3 Reasons the 2023 Bull Run Continues

The stock market has been on a strong bull run in 2023, with the S&P 500 up 20% and the Nasdaq 100 up over 40%

The stock market has been on a strong bull run in 2023, and it appears that better-than-expected corporate earnings and a resilient U.S. economy—as well as a forthcoming Fed “pivot”—have all contributed to recent optimism.

- The stock market has been on a strong bull run in 2023, with the S&P 500 now up 20% on the year, and the Nasdaq 100 up over 40% on the year.

- Corporate earnings have been stronger than expected in Q2—80% of the companies that have reported earnings have announced better-than-expected results.

- The Fed raised interest rates a quarter percentage point on July 26, but as of right now, the market isn’t expecting another increase in August or September.

The stock market has been on fire in 2023, and the onset of Q2 earnings season has done little to slow it down.

So far this year, the S&P 500 is up 20%, while the tech-heavy Nasdaq 100 is up 45%. Those levels of return are especially surprising because 2022 was such a bad year for the stock market.

So, what’s changed in 2023? It’s never easy to pinpoint exactly why the stock market is moving in one direction or the other, but several key narratives appear to be supporting the current bout of optimism in the U.S. stock market.

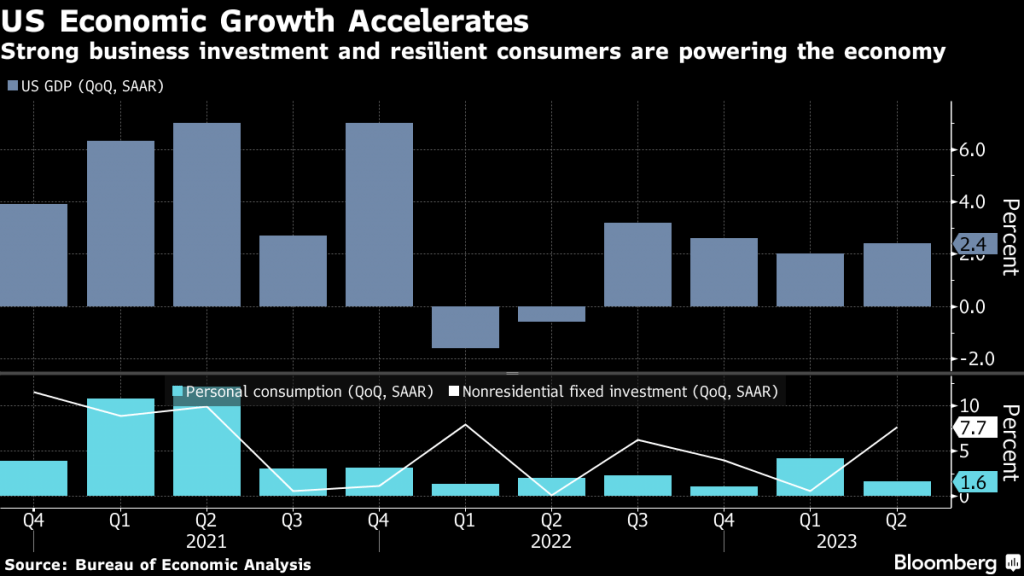

At the top of the list is the U.S. economy, which has been surprisingly resilient in 2023, despite record-high interest rates.

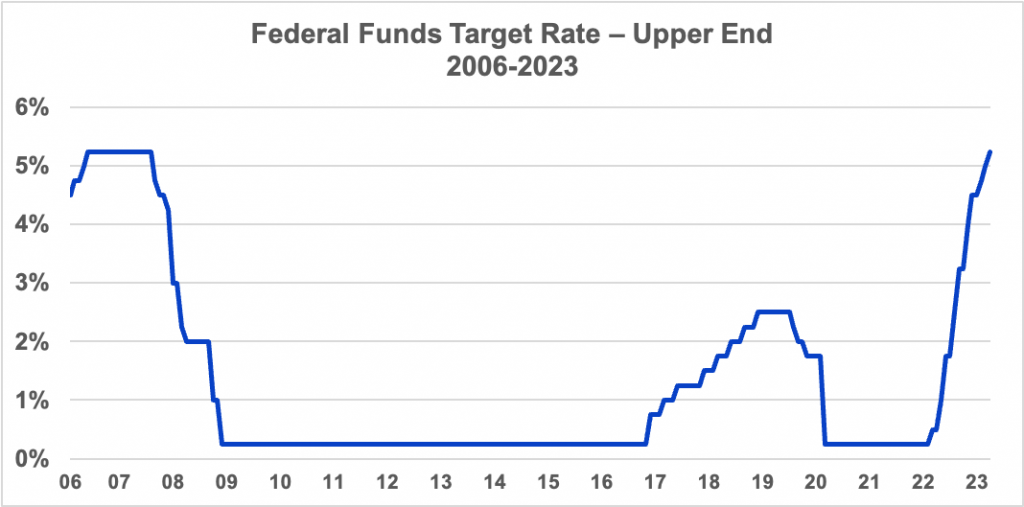

On July 26, the Federal Reserve raised interest rates for the 11th time since March of 2022, bringing the benchmark federal funds rate to a target range of 5.25-5.50%. That’s the highest level in benchmark rates since 2001.

However, despite that gloomy overhang, the government announced on July 28 that the underlying economy grew at a healthy clip of 2.4% in Q2, which was far better than most projected.

Resilience in the U.S. economy has undoubtedly contributed to greater optimism in the financial markets. And considering that backdrop, it’s no great surprise that corporate earnings have also surprised to the upside in Q2.

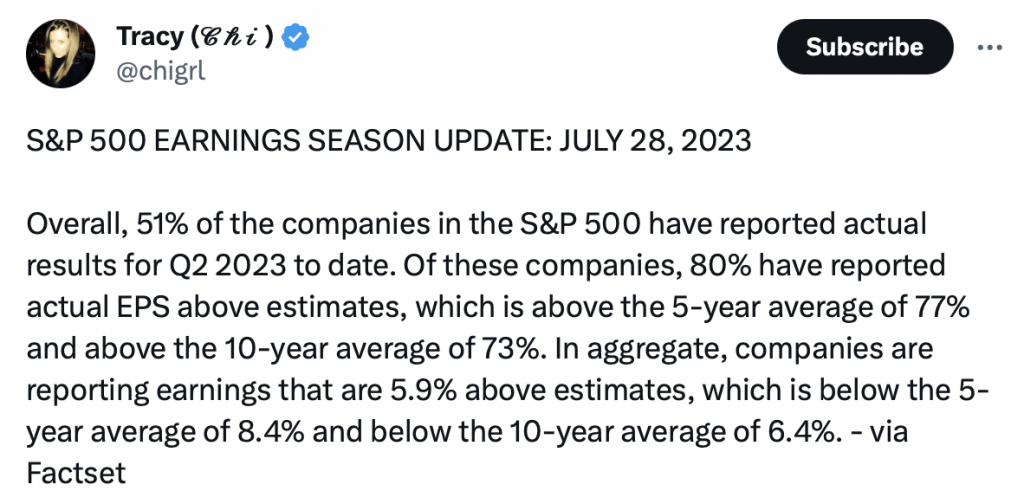

Better-Than-Expected Q2 Corporate Earnings

Corporate earnings started to contract in 2022, and many anticipated they would contract further in 2023.

However, much like the broader economy, corporate profits have remained relatively robust so far this year.

In Q1, most analyst projections suggested that corporate earnings would shrink by 6-7% in the first three months of 2023. Interestingly, however, corporate earnings dropped by only about 2% in Q1, which was vastly better than what was projected.

And that same situation appears to be playing out again in Q2.

Leading up to Q2 earnings, most analyst projections indicated that corporate earnings would drop by more than 5% in Q2. However, the Q2 figures have once again been beating expectations.

Q2 earnings season is still ongoing, but at the current clip, the earnings contraction in Q2 will be a lot milder than expected. Along those lines, JPMorgan (JPM) recently pointed out that “80% of S&P 500 firms have beat Q2 EPS estimates so far this earnings season.”

And it certainly doesn’t hurt when many of the highest-profile U.S. companies are providing upside surprises.

In recent weeks, companies like Alphabet (GOOGL), Meta (META) and Microsoft (MSFT) have all beaten expectations, and seen their shares react positively in the wake of those reports.

As such, resiliency in corporate earnings has undoubtedly contributed to fresh optimism in the stock market.

The Infamous Fed “Pivot” May Soon Be Upon Us

In addition to the economy and corporate earnings, another key theme in 2023 has been the Federal Reserve’s crusade to reign in inflation.

The Fed did raise interest rates again on July 26, but there’s fresh optimism that the current rate-hike cycle may finally be over.

Currently, interest rates markets are projecting that the Federal Reserve will stand pat on interest rates at their next meeting, which is scheduled for late September. That could mean that the Fed has raised interest rates for the last time during the current rate-hike cycle.

And considering how long the market has been waiting for the Fed to “pivot” away from its current hawkish approach, it’s no great surprise that this development has catalyzed fresh euphoria in the stock market.

Source: U.S. Bank

Importantly, however, one must keep in mind that expectations can change over time. And if the inflation figures start to rebound, and get hotter over the next six weeks, then the Fed may still be forced to raise rates another quarter percentage point in September.

But even if that scenario did play out, one wonders if it would even matter. The U.S. central bank has been raising rates steadily in 2023, and yet the stock market continues to rally.

Considering the ongoing bull, it appears that steady economic growth and resilient corporate earnings have been far more important than elevated interest rates.

Whether the rally can extend further, however, is another question altogether.

If the economy does start to falter, and corporate earnings take a bigger hit than what’s been observed thus far, the current rally could finally stall out.

It’s important to note that the impact of higher rates isn’t always felt immediately. According to some experts, it can take up to 12 months for the full effect of higher rates to be felt in the economy.

And considering that the Fed was raising rates from basically zero percent, that means the initial part of the current rate-hike cycle probably wasn’t that onerous for the economy. That may indicate that the full impact of the rate hikes hasn’t yet been absorbed into the economy.

From this perspective, the slowdown in the economy may not take effect until later in 2023, or in 2024. For example, according to a recent analysis by Citibank (C), a U.S. recession may not materialize until the end of 2024.

For now, however, the status quo appears to be enough to keep the stock market trending higher. Interestingly, the breadth of the rally has also improved in recent weeks, meaning that a higher percentage of stocks are now participating in the current bull run.

Whether that’s a signal that the current rally can expand from here is anyone’s guess. To follow everything moving the markets, readers can tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.