Argentina’s Economic Success: Can U.S. Learn from Milei’s Reforms?

The U.S. faces tough fiscal choices, and Argentina’s bold reforms may provide a blueprint.

- Argentina’s fiscal reforms helped tame inflation and sparked a market rally, but also exacerbated poverty and unemployment.

- The U.S. is considering similar austerity measures but could face economic fallout from this approach.

- The U.S. often delays major fiscal reform until a crisis unfolds.

Argentina has spent years battling debt, poverty and inflation but is seeing a remarkable turnaround under President Javier Milei. His austerity measures, including slashing government spending and devaluing the peso, have tamed inflation and sparked a market rally. However, change has come with significant social costs, including rising poverty and unemployment. Despite the pain, Milei’s approval rating remains strong because many believe his decisions will ultimately stabilize the Argentinian economy.

With the U.S. grappling with its own fiscal challenges—soaring deficits and burgeoning national debt—the question arises: Can the U.S. follow Argentina’s lead? While President-elect Trump and his advisor Elon Musk have praised Milei, applying his approach in the U.S. would be far more complex. Will the U.S. act preemptively to avoid a crisis or wait until an economic downturn forces the country to make tough decisions? Let’s consider whether the U.S. could draw lessons from Argentina’s experience—and the risks of doing so.

Milei’s shock therapy: early wins, continuing challenges

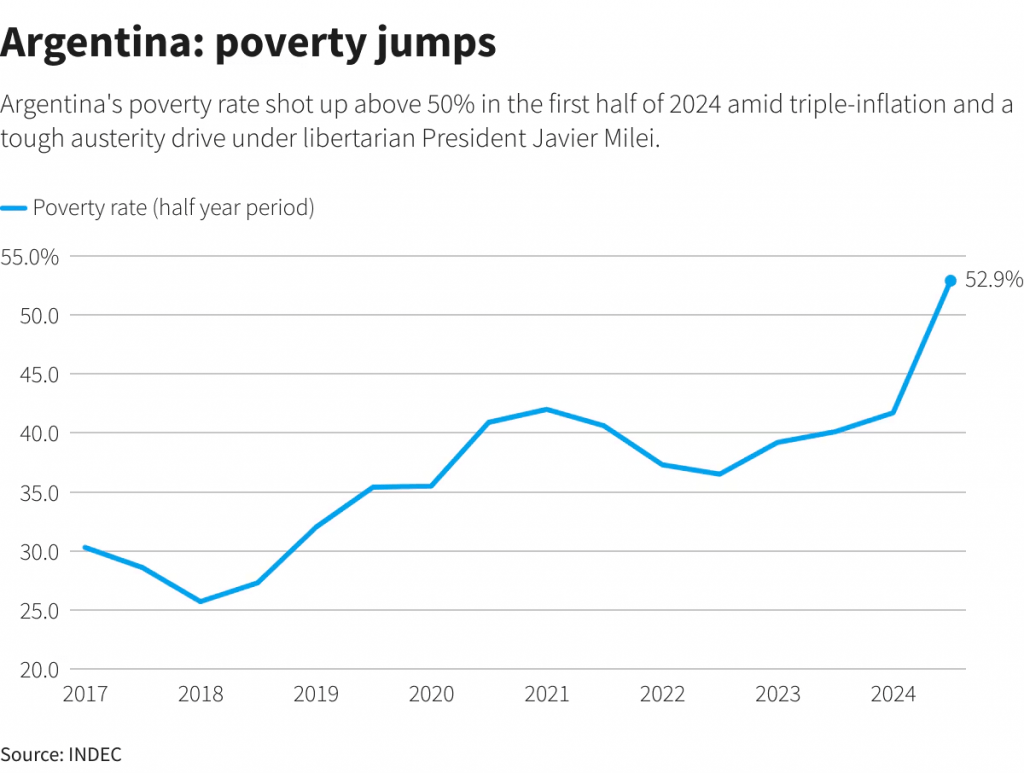

Argentina, once among the wealthiest nations in the world, has been mired in economic turmoil for decades. By the time Milei took office in December 2023, The country was grappling with the world’s third-highest inflation rate—above 200%—and a poverty rate surpassing 40%. The country’s economic quagmire was rooted in years of government mismanagement, excessive spending and unsustainable fiscal policies. Against this backdrop, Milei, a libertarian and outsider, emerged as a stark contrast to the traditional political class. His campaign promise to dismantle the state resonated with voters desperate for an alternative to decades-long economic stagnation.

Upon taking office, Milei wasted no time in implementing sweeping changes. His government immediately slashed state spending, devalued the peso by over 50% and cut subsidies on energy, transportation and essential goods. Those measures were aimed at curbing inflation and restoring fiscal discipline. As a result, inflation has dropped sharply from its 2023 peak, signaling some early signs of success. “Inflation was the big phenomenon that voters really cared about,” said Federico Robles, a Latin America expert at the Wilson Center.

But those drastic measures have come at a profound social cost. The country’s poverty rate rose to 53% in the first half of 2024, thanks to austerity policies that included cuts to pensions and government jobs. And the elimination of subsidies for public transportation and energy has left many average citizens struggling to afford necessities. But many still endorse the austerity agenda. ”Nothing about the current disinflationary dynamic has much bearing on the quality of life of families,” said economist Sergio Chouza. And despite the hardships, Milei’s approval rating remains elevated, with many Argentinians hopeful the long-term benefits will outweigh the current pain.

Internationally, Milei’s aggressive economic strategy has garnered praise, particularly from figures like Musk and 2024 presidential candidate Vivek Ramaswamy, who admire his commitment to fiscal discipline. However, the sustainability of these policies remains in doubt. The Argentinian economy was in recession during the first half of 2024. And while the recession technically ended in Q3, unemployment levels remain critically high. However, “There are some signs that the most painful phase of the Milei adjustment may be over,” noted Juan Ignacio Carranza, an economist with Aurora Macro Strategies.

Milei’s blueprint for Argentina has caught the attention of policymakers in other countries, particularly in the United States. His harsh fiscal measures, designed to reduce government spending and promote free-market principles, have sparked discussions about similar approaches in other economies. However, as Argentina’s experience shows, such reforms come with risks. “First, we will have to go through hell,” Milei himself noted during his presidential campaign.

Economic revival with a heavy social toll

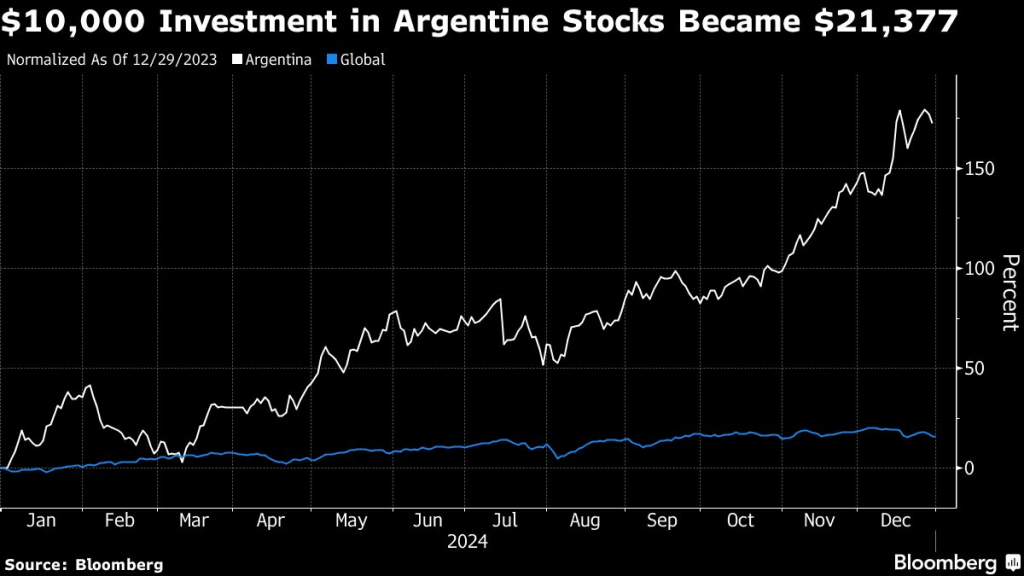

Early in Milei’s tenure, Argentina’s financial markets had a remarkable rebound, driven by investor confidence. The country’s stock market, particularly the S&P Merval Index, surged by roughly 160% in 2024, making it the top performer globally. The gains reflected the market’s optimism that Milei’s stringent austerity measures would create a more stable launchpad for economic growth.

Similarly, the Global X MSCI Argentina ETF (ARGT), which tracks the country’s stock performance, rallied by nearly 65% in 2024. Argentina’s bonds have also rallied, offering substantial returns for investors who placed bets on a potential recovery. Speaking to The Wall Street Journal, one hedge fund manager recently observed that “the nature of this U-turn has been breathtaking.”

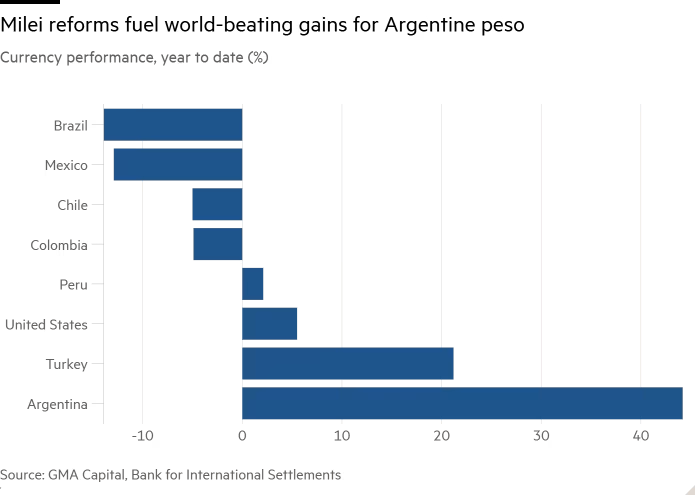

A key component of Milei’s success in stabilizing the economy has been his handling of the peso, which has strengthened dramatically in 2024. The currency appreciated by more than 40% in real terms (illustrated below) last year, bolstered by Milei’s attempt to close the gap between official and black-market exchange rates. This move, while popular among Argentinians who have seen their salaries rise, has raised concern among economists about the long-term sustainability of an overvalued peso.

Still, the short-term effect of Milei’s approach has been a surge in investor confidence. The country has even posted a fiscal surplus for the first time in many years. That helped fuel optimism in the financial markets, with analysts praising the administration. “If the fiscal anchor that Milei has so firmly planted in the ground stays in place, if this disinflation trend continues, bondholders should expect substantial gains,” said Genna Lozovsky, co-founder of Sandglass Capital Management

Despite those positive developments, the situation remains precarious. Some analysts caution that the strength of the peso, while initially beneficial, could hurt Argentina’s export competitiveness in the long term. “If the peso continues to appreciate, or if there is a big external shock, demand for cheap dollars could surge, increasing the risk of devaluation,” said Ramiro Blázquez, head of research at BancTrust. This balance between fiscal discipline and the risk of overvaluation underscores the delicate nature of Milei’s economic policies.

In the context of Argentina’s impressive market performance, it’s clear Milei’s policies have sparked a new wave of optimism. On the other hand, the very factors that have contributed to the market’s rally—such as the strong peso and aggressive fiscal cuts—could be sources of future instability.

Should the U.S. follow Argentina’s lead?

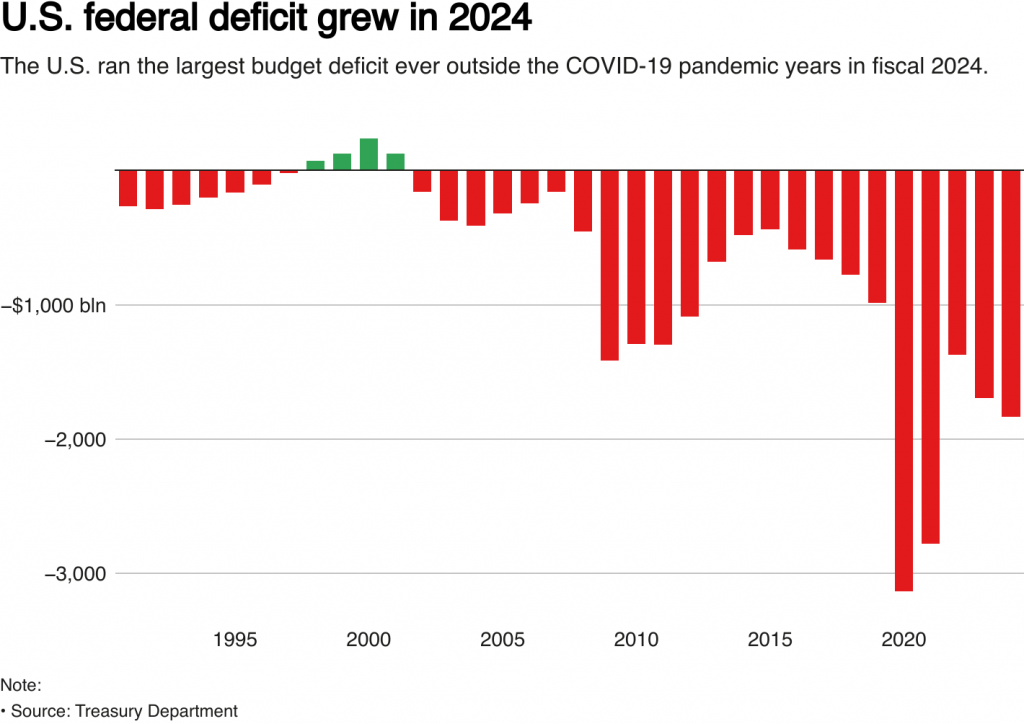

In the United States, rising government deficits have inspired some to look toward Argentina’s recent economic overhaul for potential lessons. The Department of Government Efficiency (DOGE), a new initiative led by Musk and Ramaswamy, has drawn parallels to Argentina’s experience under Milei. DOGE’s mission is to streamline government operations, reduce budgets and curb annual spending deficits—goals that echo Milei’s austerity measures in Argentina. Milei aimed to restore economic stability, much as Musk and Ramaswamy have advocated for reducing spending to throttle back the U.S. government’s deficit. The national debt in the United States now exceeds $36 trillion.

The parallels are striking: Argentina and the U.S. both face issues with government spending and high inflation. U.S. credit downgrades in 2023 highlighted the risk. Cutting government spending in both countries is viewed as critical to avoiding a debt crisis, although the U.S. arguably faces more complex circumstances.

While Milei’s measures in Argentina have garnered praise from market participants, who have rewarded Argentina’s bonds and stocks with impressive gains, the harsh reality of these austerity measures is less often discussed: rising poverty and increasing unemployment. And due to these hardships, some Argentinians have pushed back against the reforms, as evidenced by ongoing protests.

For the U.S., there could be significant risk in adopting a similar approach. Severe government cutbacks would almost cerainly cause a recession, and excerbate income inequality in the country, which is already a big problem. The stock market’s reaction in the U.S. would likely differ, as well.

In the U.S., the major stock indices are already pushing against all-time highs. And under the recession scenario, corporate earnings would assuredly fall, increasing the risk of a stock market correction. In U.S. history, the sharpest market pullbacks have corresponded with recessions, and the same pattern could emerge if austerity measures throttle economic growth in 2025 or 2026. While investors in Argentina may see the long-term potential of fiscal stability, U.S. markets probably wouldn’t be as forgiving, especially with an uncertain timeline for a potential recovery. That makes the notion of large-scale spending cuts a lot harder to sell to American voters, much less the financial markets.

Aside from the above, there’s also the question of political will. Government leaders in the U.S. have traditionally waited until a crisis takes hold to make the hard decisions, instead of doing so preemptively. And that pattern is likely to continue.

Change doesn’t come easily in the U.S.

The impressive performance of Argentina’s currency and stock market under President Milei is hard to ignore. The peso’s impressive appreciation and the skyrocketing stock market have been welcomed by investors, making Argentina one of the top-performing markets in 2024. For investors, this story may not be over—there could still be further upside, particularly if Milei’s economic reforms continue to stabilize the country’s finances.

In the U.S., political and economic realities create a far more complex situation. With Republicans holding a narrow majority in Congress, the idea of passing aggressive austerity measures—like those of Milei—seems extremely unlikely. Even President-elect Trump, a Milei supporter, may not fully back such cuts, especially when they risk alienating voters. The economy is a pivotal issue in U.S. elections, and Republicans are acutely aware any economic downturn would be detrimental to their political standing. The party in power gets blamed for recessions and with Trump’s embarking on a second term, the GOP cannot afford to be seen as responsible for an economic downturn.

The U.S. fiscal situation, highlighted recently by contentious debt ceiling negotiations, underscores just how difficult these decisions will be. As seen during the 2008 financial crisis and in the debt-limit standoffs of 2011, U.S. lawmakers tend to delay hard fiscal decisions. In 2008, the U.S. government avoided proactive steps until the global financial system was at risk of collapse. In 2011, an 11th-hour deal was brokered after a nearly disastrous political standoff. Those events suggest American politicians, while recognizing the need for fiscal reform, are unlikely to take steps unless forced into a corner.

With respect to debt, the United States has “kicked the can down the road” for many years, but at some point that may not be tenable. As the national debt continues to grow, the pressure to act will likely intensify. The question remains: Will American politicians summon the will to take decisive action before the next crisis hits, or will they wait until it’s already upon them? Based on precedent, the latter seems more likely.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.