How a Resurgence of the U.S.-China Trade War Could Disrupt the Economy and Stock Market

On the campaign trail, Trump says he plans to raise import duties on many of the country’s trading partners if he’s re-elected to the White House. That could be disruptive to the U.S. economy.

- The Biden administration recently announced new tariffs on Chinese imports, with a particular emphasis on the green energy sector.

- On the campaign trail, Donald Trump has declared his intention to increase tariffs on China and other U.S. trading partners, should he win re-election in November.

- Research indicates a protectionist trade policy resonates with the American electorate, but consumers ultimately bear the cost of high tariffs, in the form of higher prices.

It’s been about six years since former President Donald Trump first instigated his now infamous trade war with China. And with another presidential election slated for November, it’s no great surprise that tariffs have resurfaced as a key political talking point.

A recent report from The New York Times says tariffs are popular with American voters—likely because they believe tariffs protect the U.S. economy from foreign competition. However, according to many economists, tariffs ultimately raise prices for consumers.

According to a recent nonpartisan analysis, the tariffs implemented by Trump led to higher prices for many consumer goods in the United States, without providing a corresponding benefit to employment within the impacted industries. As such, the tariffs failed to deliver job growth, but they have resulted in increased costs for American consumers. The tariffs also prompted a rearrangement of trade routes and global logistics.

Trade disruption

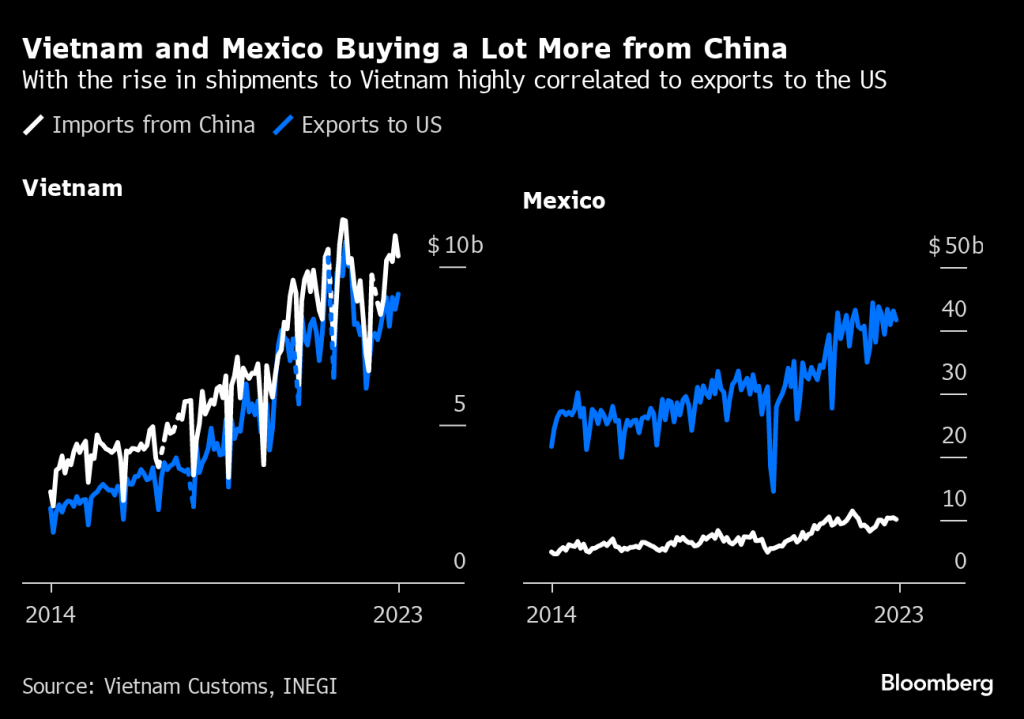

The COVID-19 pandemic was undoubtedly disruptive to global trade activity. But an analysis of Chinese export data from before the pandemic compared to today shows some disruptions persist even now, as global producers work to sidestep U.S. trade barriers. Chinese-made goods increasingly reach the U.S. through complex routes.

In February 2020, Chinese exports to the United States totaled about $43 billion. By February 2024, the figure had declined to about $30 billion. But there’s a catch.

An analysis by Nikkei Asia shows that some Chinese producers circumvent the tariffs by rerouting their goods through countries like Mexico and Vietnam. And Nikkei reports that this tactic significantly increases the flow of goods through these countries, with their origins often obscured.

A specific example involves commercial speakers originally made in China but repackaged and labeled as “made in Vietnam.” Officially, U.S. imports from Vietnam are now 95% higher, compared with 2019 levels. And such “transshipments,” explain at least part of the surge.

Producers often use transshipment—in which goods go from one destination to another via an intermediate stop—to exploit more favorable trade conditions, or to avoid tariffs. This practice illustrates the complexities and challenges in enforcing trade regulations.

Rather than navigating complex trade routes, some Chinese manufacturers have simply relocated their manufacturing facilities to countries not subject to the increased tariffs.

For example, the past few years have seen an influx of Chinese producers into the Hofusan Industrial Park in Monterrey, Mexico. This industrial park, located about 120 miles from the U.S. border, is so large that it features 12,000 homes for workers.

Due to the United States-Mexico-Canada Agreement (USMCA, formerly NAFTA), goods produced at manufacturing hubs like Hofusan can be exported duty-free to the U.S.

Latest developments in the U.S.-China trade war

After simmering on the back burner, the U.S.-China trade war has gained renewed attention in 2024, largely driven by the upcoming presidential election.

On the campaign trail, Trump has sharply criticized China and proposed aggressive new measures, including a substantial 60% tariff on Chinese goods and a blanket 10% tariff on most goods from other American trading partners.

This platform is clearly designed to appeal to voters concerned about the influences of foreign countries on the U.S. economy, while also reinforcing Trump’s “tough-on-China” image.

However, it is unlikely the government would enact a 60% across-the-board tariff on China. Such an elevated level of import duties would push down Chinese imports to virtually zero, based on some projections (highlighted below). Considering China’s vital importance in the global supply chain, this doesn’t seem feasible.

In response to Trump’s aggressive trade rhetoric, Biden’s administration has been actively fine-tuning its own trade strategies. On May 14, the White House announced a fresh round of tariffs targeting Chinese producers of electric vehicles (EVs), medical supplies, semiconductors and solar equipment. This is a strategic move by the Biden administration to publicly address trade issues, while also attempting to mitigate the impact of the tariff narrative on the upcoming election.

On May 10, The Wall Street Journal reported that tariffs on Chinese-made EVs will likely quadruple under the new tariff regime, jumping from 25% to 100%, or more. While this makes for a compelling headline, it’s important to note that Chinese EV exports to the U.S. are already minimal. The EV-focused tariffs are therefore mostly symbolic, and intended to send a message, as opposed to an actual punitive measure against China.

As a reminder, the Biden administration initiated a comprehensive review of U.S. trade policies starting back in 2022. This review placed particular emphasis on a “Section 301” review of U.S. trade law. Section 301 empowers the Office of the U.S. Trade Representative (USTR) to investigate and address trade practices deemed unfair or discriminatory, which adversely affect U.S. commerce.

If a Section 301 investigation concludes that a foreign practice is unjustifiable and burdens/restricts U.S. commerce, the USTR can take various actions. These measures can include imposing trade sanctions, such as tariffs or other trade barriers. The goal of these tactics is to compel the trading partner to eliminate the unfair practice, or to offer compensation for adverse effects on the U.S. economy.

As part of the review process, Biden indicated last month his administration intends to raise the existing tariffs on Chinese exports of steel, aluminum and other metal-related products. President Biden indicated the current tariffs of roughly 7.5% could more than triple, to around 25%. The measures were justified by allegations that China engages in unfair trade practices, including the illegal subsidization of its private sector, which distorts the competitive landscape, and harms U.S. industries.

Biden said: “Prices are unfairly low because China’s steel companies don’t need to worry about making a profit because the Chinese government subsidizes them so heavily. They’re not competing, they’re cheating.” But to take the sting off his allegations, Biden added, “I want fair competition with China, not conflict.”

In recent statements, other members of the Biden administration, including U.S. Treasury Secretary Janet Yellen, have highlighted concerns about “overcapacity” in the Chinese economy. This type of overcapacity can lead to dumping, whereby excess goods are sold below cost in global markets, thus undermining industries in other countries. In an interview with Reuters Next, Yellen criticized China’s practice of using government subsidies to maintain high production levels, noting: “China exporting its way to full employment is not acceptable to the rest of the world.”

Potential ramifications of a renewed trade war

If Trump prevails in November and implements a more stringent tariff regime, many experts predict the U.S. economy will be adversely affected. According to Mark Zandi—the chief economist at Moody’s—the retaliation to those tariffs could be substantial, and potentially catalyze a contraction in the U.S. economy. Speaking to that potential outcome, Zandi told CNN, “If Trump increases tariffs as he has proposed, the economy would likely suffer a recession soon thereafter.”

Economists at Goldman Sachs, under the leadership of Jan Hatzius, forecasted comparable results. In a client advisory, they noted, “Based on the experiences of 2018-2019, aggressive tariffs are likely to lead to broader indirect consequences, including tighter financial conditions, diminished business sentiment, and heightened uncertainty in trade policies.”

These predictions mirror some of the outcomes observed from Trump’s first trade war with China. According to a report by the Brookings Institution, Trump’s tariffs “forced American companies to accept lower profit margins, cut wages and jobs for U.S. workers, defer potential wage hikes or expansions, and raise prices for American consumers or companies.”

As noted previously, the tariffs forced China to export its goods through a more circuitous route, and as a result, the U.S. saw its trade deficits with other countries suffer. Per the Brookings report, “Trump’s unilateral tariffs on China diverted trade flows from China, causing the U.S. trade deficit with Europe, Mexico, Japan, South Korea, and Taiwan to increase as a result.”

Potential unwelcome news for farmers

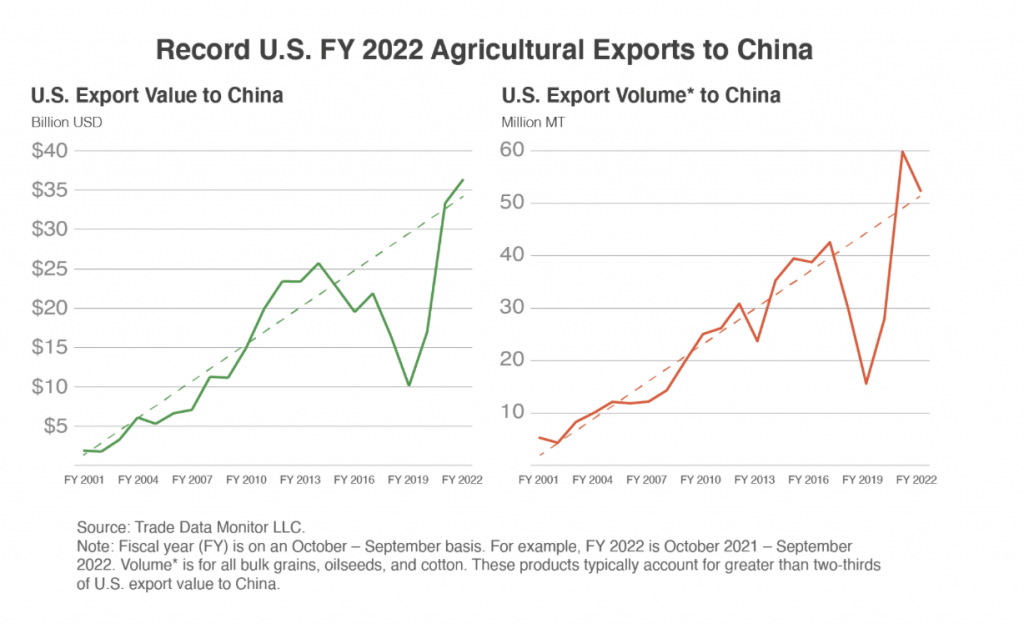

Many will recall that American farmers were significantly impacted during the initial stages of the trade war, particularly when China retaliated by cutting its imports of key American agricultural products, including cotton, sorghum, and soybeans.

About a year into the trade war, the American Farm Bureau said: “Farmers have lost the vast majority of what was once a $24 billion market in China” due to the trade war. Since Trump left office, U.S. agricultural exports to China have rebounded dramatically, as illustrated below.

If Trump is re-elected and decides to escalate the trade war, it’s almost certain that Chinese buyers will renew their boycott of American agricultural products. This risk was underscored recently when Brazil surpassed the United States as China’s leading corn supplier, highlighting the vulnerability of the U.S. agricultural market to future fallout from the trade war.

Final takeaways

A flare-up in the trade war would almost certainly weigh on the U.S. stock market. The market corrected sharply in 2018, and experts attributed the pullback largely to uncertainty linked to the trade war. As if that weren’t enough, increased global protectionism could also spur a rebound in inflation, because according to numerous studies, American businesses and consumers endure most of the cost from increased tariffs.

Another unfortunate reality is America’s trade dispute with China has arguably pushed the latter into a closer relationship with Russia. And over the medium and long-term, the risks of such a geopolitical shift could far outweigh any benefits accrued from the trade war, because a strong alliance between China and Russia could ultimately undermine the strategic interests of the United States.

Considering all the above, U.S. trade policy—including the tariff issue—looms large in the upcoming presidential election. If Trump wins re-election, investors and traders need to be cognizant of potential risks to the economy and the stock market, especially if the newly elected president implements his aggressive plan on tariffs.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.