised to disrupt how traders invest in energy as economies around the world renovate energy infrastructure.

The two largest American energy companies, Exxon Mobil (XOM) and Chevron (CVX), comprise 0.91% and 0.83% of the S&P 500, respectively. Those two companies combined make up roughly 42% of the holdings for XLE (Energy Select Sector SPDR ETF), the largest energy exchange-traded fund by market capitalization.

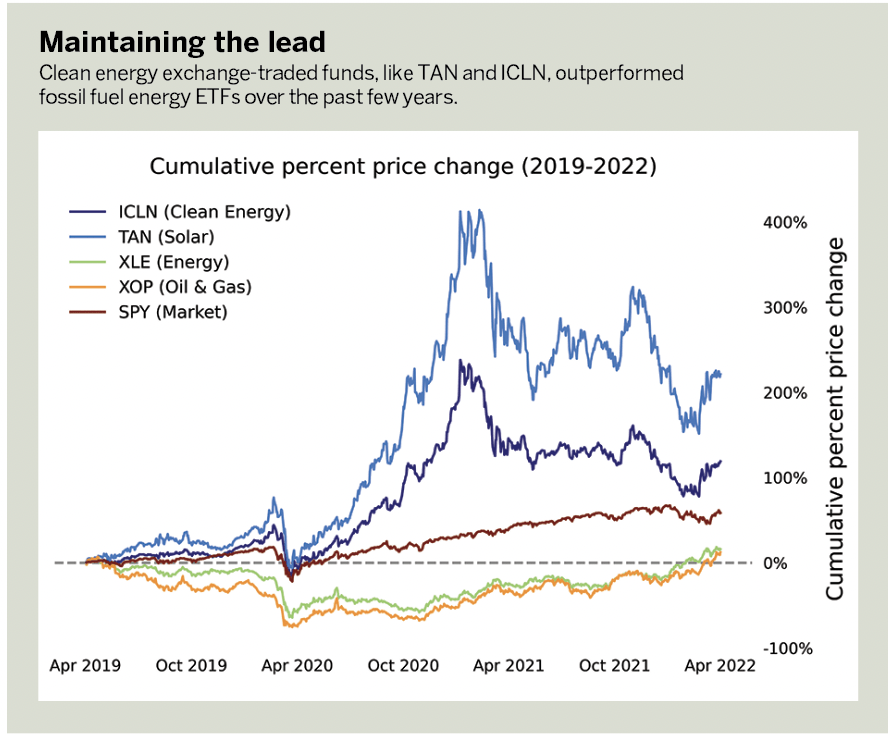

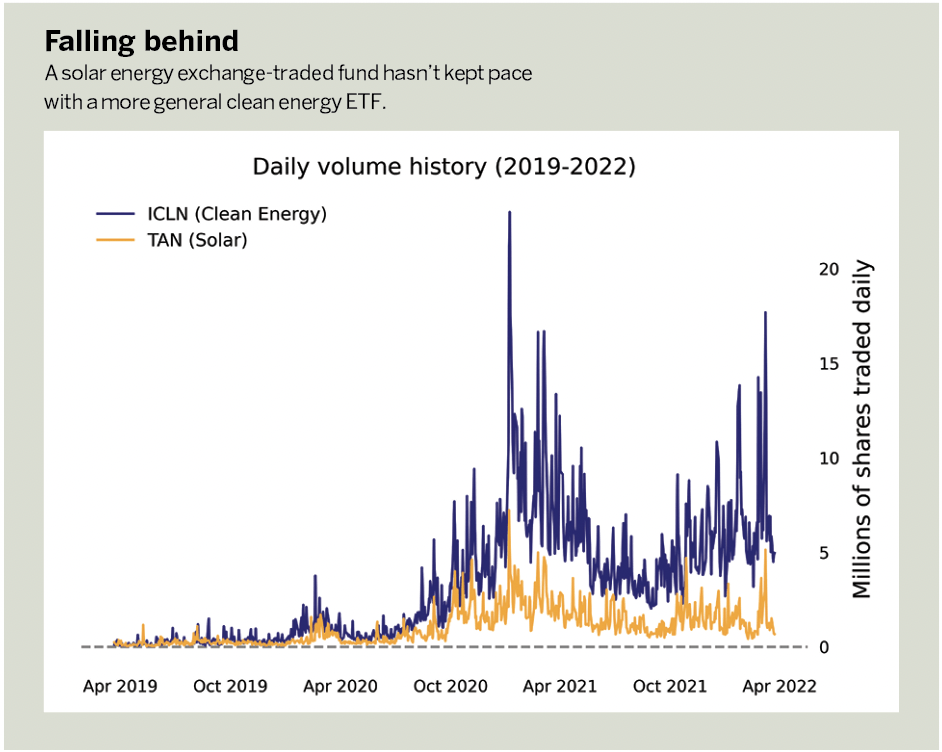

Leading energy ETFs, such as XLE and XOP (SPDR S&P Oil & Gas Exploration & Production ETF), have been concentrated in oil and gas historically. However, a number of clean energy ETFs, such as ICLN (iShares Global Clean Energy ETF) and TAN (Invesco Solar ETF), experienced explosive growth in recent years.

Despite a strong bull run since 2021, XLE and XOP showed relatively stagnant long-term performance, only growing by 18% and 9%, respectively, since 2019. Comparatively, as shown in Maintaining the lead, TAN grew by 229% in the past three years. ICLN has grown by 118% over the same period and now matches XOP in market capitalization.

The notable growth of those clean energy products presents an interesting opportunity for investors; however, liquidity is currently limiting tradability of renewable products. An equity is generally considered liquid if it fulfills the following criteria:

• A high daily volume, meaning many shares—often more than a million—are traded daily.

• A tight bid-ask spread, meaning a small difference between the maximum a buyer is willing to pay and the minimum a seller is willing to accept, often less than 0.1% of the asset price.

Options liquidity differs from equity liquidity because a liquid equity may not have an equally liquid options market. An underlying with a liquid options market should have contracts with tight bid-ask spreads, high daily volumes, and a diverse selection of durations and strikes. More specifically, an underlying with a liquid options market ideally exhibits:

• A high open interest or volume across strikes of at least a few hundred per strike.

• A tight bid-ask spread greater than 1% of the contract price.

• Contracts with several strike prices and expiration dates.

Popular clean energy ETFs, such as ICLN and TAN, have become significantly more liquid since 2020, and investors can use them to gain energy exposure while diversifying against oil- and gas-specific factors that tend to influence the rest of the energy sector.

ICLN, in particular, is the most liquid and also has a fairly liquid options market. Generally speaking, clean energy ETFs still carry some degree of illiquidity risk for investors, particularly options traders, but trends suggest that this risk is diminishing as renewables grow in the energy sector.

Julia Spina, a member of the tastytrade research team and author of The Unlucky Investor’s Guide to Options Trading, holds degrees in engineering physics and applied mathematics and a master’s in physics.

@financephoton