Economics Scorecard: Trump vs. Biden

Despite differing politics and policies, the economic records of the two presidents share a common theme: resilience

- The economy has exhibited resilience in recent years, with steady growth and the creation of millions of new jobs.

- President Trump faced COVID-19 pandemic and President Biden was challenged with high inflation and two military conflicts.

- Both presidents achieved a degree of success with the economy, fostering cautious optimism for the future.

We’ve created an economic scorecard for the U.S. economy during the presidencies of Donald Trump and Joe Biden to track employment, inflation and the growth of the Gross Domestic Product (GDP). It’s a data-driven snapshot that we hope offers an unbiased and fact-based analysis of broader trends.

It’s not our intention to advance a political agenda or endorse a candidate. Instead, we want to explore two distinct economic periods—one defined by the global pandemic and the other by recovery from rising inflation. Given the importance of the economy in the upcoming election, a balanced examination of these factors is timely.

While Vice President Kamala Harris—the Democratic nominee for president—may not pursue the same economic agenda as President Biden, it’s likely she will follow a similar path. That makes an objective analysis of the current administration’s economic performance especially relevant, as voters consider what the future might hold under continued Democratic leadership.

Economic growth and the labor market

When assessing the economic performance of any administration, the unemployment rate and growth of GDP and are typically viewed as the most important indicators. Together, they provide a comprehensive view of the economy’s health.

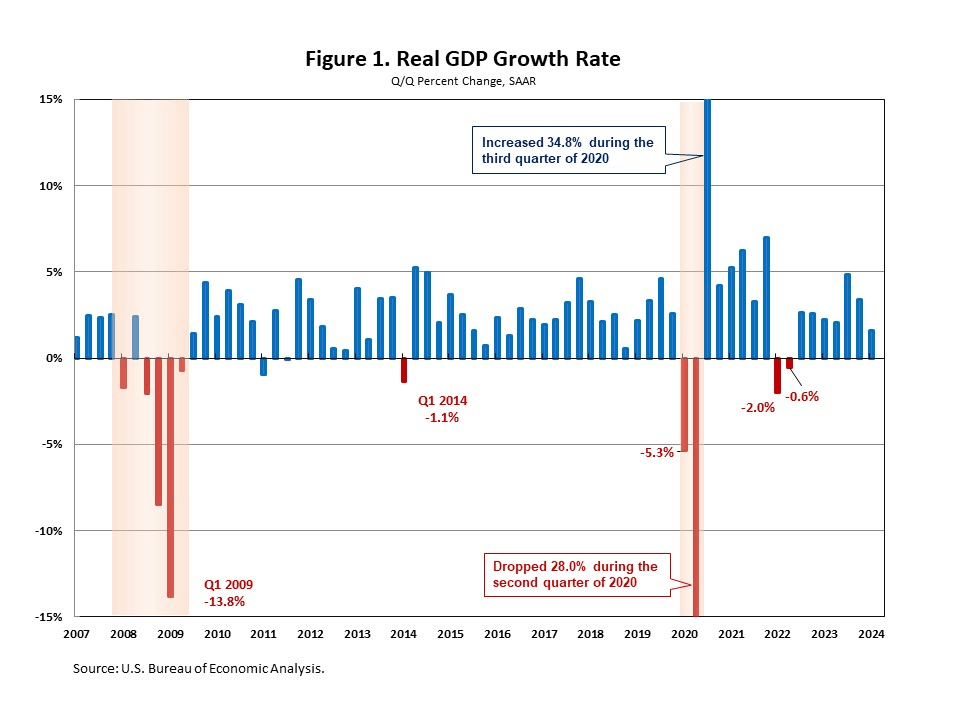

GDP reflects a country’s economic output, capturing the value of all the goods and services produced. Typically, a growing GDP signals a strong, expanding economy, while stagnant or negative growth can indicate economic struggles.

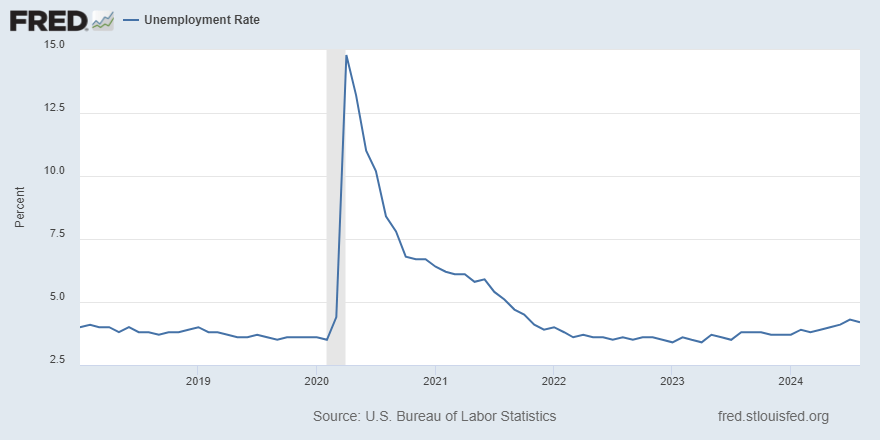

The unemployment rate measures how effectively the economy is creating jobs and sustaining employment. A low rate suggests robust job creation, and a high rate points to potential weaknesses in the labor market.

Together, these metrics capture the essence of an economy.

The Trump Era: 2017 to 2021

The period began with a strong and stable economy under President Trump, in part because of the carryover from the previous administration. His first three years (2017-2019) were marked by steady growth of GDP, with the unemployment rate falling from 4.7% in January 2017 to 3.6% by the end of 2019.

Trump fostered a business-friendly environment with tax cuts and deregulation, which encouraged corporate investment and contributed to rising stock market values. Consumer spending remained robust, and the economy expanded at a consistent pace.

But the landscape shifted dramatically in 2020 when the COVID-19 pandemic struck. The economy nearly ground to a halt as lockdowns led to a significant contraction in GDP. In the second quarter of 2020, the economy shrank sharply and unemployment peaked at 14.8% in April. By the second half of the year, recovery efforts were underway, with the unemployment rate dropping to 6.7% by December.

Despite some stabilization, GDP remained below pre-pandemic levels at the end of 2020. Over the entirety of the Trump administration, the average annual GDP growth rate was 1.8%, reflecting the mixed impact of pre-pandemic growth and the sharp downturn in 2020.

The Biden Era: 2021 to 2024

President Biden took office in January 2021, inheriting an economy still in recovery from the pandemic-induced recession. It continued to rebound throughout 2021 as businesses reopened and demand surged. GDP grew and unemployment declined, falling to 3.9% by the end of 2021 (illustrated below).

This positive momentum carried into 2022 and 2023 as businesses and industries reopened and the labor market continued to improve. By 2024, the recovery had moderated somewhat, but steady expansion continued. Over the course of Biden’s presidency, the average annual growth of GDP has been 2.9% (data from January 2021 through June 2024), reflecting consistent, robust growth over an extended period.

A broader economic perspective

Biden’s term has about three and a half months remaining, but there’s enough data for a thorough comparison with the Trump administration. We’ll use data from Biden’s inauguration through the autumn of 2024, comparing it with the Trump administration, spanning 2017 to 2021.

Let’s also consider data that contextualizes the broader economic landscape of their presidencies. Besides GDP growth rates and unemployment rates, the metrics could also include job creation figures, gasoline prices, performance of the stock market and increases in the national debt.

This data provides a well-rounded view of how each administration navigated challenges and opportunities, offering additional insight into their impact on the economy.

Both presidents faced unusual circumstances. Broader themes beyond their control did much to shape the economy.

Unemployment, for instance, spiked in 2020 because of the COVID-19 pandemic. As lockdowns swept across the globe, American businesses shut down or scaled back, drastically reducing the demand for labor. Consequently, the elevated unemployment rate at the end of the Trump administration wasn’t necessarily a reflection of government mismanagement, but rather the result of a global health crisis.

Similarly, the rise in gasoline prices during the Biden administration was driven largely by the global economic recovery. As economies reopened, demand for crude oil surged, driving prices higher. Rising gasoline prices reflect the global economic rebound, as opposed to Biden administration policies.

While the COVID-19 recession was responsible for job losses during the Trump administration, the addition of 16 million new jobs during the Biden administration (from January 2021 through today) is certainly a notable achievement. And even if some of that job growth resulted from the post-COVID rebound, the Biden-led White House deserves a share of the credit.

Post-pandemic inflation

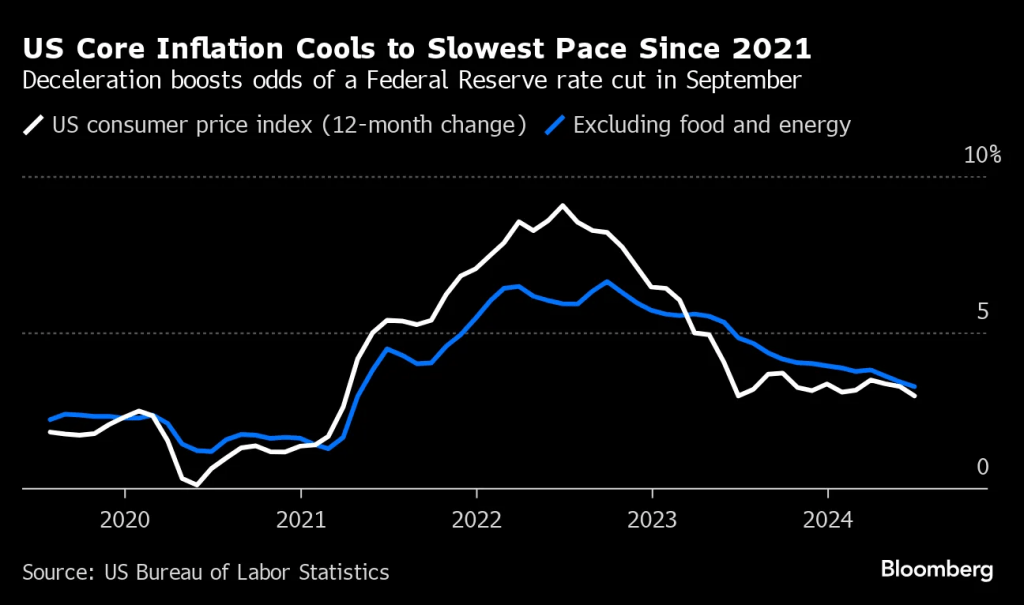

A little inflation can be a sign of a growing economy. But when prices go up too quickly, consumers feel squeezed by the rising cost of living.

The post-pandemic surge in inflation, especially from 2021 onward, can be traced to a mix of supply chain issues, soaring demand and shifts in the labor market. During the pandemic, many businesses shut down or cut back, leading to supply chain bottlenecks across the globe. And as economies reopened, a surge in demand outpaced supply, pushing prices higher.

Labor shortages contributed to rising wages, which further raised the cost of goods and services. The complex interplay of supply constraints and increased demand made inflation accelerate rapidly.

In contrast, the period from 2017 to 2020 saw relatively low and stable inflation, with annual rates generally below 2%, consistent with historical trends. During this time, supply chains were stable, the labor market was balanced and the Federal Reserve maintained low interest rates without much concern for inflationary pressures.

The inflation spike in the wake of COVID was therefore less a product of direct fiscal or monetary policy, and more a response to the unusual conditions of a global economic shutdown followed by a swift recovery. This combination of consumer demand, supply shortages and rising production costs contrasts sharply with the stable economic conditions that defined the 2017-2020 period.

Takeaways

Examining the economic scorecards of the Trump and Biden administrations, it’s evident each president faced extraordinary challenges and, in many respects, rose to meet them.

President Trump contended with the devastating COVID-19 pandemic in 2020, which caused severe economic disruption and a sudden spike in unemployment. His administration responded with substantial fiscal stimulus and swift recovery measures that helped mitigate some of the economic damage and supported an eventual rebound.

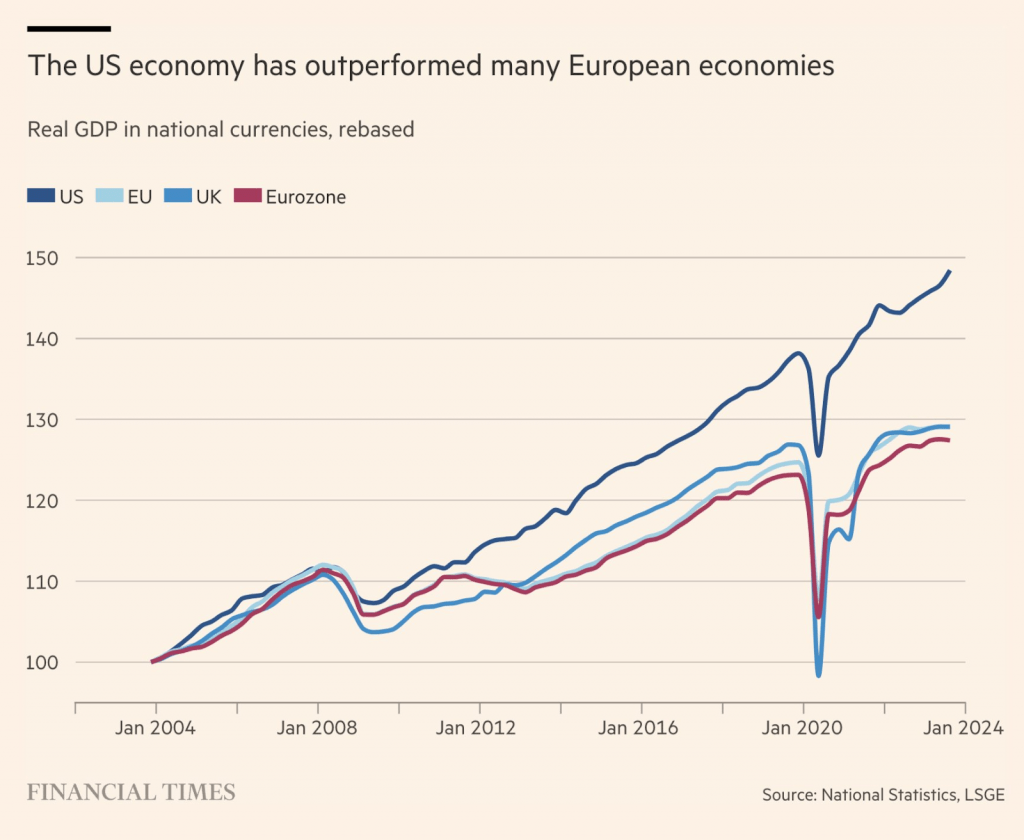

President Biden, on the other hand, has had to navigate a post-pandemic landscape of high inflation and global conflicts—one in Eastern Europe and another in the Middle East. Despite these challenges, GDP has grown steadily and job creation has been impressive. The U.S. economy has remained resilient while other developed countries have struggled.

Accordingly, the economic records of Presidents Trump and Biden are inseparable from the extraordinary challenges that defined their tenures. It would be inaccurate to blame Biden alone for the record spike in inflation, just as it would be to hold Trump solely accountable for pandemic-driven job losses.

Despite contrasting political philosophies, both presidents helped the economy navigate challenging times. Their success is reflected in the S&P 500’s performance, which delivered strong gains under both administrations. It increased 69% during Trump’s term and 51% so far under Biden. The market has thrived under differing styles of leadership.

Looking ahead, this analysis suggests the economy will be in capable hands regardless of who wins the November election. Cautious optimism may well be the prevailing market sentiment as investors look toward a future built on growth, adaptability and resilience.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. He is a frequent contributor to Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.