Surge in 0DTE Options Volume Spurs Creation of Cboe’s 1-day VIX

Cboe’s 1-day Volatility Index was designed to provide investors and traders with greater insight into short-term expected volatility.

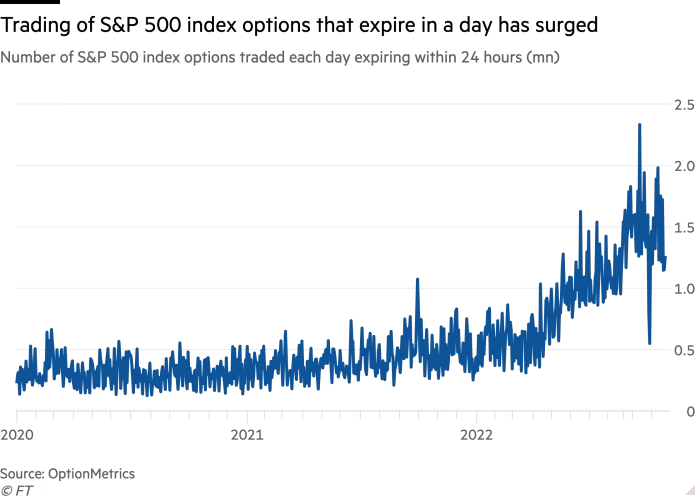

As seen in the surge in zero-day options (0DTE) trading volumes, interest in shorter-duration derivatives has skyrocketed.

According to the Financial Times, about half of the options volume in the S&P 500 during the month of April was in options that expired on the day of the trade.

This represents a subtle shift that follows the original explosion in retail options trading, which occurred during the onset of the COVID-19 pandemic in 2020. As such, rising demand for shorter-duration options is basically the trend within the trend.

In February, Cboe estimated that “approximately 46% of the total trading volume in the equities options market consisted of contracts with less than five days until expiration.”

In order to accommodate changing investor/trader preferences in the options marketplace, the industry has been scrambling to launch new products.

In 2022, the expansion of the 0DTE options marketplace was one key development, and one that has paid off handsomely for options exchanges.

And now, in response to persistently strong demand for shorter-duration options, the Cboe recently launched the one-day VIX, which is formally known as the Cboe 1-day Volatility Index (VIX1D).

VIX1D complements existing market of volatility products

Known widely as the market’s “fear gauge,” the Cboe Volatility Index (VIX) was created roughly three decades ago to provide key insight into the market’s expected 30-day volatility.

The index is calculated using front-month options in the S&P 500, and therefore reflects the market’s perception of risk based on the ever-changing demand for these 30-day options.

Generally speaking, demand for short-term options surges when fear enters the market, as investors and traders rush to buy protection. On the other hand, short-term options typically decline in value when demand for these products is weak.

Movement in the VIX, therefore, provides a real-time indication of investor/trader interest in near-term S&P 500 options.

However, as investors and traders have increasingly focused on shorter and shorter durations (0DTE options), the insight provided by the 30-day VIX has become increasingly inadequate. In that regard, the 30-day VIX doesn’t efficiently reflect short-term spikes in expected volatility.

For example, when market participants are expecting particularly volatile trading conditions over the next couple of days, but not necessarily the next several weeks. The Cboe 1-day Volatility Index was designed to help fill that gap.

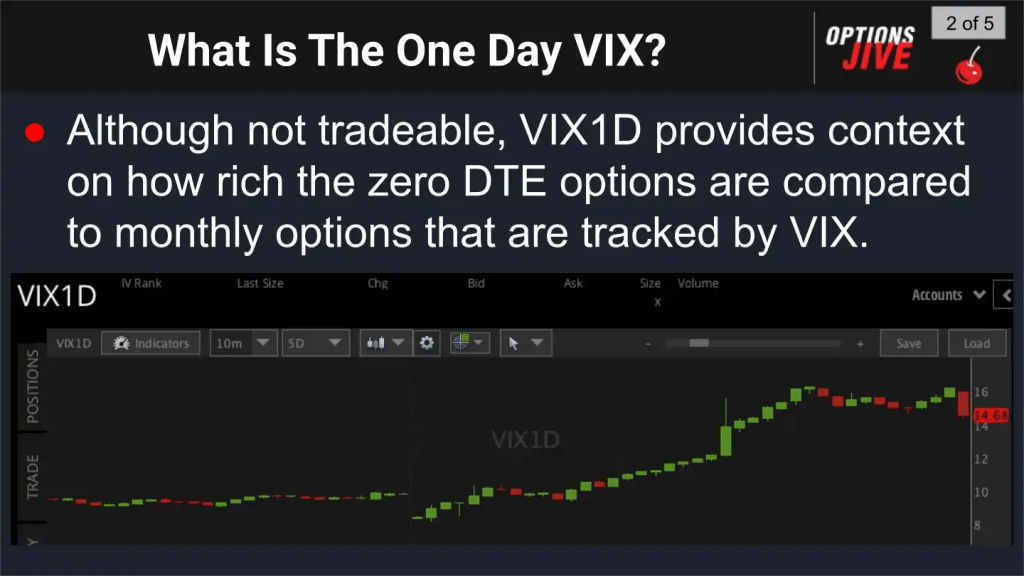

The VIX1D is calculated in a similar fashion to the normal 30-day VIX Index, except that the duration of the options used in the VIX1D calculation is limited to one-day or zero-day options in the S&P 500, instead of 30-day options.

As a result, the VIX1D is expected to behave in a more volatile manner as compared to other volatility indices that measure a longer time horizon of expected volatility.

When Silicon Valley Bank imploded in March, the VIX rallied from roughly 19 to 26 between March 8 and March 13. However, a backtest conducted by the Cboe revealed that the VIX1D would have jumped from roughly 15 to 40 during that same period.

The Cboe 1-day Volatility Index is therefore expected to provide greater insight into the short-term volatility environment.

Commenting on the new offering, Rob Hocking, the Head of Product Innovation at Cboe Global Markets, said of the new volatility index, “We believe the VIX1D Index will be a useful tool for the growing group of investors utilizing same-day options trading strategies to better understand the daily market dynamics.”

Importantly, the VIX1D isn’t directly tradeable—the same as the VIX. Instead, the VIX1D is designed to provide insight into the expected volatility of the current trading day.

In that regard, the VIX1D complements existing Cboe offerings in the volatility universe, such as the one-year VIX, six-month VIX, three-month VIX and nine-day VIX—and the widely followed 30-day VIX. The latter is the product that is most commonly referenced by the financial media.

For more details on the new VIX1D offering, check out this new installment of Options Jive on the tastylive financial network. To learn more about using the new VIX1D in conjunction with a 0DTE-focused trading approach, watch this new tastylive video.

To follow everything moving the markets in 2023, tune into tastylive weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.