Costco’s Behemoth Private Label

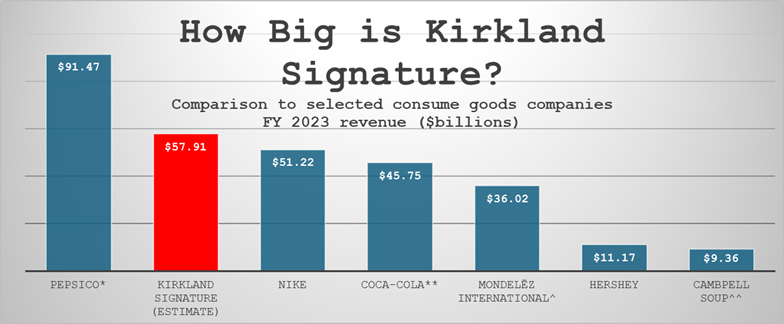

The warehouse club’s Kirkland Signature brand produces more revenue than Coca-Cola

Costco Wholesale’s Kirkland Signature product line isn’t just a successful private-label brand. It’s a powerhouse.

Over almost three decades, Costco—a membership-based warehouse club and the nation’s third-biggest retailer—built Kirkland Signature into a massive fixture in the U.S. consumer economy. How big? Bigger than Coca-Cola. Or Nike. Or Hershey.

Kirkland Signature, introduced in 1995, is a key part of Costco’s strategy to attract new customers and keep them for a lifetime.

According to the Costco website, Kirkland Signature products aren’t merely knockoffs. They are “designed to be of equal or better quality than national brands.” The store brand’s sales penetration—garnering more than a quarter of total merchandise sales—indicates Costco members value it.

Of course, the $1.50 hot-dog-and-fountain-drink combo—which has kept the same price since 1985—has also been important. The food court staple is such an integral part of Costco’s corporate culture that former CEO Craig Jelinek said Costco co-founder Jim Sinegal once told him that “if you raise the effing hot dog, I will kill you. Figure it out.”

The hot dog conundrum even became part of the Kirkland Signature story.

According to the 425 Business Magazine, Jelinek told a luncheon crowd in 2018 that “what we figured out we could do is build our own hot dog-manufacturing plant [in Los Angeles] and make our own Kirkland Signature hot dogs. Now we are doing so much hot dog business that we’ve opened up another plant in Chicago.”

Costco: A quick look

- 2023 revenue: $237.7 billion

- Members: 132 million cardholders across 73.4 million households

- U.S. employees: 206,000 full- and part-time

- Worldwide employees: 316,000 full- and part-time

- Warehouses: 876 as of April 10, 2024, of which 752 are in North America

- Warehouse sizes: 80,000 to 231,000 square feet (average 147,000 square feet)

- Membership renewal rate: 92.9% in North America and 90.5% worldwide (for the quarter, ended Feb. 18, 2024)

Costco currently operates 878 warehouses, including 605 in the United States and Puerto Rico, 108 in Canada, and 40 in Mexico. Outside North America, it has 33 in Japan, 29 in the United Kingdom, 18 in Korea, 15 in Australia, 14 in Taiwan, seven in China, four in Spain, two in France, and one each in Iceland, New Zealand and Sweden. Costco also operates e-commerce sites in the U.S., Canada, the U.K., Mexico, Korea, Taiwan, Japan and Australia.

The Cost of Membership

- Executive: $120 per year

- Business: $60 per year

- Gold Star (individual): $60 per year

Executive members get annual reward certificates worth 2% of their eligible Costco and Costco travel service purchases, with a maximum reward of $1,000. Reward certificates are redeemable toward purchases of most merchandise at Costco warehouses in the U.S.

All membership levels include two membership cards. Executive and Business memberships include the right to purchase goods for resale.

A $60 billion business

Initially launched as a brand of batteries, Kirkland Signature now includes hundreds of products. Costco puts that name on all its vast array of private-label products, which include groceries, clothing, motor oil, golf balls, sunglasses, home goods, eyeglasses and, until recently, hearing aids.

The brand is named after Kirkland, Washington, the original location of Costco’s corporate headquarters.

During a Q4 earnings call in September 2022, Richard Galanti, then Costco’s CFO, said Kirkland Signature merchandise, “excluding gas and other businesses that carry the Kirkland name,” represented 28% of Costcosales for the 2022 fiscal year.

If that 28% penetration continued in fiscal 2023, we estimate Kirkland Signature sales reached almost $60 billion that year. By contrast, the total 2023 revenue of Coca-Cola—including sales of all the brands it makes—was $45.75 billion.

Galanti retired from Costco in March 2024, after nearly 40 years with the company. Gary Millerchip, formerly chief financial officer of Kroger, then came in as Costco’s new CFO.

As the chart shows, the food and drink giant PepsiCo is much bigger than Kirkland. But, like Coca-Cola, PepsiCo owns a collection of brands. PepsiCo holdings include Frito-Lay and Quaker Foods.

Costco’s U.S. Growth Potential

Costco has plenty of growth potential in the United States, according to a March 2023 analysis by BMO Capital Markets.

At the retailer’s current expansion of about 14 new warehouses annually, the United States could absorb Costco warehouse clubs and business centers for as many as 17 more years without running out of promising locations, the analysis found.

Using U.S. Census Bureau data, BMO said Costco could add about 200 “fill-in” warehouse clubs in metropolitan markets it already serves and expand to 35 additional markets.

BMO said Costco could also open another 50-plus business centers in the U.S. A Costco Business Center carries a much broader selection of business-only merchandise, and does carry goods in purely consumer categories, such as apparel, jewelry, toys, sporting goods, housewares and books.

The Kirkland strategy

Michael Del Monte, an independent research analyst who writes an online newsletter called ThePeachPit, says Costco carries private-label products for the same reasons as other retailers, including controlling margins.

“Similar to other retailers, Costco’s private label allows for the firm to control more of the supply chain, and in turn, the costs associated with production and transport,” Del Monte told Luckbox. “Costco has dynamic pricing baked into retail prices to ensure customers pay the lowest possible price for items sold at locations. The Kirkland branding allows for even tighter margin control as the firm has more control over production, quantity, quality and timing.”

That control over margins, production and transport is great for profitability, but it doesn’t explain why Kirkland Signature is a juggernaut. Exacting standards are what set the house brand apart, Del Monte says.

“I believe one of the biggest qualities Costco brings to the table is its high bar for quality,” he said.

Sucharita Kodali, a principal retail analyst at Forrester Research, concurs. She says Costco’s private-label strategy works, largely because Kirkland Signature goods are quality products at prices lower than name-brand equivalents.

“They’ve been very successful with private labels for quite some time,” Kodali told Luckbox. “They partner with a lot of the large CPG (consumer-packaged-goods) companies to make their private labels. So, it’s a very high-quality product.”

Still a retailer

While some observers have called Kirkland Signature the largest consumer brand in the world measured by sales, it’s unlikely that Costco looks at it that way, Kelly Bania, food retailer analyst with BMO Capital Markets told Luckbox.

“In studying Costco over the past decade or so, Costco’s really just about doing everything they can to offer value and quality and create loyalty with their members, so I don’t think that Costco looks at it as ‘we’re trying to build a [consumer packaged goods company],'” Bania said.

Instead, she believes the role of Costco’s private-label operation is primarily to cement the loyalty of customers by offering something they can’t get elsewhere at a value price.

“I think Costco looks at it as ‘we know we can bring really high-quality value products in all these different categories’ that they are in with Kirkland Signature,” Bania said.

Like Bania, Forrester’s Kodali says, the goal is to build customer loyalty, not compete with consumer goods manufacturers.

“Loyalty is hugely important to them,” Kodali said. “They absolutely want to retain as many of their members as they can year after year, and part of that formula for retention is having great products that drive people back to the store year after year and more frequently than that, like week after week, in some cases, probably day after day.

Who makes the products?

It’s an open secret that Costco often sources Kirkland Signature products from name-brand manufacturers. But most of the time, Costco doesn’t name the suppliers.

In some cases, there’s no mystery about who makes what. For example, Costco sells Kirkland Signature Jelly Belly jellybeans, made in partnership with Jelly Belly Candy Co. And Costco sources some (but not all) Kirkland Signature coffees from Starbucks and sells them in bags marked “custom-roasted by Starbucks.” In most other cases, it’s difficult to figure out the origin of Kirkland Signature products.

At one point, so many consumers believed Kirkland Signature French vodka was re-bottled Grey Goose (made by Bacardi Ltd.) that the name-brand manufacturer was compelled to release a statement denying it. Media reports say Kirkland’s French vodka comes from Gayant Distillery, owned by Terroirs Distillers.

According to the website GOBankingRates, other companies that make Kirkland Signature products include Diamond Pet Foods, Duracell, Keurig, Kimberly-Clark and Ocean Spray.

Private-Label Grows Fast

Sales of private-label (aka store brand) consumer packaged goods grew by 6.3% in 2023, reaching $216.8 billion and taking market share from name brands, according to Circana surveys.

Units sold increased by 0.9%, to 53.5 billion, the research shows. Other key findings:

- Sales gains were higher for private-brand food and beverages (6.7%), compared to nonedibles (5.1%).

- Private brands gained share from name brands, increasing to 25.5% of total unit sales, up from 24.7% in 2022.

- Only about a third of American shoppers say they are committed to buying mainly name brands. Another third are committed store-brand buyers, while the remaining third tend to switch between store-brand and name-brand purchases.

In the food and beverages category, households with children represent 35% of private-brand food and beverage unit purchases; Gen X households with no children represent 36% of unit sales.

Latest quarter results

On May 30, Costco reported net sales for Q3, which ended May 12, were up 9.1% year over year, to $57.39 billion, from $52.60 billion last year. Net sales for the first 36 weeks increased 7% to $171.44 billion, from $160.28 billion last year.

During the earnings call, Millerchip talked a bit about Costco’s Kirkland Signature strategy and some of the newer products under that name:

“If we are unsuccessful in delivering ultimate value with branded goods, we evaluate the potential for new high-quality Kirkland Signature items with a goal of providing at least 20% value versus what we would sell the national brand item as,” Millerchip said.

He added that Costco added a Kirkland Signature men’s walking shoe and new Kirkland Signature facial wipes during Q3.

“We also reduced prices on a number of existing items, including lowering Kirkland Signature pine nuts from $29.99 to $24.99, and reducing the price of our Kirkland Signature frozen shrimp SKUs by $1,” Millerchip added. “These are just a couple of examples that came out of our recent monthly budget meetings where each country and region shared new and exciting items they have introduced to their warehouses and items where they’ve lowered prices.”

18.9%

Store brands’ market share of 10 consumer good segments in 2023

$60.2 billion

Store brands’ annual sales in 2023, up 34% compared to 2019

–Private Label Manufacturers Association

What about that hot dog?

Just before retiring, former CFO Galanti sat down with Bloomberg News‘ Nina Trentmann, who asked him what might happen to the $1.50 hot dog combo once he leaves.

“It’s probably safe for a while,” Galanti said of the meal deal.

We’re not sure that’s reassuring.