The Risks of a Budding Market

What active investors need to know about trading marijuana stocks and exchange-traded funds

Cannabis has come a long way. Once a focal point of America’s war on drugs, it’s now legal for recreational use in

19 states and for medical use in 37 states.

Lifting restrictions has had momentous results. U.S. marijuana sales reached a staggering $17.5 billion in 2020, as reported by Forbes, and the cannabis industry has become a promising emerging market for investors.

But the sector faces significant obstacles. Marijuana remains illegal under federal law and is still classified as a Schedule 1 drug, alongside heroin. That reduces the size of the market, hampers supply chains and limits investment in the industry.

This legal obstacle also casts a shadow over cannabis stocks and exchange-traded funds (ETFs), which this article will contextualize with examples of liquid cannabis assets that also have liquid options markets.

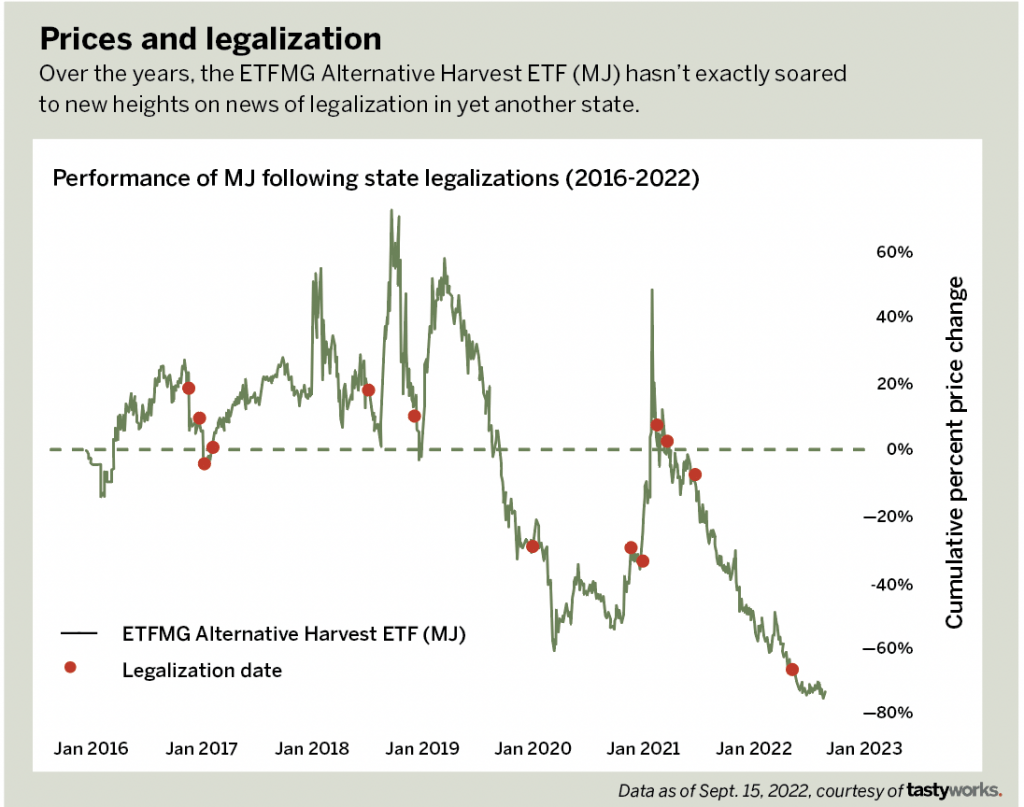

The first statewide legalizations of recreational marijuana began in 2012 with Colorado and Washington, followed by waves starting in 2015. But legalization didn’t trigger a noticeable or consistent rise in asset prices for marijuana stocks and ETFs in the short- or long-term.

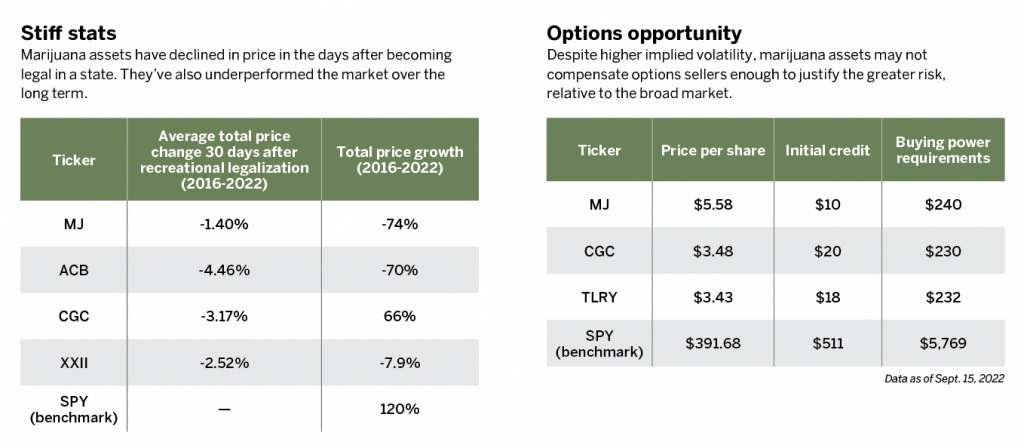

Consider the performance of the ETFMG Alternative Harvest ETF (MJ) following state recreational legalizations shown in Prices and legalization. Stiff stats, opposite page, also shows an analysis of how prices for MJ and a collection of marijuana stocks have responded to legalization in the short term (the average 30-day price change) and in the long term. All of these assets have dramatically underperformed compared with the market since 2016.

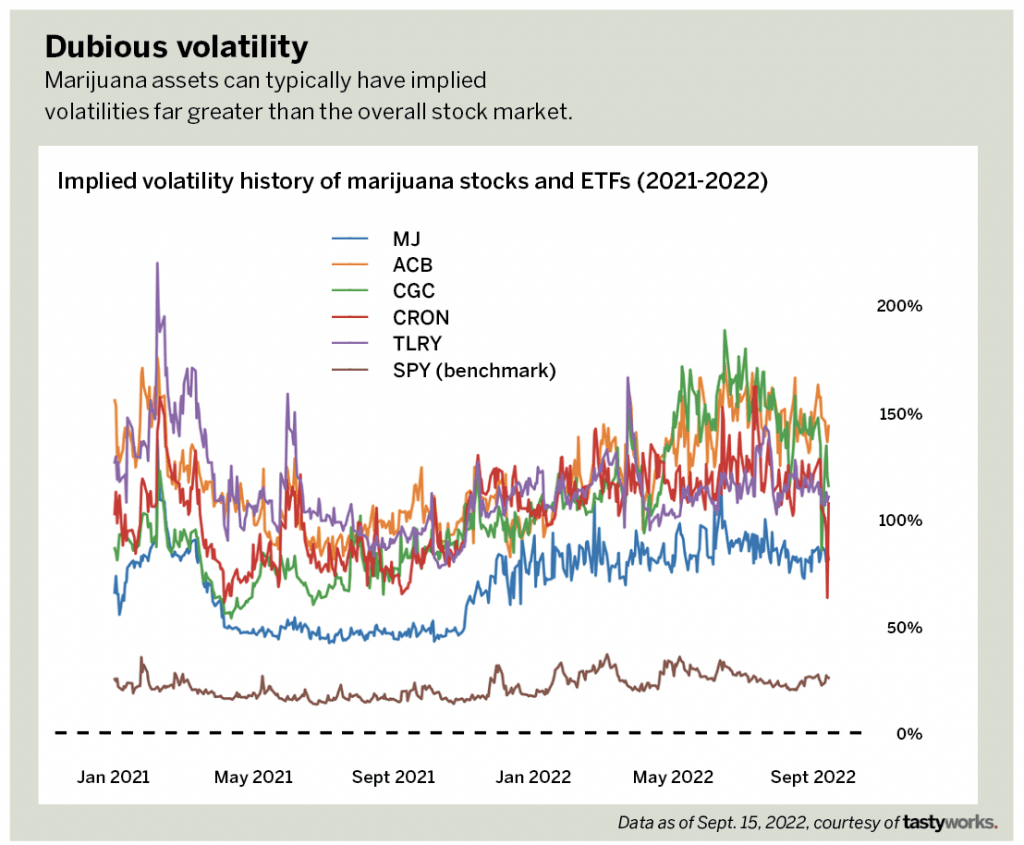

Both Prices and legalization and Stiff stats demonstrate that despite increasing legal, political and social acceptance of marijuana in the United States, the market has not yet fully embraced the industry. Marijuana assets, such as those under Dubious volatility, right, remain highly volatile compared with a market ETF, like SPY, and carry significant risk for investors.

Because many of the marijuana assets are fairly inexpensive, opportunities for options traders are also limited despite the highly implied volatility. Options opportunity, above, illustrates how to gain long exposure to marijuana assets by trading short 25∆ puts, a bullish short option trade with a roughly 75% probability of profit.

Because of buying power requirement minimums, or the capital needed to open and maintain a short premium trade, the marijuana asset put options collect roughly the same initial credit per unit of buying power as the SPY put, which has a much less volatile underlying.

The political developments of the last 10 years have resulted in a wide variety of liquid cannabis stocks, ETFs, and derivatives for the retail market. While the cannabis sector is an exciting emerging market with a promising future, trading assets in this sector remains highly speculative because of its pervasive legal obstacles.

Julia Spina, a member of the tastytrade research team and author of The Unlucky Investor’s Guide to Options Trading, holds degrees in engineering physics and applied mathematics and a master’s in physics.

@financephoton