Downside Roomba

Analysis of a contrarian take on iRobot Corp., a favorite consumer robotics company of Wall Street and retail investors

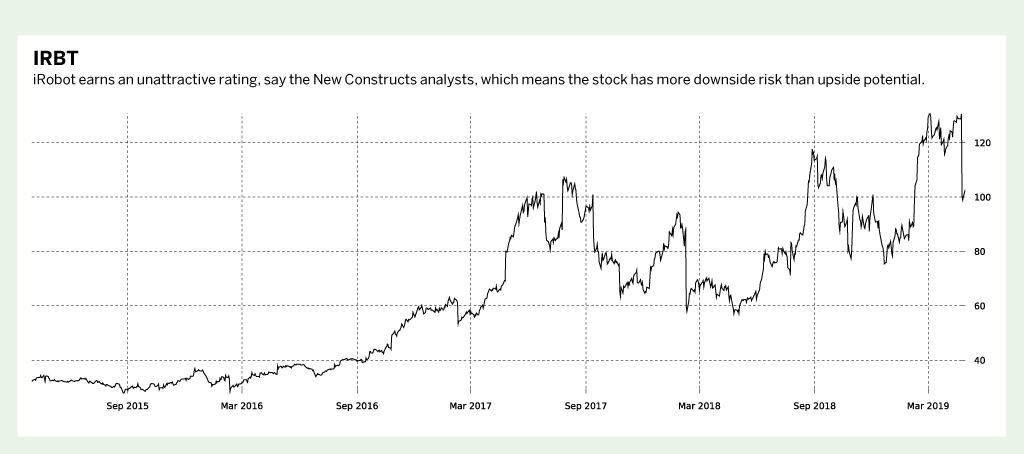

After the 2005 iRobot Corp. (IRBT) initial public offering priced at $24, the stock was range bound for 10 years until rocketing from the mid-30s at the beginning of 2016 to topping $120 recently. High-growth expectations for the consumer robotics sector continue, and iRobot expects 2019 revenue of between $1.28 billion and $1.31 billion (year-over-year growth of 17% to 20%), operating income of $108 million to $118 million, and earnings per share of $3 to $3.25, excluding discrete items.

Wall Street is generally neutral-to-positive on iRobot stock. Three major banks have issued strong buy ratings, and it’s not a surprise that no investment banks have issued a sell rating on the company. But, the robo-analysts at New Constructs have a different view.

iRobot, founded in 1990 by Massachusetts Institute of Technology roboticists that included Rodney Brooks (see p. 17), began with the vision of making practical robots a reality. By now, the company has sold more than 25 million robots worldwide. The company inspired the first micro rovers used by NASA, changing space travel forever, and it deployed the first ground robots used by U.S. Forces in conflict. It brought the first self- navigating FDA-approved remote-presence robots to hospitals and introduced the first practical home robot with Roomba, forging a path for an entirely new category in home cleaning. With more than 25 years in the robot industry, iRobot remains committed to building robots that provide people with smarter ways to clean and accomplish more in their daily lives.

—iRobot Corp. company website

The Robots Evaluating iROBOT

For the robotics & AI issue, luckbox asked New Constructs, an independent investment robo-analyst research firm powered by machine learning, to evaluate iRobot Corp.

The newconstructs.com platform, established in 2002, specializes in quality-of-earnings, forensic accounting and discounted cash flow valuation analyses for public companies. Their research includes reports and ratings for more than 3,000 company stocks, 7,000 mutual funds and 650 ETFs.

New Construct’s employees are restricted from purchasing or selling a security under consideration for inclusion in a New Constructs report, nor may they purchase or sell a security for the first 15 days after New Constructs issues a report on that security.

Unattractive economic earnings

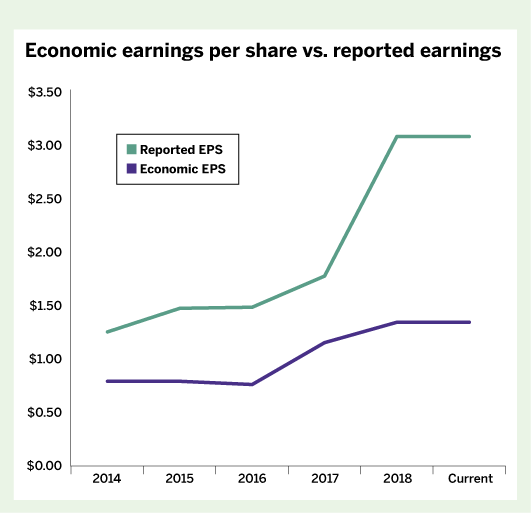

Economic earnings almost always differ meaningfully from reported earnings. Economic earnings provide a truer measure of profitability and shareholder value creation than reported earnings because they have been adjusted to remove more than 20 accounting distortions.

Most of the data required to reverse accounting distortions is available only in financial statements’ footnotes and the section of financial statements devoted to management discussion and analysis. Gathering and analyzing financial data from filings can help deliver earnings analysis that represents the true profitability of businesses.

Economic earnings per share for iRobot for the trailing 12 months are $1.34, compared to reported earnings per share of $3.07, and earn an unattractive rating.

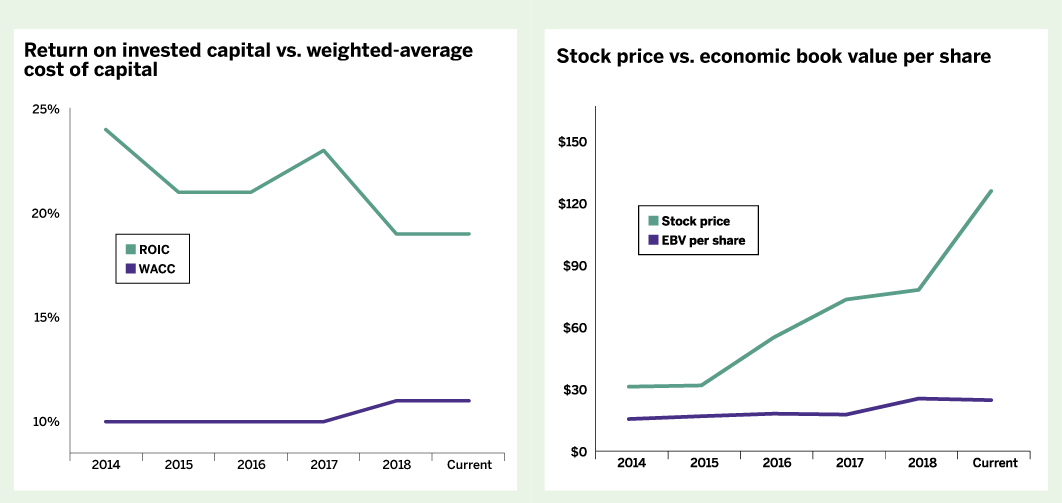

Attractive ROIC

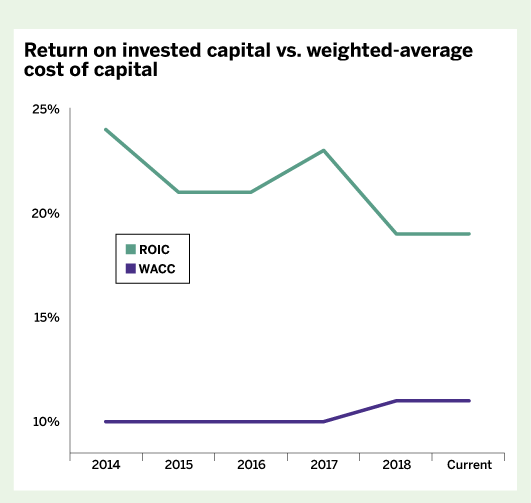

Return on invested capital (ROIC) measures a company’s return on all cash invested in the business. It’s the truest measure of profitability. Stock valuations correlate more highly to ROIC than any other metric.

Weighted-average cost of capital (WACC) is the average of debt and equity capital costs that all publicly traded companies with debt and equity stakeholders incur as a cost of operating.

iRobot has a fair value of $75

per share today, a material downside to the current stock price

Companies must earn an ROIC greater than WACC to generate positive economic earnings and create value for shareholders.

iRobot’s ROIC of 19.5% for the trailing 12 months earns a very attractive rating. ROIC is calculated as net operating profit after tax (NOPAT) of $85 million divided by average invested capital of $435 million.

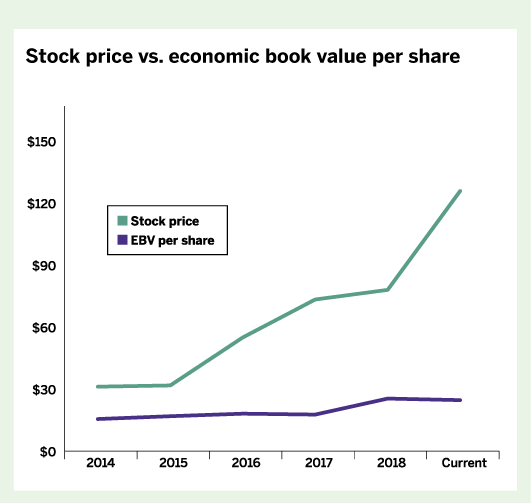

Unattractive price-to-EBV ratio

Price-to-economic book value (EBV) measures the difference between the market’s expectations for future profits and the no-growth value of the stock.

When prices rise higher than EBV, the market predicts the company’s NOPAT will increase and expectations for profit growth are reflected in the stock. If the stock price equals EBV, the market predicts NOPAT will remain the same, and there’s no expectation for profit growth. When stock prices go lower than EBV, the market predicts NOPAT will decrease, and expectations for permanent profit decline are reflected in the stock. New Constructs likes to buy stocks with low expectations for profit growth and sell/short stocks with high expectations for profit growth.

iRobot’s current price-to-EBV per share is 4.5 and earns a very unattractive rating. The company’s stock price is $128.82, and its EBV per share for the trailing 12 months is $28.34.

Unattractive growth appreciation outlook

The market-implied duration of profit growth, or GAP, measures the number of years a company must maintain an edge over competitors by earning ROIC greater than the weighted-average cost of capital on new investments.

iRobot embeds a very unattractive level of market expectations because of a large difference between the expected financial performance implied by its market price and the company’s historical performance.

At iRobot’s current stock price of $128.82, the market is expecting revenue to grow at 4.7% for more than 100 years. Over this period, the company is also expected to generate an average economic earnings margin of 80.2%.

According to New Constructs’ assessment of iRobot, “if the company grows operating profit by 14% compounded annually…the stock has a fair value of $75 per share today, a material downside to the current stock price.”

Consider selling a vertical call spread.

A bearish bet on iRobot

iRobot is displaying an implied volatility of 70, which means traders are expecting the stock to continue to trade with a large amount of volatility. By comparison, the S&P 500 has an implied volatility of 14, so traders are expecting IRBT to have five times as large a percentage move in the price. The market is placing an expectation of the stock moving.

If traders think that iRobot is overbought, they could consider using options. Two factors make options ideal for this trade. First, the stock is hard to borrow, meaning investors will have a difficult time selling the stock short with their brokerages. Second, options become particularly useful in speculative plays such as this— investors can use them to limit risk, which greatly reduces overall theoretical risk in a trade.

Consider selling a vertical call spread. Sell the first out-of-the-money call for a credit and then cap that “unlimited loss” by buying a call above that strike. Do that in July. The theoretical probability of making money on the trade should be considerably greater than 50%.